Predictions and analysis

I'm short $ZM since earlier today, I believe it has peaked here. Investors are likely to take profits now that competition has increased dramatically for them. They thrived when the world was locked down due to the threat of COVID-19, but now that vaccines will be widely available and distributed globally very soon, holding shares has become extremely risky. I'd...

SSR Mining has a very interesting setup here, both a quarterly and also a daily signal warrant a long entry here. If the quarterly signal pans out, initially we'd target $16.50 by Q4 2020, but eventually, this could make price trigger further quarterly confirmation for bulls, potentially pushing price to even higher levels, circa 28.31. Free cash flow is an...

$RDY has a very strong monthly trend that is currently active, and also a strong daily chart, showing a trend is now active. We can go long risking a fall under the red line on chart, if aggressive, following the daily signal but aiming to capture the monthly trend as well. This would be a huge reward to risk position if it were to pan out favorably for us. I see...

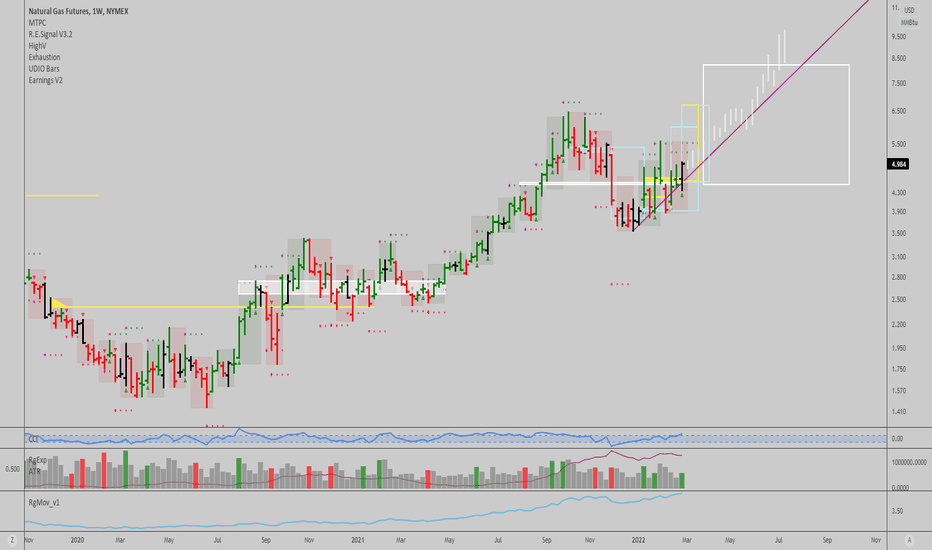

It's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my...

$TSLA has a bottom signal in the daily here, I'm long as of yesterday, time and price target is shown in yellow. Until the next earnings report, price might glide higher. Considering the $TWTR merger, risk of Elon needing to sell more shares is a scary but not impossible bearish catalyst that could rain in the bull's parade soon. Partnering with a PE firm would be...

There's a possibility of further downside for $AMZN over time, but currently, price action and the drop in commodities suggest that $AMZN is likely to go higher for a while. Until the next FOMC meeting, market participants might bet on a Fed pivot taking place sooner rather than later, given the drop in commodities suggesting inflation might be under control...

I'm long $TSLA for a few days already, and it is coiling for a massive move up in my opinion, as many fundamental catalysts are lining up in the coming weeks and months. I can see a resumption of the big uptrend that kicked in after basing during late 2019. Sentiment has turned pretty grim as the stock corrected and lagged $Nasdaq, and investors seemed pessimistic...

$SPX confirmed a bullish signal today, after it was evident selling had been absorbed systematically by long term investors since September 4th until today. This buying puts a floor on the market here, and potentially offers a solid support level if retested once prices move higher, if they do hold here for a couple weeks. A new weekly signal can trigger by the...

This is the lowest risk idea to hold for a decade here and add to it from savings or profits generated in other shorter term accounts...Ideal fit for a long term account, to simply sit in it and add gradually, never selling until this pans out. I'd say this has 10% downside risk due to the monthly chart structure, but upside is enormous. Cheers, Ivan Labrie.

I outline time duration and potential upside for the current trend signal in this chart, I had described this possibility in my previous publication. As a positive, we have pretty pessimistic wall of worry kinda sentiment now, and odds of a rally are big with this timeframe being in control of most of the major swings historically in $Bitcoin. Moving below 47k...

In this chart I plotted the period following a sub 25% AAII bulls reading, followed by a sharp rise to 55% bulls at the peak in April 2021. We now reset back down to sub 25% this week, so we might be watching a 'coiled spring' situation in equities. This is not so easily seen in $SPY as the $AAPL performance as of late distorts how equities acted for the majority...

I think it's either the bottom or very close to it. Worth taking a punt here, risk 3 average ranges down and go for the gold . Let's see how this one works out, I'm not risking big on China overall, but from a contrarian standpoint it is really interesting as to pass on it here. It will be more confirmed once the daily chart flashes a bottom signal, this would...

This means we have a chance of triggering a 2 week timeframe uptrend signal if price breaks over 53k ish before Jan 3rd. The 2 month timeframe trend, which has historically drove $BTCUSD's main cycle suggests the market is bullish until May 2022, and the current juncture allows for a move up to confirm, which would last until mid May give or take. This is a good...

The Pound has triggered a bottom signal, in both the daily and weekly timeframe, right after seeing the 1st rate hike across developed nations since the Pandemic started. Weekly charts point to a rally towards 1.3875 within the next 11 weeks, and the daily chart has a buy signal right here. I'm long with a stop below 1.31625, aiming to capture the weekly move...

Reward to risk long term in $BIIB is very attractive here. I've gone long via a calendar spread before the latest FDA approval news, which turned out like a good long position when Biogen's Alzheimer's drug Aduhelm received accelerated approval. Following this, related companies which also have Alzheimer's drugs pending approval (like $LLY) received a dramatic...

I plotted inverse oil here vs $USDCAD, it seems there's a nice opportunity for a big short to close that spread. I'm long $CADJPY and short $USDCAD from earlier today, now made some time to post the weekly signal in $USDCAD, which is cooking here. If price breaks 1.24603, a weekly down trend with a target @ 1.16536 will be active, predicting a 18 week decline is...

I found the culprit of my confusion regarding the last upswing in $BTCUSD, the spot chart has become unreliable compared to the CME futures chart, at least when it comes to Time@Mode analysis. Finer details of how weekly bar ranges look, impact the analysis outcome. I missed a signal indicating that we could go long, like 4 weeks ago, and given sentiment didn't...

I think we are ready for the next big rally in oil, this will cause a dramatic effect on inflation and affect earnings negatively going forward long term. I think it could reach as high as over $100 a barrel by mid August here. If so, the impact on the economy would be very large, with a delay of 6 months according to research by my mentor, @timwest With the...