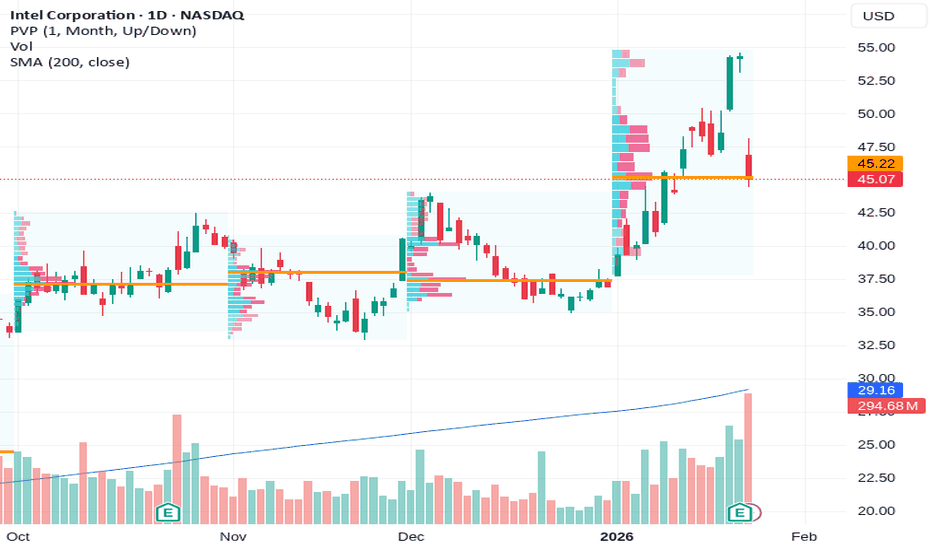

Trading the DivergenceI’m seeing a clear divergence: while AMD and Nvidia have been stalling, Intel has been moving higher, even after a weak earnings outlook. To me, that signals that capital is willing to rotate into Intel despite questionable near-term fundamentals.

The trade itself doesn’t fully align with the curre

Key facts today

The Trump administration has taken a 9.9% stake in Intel Corp, aiding its plans to enhance U.S. manufacturing facilities and improve supply chain security.

Intel will create its own graphics chips to rival NVIDIA and AMD, announced CEO Lip Bu-Tan. Eric Demers, ex-Qualcomm, is appointed as chief GPU architect.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.08 USD

−267.00 M USD

52.85 B USD

4.22 B

About Intel Corporation

Sector

Industry

CEO

Lip-Bu Tan

Website

Headquarters

Santa Clara

Founded

1968

IPO date

Oct 13, 1971

Identifiers

3

ISIN US4581401001

Intel Corporation engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage, and communications platforms. The firm operates through the following segments: Client Computing Group (CCG), Data Center Group (DCG), Internet of Things Group (IOTG), Non-Volatile Memory Solutions Group (NSG), Programmable Solutions (PSG), and All Other. The CCG segment consists of platforms designed for notebooks, 2-in-1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components. The DCG segment includes workload-optimized platforms and related products designed for enterprise, cloud, and communication infrastructure market. The IOTG segment offers compute solutions for targeted verticals and embedded applications for the retail, manufacturing, health care, energy, automotive, and government market segments. The NSG segment constitutes of NAND flash memory products primarily used in solid-state drives. The PSG segment contains programmable semiconductors and related products for a broad range of markets, including communications, data center, industrial, military, and automotive. The All Other segment consists of results from other non-reportable segment and corporate-related charges. The company was founded by Robert Norton Noyce and Gordon Earle Moore on July 18, 1968 and is headquartered in Santa Clara, CA.

Related stocks

INTEL has broken above its 6-year Bear Cycle.Intel (INTC) made a key long-term development this month as following last months rejection, it managed to break above its Lower Highs trend-line with force and despite the strong retracement of these days, it aims to close above it.

This technically brings an end to the stock's 6-year Bear Cycle s

Intel - Starting 2026 with a +50% rally!💰Intel ( NASDAQ:INTC ) just remains completely bullish:

🔎Analysis summary:

Over the course of the past three weeks, Intel has been rallying an incredible +50%. Following this very bullish momentum, there is a high chance of new all time highs soon. Just give Intel some time and don't get caug

Intel Corporation | INTC | Long at $44.26Entered Intel NASDAQ:INTC after-hours at $44.26. The US government is too heavily invested in this one to let it truely slide. The earnings / EPS projections show a likely major turnaround. Any dips are purely programmatic for entry (watch insiders and politicians . I may sound like a conspir

Intel $46.47 Holding Support as Traders Eye Upside Break:Current Price: 46.47

Direction: LONG

Confidence level: 62%(Several professional traders emphasize strategic government backing and AI-related upside, while social sentiment supports dip buying; confidence is tempered by limited data volume and some retail caution.)

Targets

Target 1: 48.8

Target

Intel - Here comes the bullish breakout!💾Intel ( NASDAQ:INTC ) will soon break out:

🔎Analysis summary:

During 2025, Intel has over and over again been retesting major support. That was exactly the reason why I told everyone to enter longs here on Intel. Just a couple months later we witnessed a +150% rally and Intel is about to cre

Breaking: Intel (NASDAQ: INTC) Rallies Ahead of Earnings Intel Corporation (NASDAQ: NASDAQ:INTC ) stock has been on a tear lately, as expectations grow ahead of the chipmaker's quarterly results due after the closing bell Thursday.

The shares jumped nearly 12% amid a broad market rally to close above $54 Wednesday, extending the stock's recent gains as

Intel rebounds from earnings shock as traders eye upside continCurrent Price: 45.07

Direction: LONG

Confidence level: 58%(Based on mixed but improving professional trader sentiment, bullish X momentum, and price holding above key support despite earnings volatility)

Targets

Target 1: 48.00

Target 2: 52.00

Stop Levels

Stop 1: 44.18

Stop 2: 41.00

Wisdom of

INTC heads up into $37: Double Golden zone likely to GRAB itINTC keeps getting "good" news after good news.

Now approaching a Double Golden Zone at $36.62-37.03

This should be a "Sticky" level stalling the wave for a bit.

.

Previous Analysis about another Goldden Genesis that caught the BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts

Is Intel a Tech Stock or a Weapon?In 2026, Intel Corporation is going through a major transformation. It is moving away from being just a company that makes chips for personal computers and is becoming a critical partner for the U.S. military. The United States government has officially recognized Intel as a "National Champion," whi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US458140CD0

Intel Corporation 4.875% 10-FEB-2026Yield to maturity

10.65%

Maturity date

Feb 10, 2026

INTC4949821

Intel Corporation 3.1% 15-FEB-2060Yield to maturity

6.26%

Maturity date

Feb 15, 2060

INTC5456467

Intel Corporation 5.05% 05-AUG-2062Yield to maturity

6.25%

Maturity date

Aug 5, 2062

US458140CK4

Intel Corporation 5.9% 10-FEB-2063Yield to maturity

6.24%

Maturity date

Feb 10, 2063

US458140CJ7

Intel Corporation 5.7% 10-FEB-2053Yield to maturity

6.18%

Maturity date

Feb 10, 2053

INTC5456466

Intel Corporation 4.9% 05-AUG-2052Yield to maturity

6.16%

Maturity date

Aug 5, 2052

INTC4969549

Intel Corporation 4.75% 25-MAR-2050Yield to maturity

6.15%

Maturity date

Mar 25, 2050

INTC4969550

Intel Corporation 4.95% 25-MAR-2060Yield to maturity

6.15%

Maturity date

Mar 25, 2060

INTC5238071

Intel Corporation 3.2% 12-AUG-2061Yield to maturity

6.14%

Maturity date

Aug 12, 2061

US458140AY6

Intel Corporation 4.1% 11-MAY-2047Yield to maturity

6.14%

Maturity date

May 11, 2047

US458140AV2

Intel Corporation 4.1% 19-MAY-2046Yield to maturity

6.13%

Maturity date

May 19, 2046

See all INTC bonds

Frequently Asked Questions

The current price of INTC is 48.60 USD — it has decreased by −1.18% in the past 24 hours. Watch Intel Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Intel Corporation stocks are traded under the ticker INTC.

INTC stock has risen by 4.44% compared to the previous week, the month change is a 17.02% rise, over the last year Intel Corporation has showed a 154.45% increase.

We've gathered analysts' opinions on Intel Corporation future price: according to them, INTC price has a max estimate of 150.00 USD and a min estimate of 30.00 USD. Watch INTC chart and read a more detailed Intel Corporation stock forecast: see what analysts think of Intel Corporation and suggest that you do with its stocks.

INTC reached its all-time high on Aug 28, 2000 with the price of 75.81 USD, and its all-time low was 0.03 USD and was reached on Sep 17, 1974. View more price dynamics on INTC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

INTC stock is 5.74% volatile and has beta coefficient of 1.34. Track Intel Corporation stock price on the chart and check out the list of the most volatile stocks — is Intel Corporation there?

Today Intel Corporation has the market capitalization of 246.00 B, it has increased by 7.97% over the last week.

Yes, you can track Intel Corporation financials in yearly and quarterly reports right on TradingView.

Intel Corporation is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

INTC earnings for the last quarter are 0.15 USD per share, whereas the estimation was 0.08 USD resulting in a 84.37% surprise. The estimated earnings for the next quarter are 0.01 USD per share. See more details about Intel Corporation earnings.

Intel Corporation revenue for the last quarter amounts to 13.67 B USD, despite the estimated figure of 13.43 B USD. In the next quarter, revenue is expected to reach 12.30 B USD.

INTC net income for the last quarter is −591.00 M USD, while the quarter before that showed 4.06 B USD of net income which accounts for −114.55% change. Track more Intel Corporation financial stats to get the full picture.

Yes, INTC dividends are paid quarterly. The last dividend per share was 0.13 USD. As of today, Dividend Yield (TTM)% is 0.00%. Tracking Intel Corporation dividends might help you take more informed decisions.

As of Feb 5, 2026, the company has 85.1 K employees. See our rating of the largest employees — is Intel Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Intel Corporation EBITDA is 11.68 B USD, and current EBITDA margin is 22.10%. See more stats in Intel Corporation financial statements.

Like other stocks, INTC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Intel Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Intel Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Intel Corporation stock shows the strong buy signal. See more of Intel Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.