Market Review: Full Higher Time Frame Review of NASDAQ bear runI hope this get's featured 🎯

The simplest macroeconomic review of NASDAQ you may see this year.

It's all a fib retracement. That's all I have to say for now 🔪 Share this with someone looking for a good review 💰

**Video was cut short by a minute or two but the general idea was complete

Candlestick Analysis

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

GBPJPY Sell idea/analysis On the 4-hour timeframe, we can see a downtrend forming by having a Lower high and a low that has been broken, and I can see a rejection off of the low that can be a confirmation for a downtrend to shape. The uptrend trendline is broken, and the downtrend trendline has been respected so far, so these are enough confirmations for me to take this trade.

W14 Daily Edge – Play Likelihood ThesisMomentum structure. Strong weekly open. Large Initial Balance. Breakout bias remains dominant unless we hit exhaustion.

🔭 Likely Play Occurrences

✅ Clean breakout long – Very High

🟡 Rejection-and-hold near VAH – Moderate (watch for retest)

🟠 Failed breakout then rotation long – Low–Moderate

🔒 Shorts – Only valid after AWR High (3170) is hit

🎯 Key Reference Levels (W13 Context + W14 Targets)

W14 AWR High: 3170

50% AWR Target: 3134

W13 High: 3086

W13 VAH: 3046

W13 POC: 3016

W13 VAL: 3004

W13 Low: 3002

Holding structure above 3046 keeps breakout thesis alive. Watching for reaction near 3134 and exhaustion into 3170. Shorts only considered above AWR.

NAS100 EYESI am honestly intending to see some buys, so I did not draft for this video hence my mind was all over the zones and the gaps, I wannit to talk bias but I ended up analyzing to trade. I am sorry about that but we will fix it as soon as possible. Happy Trading.

Lastly, if your plan fail, don't reconsider another entry, especially on the same day.

Daily Edge – March 29, 2025Friday Close – Week 13 Wrap + Week 14 Setup Preview

Context

Week 13 closed bullish, forming a double distribution profile and finishing just below all-time highs.

Week 14 opens on the final day of March + Q1 — a high-stakes inflection point.

Red folder news events dominate the week ahead, including Non-Farm Payroll (NFP) on Friday.

Key Weekly Levels (Week 13)

MPH: 3086

VAH: 3046

POC: 3016 (below W12 POC at 3034)

VAL: 3004

MPL: 3002

Last Week’s Play Recap

Entered a Failed Auction Long early in W13 near W12 VAL (3014–3020)

Structure evolved into clean IB Breakout, then full range extension and continuation toward highs

Late-week close confirmed expansion above AMR High and value structure

Some live positions remain open, awaiting Monday’s open for management decisions

Looking Ahead to Week 14

Monday is observation-only — waiting for the Initial Balance (IB) to form on the 4H TPO Weekly Profile

This week also prints:

The February IB (from Daily/Monthly TPO)

The Week 14 IB (Weekly TPO)

The Q2 Opening Profile (Quarterly TPO)

Higher timeframe structure remains bullish, but entries will only follow confirmed setups from the PNP playbook

Execution Plan for the Week

Let Monday define IB

Match structure to historical high-probability patterns

Tag validated setups: FA, IBX, Reversion, etc.

Execute using the scaling-in model only after confirmation

Maintain consistent VAR and clarity on exit plan

“Structure prints the story. Data confirms the play. We only act when both align.”

Ready to trade with clarity and control?

Hand-drawn charts + structured execution = Calm. Confident. In Control.

Join the PipsnPaper community.

GBPUSD | APRIL 2025 FORECAST | Chopping Block is Hot!GBP/USD is approaching the psychological 1.3000 level, a key battleground for bulls and bears. The pair has been trading within a rising channel, but recent price action suggests momentum could be shifting.

🔹 Trend & Structure: GBP/USD remains in a broader uptrend but is struggling to maintain bullish momentum above 1.3000. A confirmed break could signal continuation, while rejection may trigger a retracement toward 1.2800-1.2750.

🔹 Technical Outlook:

Support Levels: 1.2850, 1.2750

Resistance Levels: 1.3050, 1.3150

Indicators: RSI hovers near 65, signaling slight overextension; MACD shows bullish momentum but weakening.

🔹 Fundamental Factors:

BOE policy expectations vs. Fed’s stance on rate cuts.

US & UK economic data—watch CPI and employment figures.

If GBP/USD clears and holds above 1.3000, it could open doors for a rally toward 1.3150. But if sellers defend this level, we might see a pullback toward 1.2850-1.2750 before the next move.

Will 1.3000 hold, or is a reversal on the horizon? Drop your predictions below! 📉📈 #GBPUSD #ForexTrading #MarketAnalysis

GBPJPY | APRIL 2025 FORECAST| Will GJ fly to the SKY?GBP/JPY has been riding strong volatility, reacting to both BOE and BOJ policy shifts. As we head into the new month, the pair is testing a critical resistance zone near , with momentum signaling a potential breakout or rejection.

🔹 Trend Analysis: The pair remains in a strong , with price respecting the as dynamic support/resistance.

🔹 Key Levels: Resistance at , support at . A break above could open the door to .

🔹 Technical Outlook: RSI divergence hints at possible exhaustion, while Fibonacci retracements suggest key reaction zones around .

Will GBP/JPY continue its bullish momentum, or are we looking at a deeper correction? Share your insights below! 📉📈 #GBPJPY #ForexForecast #MarketAnalysis

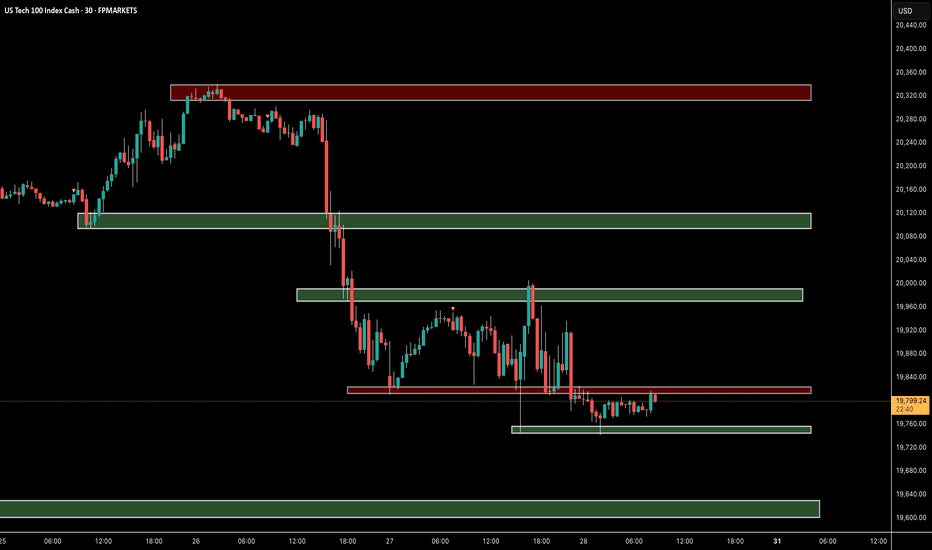

Realtime markups: Indices tailspin to the weekly range lowsAfter rejecting the weekly highs aggressively on Wednesday, we had a clear run toward the low of the same weekly range candle's low. I believe this low will be hit before anything else.

We will see what the Monday open sequence looks like. See you then 🫡

AUDUSD | APRIL 2025 FORECAST| This Next Move will be Massive!AUD/USD is shaping up for a critical month, with price action hovering around a key support zone near . The pair has been reacting to , influencing both bullish and bearish momentum.

🔹 Trend Analysis: The pair remains in a on the higher timeframe, with acting as dynamic support/resistance.

🔹 Key Levels: Support at , resistance at .

🔹 Momentum & Structure: A break above could trigger bullish continuation, while failure to hold may lead to a deeper retracement.

With fundamentals aligning with technicals, this month could present solid trading opportunities. Will AUD/USD push higher, or are we in for a reversal? Drop your thoughts below! 🚀📊 #AUDUSD