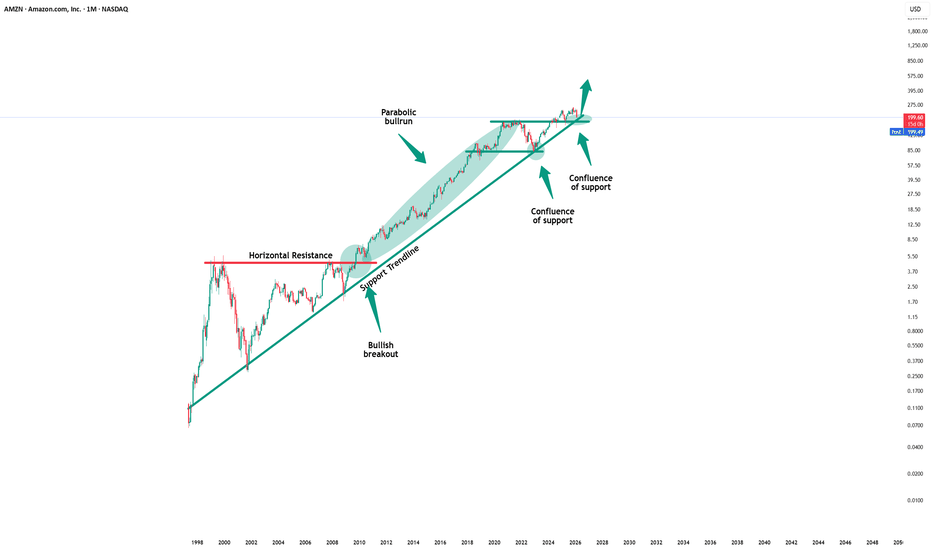

Amazon - This stock is still 100% bullish!🎉Amazon ( NASDAQ:AMZN ) just remains totally bullish:

🔎Analysis summary:

This month alone, Amazon is down about -15%. But looking at the higher timeframe, the underlying uptrend still remains incredibly strong. And even if Amazon drops another -15%, it will retest a significant support and su

Key facts today

Italian police searched Amazon's Milan headquarters in a tax evasion probe. They are investigating if Amazon had an undisclosed base in Italy from 2019 to 2024, requiring extra taxes.

In 2026, Amazon plans to invest $200 billion, leading hyperscalers in AI capital spending, part of a total $650 billion projected by Amazon, Microsoft, Meta, and Alphabet.

Amazon plans $200 billion in capital spending by 2026, fueled by growth in cloud services and increasing demand for artificial intelligence across customer sectors.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.29 USD

77.67 B USD

716.92 B USD

9.73 B

About Amazon.com, Inc.

Sector

Industry

CEO

Andrew R. Jassy

Website

Headquarters

Seattle

Founded

1994

IPO date

May 15, 1997

Identifiers

3

ISIN US0231351067

Amazon.com, Inc. engages in the provision of online retail shopping services. It operates through the following business segments: North America, International, and Amazon Web Services (AWS). The North America segment includes retail sales of consumer products and subscriptions through North America-focused websites such as amazon.com and amazon.ca. The International segment offers retail sales of consumer products and subscriptions through internationally-focused websites. The Amazon Web Services segment involves in the global sales of compute, storage, database, and AWS service offerings for start-ups, enterprises, government agencies, and academic institutions. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA.

Related stocks

AMZN Wait For The Crack!This is a complete structure with 4 points, 3 waves, and a hook revealing a rising wedge.

The first mini-crack has already taken place.

The structure is all set up, valid, and ready to crack! All you have to do is wait.

🚨CAUTION! To all the bulls!

If you enjoy the work:

👉 Boost

👉 Follow

👉 Drop a

Why AMZN had a Flash Crash and what comes next.

TradingView has awesome tools for your trading. However, tools along are not enough. AMZN had a Flash Crash on strong earnings and revenues for its 4th quarter of 2025. The reason it had a Flash Crash has NOTHING to do with its earnings. It had a Flash Crash on a NON-event which is a fear that so

AMZN Q4 2025 - "The Infrastructure Pivot" "The Infrastructure Pivot" – Aggressive Capital Deployment for AI Dominance

Amazon has effectively declared the "AI Arms Race" is entering its deployment phase. While the retail business remains a cash engine, the company is pivoting aggressively to become the primary infrastructure provider for th

$AMZN to upside during earnings week This is my AMZN long-term call setup.

I’m currently positioned in the 255 call expiring February 27th, 2026.

From a 1D-timeframe perspective, the uptrend remains intact from Nov 24, 2025.

Price continues to print higher lows on the daily, and we’re holding above the rising 200 EMA — which keeps th

Amazon (AMZN) Shares Struggle to Find Support After Weak ReportAmazon (AMZN) Shares Struggle to Find Support After Weak Report

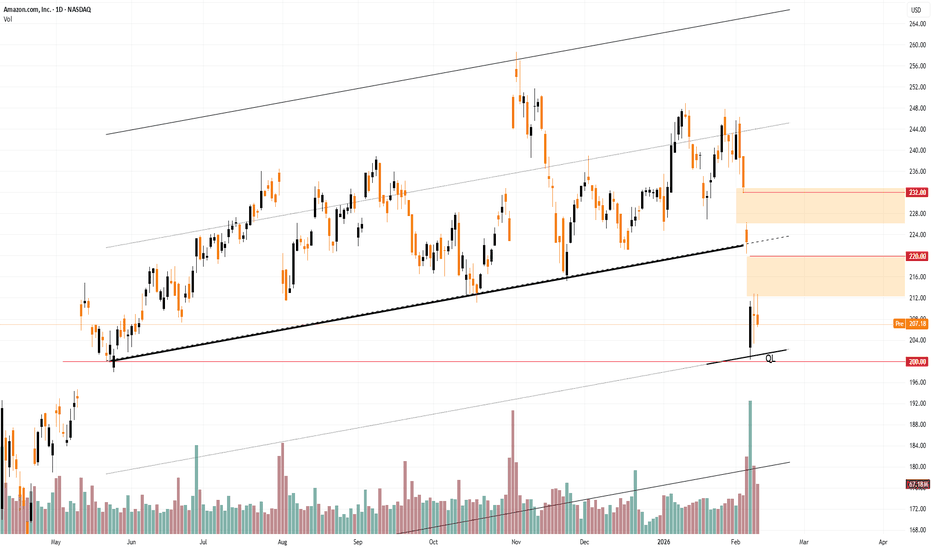

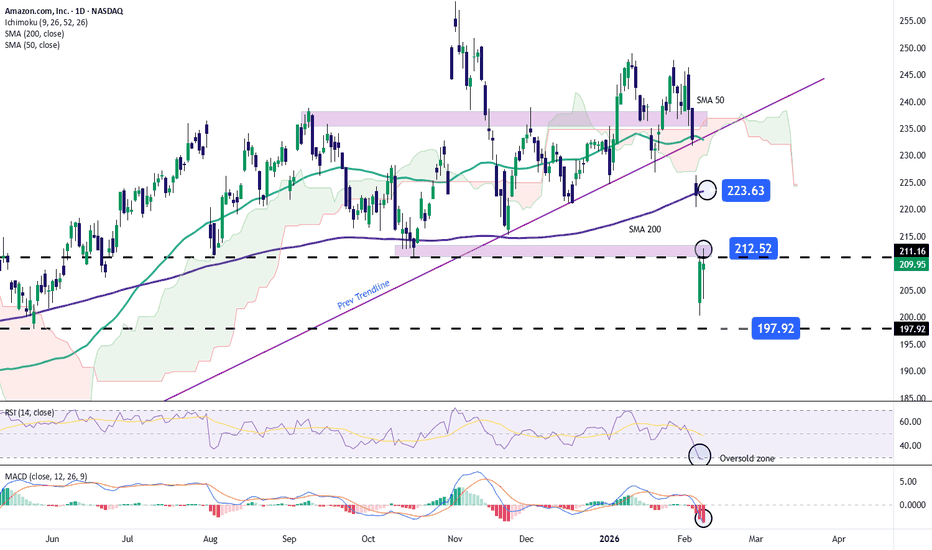

As the chart shows, Amazon (AMZN) shares have displayed pronounced bearish momentum following the release of a weak earnings report on 5 February:

→ Revenue: $213.4 bn (forecast: $211.4 bn)

→ Earnings per share (EPS): actual $1.95, f

Amazon stock continues to show weakness near the $200 levelAmazon shares have lost more than 9% of their value since earnings were released on February 5. Despite generally solid results — EPS of $1.95 per share versus an estimated $1.97, and revenues of $213 billion compared to $211 billion expected — what truly concerned the market was the increase in the

Long Amazon golden pocket Amazon had a surprise dump, but it wasn’t really a surprise because it was recently in the weekly supply zone which rejected bulls. This golden pocket is my favorite strategy I have found for weekly chart strategies. Amazon is already my largest holding. 283 remains my target which is the golden fib

Amazons next move.Right now, Amazon is swimming in red flags that are dragging sentiment and stock performance into troubling territory. After reporting solid top-line growth with revenue gains and AWS expansion, investors shocked markets by unveiling a massive $200 billion capital expenditure plan for 2026, far abov

Breaking: Amazon.com, Inc. ($AMZN) Shares Are TankingShares of Amazon.com, Inc. (NASDAQ: NASDAQ:AMZN ) are nosediving amidst market bloodbath in both crypto and stock market world.

Shares of Amazon ( NASDAQ:AMZN ) closed Thursday's session down 4.42% extending lose to Friday's premarket currently down 7.78% approaching $100+ levels. Shares of Amaz

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMZN6237342

Amazon.com, Inc. 5.55% 20-NOV-2065Yield to maturity

5.71%

Maturity date

Nov 20, 2065

AMZN4531868

Amazon.com, Inc. 4.25% 22-AUG-2057Yield to maturity

5.61%

Maturity date

Aug 22, 2057

AMZN5182960

Amazon.com, Inc. 3.25% 12-MAY-2061Yield to maturity

5.60%

Maturity date

May 12, 2061

AMZN5396185

Amazon.com, Inc. 4.1% 13-APR-2062Yield to maturity

5.59%

Maturity date

Apr 13, 2062

AMZN4996701

Amazon.com, Inc. 2.7% 03-JUN-2060Yield to maturity

5.59%

Maturity date

Jun 3, 2060

AMZN6237344

Amazon.com, Inc. 5.45% 20-NOV-2055Yield to maturity

5.58%

Maturity date

Nov 20, 2055

AMZN5396184

Amazon.com, Inc. 3.95% 13-APR-2052Yield to maturity

5.52%

Maturity date

Apr 13, 2052

AMZN4996700

Amazon.com, Inc. 2.5% 03-JUN-2050Yield to maturity

5.52%

Maturity date

Jun 3, 2050

AMZN5182959

Amazon.com, Inc. 3.1% 12-MAY-2051Yield to maturity

5.49%

Maturity date

May 12, 2051

AMZN4531866

Amazon.com, Inc. 4.05% 22-AUG-2047Yield to maturity

5.47%

Maturity date

Aug 22, 2047

US23135AQ9

Amazon.com, Inc. 4.95% 05-DEC-2044Yield to maturity

5.27%

Maturity date

Dec 5, 2044

See all AMZN bonds

Frequently Asked Questions

The current price of AMZN is 199.60 USD — it has decreased by −2.56% in the past 24 hours. Watch Amazon.com, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Amazon.com, Inc. stocks are traded under the ticker AMZN.

AMZN stock has fallen by −11.58% compared to the previous week, the month change is a −19.34% fall, over the last year Amazon.com, Inc. has showed a −13.39% decrease.

We've gathered analysts' opinions on Amazon.com, Inc. future price: according to them, AMZN price has a max estimate of 360.00 USD and a min estimate of 175.00 USD. Watch AMZN chart and read a more detailed Amazon.com, Inc. stock forecast: see what analysts think of Amazon.com, Inc. and suggest that you do with its stocks.

AMZN reached its all-time high on Nov 3, 2025 with the price of 258.60 USD, and its all-time low was 0.07 USD and was reached on May 22, 1997. View more price dynamics on AMZN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AMZN stock is 3.30% volatile and has beta coefficient of 0.08. Track Amazon.com, Inc. stock price on the chart and check out the list of the most volatile stocks — is Amazon.com, Inc. there?

Today Amazon.com, Inc. has the market capitalization of 2.14 T, it has decreased by −12.16% over the last week.

Yes, you can track Amazon.com, Inc. financials in yearly and quarterly reports right on TradingView.

Amazon.com, Inc. is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

AMZN earnings for the last quarter are 1.95 USD per share, whereas the estimation was 1.97 USD resulting in a −1.00% surprise. The estimated earnings for the next quarter are 1.62 USD per share. See more details about Amazon.com, Inc. earnings.

Amazon.com, Inc. revenue for the last quarter amounts to 213.39 B USD, despite the estimated figure of 211.44 B USD. In the next quarter, revenue is expected to reach 176.94 B USD.

AMZN net income for the last quarter is 21.19 B USD, while the quarter before that showed 21.19 B USD of net income which accounts for 0.02% change. Track more Amazon.com, Inc. financial stats to get the full picture.

No, AMZN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 13, 2026, the company has 1.58 M employees. See our rating of the largest employees — is Amazon.com, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Amazon.com, Inc. EBITDA is 150.37 B USD, and current EBITDA margin is 20.97%. See more stats in Amazon.com, Inc. financial statements.

Like other stocks, AMZN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Amazon.com, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Amazon.com, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Amazon.com, Inc. stock shows the neutral signal. See more of Amazon.com, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.