Key facts today

India's Pilot Union has asked the air safety regulator to inspect the electrical systems in Boeing Dreamliner aircraft operating in the country.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−16.52 USD

−11.82 B USD

66.52 B USD

755.13 M

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

ISIN

US0970231058

FIGI

BBG000BCSST7

The Boeing Co is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space and security systems. It operates through the following segments: Commercial Airplanes; Defense, Space and Security; Global Services; and Boeing Capital. The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems; global mobility, including tanker, rotorcraft and tilt-rotor aircraft; and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The Boeing Capital segment seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. The company was founded by William Edward Boeing on July 15, 1916 and is headquartered in Chicago, IL.

Related stocks

Another fake news on orders from Turkish AirlinesAnother round of “fake news”?

Headline: Boeing receives a major order from Turkish Airlines for up to 225 aircraft.

Reality check: Turkish Airlines currently operates just 387 aircraft in its fleet. Earlier this year, we saw the same script play out when reports claimed Pegasus Airlines — the low-co

Boeing (BA) Technical Outlook: Is Downside Momentum Building?✈️ BA "BOEING COMPANY" | Cash Flow Management Strategy (Swing/Day Trade)

📉 Plan: Bearish Setup

This analysis follows the Thief Strategy 🕶️ — a layering method of multiple sell-limit orders across different levels.

🔑 Trade Plan

Entry (Layered Sell Limits):

220.00

218.00

216.00

214.00

(You can incre

Boeing poised for recovery as record order pipeline builds momenCurrent Price: $215.65

Direction: LONG

Targets:

- T1 = $224.50

- T2 = $230.00

Stop Levels:

- S1 = $211.75

- S2 = $208.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intel

Boeing Poised for Recovery: Key Levels for a Bullish Move Current Price: $221.26

Direction: LONG

Targets:

- T1 = $235.00

- T2 = $250.00

Stop Levels:

- S1 = $215.00

- S2 = $208.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intel

$BA Rolling over again?After a push higher BA has recently run out of steam and looks like its rolling over. The last few weeks has failed to follow through higher after the Bearish Engulfing Candle. Last week we saw a move down and a close below the 20MA. I expect a reaction higher, initially, and then we see a further m

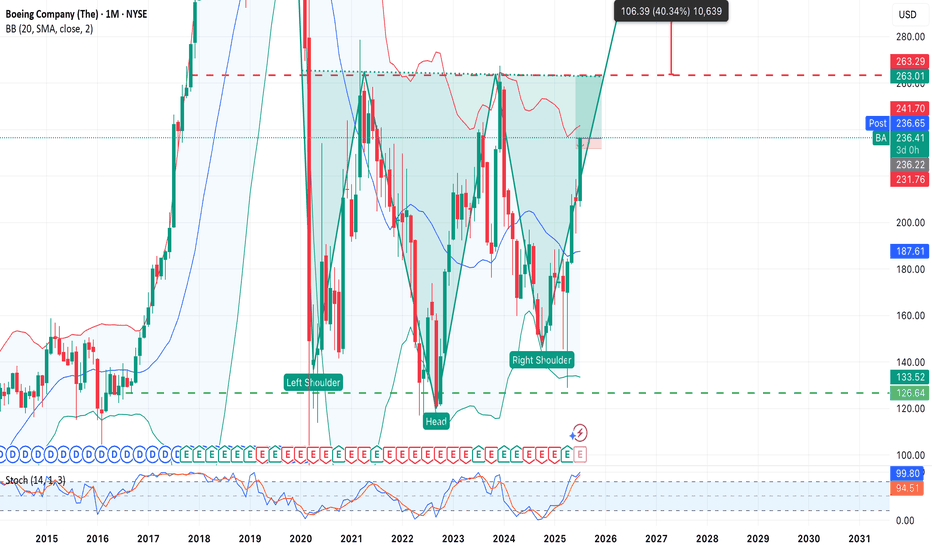

An adventure? Yes. But technically — beautiful. Boeing.Adventure Idea: The Return of Boeing NYSE:BA

An inverted “Head and Shoulders” pattern is forming on the BA (Boeing) chart — one of the most reliable bullish formations in technical analysis. The price is confidently approaching the neckline around $235–241, and a breakout above this level could

Professional Analysis of Boeing (BA) Stock – Daily TimeframeOn the daily chart, Boeing (BA) has entered a descending channel after a strong rally from the $175 lows up to around $240 highs.

Bullish Scenario:

The price is currently around $215, near the channel’s lower boundary.

If this support holds and the stock reclaims the 50-day moving average (yellow

Breaking: Boeing's $215.94 Price Tests Crucial Upside ResistanceCurrent Price: $215.94

Direction: LONG

Targets:

- T1 = $225.00

- T2 = $235.00

Stop Levels:

- S1 = $210.00

- S2 = $205.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intel

Levels to watch during $BA bear momentumLabor Strike at Boeing Defense

• 3,200 Boeing Defense workers in St. Louis have rejected a third contract offer, extending a strike that began on August 4.

• The rejected offer included a 45% average wage increase and a $4,000 signing bonus, but union members felt it fell short compared to other

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.72%

Maturity date

May 1, 2064

BA5803370

Boeing Company 6.858% 01-MAY-2054Yield to maturity

6.40%

Maturity date

May 1, 2054

BA5803367

Boeing Company 6.528% 01-MAY-2034Yield to maturity

6.28%

Maturity date

May 1, 2034

BA5803365

Boeing Company 6.388% 01-MAY-2031Yield to maturity

6.14%

Maturity date

May 1, 2031

BA5803162

Boeing Company 6.298% 01-MAY-2029Yield to maturity

6.07%

Maturity date

May 1, 2029

BA5803363

Boeing Company 6.259% 01-MAY-2027Yield to maturity

6.03%

Maturity date

May 1, 2027

US97023BV6

Boeing Company 3.65% 01-MAR-2047Yield to maturity

5.94%

Maturity date

Mar 1, 2047

BA5946120

Boeing Company 7.008% 01-MAY-2064Yield to maturity

5.93%

Maturity date

May 1, 2064

US97023BS3

Boeing Company 3.375% 15-JUN-2046Yield to maturity

5.92%

Maturity date

Jun 15, 2046

BCOC

Boeing Company 3.5% 01-MAR-2045Yield to maturity

5.89%

Maturity date

Mar 1, 2045

BA4983331

Boeing Company 5.93% 01-MAY-2060Yield to maturity

5.88%

Maturity date

May 1, 2060

See all BA bonds

Curated watchlists where BA is featured.

Frequently Asked Questions

The current price of BA is 216.30 USD — it has decreased by −0.52% in the past 24 hours. Watch Boeing Company (The) stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Boeing Company (The) stocks are traded under the ticker BA.

BA stock has fallen by −3.16% compared to the previous week, the month change is a −8.76% fall, over the last year Boeing Company (The) has showed a 42.19% increase.

We've gathered analysts' opinions on Boeing Company (The) future price: according to them, BA price has a max estimate of 287.00 USD and a min estimate of 217.00 USD. Watch BA chart and read a more detailed Boeing Company (The) stock forecast: see what analysts think of Boeing Company (The) and suggest that you do with its stocks.

BA stock is 1.66% volatile and has beta coefficient of 1.51. Track Boeing Company (The) stock price on the chart and check out the list of the most volatile stocks — is Boeing Company (The) there?

Today Boeing Company (The) has the market capitalization of 163.56 B, it has increased by 0.34% over the last week.

Yes, you can track Boeing Company (The) financials in yearly and quarterly reports right on TradingView.

Boeing Company (The) is going to release the next earnings report on Oct 29, 2025. Keep track of upcoming events with our Earnings Calendar.

BA earnings for the last quarter are −1.24 USD per share, whereas the estimation was −1.40 USD resulting in a 11.11% surprise. The estimated earnings for the next quarter are −0.43 USD per share. See more details about Boeing Company (The) earnings.

Boeing Company (The) revenue for the last quarter amounts to 22.75 B USD, despite the estimated figure of 22.15 B USD. In the next quarter, revenue is expected to reach 21.50 B USD.

BA net income for the last quarter is −611.00 M USD, while the quarter before that showed −37.00 M USD of net income which accounts for −1.55 K% change. Track more Boeing Company (The) financial stats to get the full picture.

As of Oct 5, 2025, the company has 172 K employees. See our rating of the largest employees — is Boeing Company (The) on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Boeing Company (The) EBITDA is −7.46 B USD, and current EBITDA margin is −13.46%. See more stats in Boeing Company (The) financial statements.

Like other stocks, BA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Boeing Company (The) stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Boeing Company (The) technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Boeing Company (The) stock shows the buy signal. See more of Boeing Company (The) technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.