Candlestick Analysis

Uniswap Coin (UNI): 2 Ways To Go | Good Risk:Reward TradesUniswap coin is at a crucial zone where we are going to wait for further confirmations. We have spotted 2 good trades that can be taken on a daily timeframe so we are now going to wait for either a breakout in the form of BoS or a breakdown!

More in-depth info is in the video—enjoy!

Swallow Team

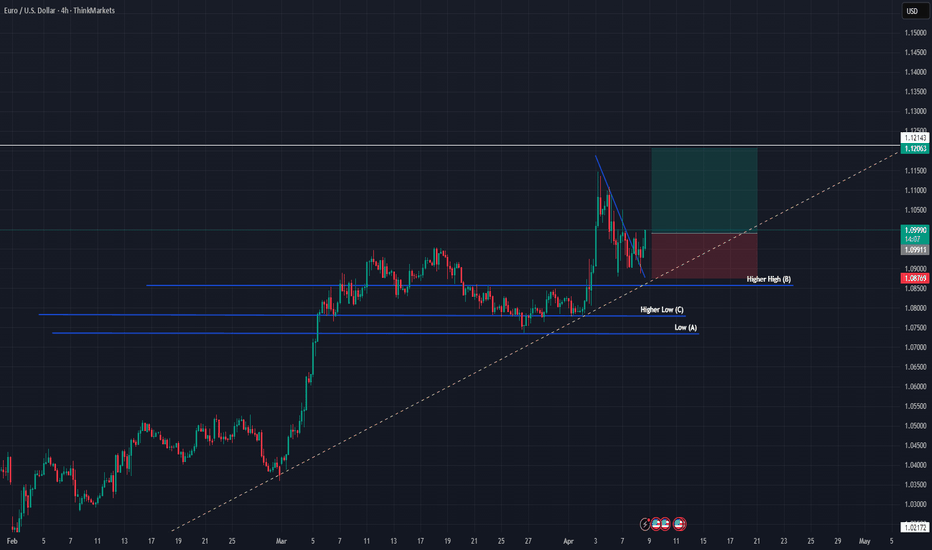

How low Can the Dollar Go? And What It Could Mean for EUR/USDThe US dollar index has handed back all of its Q4 gains with traders betting that Trump's trade war will do more damage than good to the US economy. I update my levels on the US dollar index and EUR/USD charts then wrap up market exposure to USD index futures.