GBPUSD: consolidation at 1.37🛠 Technical Analysis: On the H1 chart, GBPUSD remains bullish after a strong impulse move and is now compressing beneath the marked resistance zone around 1.37000. Price is holding inside a rising structure, with the steep trend channel still intact and suggesting continuation if buyers defend the pullbacks. The moving averages are angled higher and sit below price, reinforcing the upward bias. A clean push above the resistance area opens the way toward the next upside target, while a drop back below the consolidation base would signal a deeper retracement into the nearest support zone.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 1.36872

🎯 Take Profit: 1.37532

🔴 Stop Loss: 1.36438

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Fed

PA roadmap for Interest Rates week.This week's open suggests a short-term bullish scenario before Wednesday, interest rates where I anticipate will be the high/low of the week.

The first target is Friday's high (25845.75) and then the high from January 13th, where there is pending CPI Data highs (26045.5).

The invalidation point is 25461.75. If the idea is invalidated, I'm looking for 24887.75 as a bearish target.

Also, Trump speaking on Tuesday could bring some volatility to the markets.

CADJPY Daily: Premium Zone RejectionCADJPY remains in a solid bullish Daily structure (higher highs/higher lows) and is still respecting the ascending channel, but price is now trading inside a major Daily supply/premium zone where the probability of a deeper correction is rising. The latest candles are showing rejection from the highs and RSI is rolling over, signaling weakening momentum right at a key technical area. Below current price, the first major demand/support sits at 112.70–113.00, and if that level fails the next downside target becomes 110.00. Retail sentiment is ~60% short (contrarian supportive, potential squeeze risk), but sentiment alone is not enough to justify longs into supply. COT still points to structural JPY weakness (speculators net-short), keeping the macro bias supportive for CADJPY, but the technical context favors a pullback before continuation. Seasonality in January is mixed/soft for both JPY and CAD, reinforcing the idea of a corrective phase rather than a clean trend acceleration. Plan: avoid chasing longs into supply, wait for confirmation—either a rejection and breakdown targeting 112.70–113.00 then 110.00, or a breakout/acceptance above supply followed by a retest before considering continuation entries.

GBPAUD: 89% Retail Long + Daily Supply GBPAUD remains clearly bearish on the daily timeframe: we still have a clean LH/LL structure and steady selling pressure inside a well-defined descending channel. The latest bearish leg pushed price back into a key demand zone around 1.98–1.96. This area has produced technical bounces in the past, but it has never turned into a real trend reversal. That’s why the cleanest read right now is simple: bearish trend + sellable pullback, not a reversal. Price already reacted with a sharp spike, but as long as we stay below the 2.00–2.02 supply/imbalance, any upside move is simply a potential spot for trend sellers to step back in. My main scenario is a rebound into supply followed by short continuation, targeting liquidity below the lows: 1.9650 first, then 1.9500 if momentum expands. Invalidation is clear: only a sustained recovery above 2.02/2.03 with strong daily closes and follow-through would shift the bias.

On the COT side, I don’t see positioning supporting a sustainable GBP upside, and AUD strength isn’t showing the type of structural shift needed to justify a GBPAUD reversal. This reinforces the idea that most bounces are more likely exit liquidity than real bullish restarts. Seasonality in this phase tends to move in “bursts”: quick rebounds that fade once the market reprices relative strength and flows—perfectly aligned with a bounce → continuation setup. The final piece is retail sentiment: roughly 89% long on the cross. It’s not an entry trigger by itself, but in a bearish trend it often becomes the perfect fuel for the next leg down—because when retail is this crowded on the long side, it doesn’t take much to trigger stops, pressure, and acceleration.

Operational summary: below 2.02/2.03, GBPAUD remains a sell-on-rallies market. I want to see a clean pullback, rejection into supply, then a breakdown back toward the lows.

XAUUSD: Key Pullback Zones Before the Next Leg UpXAUUSD remains in a strong daily uptrend, trading inside a well-defined ascending channel. Price is holding around 4,700, near recent highs, and moving in a “stair-step” structure: impulse → controlled pullback, with no major structural breakdowns. This is typical of a healthy trend where liquidity gets absorbed and repositioned progressively.

In the short term, the most important level is the GAP/imbalance around 4.63k, acting as a natural magnet zone for a pullback. In a bullish environment, it’s common to see price retrace into that inefficiency to “fill” part of the move before continuation. The key concept is simple: the best long timing is not chasing highs, but waiting for a controlled retracement as long as price remains above demand.

Main Daily Demand Zones

4.42k–4.50k: primary pullback area, if it holds, it confirms a classic buy-the-dip continuation scenario.

4.00k–4.18k: deeper major demand, a test here would imply a broader reset and deeper mean reversion risk.

Momentum-wise, RSI remains trend-consistent: no clear structural reversal signal, but it highlights that buying “high” without a pullback increases the risk of poor timing.

From a macro positioning perspective, COT is clearly bullish:

Non-Commercials heavily net long (296k vs 45k short)

Commercials heavily net short (typical hedging behavior)

With Open Interest rising (527,455), the move looks supported by fresh participation, not just short covering.

Seasonality also supports the bullish bias: January is historically positive for gold, especially mid-to-late month. This works best as a probability filter, not an entry trigger.

Retail sentiment shows 59% short vs 41% long, which is a clean contrarian bullish signal: the crowd keeps trying to fade the trend, often fueling further upside spikes and extensions.

Primary bias: bullish continuation.

Scenario A (preferred): pullback into 4.63k–4.65k and/or 4.50k–4.42k → bullish reaction (rejection / engulfing / strong close) → continuation to new highs.

Scenario B: direct breakout continuation → more fragile structure, higher risk of fakeouts and a sharp drop back into the GAP.

Invalidation: daily breakdown below 4.42k with strong closes below support → potential mean reversion toward the lower demand zone.

EUR/USD | Bounce to 1.18 or Breakdown to 1.15?EURUSD is at a key inflection point: on the Daily chart the structure is still bearish (lower highs/lower lows inside a descending channel), but price has now reached a major demand/support zone with an ascending trendline coming in. This creates a high-probability “reaction area” where a corrective bounce can start. This is not a full reversal call: a long only makes sense with confirmation (base holding + higher lows + reclaim of the first key levels). Upside targets are 1.1695–1.1705 as the first magnet, then 1.1750, and finally 1.1800–1.1820 if price can reclaim and hold above resistance. If EURUSD fails to hold demand and closes below the base on the Daily, the long scenario is invalidated and bearish continuation opens toward 1.1570 and 1.1535.

COT: Non-Commercials are still net long EUR, but longs are decreasing and shorts are increasing (not a strong bullish signal), while USD Index positioning remains net short without aggressive expansion, so price confirmation is essential.

Seasonality for January is often mixed, typically favoring corrective moves over clean trends, meaning a bounce is possible but must be managed with discipline. FX sentiment is retail-short heavy (~57%), so a clean reclaim could trigger a short squeeze and accelerate into higher liquidity pools.

Trade idea: look for longs only with confirmation from demand, targeting 1.1700 → 1.1750 → 1.1800/1.1820; a break below the base invalidates the setup and shifts bias back bearish toward 1.1570/1.1535.

AUDJPY | Weekly Bullish EngulfingAUDJPY remains structurally bullish and the higher timeframe context is still supportive of continuation.

The weekly chart printed a bullish engulfing candle, which is a strong confirmation signal when it appears within an established uptrend. This type of weekly engulfing often represents sell-side absorption and renewed demand, meaning pullbacks are still being bought and the market is not ready to reverse yet.

On the daily chart, price is moving inside a clean ascending channel, respecting higher lows and maintaining momentum.

After the latest impulsive leg, I’m not interested in chasing the highs. Instead, I’m looking for a controlled pullback into key demand areas to align with the trend and improve execution quality.

COT (Commitments of Traders)

COT positioning is not giving an aggressive “all-in” bullish signal on AUD, but JPY positioning remains fragile, which keeps the JPY-cross upside pressure valid. In this context, I treat COT as a supportive filter, not as the main trigger.

Seasonality

Seasonality supports the idea that upside continuation is possible, but it also suggests price may need a reset/pullback after a strong extension. That’s why I prefer a buy-the-dip approach rather than breakout chasing.

FX Sentiment (Retail Positioning)

Retail sentiment is extremely one-sided: around 89% of traders are short AUDJPY.

In trending conditions, this is often a contrarian tailwind and can help fuel continuation as shorts get squeezed.

Trading Plan

Bias: Bullish (LONG)

Execution idea: Wait for pullback into daily demand / channel support and look for confirmation (H4/D1 reaction).

Invalidation: Daily breakdown below the key demand zone + loss of channel structure.

Targets: Retest of highs first, then continuation into the next extension leg.

GBPUSD | Breakout Watch from the ChannelCable’s tone has improved as UK inflation has stopped falling cleanly. December CPI ticked up to 3.4% y/y (from 3.2%), with services inflation still sticky (CPIH services 4.5% y/y), which can keep the market cautious about pricing aggressive BoE easing.

Technical lens: Price has been compressing inside a downward sloping channel after the prior leg higher, and we’re now pressing the upper channel line around the mid-1.36s. RSI is also pushing into the high-60s, which fits with “pressure building” rather than a clean mean-reversion setup. A sustained push through the channel top would put the next obvious magnet at the 1.41–1.42 supply zone marked on the chart.

Catalysts: The next FOMC meeting is 27–28 January (press conference on the 28th), which is the near-term volatility trigger for USD legs. On the UK side, the latest CPI print firming up keeps the “higher-for-longer vs slower cuts” debate alive into the BoE’s 5 February decision.

COCOA(CC1!) is ready for a new leg up?Cocoa (CC) is currently reacting from a major Monthly Swing Low demand zone after an extended bearish leg. The Daily chart shows a rebound from support, but price is now approaching a key Weekly Swing High supply area that will determine the next directional move. The latest COT report delivers a mixed but highly informative signal. Non-Commercial traders remain net short (27,010 longs vs 36,506 shorts) and the weekly changes show aggressive long liquidation, confirming that speculative sentiment is still cautious. At the same time, Commercials are strongly net long (65,030 longs vs 52,935 shorts) and increased their long exposure while reducing shorts, which is typically consistent with institutional buying interest and hedging activity near key value zones. Open Interest also increased sharply (+11,181), suggesting fresh participation and a potentially decisive phase ahead. Seasonality adds a bullish timing component: historically, Cocoa tends to perform well in January and February, which supports the probability of a continuation higher if price confirms structure. From a technical perspective, the Monthly Swing Low remains the key invalidation level. As long as price holds above that demand zone, the market can be in a potential accumulation phase. A Daily close above the Weekly Swing High would confirm a breakout and unlock the next upside target into the previous Daily supply area. Until that confirmation occurs, the current move should still be treated as a rebound within a broader corrective structure.

AUD/USD: Bull Trap Incoming?AUD/USD is showing clear signs of a slowdown in the bullish trend after December’s impulse, with price now consolidating below a key supply area and within a structure that is starting to lose momentum. On the daily chart, the market delivered a clean directional move, but the current phase is typical of a context where institutional players begin to distribute gradually, while retail traders tend to enter late, chasing the trend. This makes the current zone a major decision area: either price breaks higher and accelerates, or it triggers a bearish rotation into the demand blocks below.

From a technical standpoint, price action highlights a recent top in the 0.6740–0.6760 area, followed by an immediate rejection and pullback. At the moment, AUD/USD is trading within a balance zone between 0.6660–0.6685, which acts as a “holding” range where the market could attempt one last recovery before a potential breakdown. The key point is that the structure is becoming increasingly fragile: bounces are less explosive and price is no longer printing progressive highs with the same efficiency.

The most attractive probabilistic scenario is tied to a bearish rotation: a clean breakdown below the 0.6660 level would significantly increase the odds of a move into the first intermediate demand zone around 0.6600–0.6620, with a potential extension toward the deeper demand block between 0.6450–0.6520 (the area where the market previously accumulated before the bullish impulse). This lower zone represents the natural “magnet” if distribution completes, as it aligns with liquidity and a prior rebalancing area within the trend.

Daily RSI is also losing strength and normalizing, consistent with a market shifting from an impulsive phase into a corrective one. In this type of environment, the most dangerous moves are “W-shaped” patterns or sharp spikes above recent highs, as they often serve to grab liquidity before reversing aggressively. For this reason, the 0.6740–0.6760 range remains the ideal zone to monitor for a potential fake breakout, followed by a drop back below 0.6700 as a weakness trigger.

Looking at the COT report, Australian Dollar positioning shows Non-Commercial traders still net short (short exposure higher than long exposure). Meanwhile, the Dollar Index also shows a speculative component leaning short, but with dynamics that require caution: if USD finds macro support, even for a technical rebound, AUD/USD would automatically become vulnerable. The key takeaway is that we do not have a “clean bullish” positioning backdrop for AUD, making an extended rally less sustainable without a fresh accumulation phase.

From an FX sentiment perspective, the signal is extremely clear: the majority of traders are short AUD/USD (87%), with only 13% long. This matters because, from a contrarian angle, it could still fuel one final upside push via a short squeeze. However, when price is trading below supply and fails to progress, such an extreme sentiment imbalance can also act as a trap signal: if the market breaks lower, many shorts already in position may take profits too early, while late longs get liquidated, accelerating the downside move.

Finally, seasonality on AUD/USD suggests that January is often not a linear month: the market frequently experiences rotation and rebalancing phases after year-end trends. This fits perfectly with the idea of a mean reversion / pullback phase before any potential new directional cycle.

Operational conclusion: as long as AUD/USD remains below 0.6740–0.6760, the bias stays for a controlled correction, with downside acceleration risk below 0.6660. My focus is on a distribution pattern followed by a rotation toward 0.6600 and then 0.6450–0.6520, while keeping the alternative scenario open for one last bullish liquidity grab before the real move unfolds.

CADJPY – Bullish Structure IntactOn the CADJPY daily chart, price is trading within a well-defined bullish structure, characterized by higher highs and higher lows and supported by an ascending dynamic trendline. Following the impulsive move into the 114.50–115.00 area, the market is currently undergoing a consolidation phase below a daily supply zone, with compressed highs and a short-term loss of momentum. This price behavior is consistent with a technical pause rather than a structural reversal, especially considering that the lower demand areas between 112.50–111.00 remain clean, well-defended, and aligned with previous breakout levels.

From a COT perspective, the outlook remains constructive for CADJPY. On the CAD side, Commercials are showing a renewed increase in net long exposure, while JPY positioning continues to reflect structural weakness, leaving the market exposed to further carry-driven flows. January seasonality reinforces this setup: historically, the Japanese yen tends to underperform during this month, while the Canadian dollar shows relative stability, creating a favorable backdrop for a bullish continuation after potential pullbacks.

On the FX sentiment side, retail positioning is heavily skewed to the short side (above 70%), providing a clear contrarian signal. The majority of market participants remain positioned against the prevailing trend, increasing the probability of continuation once weak hands are flushed out.

In summary, CADJPY remains medium-term bullish, with a preference for long exposure on pullbacks into daily demand. Only a decisive and confirmed break below 111.00 would invalidate the constructive scenario and require a reassessment of the directional bias.

EURUSD at a Turning Point: Bull Trap Rally Into SupplyRight now, EURUSD is trading within a very clean daily structure, where price is essentially “compressed” between two major forces: a higher-timeframe supply zone overhead and a strong daily demand zone below. After the latest bearish leg, price is rotating back toward the lower side of the range again, and this is exactly the type of area where institutional money makes real decisions: either defend demand and rotate higher, or break the base and trigger continuation into deeper liquidity. From a pure price action perspective, the market is not trending aggressively at the moment, it’s transitioning, and transition phases are where traders either catch their best trades… or get chopped if they force entries too early.

On the daily chart, the most important element is the major demand area below current price, which has already acted as a pivot for bullish rotations in the past. This zone is not just a generic “support”: it’s a real liquidity pocket where buyers previously stepped in with enough strength to reverse momentum. Price is now revisiting that same area again after rejecting the upper side of the structure, and the reaction here will likely define the directional flow over the next 1–3 weeks. Above, the chart shows a well-defined supply zone sitting under a descending trendline. This creates a classic “sell-the-rally” environment, unless the market proves otherwise through a clear daily reversal sequence.

Technically, the current downside move looks more like a controlled retracement than panic selling. Price is bleeding lower into demand, and that usually opens two scenarios: the first is a rotation long from demand back into the mid-range/premium area, and the second is a “fake bounce” that fails under resistance and leads to a bearish breakdown continuation. The projected path on the chart highlights exactly this concept: a potential rebound into the grey zone (where sellers can re-enter), followed by a deeper push lower if bulls fail to reclaim structure.

From an RSI perspective, the market is pushing into oversold territory on the daily, which supports the idea that selling at these levels may be “late.” Oversold doesn’t mean “buy immediately,” but it does increase the probability of a bounce, especially when it aligns with a demand zone.

Looking at positioning, the COT picture is sending a key message: the Euro side is not positioned as a strong bullish story right now. In the Euro FX report, Large Speculators remain net long, but positioning is not extreme and the longer-term COT index is still relatively depressed. This suggests EUR is not in a “crowded long” state that would fuel an explosive bullish continuation. On the USD side, the COT index is higher, signaling that the market still holds a structural bias toward USD strength. This combination supports the idea that any EURUSD upside is more likely to be corrective/rotational, rather than the start of a new macro bull trend — unless price breaks and holds above the key daily supply.

Seasonality adds another layer: EURUSD in January often shows choppy and mixed performance early in the month, with direction becoming clearer later on.

Finally, FX sentiment shows around 60% of retail traders currently long EURUSD, versus 40% short. This isn’t an extreme reading, but it still leans toward a classic contrarian interpretation: retail is already positioned for upside while price remains in a technically vulnerable area. From an execution standpoint, this means that if EURUSD bounces from demand, it can still be a valid long, but it should be treated as a tactical long, not a “buy and hold” narrative. And if the bounce fails under resistance, sentiment positioning can amplify the downside move as late longs get trapped.

At this stage, my bias is neutral with a slight bearish tilt on the broader picture, but bullish for a short-term rotation if demand prints a strong and credible daily reaction. The key is not predicting direction, it’s reacting to confirmation at the most important location on the chart.

GBPNZD: Retail Is 68% Long…GBPNZD is trading around 2.3269 and after the strong rally we’ve seen, this feels like a zone where price may “breathe” a bit before the next move. In simple terms: we’re already high, so this is not the best place to chase a fresh long. Around this area (roughly 2.33–2.35), the market usually does one of two things: either it breaks and keeps running, or it delivers a classic “messy move” where it first flushes late buyers and then continues higher.

My base case is the second scenario: a pullback first, with a move down into the 2.305–2.300 zone, which is the most logical area where real buying interest could step in.

I still like the GBP-stronger-than-NZD idea. The COT positioning supports that NZD is structurally weaker than GBP, so even if we get a short-term drop, I don’t see it as a trend reversal, more like a reset before the next leg.

Seasonality also helps the bias: January tends to be mildly supportive for GBP, while NZD doesn’t really shine in this period. That’s why, in my view, any aggressive short from here is only a tactical pullback trade, not something I’d want to hold as a long-term bearish swing idea.

One more key point: retail sentiment is already heavily skewed long (around 68% long). And when the crowd is stacked on one side, the market often pulls a fake move first, shaking people out, hitting stops, and only then delivering the clean continuation. That’s exactly why I’d rather not buy up here.

Plan: I’m treating this area as “sell to buy lower.” Either price rejects from here and pulls back into 2.305–2.300, or I stay patient and wait for price to reach that zone and show confirmation before looking for a long with better upside and less stress. The only thing that would invalidate the pullback idea is strong acceptance above the 2.345–2.35 area, because if price holds above that zone, it’s not pulling back… it’s simply continuing.

USDCHF: Retail Overcrowded Long While Price Rejects SupplyUSDCHF is currently sitting in a highly sensitive technical area, where multiple high-probability factors are converging: a Daily supply zone, a descending trendline acting as dynamic resistance, an unbalanced retail sentiment, and a seasonal backdrop that often supports corrective moves. In this type of environment, I’m not interested in blindly anticipating the move—I want price to confirm weakness first, because when the market rejects supply while sentiment is already overcrowded, the rotation can become clean and fast.

Daily Chart – Structure & Key Levels

On the Daily chart, USDCHF has delivered a strong rebound from recent lows, but it is now losing momentum as it pushes into a major supply area around 0.8000–0.8040. This is not a “random” resistance zone: it’s an area where sellers previously reacted aggressively and where distribution often takes place.

The most important detail is that price is testing this supply while also reacting to a descending trendline, which has been acting as a dynamic ceiling. When supply and trendline resistance align in the same area, the probability of a reaction increases significantly: either the market absorbs supply and breaks higher with conviction, or it rejects and rotates back to the downside.

COT – Swiss Franc Positioning (Smart Money)

According to the COT report, Non-Commercials are heavily net short CHF. From a practical trading perspective, this means large speculators are meaningfully positioned against the Swiss Franc, which generally supports a broader CHF weakness narrative.

Seasonality – January Context

USDCHF shows a historical tendency to experience phases of weakness, and January in particular tends to be more “bearish” across multiple time windows. Seasonality alone is never enough, but when it aligns with a Daily supply zone and extreme retail sentiment, it becomes an additional probability layer supporting a bearish rotation.

FX Sentiment (Retail) – Strong Contrarian Signal

Currently, 78% of traders are LONG USDCHF, while only 22% are short. This is exactly the type of imbalance that, from a contrarian perspective, often precedes a move in the opposite direction.

When retail is heavily long right as price reaches resistance/supply, the market often:

sweeps liquidity above the highs

traps late buyers

then sells off with a sharp bearish rotation

That’s why this area is particularly interesting: sentiment is clearly one-sided, and price is sitting at a technically meaningful reversal location.

USDJPY – Structural Bullish ContinuationUSDJPY remains structurally bullish on the daily timeframe, with price continuing to respect an ascending channel that has been intact since Q4. The recent consolidation phase above prior daily demand has allowed the market to absorb supply without breaking structure, confirming strong underlying demand pressure. From a price action perspective, the pair is printing higher lows within the channel, while the most recent impulsive leg has reclaimed the mid-range equilibrium, suggesting continuation rather than distribution. The current pullback scenario appears corrective and controlled, with no signs of structural weakness as long as price holds above the daily demand zone around 154.50–155.00. From a COT standpoint, non-commercials remain net long Japanese Yen futures, but recent changes show a reduction in long exposure rather than aggressive short building. This typically aligns with trend continuation phases in USDJPY, especially when paired with rising open interest on USD Index futures, signaling sustained USD strength rather than exhaustion. Retail sentiment remains heavily skewed to the short side, with approximately 78% of traders positioned against the move. This persistent bearish crowd positioning acts as a contrarian fuel, increasing the probability of further upside expansion as stops remain above recent highs. From a seasonality perspective, January historically favors USDJPY strength, with positive average performance across 5, 10, and 20-year datasets. While short-term volatility is expected mid-month, the broader seasonal bias supports continuation rather than reversal. Conclusion: As long as price holds above the daily demand zone and maintains channel structure, USDJPY remains a buy-on-dips market. Upside targets remain aligned with the upper channel resistance and the 160.50–161.50 supply zone, where profit-taking and structural reassessment become relevant.

The Yield Curve: A Forex Trader’s Early Warning SystemTradingView added the Yield Curves tab (found at the bottom right of your chart) to their UI last Year and constantly improved upon it. At first glance, it looks like a tool just for bond traders. But even though I am not a bond trader (yet), I started wondering: Can we use this as an early indicator for Forex trading?

The short answer is YES . While Forex traders usually watch price action and news, bond yields often move before the news hits the screen. In this write-up, I will show you how to use this "hidden" signal to stay one step ahead of the market.

First things first: How to Recreate My Charts

If you want to track this yourself on TradingView, search for these two symbols:

- US10Y - US02Y: This shows the "Spread" the gap between long and short rates.

- FRED:DFF: This shows the actual daily interest rate set by the Federal Reserve.

By overlaying these, you can see exactly when the bond market (the Spread) moved before the Fed (the Rate).

The Basics: What is a Bond Yield? (The Seesaw Rule)

To understand the chart, you only need to know Bond prices and yields move like a seesaw.

- When traders buy bonds: The price goes up, and the yield goes down.

- When traders sell bonds: The price goes down, and the yield goes up.

Why do we care? Yields represent the "market's opinion" on interest rates. If yields are falling, the market is betting that the Fed will cut interest rates soon. If yields are rising, the market expects rates to stay high. Because interest rates drive currency value, the yield curve is the ultimate indicator of what "Smart Money" is doing before the news goes public.

The Simple Math (The "Seesaw")

Bond yields and bond prices move on a seesaw. When one goes up, the other must go down because the interest payment (the "coupon") is fixed.

Think of a bond as a fixed contract that never changes. If you own a bond that pays exactly $50 a year, that $50 is locked in.

- Scenario A: You buy a bond for $1,000 that pays $50 interest. Your yield is 5% ($50 / 1,000).

- Scenario B: (Low CPI): Suddenly, a low inflation (CPI) report comes out. Investors get excited because they think the Fed will cut interest rates soon. They rush to buy your bond. Because everyone wants it, the price of your bond rises to $1,100.

The Result: The bond still only pays that fixed $50. But because the new buyer paid $1,100 for it, their yield is now only 4.5% ($50 / 1,100).

Simple English: You are paying more money (higher price) to get the same fixed reward. Therefore, your percentage of profit (yield) goes down.

Summary so far:

Low CPI: The market anticipates lower interest rates in the future.

The Action: Traders rush to lock in today's higher rates by buying bonds.

The Result: Bond prices go up.

The Math: Higher price for the same interest = Lower Yield.

This is why you will see the US10Y yield drop on your TradingView chart the second a "cool" inflation report hits the news.

Setting the Scene: The "Early Indicator" Theory

In a healthy economy, a 10-year bond should pay more than a 2-year bond. Why? Because lending money for 10 years is riskier than lending it for 2 years. This is a "Normal" curve.

An Inverted Curve happens when the 2-year yield is higher than the 10-year yield. This is the market’s way of saying: "We think the Fed has pushed rates too high for the 'Now,' and they will be forced to cut them in the 'Future' to save the economy."

The Timeline: 2019 to Today (Context to the Chart Above)

1. Aug. 2019: Pre-Covid Jitters The spread touches 0. The US-China trade war was slowing global growth. The bond market warned of a slowdown months before the pandemic.

2. Mar. 2020: Pandemic Shock The Fed cuts rates to 0.1%. The spread spikes as the market expects a massive recovery.

3. Mar. 2021: The "Transitory" Trap Inflation starts rising. The Fed says it’s temporary and keeps rates at 0.1%, but the spread starts falling. The bond market knew the Fed was wrong and that rate hikes were coming.

4. Mar. 2022: The Pivot The Fed finally hikes rates. The "Cheap Money" era ends. The 2-year yield spikes to keep up with the Fed.

5. Jun. 2022: Inflation Spike (KEY EVENT) (9.1%) Inflation hits a 40-year high. This is the "Panic Point." Investors realize the Fed must hike aggressively to break inflation.

6. Jul. 2022: The Great Inversion The spread falls below 0. The market signals a recession is coming. For the first time since 2008, the market decided that the "Now" was more risky than the "Future.”

7. Jul. 2023: The Bottom (KEY EVENT) (Soft Landing Bet) The spread hits its lowest point (-1.08%). Inflation drops to 3%, but jobs stay strong. The market starts betting that we might avoid a crash. The spread begins to rise.

8. 2022–2024: The Long Wait The longest inversion in history (26 months). The economy was "immune" to high rates because of 3% mortgages and corporate cash.

9. Sep. 6, 2024: The Un-Inversion (KEY EVENT) (Soft Landing Confirmed) The Golden Signal. The curve turns positive. This wasn't because of a crash, but because inflation was defeated. The bond market confirmed the Soft Landing 12 days before the Fed’s first 0.50% cut.

10. Jan. 2026: Normalization We are here today. The spread is stable at +0.68%. The Fed rate is 3.50%. The curve is healthy again.

The Takeaway

The Rule: The bond market represents "Smart Money."

The Signal: A rising spread usually means the market expects rate cuts or economic strength.

For Forex: If the spread rises before the Fed cuts, it’s an early signal to look for Dollar weakness.

The next time you see the US10Y - US02Y line making a big move on your chart, don't wait for the Fed meeting. The bond market has already made its decision. If the spread is rising, the market is "pricing in" a weaker dollar or a rate cut. As Forex traders, that is our cue to look for setups.

Think of it this way: The spread is a "Confidence Meter."

Falling Spread: "We are worried the Fed is hiking too much."

Rising Spread: "We are excited the Fed is finally cutting rates to help the economy."

*** Congratulations for making it this far! Let me know in the comments if you use or plan to use these early indicators.

EUR/USD – When COT, Seasonality and Price Action Align BearishPrice has completed a bullish impulsive leg and reached a key daily supply zone around 1.1780–1.1800, where a clean and well-structured bearish reaction developed. The break of the ascending channel, followed by a sequence of lower highs and lower lows, confirms a daily structure shift.

Price is now rotating lower toward an initial intermediate demand area at 1.1620–1.1580, a technically relevant zone where a corrective bounce is statistically possible. However, the main liquidity magnet remains the deeper daily demand at 1.1560–1.1500, still unmitigated and representing the primary bearish extension scenario.

The technical bias remains short as long as price stays below the 1.1720–1.1740 resistance area.

2. COT Report – EUR vs USD

On EURO FX futures (CME), Commercials remain heavily net short, consistent with a distribution phase following the recent rally. Non-Commercials are still net long, but without meaningful expansion, a typical configuration near a medium-term top.

On the U.S. Dollar Index, Commercials maintain a structural net long position, while Non-Commercials are gradually reducing short exposure. This positioning supports the view of a USD stabilization phase, aligning with a broader corrective bearish continuation on EUR/USD.

3. Seasonality

Historical seasonality shows that January is on average a weak month for EUR/USD, particularly during the second half of the month. After an initial sideways phase, the pair statistically tends to develop downside pressure, with lows often printed between mid and late January.

This seasonal pattern favors short continuation or sell-on-rallies scenarios, rather than fresh bullish expansions.

4. Retail Sentiment

Retail sentiment shows a majority of long positions (around 54%), while price continues to move lower. This classic price–sentiment divergence reinforces the bearish bias, suggesting the market is moving against the retail crowd, as typically observed during directional corrective phases.

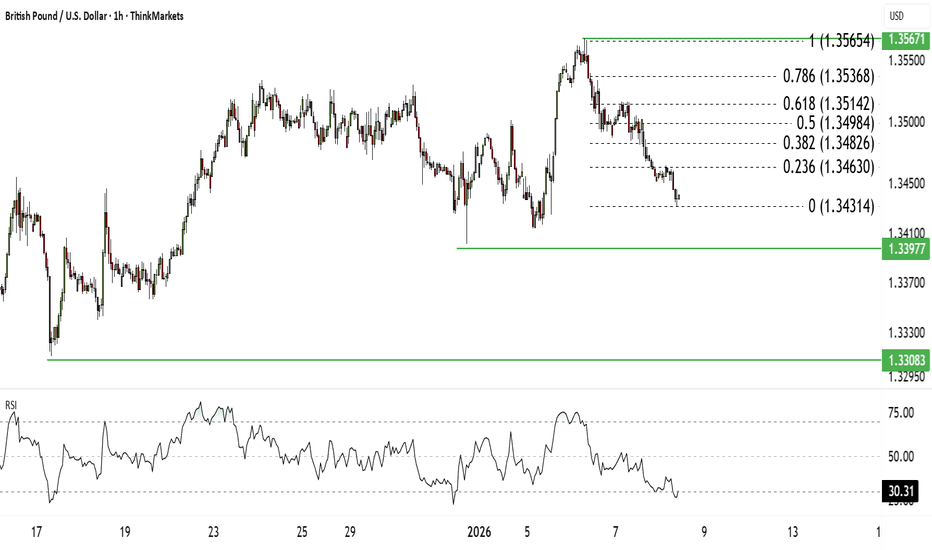

Cable eyes 1.34 on weak housing data.NFP to make or break bottomCable is pushing toward 1.34 with signs of a potential top forming, as clear divergence on the 4-hour RSI pushes prices lower. The big question: Will UK housing weakness and a divided Fed allow a break to 1.34 towards 1.33, or are we heading back to 1.35?

We analyse the impact of soft UK housing data, Halifax reported a 0.6% drop in December, against a backdrop of US dollar weakness and Fed uncertainty. With NFP looming tomorrow and President Trump potentially announcing a new dovish Fed Chair this month, volatility is guaranteed.

Key drivers

UK Housing softens : High mortgage rates are biting, with prices falling for the first time since June. Markets are split (47%) on an April BOE rate cut, capping Sterling's upside.

Fed & dollar : An 82% probability of a Fed pause in January is priced in, but markets still see cuts in 2026. A "U-shaped" dollar outlook favours GBPUSD upside early in the year.

NFP wildcard : Friday's jobs report could validate the Fed's "wait-and-see" stance or boost rate cut odds above 85%.

Technical levels

Bullish case : If 1.3400 holds as support (double bottom), we could bounce toward 1.3450 and eventually target 1.3500-1.3570 post-NFP.

Bearish case : A breakdown below 1.34 targets 1.3355 and the major support at 1.3300, especially if NFP comes in strong.

RSI check : The 1-hour RSI is oversold, suggesting a short-term bounce, but 4-hour divergence warns of medium-term weakness.

Are you betting on a breakout to 1.35 or fading the divergence? Share your plan in the comments and subscribe for our NFP coverage! Trade safe.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Fundamental Note: EURUSD 07 Jan 2026EURUSD is trading around the 1.17 area as markets position for the first Non-Farm Payrolls release of 2026 on Friday, 9 Jan (Employment Situation for Dec 2025). This print matters more than usual because it’s the year’s first “reality check” on whether the late-2025 slowdown in hiring is turning into a softer trend (supporting more Fed cuts) or stabilizing (supporting USD via higher yields). Right now, consensus expectations lean toward a modest jobs gain in the mid-50k to ~60k range, with unemployment seen near 4.5% and wage growth watched closely for a rebound risk. In the short term, a weaker NFP and/or softer earnings would likely push US yields and the USD lower, giving EURUSD room to squeeze back toward recent highs; a hot wages surprise or upside payroll miss could quickly flip the move into a USD rebound. On the Euro side, easing inflation keeps the ECB comfortable in its “hold” stance, which reduces near-term EUR policy volatility versus the US data-driven repricing this week.

Bottom line: the market is mostly looking for a “soft-but-not-breaking” NFP that validates expectations for further Fed easing in 2026—any big deviation should produce an outsized EURUSD reaction.

🟢 Bullish factors:

1. NFP downside surprise or softer wages → lower US yields/USD.

2. Market still broadly positioned for additional Fed cuts in 2026.

3. ECB “on hold” narrative reduces euro-side policy shock risk near-term.

🔴 Bearish factors:

1. Strong NFP and/or hot wage growth → higher US yields, USD bid.

2. Risk-off flows (or renewed geopolitical stress) typically favor USD liquidity.

3. Euro inflation cooling can revive future ECB cut discussions if growth fades.

🎯 Expected targets: Volatile range into/through NFP. Base case (soft NFP): upside toward 1.1750–1.1820. Hawkish surprise (strong jobs/wages): pullback toward 1.1600–1.1550, with 1.1500 as the next downside area if the USD rally extends.

SPXL: The Path to $252 Amid Geopolitical JoltsSPXL: The Path to $252 Amid Geopolitical Jolts

As we move through the first week of 2026, SPXL is showing signs of a coiled spring. After trading near the $230 level, the technical setup suggests a potential squeeze to $252. The speed of this move likely hinges on how the market digests the dramatic news out of South America and the Federal Reserve's first moves of the year.

The Venezuela Catalyst

The recent U.S. military operation in Venezuela and the capture of Nicolas Maduro have introduced a massive geopolitical wildcard. While such events often trigger "risk-off" sentiment, the market’s reaction has been surprisingly resilient.

Energy Impact: Venezuela holds the world's largest proven oil reserves. Any "breakout" news regarding the stabilization of their energy infrastructure could lead to a massive relief rally in U.S. equities as energy costs anticipate a long-term decline.

The Timeline: If the market views this as a definitive turning point for global energy stability, we could see the $252 squeeze materialize by the end of January. However, if the situation leads to prolonged regional instability, expect a period of consolidation, pushing my target arrival to late February.

Fed Actions: The January Pivot?

The FOMC meeting on January 27–28 is the next major hurdle. With the market already pricing in a "measured approach" to easing, any dovish tilt from the Fed—perhaps acknowledging that geopolitical risks require a more supportive liquidity environment—could be the fuel for the SPXL breakout. Conversely, a "hawkish hold" might favor the late February consolidation path.

SPXL vs. SPX: Understanding the Engine

It is vital for traders to distinguish between SPXL and the SPX (S&P 500 Index).

3x Daily Leverage: SPXL seeks to return 300% of the daily performance of the S&P 500. If the SPX rises 1%, SPXL aims to rise 3%.

Compounding & Decay: Because the leverage resets daily, SPXL is subject to "volatility decay." In a choppy, sideways market, SPXL can lose value even if the SPX remains flat.

The "Squeeze" Factor: Because of its leveraged nature, SPXL moves much faster than the broad market. A move to $252 represents a roughly 10% gain from current levels, which would only require a ~3.3% move in the underlying S&P 500.

Bottom Line

Watch the $232 resistance level. A clean break above this, fueled by positive developments in Venezuela or a dovish Fed, puts $252 on the map for a January sprint. Otherwise, pack your patience for a late February arrival.

EURCAD: Smart Money Trap LoadingMacro / COT

The latest COT data paints an interesting picture:

EUR – Non-Commercials remain heavily net-long, and long exposure continues to increase. This indicates that a large portion of speculative capital is already positioned to the upside.

CAD – Commercials are accumulating long exposure, while Non-Commercials are reducing longs and adding shorts.

From a Smart Money perspective, when commercials accumulate, they historically tend to anticipate medium-term reversals. This increases the probability that EURCAD is entering a distribution phase.

Seasonality

Historically, January is not supportive for the Euro. Multi-timeframe seasonality data (2–20 years) shows a negative tendency during the early part of the year.

This reinforces a medium-term bearish bias, especially after technical relief rallies.

Retail Sentiment

Currently, 73% of retail traders are SHORT EURCAD.

Such an extreme imbalance increases the probability of a temporary bullish squeeze, often used to clean weak retail shorts before the real directional move takes place.

In other words: bullish spike first → potential bearish reversal afterwards.

Price Action — Daily Chart

On the daily chart, price is trading inside a descending channel and bouncing from lower demand, moving toward a key supply area between 1.6180 – 1.6250.

The technical structure suggests:

1️⃣ Potential push higher into supply

2️⃣ Reaction and shift in structure

3️⃣ Targets around 1.6000 – 1.6030

RSI confirms weak momentum on rallies — an ideal context to sell a deep retracement rather than chase breakouts.

Key Levels

Sell Zone: 1.6180 – 1.6250

Target: 1.6030 → extension 1.5980

Invalidation: Daily close above 1.6300

This scenario remains valid as long as price does not structurally break above the supply block.

Gold surges 2.75% on Venezuela, weak dollar! Eyes on new recordsGold has surged 2.75% on Monday and continues higher on Tuesday, now trading around $4,465 and eyeing a retest of record highs at $4,550. This rally is fuelled by Venezuelan tensions, a weaker US dollar, and soft manufacturing data—but is this a breakout or a trap before NFP?

We analyse why the weaker dollar—not pure safe-haven demand—is the dominant driver, as both gold and stocks are rallying together. We then map out the critical Fibonacci levels that will determine whether gold breaks to new highs or corrects back toward $4,400.

Key drivers

- Venezuela tensions & dovish Fed : Gold got a safe-haven bid following Trump's aggressive stance on Venezuela, but the real driver is dollar weakness after Fed Governor Kashkari's dovish comments about slow disinflation and rising unemployment risks.

- Weak Manufacturing PMI : US ISM PMI dropped to 47.9 from 48.4 expected, reinforcing the soft-landing narrative and pushing the dollar lower.

- Dead Cat Bounce invalidated : Price has broken above both the 50% and 61.8% Fibonacci retracements ($4,447), invalidating the bearish "dead cat bounce" scenario that suggested another leg down.

- Upside targets : The immediate hurdle is the 78.6% Fib at $4,490. A break here strongly suggests new record highs toward $4,550 before the NFP report on January 9. Above that, $4,600 and $4,750 are psychological targets.

- Downside risks : Key support is the weekly open at $4,430 (or gap fill at $4,455). A breakdown below the 50% Fib at $4,412 would shift sentiment bearish and open the door to deeper corrections.

- NFP wildcard : Markets are cautious heading into Thursday's jobs report. A weak NFP could fuel another leg higher, while a strong print may trigger profit-taking.

Are you buying the breakout toward $4,550 or waiting for a pullback? Share your gold strategy in the comments and follow for NFP coverage later this week.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.