EDUCATION - Candlestick Cheat Sheet ⚡⚡One of the most powerful tools in your trading arsenal should be candlestick patterns. Various candlestick patterns can tell us where the market is heading.

These patterns can be found on all timeframes, however the Daily candlestick patterns appear to be the most reliable.

Once you see these patterns, you can ready yourself for the next move and use other tools to enter the market such as flag patterns, MA strategy - which we've covered before (See linked charts).

Signal

Trading - Expectations VS RealityHey Traders,

In this post we will aim to clear some of common misconceptions of trading and how we can help you go further in your trading career by giving you all the tools you need to better understand the market and kill the game.

____________________________________________________________

1. Trading is easy.

Trading is relatively easy IF you know the rules of the market and use certain analytical techniques. Once you have a full arsenal of technical tools, you can easily understand the market and figure out where it may go next.

2. Market moves in one direction.

That can be true to a certain extent where we have trending markets. However, within that trend there are various types of pullbacks. Once you understand the different market phases, you can make money whether it's a trending or ranging market. Opportunities are endless!

3. Buy when low. Sell when high.

If only things were that straight forward, right? Sometimes the lows aren't really the lows and the highs push higher and higher. This is when you need to understand the different patterns and structure of the market to help you figure out where the best possible place is to buy or sell.

Once we understand the market, we need a trading plan. How do we enter? Where do we enter? Where is the stop loss? This is where having rigid checklist really helps! You can tick things off the list and grade the trade setup from good to bad and then enter accordingly using various entry methods.

It may sound like a lot of but once broken down into little bits, you can learn this EASILY and know exactly how to analyse and enter trades!

____________________________________________________________

What we will be covering:

- Market structure: Impulse & Corrections

- Using Index charts to correlate your trades (Very important Topic!)

- Drawing a trendline and levels correctly – There’s a hack to it!

- Using Moving Averages Correctly

- Combining higher timeframe & lower timeframe

- Different patterns and how to trade them

- More topics to come!

Comment below on what other topics you would like to see!

I hope this post help clarify some of the misconceptions of trading and the different elements involved.

See the links below for information on how we can help you!

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 5-m time frame chart, you can see the panel of the latest breakouts on it (You can enable the panel in the settings menu):

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ⚠)

Minor volume (potential fake breakout ⚠)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 2-H time frame chart, you can see the panel of the latest breakouts on it (You can enable the panel in the settings menu):

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ❌)

Minor volume (potential fake breakout ❌)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 15-min time frame:

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ❌)

Minor volume (potential fake breakout ❌)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 2-H time frame:

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ❌)

Minor volume (potential fake breakout ❌)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 3-min time frame:

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ❌)

Minor volume (potential fake breakout ❌)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 5-min time frame:

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ❌)

Minor volume (potential fake breakout ❌)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01(orange) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ❌)

Minor volume (potential fake breakout ❌)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Trading - Expectations VS RealityHey Traders,

In this post we will aim to clear some of common misconceptions of trading and how we can help you go further in your trading career by giving you all the tools you need to better understand the market and kill the game.

____________________________________________________________

1. Trading is easy.

Trading is relatively easy IF you know the rules of the market and use certain analytical techniques. Once you have a full arsenal of technical tools, you can easily understand the market and figure out where it may go next.

2. Market moves in one direction.

That can be true to a certain extent where we have trending markets. However, within that trend there are various types of pullbacks. Once you understand the different market phases, you can make money whether it's a trending or ranging market. Opportunities are endless!

3. Buy when low. Sell when high.

If only things were that straight forward, right? Sometimes the lows aren't really the lows and the highs push higher and higher. This is when you need to understand the different patterns and structure of the market to help you figure out where the best possible place is to buy or sell.

Once we understand the market, we need a trading plan. How do we enter? Where do we enter? Where is the stop loss? This is where having rigid checklist really helps! You can tick things off the list and grade the trade setup from good to bad and then enter accordingly using various entry methods.

It may sound like a lot of but once broken down into little bits, you can learn this EASILY and know exactly how to analyse and enter trades!

____________________________________________________________

What we will be covering:

- Market structure: Impulse & Corrections

- Using Index charts to correlate your trades (Very important Topic!)

- Drawing a trendline and levels correctly – There’s a hack to it!

- Using Moving Averages Correctly

- Combining higher timeframe & lower timeframe

- Different patterns and how to trade them

- More topics to come!

Comment below on what other topics you would like to see!

I hope this post help clarify some of the misconceptions of trading and the different elements involved.

See the links below for information on how we can help you!

EDUCATION - Moving Average Trading Tutorial ⚡⚡What is a Moving Average?

In technical analysis, there’s an indicator called moving average which calculates the average closing price over a set period of time. If the market is too choppy, often a moving average can help smooth things out and provide a clearer visual of what’s going on in the market and an indication as to where the momentum is whether it’s a bear market or a bull market.

How is moving average calculated?

A moving average is calculated by calculating the closing prices and then divided by the set number of days e.g. 100 day moving average takes into account the closing prices for the last 100 days and then divides it by 100 to give you the moving average. Once you have enough data, you will be able to plot a smooth line which you can use to help with your analysis.

How do you use moving average?

In very simple terms: if the price is above the moving average, you can assume that the market is bullish. If price is below the moving average, you can assume that the market is bearish.

The way we use the moving average is that we see it as dynamic resistance/support.

Dynamic support – When price is above the moving average and approaches it, the moving average will act as a support base where price could potentially bounce off.

Dynamic resistance – when price is below the moving average, price may come up to reject the moving average before moving lower.

Transition from bearish to bullish (vice versa)

We found that one of the most probable moments where the moving average acts as a dynamic support/resistance is when price impulses through the moving average and then retests it. It is possible to gain an entry on the retest provided there are other confluences playing a part such as previous structure or price action.

What moving average do we use?

100 and 200 moving average.

Examples

EDUCATION - Moving Average Trading Tutorial ⚡⚡What is a Moving Average?

In technical analysis, there’s an indicator called moving average which calculates the average closing price over a set period of time. If the market is too choppy, often a moving average can help smooth things out and provide a clearer visual of what’s going on in the market and an indication as to where the momentum is whether it’s a bear market or a bull market.

How is moving average calculated?

A moving average is calculated by calculating the closing prices and then divided by the set number of days e.g. 100 day moving average takes into account the closing prices for the last 100 days and then divides it by 100 to give you the moving average. Once you have enough data, you will be able to plot a smooth line which you can use to help with your analysis.

How do you use moving average?

In very simple terms: if the price is above the moving average, you can assume that the market is bullish. If price is below the moving average, you can assume that the market is bearish.

The way we use the moving average is that we see it as dynamic resistance/support.

Dynamic support – When price is above the moving average and approaches it, the moving average will act as a support base where price could potentially bounce off.

Dynamic resistance – when price is below the moving average, price may come up to reject the moving average before moving lower.

Transition from bearish to bullish (vice versa)

We found that one of the most probable moments where the moving average acts as a dynamic support/resistance is when price impulses through the moving average and then retests it. It is possible to gain an entry on the retest provided there are other confluences playing a part such as previous structure or price action.

What moving average do we use?

100 and 200 moving average.

Examples

EURCHF - How To Trade This BreakoutEURCHF is within a descending channel of an ascending channel... pretty confusing I know but have a look at the chart and you can see which way price will be heading. What we need to do now is find the best entry which is safe and clean.

From the diagram in the chart, you can see that our entry will only be after the break of the descending channel and after a bullish correction such as a bull flag. We need to make sure that price has the momentum to move up so we will be waiting for a breakout of the bullflag before entering with stops below the correction.

Goodluck and trade safe!

EURCHF - How To Trade This BreakoutEURCHF is within a descending channel of an ascending channel... pretty confusing I know but have a look at the chart and you can see which way price will be heading. What we need to do now is find the best entry which is safe and clean.

From the diagram in the chart, you can see that our entry will only be after the break of the descending channel and after a bullish correction such as a bull flag. We need to make sure that price has the momentum to move up so we will be waiting for a breakout of the bullflag before entering with stops below the correction.

Goodluck and trade safe!

EDUCATION - Rising & Falling Wedges - Reversal PatternsWhat is an ascending/descending correction?

The most common reversal pattern is the rising and falling wedge, which typically occurs at the end of a trend. The pattern consists of two trendiness which contract price leading to an apex and then a breakout appears.

Rising Wedge – Bearish Reversal

The ascending reversal pattern is the rising wedge which consists of higher highs and higher lows whilst losing momentum to the upside. Price contracts and eventually has a bearish break.

Falling Wedge – Bullish Reversal

The falling wedge reversal pattern occurs at the end bear run and indicates that price is ready to reverse. Again, price contracts and then eventually breaks out upwards.

There are 2 types of ways we can trade wedge patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

__________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the third touch of the trendline (as indicated in the chart above). Price may have the potential to go past the trendline for a deeper correction before moving up hence why this is called a risk entry. Whereas for the safe entry, the confirmation would be the break of the wedge.

How to trade using Risk Entry:

Wait for price to bounce off the trendline and then enter with stops below/above the correction depending on whether it’s a rising wedge or falling wedge.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and have massive gains!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. One of the confirmations of the safe entry is the third touch bounce and then another confirmation is when price breaks the correction which confirms that the structure has changed and that we are in a reversal.

How to trade using Safe Entry:

For a safe entry, enter when price has broken the correction with stops above/below the correction. Please note that with this entry method, the stoploss will be greater.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

RISING WEDGE EXAMPLES

RISK ENTRY

SAFE ENTRY

FALLING WEDGE EXAMPLES

RISK ENTRY

SAFE ENTRY

EDUCATION - Rising & Falling Wedges - Reversal PatternsWhat is an ascending/descending correction?

The most common reversal pattern is the rising and falling wedge, which typically occurs at the end of a trend. The pattern consists of two trendiness which contract price leading to an apex and then a breakout appears.

Rising Wedge – Bearish Reversal

The ascending reversal pattern is the rising wedge which consists of higher highs and higher lows whilst losing momentum to the upside. Price contracts and eventually has a bearish break.

Falling Wedge – Bullish Reversal

The falling wedge reversal pattern occurs at the end bear run and indicates that price is ready to reverse. Again, price contracts and then eventually breaks out upwards.

There are 2 types of ways we can trade wedge patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

__________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the third touch of the trendline (as indicated in the chart above). Price may have the potential to go past the trendline for a deeper correction before moving up hence why this is called a risk entry. Whereas for the safe entry, the confirmation would be the break of the wedge.

How to trade using Risk Entry:

Wait for price to bounce off the trendline and then enter with stops below/above the correction depending on whether it’s a rising wedge or falling wedge.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and have massive gains!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. One of the confirmations of the safe entry is the third touch bounce and then another confirmation is when price breaks the correction which confirms that the structure has changed and that we are in a reversal.

How to trade using Safe Entry:

For a safe entry, enter when price has broken the correction with stops above/below the correction. Please note that with this entry method, the stoploss will be greater.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

RISING WEDGE EXAMPLES

RISK ENTRY

SAFE ENTRY

FALLING WEDGE EXAMPLES

RISK ENTRY

SAFE ENTRY

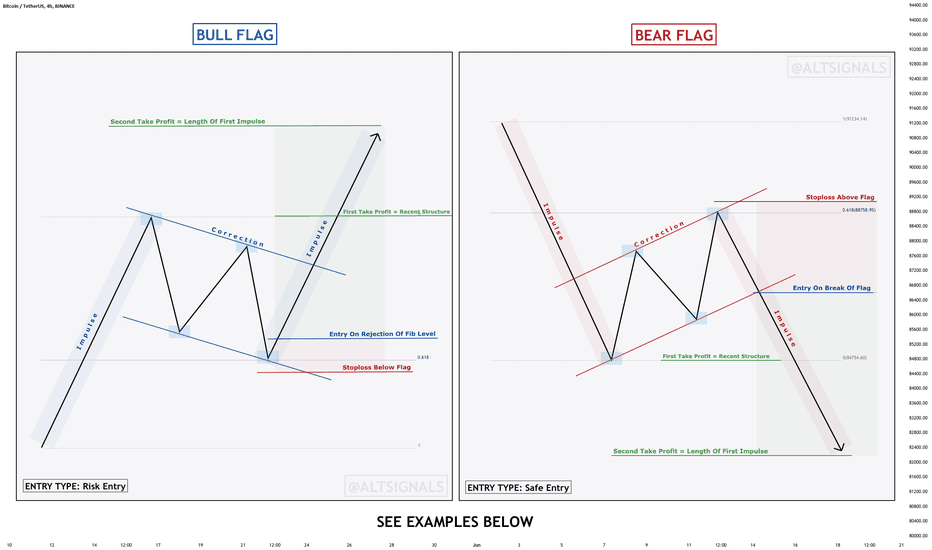

EDUCATION - Identifying & Trading Flag PatternsIn this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

EDUCATION - Identifying & Trading Flag Patterns In this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

No its not a picture of Mickey Mouse...🐭It's a super clear diagram on what key ingredients you need to find the 'sweet spot' = profitability.

The thing is, most people are desperately hunting for the holy-grail, you know - that 100% winning strategy... the silver bullet.

It doesn't exist - I'm sorry. 😢

So even a profitable strategy that's awesome can blow your account if the other 'factors' are not considered....

Greed and risk management.

With poor risk management you can blow your account on a profitable strategy.

Much like if the casino didn't set a trade limit - they could go bust if a gambler got 'lucky' - because its the casino that has the mathematical 'edge', right?

You must factor in your losing runs to ensure you not exposing your account to the 'risk of ruin'.

So yeah a profitable 'edge' is key, but without managing your mindset and using effective risk management, its actually useless too.

Having an understanding of probability is fine too - but if you don't execute your 'edge' or if you don't have one, you won't be profitable too.

And lastly, yeah - you can have your risk management nailed on - but if you've not got a profitable edge too, you'll lose money.

Just less money.

You could absorb 500 consecutive losses on a £1000 account at 1% risk per trade, but you'd only have about £6 left. Your strategy would have to be really poor for that to happen!

But you catch my drift, that effective risk management is vital.

So in summary, you need these three key ingredients...

Strategy with an Edge

Effective Risk Management planning for probability

Trading Psychology - (greed under control, no fear, discipline, resilience, etc)

You can't get to the 'sweet spot' without all 3 being in perfect alignment.

Good luck.

Darren

If this helps - please show me by liking this post if you can, its appreciated and I'll do more like this 😎

📚 Understanding Price Action - Impulsive & Corrective Moves 📚For every currency pair, all the price action can be broken down into 2 different waves. Impulse waves and corrective waves.

Both of these waves have the same patterns within them such as flags, ascending/descending corrections, channels etc.

The tip to finding out what phase we're in is to zoom out to a bigger timeframe and look at price action as a whole and ask yourself "is this impulsive or is this corrective". Once you understand that, you can more often than not understand where price will be going next.

For CADJPY, we are in a flat ABC triangle and we are approaching the upper limits of the triangle. We also are in an ABC correction. On the smaller timeframe, if things line up, we can get in at the very top of the impulse and ride this back down!

Try spotting corrections and impulses and watch how your chart game levels up!

📚 Understanding Price Action - Impulsive & Corrective Moves 📚For every currency pair, all the price action can be broken down into 2 different waves. Impulse waves and corrective waves.

Both of these waves have the same patterns within them such as flags, ascending/descending corrections, channels etc.

The tip to finding out what phase we're in is to zoom out to a bigger timeframe and look at price action as a whole and ask yourself "is this impulsive or is this corrective". Once you understand that, you can more often than not understand where price will be going next.

For CADJPY, we are in a flat ABC triangle and we are approaching the upper limits of the triangle. We also are in an ABC correction. On the smaller timeframe, if things line up, we can get in at the very top of the impulse and ride this back down!

Try spotting corrections and impulses and watch how your chart game levels up!

📚 Impulsive & Corrective Breaks - How To Identify & Trade Them 📚What is an Impulse?

An impulse is defined as a strong move whereby the market moves quite strongly or heavily in one direction, covering a great distance in a short period of time.

Typically, when there's a trend reversal occurring, we require an impulse in the opposite direction of the trend, indicating to us that there's a possible trend reversal. The question we face now is "What does an impulse need to look like for there to be a trend reversal?". Throughout my years in trading, I've found that if a significant level is broken during the impulse, we can expect a follow through of that impulse after a brief correction or a retest.

In the Impulse diagrams, you can see that I've marked out a recent significant level where price reacted. When there was an impulse, I kept an eye on the level to see if it breaks. If it did not break, I can assume that the impulse wasn't strong enough to create a trend reversal and it is merely a bigger more aggressive correction.

However, if the level did break along with the trendline, we can assume that there is a trend reversal taking place and we should keep our focus on the key level and price action for corrections such as flags, pennants , channels etc.

Please see chart updates for examples of Impulsive Breaks and how to trade them.

What is a Correction?

A correction is defined as a relatively short-term movement of the market in the direction opposite to the main trend.

To identify whether a break of a trendline is an impulsive break of corrective break, we must also identify the key level by looking at a significant level where price reacts. If the impulse that breaks the trendline does NOT break the level, we can assume that the trend isn't ready to reverse yet and it is a corrective break. Often a corrective break ends up with an impulse breaking the significant level, at which time we can look for a correction to take our trade.

See chart updates below for examples of corrective breaks and how to trade them.

Please leave a like and comment what you think!

As always, Goodluck and trade safe!

Mr Wick.

📚 The Perfect Impulse - Correction - Impulse 📚NZDUSD has recently given us the perfect impulse, correct, impulse move, which is probably our favourite pattern to trade.

The market moves in waves. There's an impulse wave, followed by a brief period of consolidation/correction where buyers and sellers accumulate their orders. This is often followed by another impulse wave in the same initial direction as the first impulse.

The great thing about these patterns is that we can have a clear stop placement, which is above the correction. If you have a closer look at this chart, you will be able to notice various impulse waves followed by corrections.

Do your best to find them in your trading!