Gold Daily Update - Looking Bullish!Gold has successfully broken above the critical 3030 level, at least on the shorter time frames of 30 minutes and 1 hour. It has closed above this level and is now retracing slightly, possibly to test the area again. If the price holds above this level during the London session, further upward momentum is likely. The first target could be a retest of the 3050 level, and depending on the volume during the New York session—particularly at the New York Stock Exchange's opening at 9:30 AM EST—it might even attempt to retest its all-time high.

Given this price action, the downside appears limited for now, and I wouldn't recommend shorting this market at the moment. Even though we're approaching the end of the month and quarter, when fund managers often rebalance portfolios or book profits from recent gains, the momentum currently seems firmly bullish. Shorts would only become a consideration if the price closes decisively below 3030, fails to reclaim that level, and gradually breaks below 3015. Until we see such developments, the current trend favors the bulls.

Wishing you a great day and week ahead! Don't forget to like and subscribe to my channel to keep receiving free analysis and content.

Candlestick Analysis

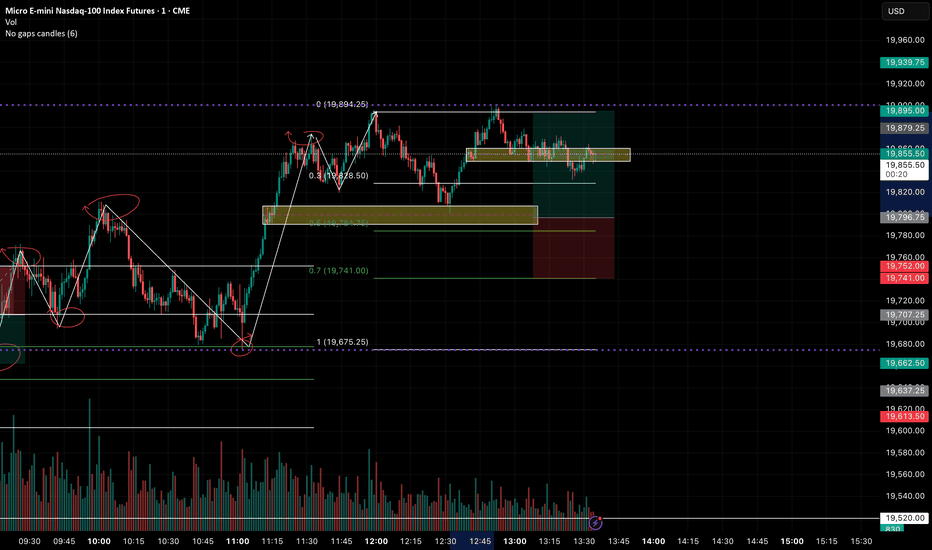

NAS still charging for bullish targets but currently retracingWe are looking at a retest of break points on the session. Going into this session we will monitor what happens at the previously broken levels.

We do have bearish imbalances in LTFs that have yielded neat entry on shorts. Stay sharp in this range.

Share with someone in need on true levels 🔑

Gold is eyeing highs after a bullish daily candleThis is def a consolidation range so keep your eyes sharp and pay attention to what happens as we break into the highs. Will we displace with longs or will be be saturated by the bearish imbalances above the current hourly range?

Share with a friend in need 🔑

EURUSD - Has Bears Taken Control Now? First and foremost, I want to give a lot of credit to TradingView for picking my previous EURUSD post as the editors picks!

If we have a look at how this week has delivered, the previous weeks buyside was attacked before EURUSD saw rejection, indicating further decline in price.

This also goes hand in hand with the expansion with dollar index

Dow Jones - Frontrunning Nasdaq & S&P 500When comparing Dow Jones to Nasdaq and S&P500, you will notice that this weeks price range is larger than the others, indicating that Dow Jones is the front running market.

Dow is the leading stock index pair to study. If I am expecting to see appreciation in NQ, ES, I want to see YM move first.

ZB1! - Will Donald Trump Pump The Bond Market? On Wednesday, Trump mentioned the need to lower interest rates as the tariffs will have major effects with the rates being where they are at now.

In the last, whenever yields rise, bonds will fall and we have been seeing this from the beginning of September 2024, with minor signs of retracement (factoring Jan 2025 bull run)

Overall, when you look at price action over the past few weeks, it seems as though the bull run has slowed down and there could be a chance for bonds to drop to 116 going into next week.

US10Y - Will Donald Trumps Lower Interest Rates Come True?President Donald Trump late Wednesday criticized the Federal Reserve, urging the central bank to reduce interest rates, hours after it chose to leave borrowing rates unchanged.

He quotes “The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy,” Trump said in a post on Truth Social on Wednesday, adding “Do the right thing.”

On Thursday, we witnessed manipulation to the downside, indicating that in the short term we could be in for higher yields, with 4.267% being the 1st point of interest.

Reference: abcnews.go.com

XAUUSD – Market Profile - Week 13 Update - 25.03.25IB (3002–3033) formed Monday.

Confirmed Failed Auction Low after reclaiming VAL (3014).

POC now migrating up (3020), price holding inside value (3012–3026).

Watching for 4H close above IB High (3033) to trigger IBX Long toward 3050–3070.

No valid short plays historically from this structure.

#XAUUSD #MarketProfile #FailedAuction #IBX #PipsnPaper

GOLD TOP IS NEARGold appears to be distributing on all timeframes excepting daily , this added to the extensive media coverage recently makes me think that a significant all time top is near , gold still maintains support on all timeframes but that is probably the only thing holding it from a big crash.

GBPUSD - Nearly 1,000 Pips In 2025!GBPUSD was sideways around $1.29452 after a surprise news from the UK caught sterling bulls unprepared. The UK economy surprisingly shrunk by 0.1% in January, month on month, according to the latest GDP figures released by the Office for National Statistics.

With price reaching up into the premium SIBI, there is a chance for a minor pullback. Risky, yet possible with this weeks high impact events

Dollar Index - Will Rate Hikes Cause Risk Off Conditions?It’s been a risk off environment over the last few weeks and because of this, we have seen the appreciation of GBPUSD and EURUSD which was called weeks in advance.

With a massive imbalance above and daily sellside liquidity taken, the question is will Dollar Index fill the daily SIBI before the rate announcements happen?

If this happens, it will be a classic ‘buy the rumour, sell the news’ scenario.

Next week will be very volition due to the news events being released and this could be the catalyst for price to expand into the local SIBI outlined on the daily timeframe.