Editors' picksOPEN-SOURCE SCRIPT

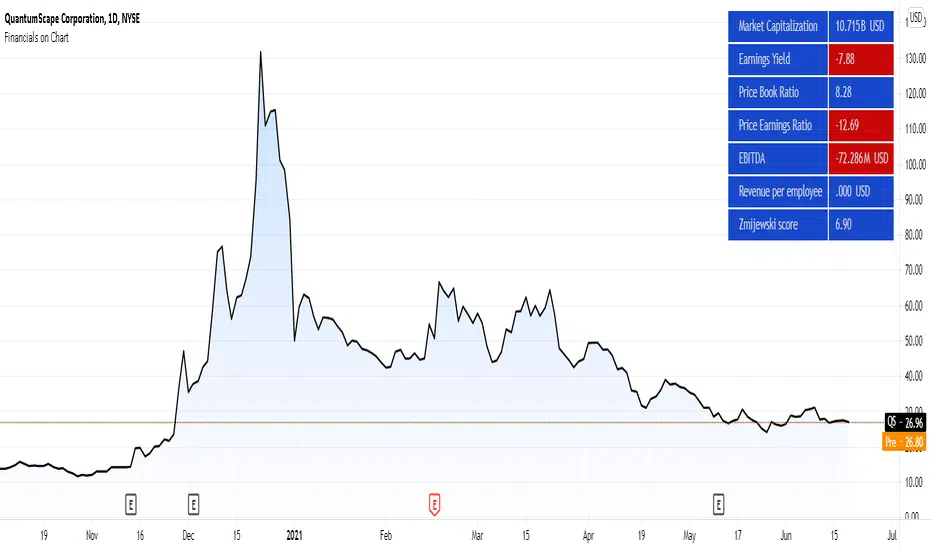

Financials on Chart

Updated

█ OVERVIEW

This indicator displays your choice of up to 9 fundamentals on your chart.

█ FEATURES

You can configure the following attributes of the display:

• Its position on your chart.

• Automatic or custom height and width of rows.

• The size and color of text.

• The default background color (you can override it with a custom color for individual values).

• Conversion of values expressed in USD to one of the major currencies. Financials are normally expressed in quote currency.

Conversion to other currencies is only done when the symbol's quote currency is USD.

• Choose if the currency used for the financials is displayed. Note that some financials are calculated values that are not expressed in currency units.

No currency will be displayed for these values.

• Abbreviate large values.

For each value, you may:

• Pick one of the 222 financials available in Pine, or one of five values calculated from the financials (Market Cap, Earnings Yield, P/B Ratio, P/E Ratio and Price-To-Sales Ratio).

• Choose a period (see the "i" icon near the first value's fields in the script's inputs for a list of exceptions).

• Specify the value's precision.

• Change the legend displayed with the value.

• Adjust the text's size.

• Use a custom background.

█ LIMITATIONS

When changing the indicator's inputs, allow a few seconds for the change to be reflected in the display.

If your chart displays a symbol for which the configured financials cannot be fetched, an error will occur.

Not all periods are available for all fundamentals or for all markets. What financial data is available in Pine? will give you an overview of the available periods for each value. The page also contains the formulas used for the five values we calculate from the financials. This page shows the typical reporting frequency for different countries.

█ FINANCIALS

See What is Financial Data? and Why does Financial Data differ from other sources? for more information on the data used by this indicator.

This lists all the financials. Clicking on one will bring up more information about it:

CALCULATED

Market Capitalization

Earnings Yield

Price Book Ratio

Price Earnings Ratio

Price-To-Sales Ratio

INCOME STATEMENTS

After tax other income/expense

Average basic shares outstanding

Other COGS

Cost of goods

Deprecation and amortization

Diluted net income available to common stockholders

Diluted shares outstanding

Dilution adjustment

Discontinued operations

Basic EPS

Diluted EPS

EBIT

EBITDA

Equity in earnings

Gross profit

Taxes

Interest capitalized

Interest expense on debt

Non-controlling/minority interest

Net income before discontinued operations

Net income

Non-operating income, excl. interest expenses

Interest expense, net of interest capitalized

Non-operating interest income

Operating income

Operating expenses (excl. COGS)

Miscellaneous non-operating expense

Other operating expenses, total

Preferred dividends

Pretax equity in earnings

Pretax income

Research & development

Selling/general/admin expenses, other

Selling/general/admin expenses, total

Non-operating income, total

Total operating expenses

Total revenue

Unusual income/expense

BALANCE SHEET

Accounts payable

Accounts receivable - trade, net

Accrued payroll

Accumulated depreciation, total

Additional paid-in capital/Capital surplus

Tangible book value per share

Book value per share

Capitalized lease obligations

Capital and operating lease obligations

Cash & equivalents

Cash and short term investments

Common equity, total

Common stock par/Carrying value

Current portion of LT debt and capital leases

Deferred income, current

Deferred income, non-current

Deferred tax assets

Deferred tax liabilities

Dividends payable

Goodwill, net

Income tax payable

Net intangible assets

Inventories - finished goods

Inventories - progress payments & other

Inventories - raw materials

Inventories - work in progress

Investments in unconsolidated subsidiaries

Long term debt excl. lease liabilities

Long term debt

Long term investments

Note receivable - long term

Other long term assets, total

Minority interest

Notes payable

Operating lease liabilities

Other common equity

Other current assets, total

Other current liabilities

Other intangibles, net

Other investments

Other liabilities, total

Other receivables

Other short term debt

Paid in capital

Gross property/plant/equipment

Net property/plant/equipment

Preferred stock, carrying value

Prepaid expenses

Provision for risks & charge

Retained earnings

Short term debt excl. current portion of LT debt

Short term debt

Short term investments

Shareholders' equity

Total assets

Total current assets

Total current liabilities

Total debt

Total equity

Total inventory

Total liabilities

Total liabilities & shareholders' equities

Total non-current assets

Total non-current liabilities

Total receivables, net

Treasury stock - common

CASHFLOW

Amortization

Capital expenditures - fixed assets

Capital expenditures

Capital expenditures - other assets

Cash from financing activities

Cash from investing activities

Cash from operating activities

Deferred taxes (cash flow)

Depreciation & amortization (cash flow)

Change in accounts payable

Change in accounts receivable

Change in accrued expenses

Change in inventories

Change in other assets/liabilities

Change in taxes payable

Changes in working capital

Common dividends paid

Depreciation/depletion

Free cash flow

Funds from operations

Issuance/retirement of debt, net

Issuance/retirement of long term debt

Issuance/retirement of other debt

Issuance/retirement of short term debt

Issuance/retirement of stock, net

Net income (cash flow)

Non-cash items

Other financing cash flow items, total

Financing activities - other sources

Financing activities - other uses

Other investing cash flow items, total

Investing activities - other sources

Investing activities - other uses

Preferred dividends paid

Purchase/acquisition of business

Purchase of investments

Repurchase of common & preferred stock

Purchase/sale of business, net

Purchase/sale of investments, net

Reduction of long term debt

Sale of common & preferred stock

Sale of fixed assets & businesses

Sale/maturity of investments

Issuance of long term debt

Total cash dividends paid

STATISTICS

Accruals

Altman Z-score

Asset turnover

Beneish M-score

Buyback yield %

Cash conversion cycle

Cash to debt ratio

COGS to revenue ratio

Current ratio

Days sales outstanding

Days inventory

Days payable

Debt to assets ratio

Debt to EBITDA ratio

Debt to equity ratio

Debt to revenue ratio

Dividend payout ratio %

Dividend yield %

Dividends per share - common stock primary issue

EPS estimates

EPS basic one year growth

EPS diluted one year growth

EBITDA margin %

Effective interest rate on debt %

Enterprise value to EBITDA ratio

Enterprise value

Equity to assets ratio

Enterprise value to EBIT ratio

Enterprise value to revenue ratio

Float shares outstanding

Free cash flow margin %

Fulmer H factor

Goodwill to assets ratio

Graham's number

Gross margin %

Gross profit to assets ratio

Interest coverage

Inventory to revenue ratio

Inventory turnover

KZ index

Long term debt to total assets ratio

Net current asset value per share

Net income per employee

Net margin %

Number of employees

Operating earnings yield %

Operating margin %

PEG ratio

Piotroski F-score

Price earnings ratio forward

Price sales ratio forward

Price to free cash flow ratio

Price to tangible book ratio

Quality ratio

Quick ratio

Research & development to revenue ratio

Return on assets %

Return on equity adjusted to book value %

Return on equity %

Return on invested capital %

Return on tangible assets %

Return on tangible equity %

Revenue one year growth

Revenue per employee

Revenue estimates

Shares buyback ratio %

Sloan ratio %

Springate score

Sustainable growth rate

Tangible common equity ratio

Tobin's Q (approximate)

Total common shares outstanding

Zmijewski score

█ NOTES

This script uses the Pine financial() function to fetch the values it displays.

Look first. Then leap.

This indicator displays your choice of up to 9 fundamentals on your chart.

█ FEATURES

You can configure the following attributes of the display:

• Its position on your chart.

• Automatic or custom height and width of rows.

• The size and color of text.

• The default background color (you can override it with a custom color for individual values).

• Conversion of values expressed in USD to one of the major currencies. Financials are normally expressed in quote currency.

Conversion to other currencies is only done when the symbol's quote currency is USD.

• Choose if the currency used for the financials is displayed. Note that some financials are calculated values that are not expressed in currency units.

No currency will be displayed for these values.

• Abbreviate large values.

For each value, you may:

• Pick one of the 222 financials available in Pine, or one of five values calculated from the financials (Market Cap, Earnings Yield, P/B Ratio, P/E Ratio and Price-To-Sales Ratio).

• Choose a period (see the "i" icon near the first value's fields in the script's inputs for a list of exceptions).

• Specify the value's precision.

• Change the legend displayed with the value.

• Adjust the text's size.

• Use a custom background.

█ LIMITATIONS

When changing the indicator's inputs, allow a few seconds for the change to be reflected in the display.

If your chart displays a symbol for which the configured financials cannot be fetched, an error will occur.

Not all periods are available for all fundamentals or for all markets. What financial data is available in Pine? will give you an overview of the available periods for each value. The page also contains the formulas used for the five values we calculate from the financials. This page shows the typical reporting frequency for different countries.

█ FINANCIALS

See What is Financial Data? and Why does Financial Data differ from other sources? for more information on the data used by this indicator.

This lists all the financials. Clicking on one will bring up more information about it:

CALCULATED

Market Capitalization

Earnings Yield

Price Book Ratio

Price Earnings Ratio

Price-To-Sales Ratio

INCOME STATEMENTS

After tax other income/expense

Average basic shares outstanding

Other COGS

Cost of goods

Deprecation and amortization

Diluted net income available to common stockholders

Diluted shares outstanding

Dilution adjustment

Discontinued operations

Basic EPS

Diluted EPS

EBIT

EBITDA

Equity in earnings

Gross profit

Taxes

Interest capitalized

Interest expense on debt

Non-controlling/minority interest

Net income before discontinued operations

Net income

Non-operating income, excl. interest expenses

Interest expense, net of interest capitalized

Non-operating interest income

Operating income

Operating expenses (excl. COGS)

Miscellaneous non-operating expense

Other operating expenses, total

Preferred dividends

Pretax equity in earnings

Pretax income

Research & development

Selling/general/admin expenses, other

Selling/general/admin expenses, total

Non-operating income, total

Total operating expenses

Total revenue

Unusual income/expense

BALANCE SHEET

Accounts payable

Accounts receivable - trade, net

Accrued payroll

Accumulated depreciation, total

Additional paid-in capital/Capital surplus

Tangible book value per share

Book value per share

Capitalized lease obligations

Capital and operating lease obligations

Cash & equivalents

Cash and short term investments

Common equity, total

Common stock par/Carrying value

Current portion of LT debt and capital leases

Deferred income, current

Deferred income, non-current

Deferred tax assets

Deferred tax liabilities

Dividends payable

Goodwill, net

Income tax payable

Net intangible assets

Inventories - finished goods

Inventories - progress payments & other

Inventories - raw materials

Inventories - work in progress

Investments in unconsolidated subsidiaries

Long term debt excl. lease liabilities

Long term debt

Long term investments

Note receivable - long term

Other long term assets, total

Minority interest

Notes payable

Operating lease liabilities

Other common equity

Other current assets, total

Other current liabilities

Other intangibles, net

Other investments

Other liabilities, total

Other receivables

Other short term debt

Paid in capital

Gross property/plant/equipment

Net property/plant/equipment

Preferred stock, carrying value

Prepaid expenses

Provision for risks & charge

Retained earnings

Short term debt excl. current portion of LT debt

Short term debt

Short term investments

Shareholders' equity

Total assets

Total current assets

Total current liabilities

Total debt

Total equity

Total inventory

Total liabilities

Total liabilities & shareholders' equities

Total non-current assets

Total non-current liabilities

Total receivables, net

Treasury stock - common

CASHFLOW

Amortization

Capital expenditures - fixed assets

Capital expenditures

Capital expenditures - other assets

Cash from financing activities

Cash from investing activities

Cash from operating activities

Deferred taxes (cash flow)

Depreciation & amortization (cash flow)

Change in accounts payable

Change in accounts receivable

Change in accrued expenses

Change in inventories

Change in other assets/liabilities

Change in taxes payable

Changes in working capital

Common dividends paid

Depreciation/depletion

Free cash flow

Funds from operations

Issuance/retirement of debt, net

Issuance/retirement of long term debt

Issuance/retirement of other debt

Issuance/retirement of short term debt

Issuance/retirement of stock, net

Net income (cash flow)

Non-cash items

Other financing cash flow items, total

Financing activities - other sources

Financing activities - other uses

Other investing cash flow items, total

Investing activities - other sources

Investing activities - other uses

Preferred dividends paid

Purchase/acquisition of business

Purchase of investments

Repurchase of common & preferred stock

Purchase/sale of business, net

Purchase/sale of investments, net

Reduction of long term debt

Sale of common & preferred stock

Sale of fixed assets & businesses

Sale/maturity of investments

Issuance of long term debt

Total cash dividends paid

STATISTICS

Accruals

Altman Z-score

Asset turnover

Beneish M-score

Buyback yield %

Cash conversion cycle

Cash to debt ratio

COGS to revenue ratio

Current ratio

Days sales outstanding

Days inventory

Days payable

Debt to assets ratio

Debt to EBITDA ratio

Debt to equity ratio

Debt to revenue ratio

Dividend payout ratio %

Dividend yield %

Dividends per share - common stock primary issue

EPS estimates

EPS basic one year growth

EPS diluted one year growth

EBITDA margin %

Effective interest rate on debt %

Enterprise value to EBITDA ratio

Enterprise value

Equity to assets ratio

Enterprise value to EBIT ratio

Enterprise value to revenue ratio

Float shares outstanding

Free cash flow margin %

Fulmer H factor

Goodwill to assets ratio

Graham's number

Gross margin %

Gross profit to assets ratio

Interest coverage

Inventory to revenue ratio

Inventory turnover

KZ index

Long term debt to total assets ratio

Net current asset value per share

Net income per employee

Net margin %

Number of employees

Operating earnings yield %

Operating margin %

PEG ratio

Piotroski F-score

Price earnings ratio forward

Price sales ratio forward

Price to free cash flow ratio

Price to tangible book ratio

Quality ratio

Quick ratio

Research & development to revenue ratio

Return on assets %

Return on equity adjusted to book value %

Return on equity %

Return on invested capital %

Return on tangible assets %

Return on tangible equity %

Revenue one year growth

Revenue per employee

Revenue estimates

Shares buyback ratio %

Sloan ratio %

Springate score

Sustainable growth rate

Tangible common equity ratio

Tobin's Q (approximate)

Total common shares outstanding

Zmijewski score

█ NOTES

This script uses the Pine financial() function to fetch the values it displays.

Look first. Then leap.

Release Notes

v2Changed the calculation of Market Capitalization, Earnings Yield, Price Book Ratio, Price Earnings Ratio and Price-To-Sales Ratio so they use the `close` price rather than the `open`.

Release Notes

Updated to Pine Script™ v5Release Notes

v4Minor change to resolve errors on symbols without financial data.

Release Notes

v5• Fixed a bug that was causing issues in the rendering of certain financial data points.

• Enhanced the currency conversion process by integrating request.security() and the `currency` parameter directly. This has streamlined the method from two separate functions into a single, more efficient one.

• Increased the breadth of currency coverage to 20 currencies.

• Implemented general formatting updates to align with the Pine Script® style guide.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Want to use this script on a chart?

Share TradingView with a friend:

tradingview.com/share-your-love/

Read more about the new tools and features we're building for you: tradingview.com/blog/en/

tradingview.com/share-your-love/

Read more about the new tools and features we're building for you: tradingview.com/blog/en/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.