JPM – JPMorgan Chase (Daily)JPM is trading inside a well-defined ascending channel after a strong bullish rally.

Price has now pulled back sharply and is currently testing the lower boundary of the channel, making this a critical decision zone.

Technical Structure

• Primary trend: Bullish (as long as channel support holds)

Key facts today

JPMorgan Chase is creating an index for frontier market local currency bonds, covering 20-25 countries like Egypt, Vietnam, and Nigeria, with a launch expected next year.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.05 USD

56.78 B USD

280.35 B USD

About JP Morgan Chase & Co.

Sector

Industry

CEO

James Dimon

Website

Headquarters

New York

Founded

1799

IPO date

Mar 5, 1969

Identifiers

3

ISIN US46625H1005

JPMorgan Chase & Co is a financial holding company. It provides financial and investment banking services. The firm offers a range of investment banking products and services in all capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, risk management, market making in cash securities and derivative instruments, and brokerage and research. It operates through the following segments: Consumer and Community Banking, Corporate and Investment Bank, Commercial Banking, and Asset and Wealth Management. The Consumer and Community Banking segment serves consumers and businesses through personal service at bank branches and through automated teller machine, online, mobile, and telephone banking. The Corporate and Investment Bank segment offers a suite of investment banking, market-making, prime brokerage, and treasury and securities products and services to a global client base of corporations, investors, financial institutions, government and municipal entities. The Commercial Banking segment delivers services to U.S. and its multinational clients, including corporations, municipalities, financial institutions, and non profit entities. It also provides financing to real estate investors and owners as well as financial solutions, including lending, treasury services, investment banking, and asset management. The Asset and Wealth Management segment provides asset and wealth management services. The company was founded in 1968 and is headquartered in New York, NY.

Related stocks

JP Morgan stock may present a good buying opportunity after the JPMorgan is one of the strongest financial stocks in the market. After the recent correction, it could present an attractive opportunity for long-term investment.

However, caution is warranted due to recent statements by Donald Trump regarding potential measures to reduce comissions. Such actions

Bearish Edge on JPM: QS V4 Signals Speculative Put OpportunityJPM Weekly (QS V4 Elite | 2026‑02‑01)

Signal: PUTS

Conviction: Speculative / Moderate

Alpha Score: 62 (Quant Synthesis)

Time Horizon: Weekly (Expiry 2026‑02‑07)

Stop Loss: $2.25 (‑25% premium)

Targets:

Target 1: $3.75 (+25%)

Target 2: $4.80 (+60%+)

Core Thesis:

Short-term bearish edge due to

JPM Plunges as Credit Card Interest Caps Threaten ProfitsJPM Plunges as Credit Card Interest Caps Threaten Profits

NYSE:JPM is feeling the heat today after news about a potential 10%cap on credit card interest rates sent shockwaves through the banking sector.

This political pressure has triggered a sharp selloff causing the stock to break out of

JPM EARNINGS 01-2026JPM is stalling right below a heavy monthly supply band (324.6–329.3 gap area into 330+), with price being defended near 324.6–327 (absorption on dips). As long as 324.6 holds, the path of least resistance is a gap-fill/retest higher; failure there likely sends price back to the earnings anchor.

Ke

Will the party continue at $JPM?An excerpt from analysis covered on the @ForexTraderPaul Monday Market Update.

JPM often leads financial sentiment — weakness here can signal broader risk-off across US equities. Hence why we're interested in a) its numbers and b) how it reacts.

JPM has been on a great trend, and remain the quali

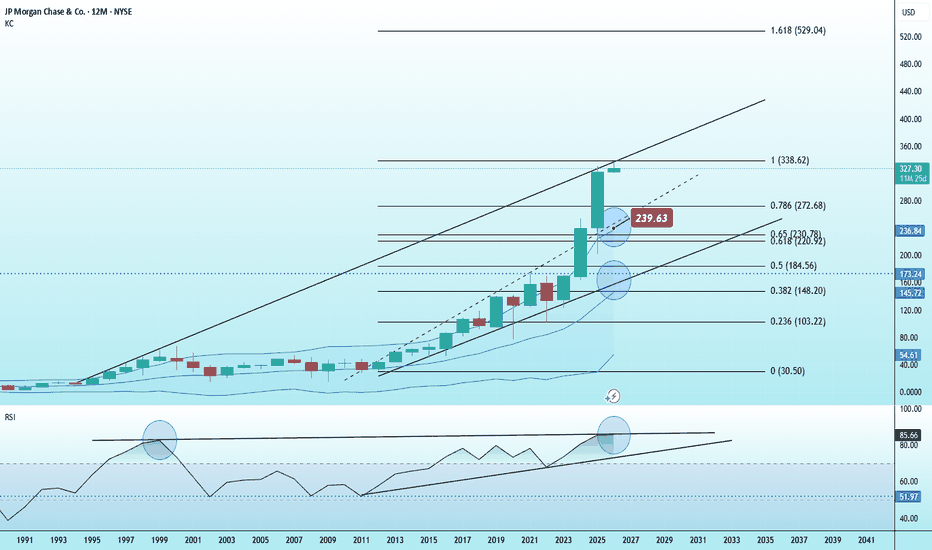

JPM JP Morgan Chase 1Y Chart Review - RSI focus pointToday you can review the technical analysis idea on a 1Y linear scale chart for JP Morgan Chase Bank (JPM).

It seems there is some action going on here with JPM reviewing the RSI and the ATH. This may be a concern.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading y

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS1569768143

JPMorgan Chase Bank, NA (New York Branch) 0.0% 20-APR-2026Yield to maturity

209.78%

Maturity date

Apr 20, 2026

XS1569765396

JPMorgan Chase Bank, NA (New York Branch) 0.0% 19-OCT-2026Yield to maturity

205.37%

Maturity date

Oct 19, 2026

XS1879176623

JPMorgan Chase Bank, National Association (417) 0.0% 25-AUG-2026Yield to maturity

199.60%

Maturity date

Aug 25, 2026

XS1879190533

JPMorgan Chase Bank, NA (New York Branch) 0.0% 29-APR-2026Yield to maturity

198.88%

Maturity date

Apr 29, 2026

JPM5489894

JPMorgan Chase Financial Co. LLC 0.0% 20-OCT-2027Yield to maturity

184.40%

Maturity date

Oct 20, 2027

XS1879172044

JPMorgan Chase Bank NA 0.0% 14-SEP-2026Yield to maturity

180.39%

Maturity date

Sep 14, 2026

JPM5515395

JPMorgan Chase Financial Co. LLC 0.0% 20-DEC-2027Yield to maturity

172.83%

Maturity date

Dec 20, 2027

XS1879170006

JPMorgan Chase Bank NA 0.0% 12-OCT-2026Yield to maturity

170.92%

Maturity date

Oct 12, 2026

XS1569755322

JPMorgan Chase Bank, NA (New York Branch) 0.0% 02-NOV-2026Yield to maturity

147.52%

Maturity date

Nov 2, 2026

XS1569761999

JPMorgan Chase Bank, NA (New York Branch) 0.0% 28-MAR-2028Yield to maturity

117.89%

Maturity date

Mar 28, 2028

JPM5545511

JPMorgan Chase Financial Co. LLC 0.0% 29-FEB-2028Yield to maturity

116.03%

Maturity date

Feb 29, 2028

See all JPM bonds

Frequently Asked Questions

The current price of JPM is 314.15 USD — it has increased by 0.59% in the past 24 hours. Watch JP Morgan Chase & Co. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange JP Morgan Chase & Co. stocks are traded under the ticker JPM.

JPM stock has risen by 2.86% compared to the previous week, the month change is a −3.89% fall, over the last year JP Morgan Chase & Co. has showed a 19.98% increase.

We've gathered analysts' opinions on JP Morgan Chase & Co. future price: according to them, JPM price has a max estimate of 400.00 USD and a min estimate of 280.00 USD. Watch JPM chart and read a more detailed JP Morgan Chase & Co. stock forecast: see what analysts think of JP Morgan Chase & Co. and suggest that you do with its stocks.

JPM stock is 2.62% volatile and has beta coefficient of 3.21. Track JP Morgan Chase & Co. stock price on the chart and check out the list of the most volatile stocks — is JP Morgan Chase & Co. there?

Today JP Morgan Chase & Co. has the market capitalization of 838.84 B, it has increased by 2.92% over the last week.

Yes, you can track JP Morgan Chase & Co. financials in yearly and quarterly reports right on TradingView.

JP Morgan Chase & Co. is going to release the next earnings report on Apr 14, 2026. Keep track of upcoming events with our Earnings Calendar.

JPM earnings for the last quarter are 4.63 USD per share, whereas the estimation was 4.85 USD resulting in a −4.57% surprise. The estimated earnings for the next quarter are 5.21 USD per share. See more details about JP Morgan Chase & Co. earnings.

JP Morgan Chase & Co. revenue for the last quarter amounts to 45.80 B USD, despite the estimated figure of 46.17 B USD. In the next quarter, revenue is expected to reach 48.26 B USD.

JPM net income for the last quarter is 12.97 B USD, while the quarter before that showed 14.32 B USD of net income which accounts for −9.47% change. Track more JP Morgan Chase & Co. financial stats to get the full picture.

Yes, JPM dividends are paid quarterly. The last dividend per share was 1.50 USD. As of today, Dividend Yield (TTM)% is 1.88%. Tracking JP Morgan Chase & Co. dividends might help you take more informed decisions.

JP Morgan Chase & Co. dividend yield was 1.80% in 2025, and payout ratio reached 28.97%. The year before the numbers were 2.00% and 24.30% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 3, 2026, the company has 318.51 K employees. See our rating of the largest employees — is JP Morgan Chase & Co. on this list?

Like other stocks, JPM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JP Morgan Chase & Co. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JP Morgan Chase & Co. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JP Morgan Chase & Co. stock shows the strong buy signal. See more of JP Morgan Chase & Co. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.