Bitcoin flashing traditional accumulation signals (alt season?)TL:DR

Bitcoin is finding a bottom but probably still has some downside. Strong hand are probably accumulating Bitcoin and especially alts.

Introduction

Bitcoin is flashing multiple accumulation signals. But this downtrend has been so gradual and lacking in volatility it barely feels like a bea

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Bitcoin: Is the WXYXZ Correction Setting Up Wave C?Bitcoin: Is the WXYXZ Correction Setting Up Wave C?

During the last 5 days BTC declined by nearly 5% from 72250 to 65170

Looks like the B wave has more a corrective movement and is expanding as WXYXZ pattern. If the price manages to move above the previous X near 68300 it will add the chances t

Microsoft: a major technical support at $350–$400Should Microsoft stock once again be considered in a DCA zone, after having corrected on the stock market since last November and now being the most expensive (in valuation terms) among the Magnificent 7 stocks?

This is the question I will address in this new analysis on TradingView. Feel free to f

Job Growth Takes Off but Traders Stay Put. What’s Happening?Are these jobs in the room with us right now?

📊 A Blockbuster Headline

The delayed January jobs report arrived Wednesday. Nonfarm payrolls ECONOMICS:USNFP showed 130,000 new hires , more than double the 55,000 estimate. On paper, that looked like a strong start to the year.

Wall Street’s re

$TAO Sitting on a Level That Has Never FailedGETTEX:TAO is sitting on a major long-term support level and this isn’t the first time.

If we look at the last three times we touched this support, we bounced strongly.

We may see some drop to form a wick below the support, just as we’ve seen in the last three instances. However, in each case, we

BTC: The "Invisible Wall" at $70k (Why We Flush to $59.8k)The retail narrative is that Bitcoin is "consolidating" at $70k. The On-Chain data says Bitcoin is DISTRIBUTING . We just hit an "Invisible Sell Wall" driven by three massive structural failures. This is not a dip to buy; it is a Rational Deleveraging triggered by a $6.3B supply shock that the ma

Silver Under Pressure – Sellers Are in ControlXAGUSD is currently clearly leaning toward a short-term BEARISH trend, as both recent news and the technical structure fail to support a sustainable bullish move.

From a news perspective , silver is facing pressure from profit-taking after the previous strong rebound , while the U.S. dollar and

S&P 500: Late-Cycle Signals Are BuildingThe S&P 500 is still holding near highs, but under the surface, things are starting to weaken. Both the chart and the economy are sending warning signs that are easy to miss if you only look at price.

Weekly Bearish Divergence

On the weekly chart, price made higher highs, but momentum did not .

EURUSD Buyers in Control After Corrective Move, Eyes on 1.1930Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD previously traded within a strong bullish environment, supported by a well-defined rising trend line. During this phase, price consistently formed higher highs and higher lows, confirming sustained

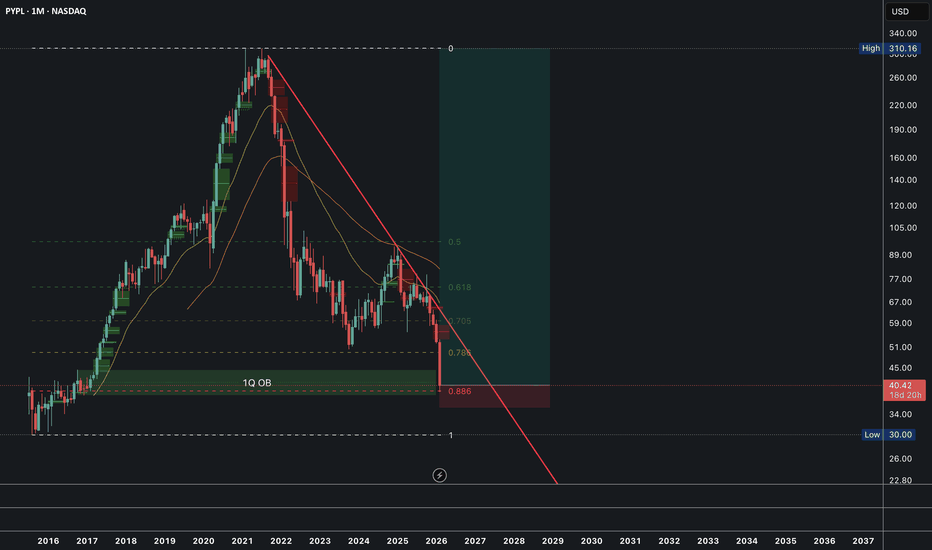

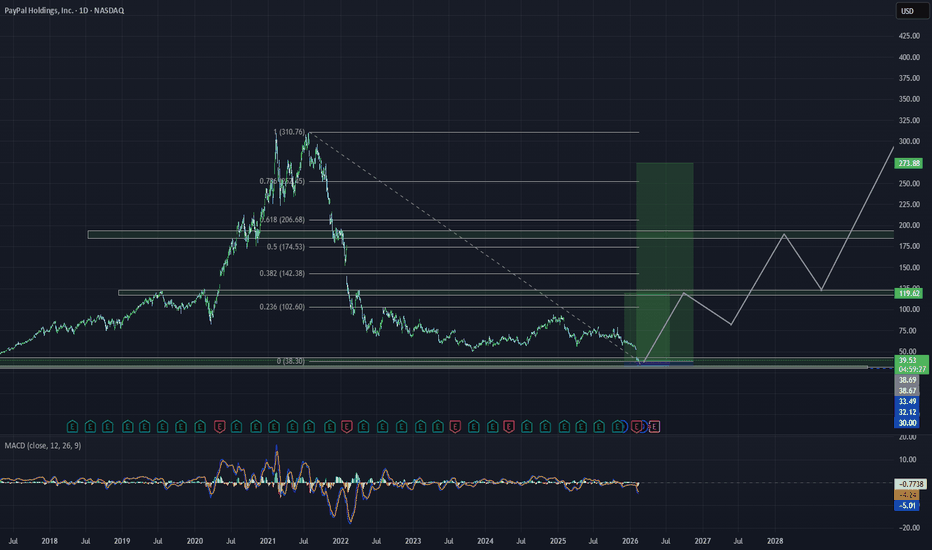

Paypal Bottom is in ?! Long from herePayPal Holdings (PYPL) is currently trading at approximately $40.42 (as of the latest close, +1.30% on the session), marking a continuation of the multi-year downtrend from its 2021 peak of ~$310–$340.

The chart applies a Fibonacci retracement drawn from the 2021 high (~$310.16) to the post-peak lo

See all editors' picks ideas

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

See all indicators and strategies

Community trends

NVDA - Techs Fail and Insiders BailThis chart looks ugly for the bulls. That red trendline has been holding the price up for months, but now it is finally giving way. When a major support level like this cracks, it usually means the uptrend is over and we are heading lower.

But the real red flag is what the leadership is doing.

Ins

Coinbase triple-bottom, complete correction & bullish impulseThis signal is so strong that I will not have to go too much about it. It is just too simple and so hard to miss—easy to see.

When in doubt, look around. Coinbase moves together with Bitcoin and Cryptocurrency as a whole.

When the Cryptocurrency market is bullish and set to grow, Coinbase (COIN) i

CRWV CoreWeave StockThe Chart reads as Ai will always be the future to come, it is a tool.

A tool is either used or not and often mastered. Cloud storage is the future as well.

The chart shows where the algo is leaving $ behind once HHighs are made and held we will see NEW ATH. NFA.... But one thing is for sure laws

AAPL Daily Chart Analysis – Bullish Continuation Setup | Target Strong Support Zone: $243 – $258 area

Price previously bounced from this level, confirming it as a major demand zone.

• Resistance Level: $289

This is the next major resistance marked on the chart. A breakout above this level could open the path toward $300+.

• Market Structure:

After a correction

RECAP - Rivian's Inflection Point: R2 Hype, Earnings BeatRivian's Inflection Point: R2 Hype, Earnings Beat, and the Battle for Tesla's Crown

Rivian Automotive Inc. delivered a emphatic response to skeptics this week, as shares surged more than 26% on Friday following a fourth-quarter earnings report that, while mixed, successfully refocused investor atten

COINBASE $150 Target hit. Bear Cycle now enters Phase 2 to $55.More than 2 months ago (December 04 2025, see chart below), we gave a massive Sell Signal on Coinbase (COIN) as it was testing for several weeks its 1W MA50 (blue trend-line) without breaking above it:

Last week's dramatic sell-off finally hit our $150 mid-term Target and this week despite its

750% Upside Potential! Only Green From HereFrom a technical standpoint:

The stock has retraced nearly the entire 2020–2021 move. Price is testing deep Fibonacci retracement levels (~0.886). Prior consolidation in the $45 - $50 zone now acts as resistance.

Sentiment is extremely bearish — which historically aligns with long-term opportunity

RDW 1W Structural Compression After ExpansionOn the weekly chart Redwire has completed a full market cycle from base formation to impulsive expansion and into deep correction. The long-term bottom formed in the 2–3 range, where accumulation developed before the breakout phase. That base led to an expansion move toward 26.66, marked by volatili

Why Amazon Is a Buy NowWhy Amazon Is a Buy Now

Amazon is currently going through a significant transition period in early 2026.

Although the stock has experienced recent volatility with a drop of nearly 20% so far this year the analyst consensus remains mostly bullish with price targets ranging between $260 and $300.

PLTR: Confirmed 3.2x Breakout Holding PLTR: Confirmed 3.2x Breakout Holding — But the Multi-Timeframe Bias Says the Trend is Against It.

Overview

PLTR at 131.72 presents a clean tension between price action and directional structure. On one hand, there's a confirmed 3.2x breakout with a 4.3% bounce off demand and only -1.4% retrace — t

See all stocks ideas

Tomorrow

CVMCel-Sci Corporation

Actual

—

Estimate

—

Tomorrow

VTSVitesse Energy Inc.

Actual

—

Estimate

0.24

USD

Tomorrow

BKKTBakkt, Inc.

Actual

—

Estimate

−0.55

USD

Tomorrow

USBCUSBC, Inc.

Actual

—

Estimate

−2.80

USD

Tomorrow

CCECCapital Clean Energy Carriers Corp.

Actual

—

Estimate

0.48

USD

Tomorrow

GMGIGolden Matrix Group, Inc.

Actual

—

Estimate

0.01

USD

Tomorrow

BBGIBeasley Broadcast Group, Inc.

Actual

—

Estimate

—

Tomorrow

OTLKOutlook Therapeutics, Inc.

Actual

—

Estimate

−0.23

USD

See more events

Community trends

Dash long-term —Can it go higher?Looking at Dash, a privacy oriented Cryptocurrency-payment project based on Bitcoin's protocol, we want to answer one question only: Can it go higher?

Dash hit bottom mid-June 2025 then never looked back. It has been rising since.

The short answer is yes, it can continue growing. The long answer r

Bitcoin at Strong Demand Zone – Next Big Move Loading!📊 Description✅ Setup BINANCE:BTCUSDT

BTC has been in a clear downtrend, respecting a descending trendline with multiple rejections.

Now price has reached a strong support/demand zone and we’re seeing a reaction.

Confluences on chart:

✔ Descending trendline break attempt

✔ Strong horizontal de

BITCOIN - Correction against the global bearish trend BINANCE:BTCUSDT.P is recovering from an interim low of 65K. The area of interest is 71,500, but it is too early to talk about a bull market, as the influence of buyers may be short-term within the global downtrend.

The main growth factor that emerged on Thursday/Friday was cooling inflation in

$BTC Post-Drop Consolidation in ProgressCRYPTOCAP:BTC 3D timeframe

After that sharp flush toward $60K, price is doing exactly what we talked about bouncing and moving between nearby support and resistance instead of continuing straight down.

That $60K area looks like it’s acting as a local low for now.

Not saying it’s the bottom… but i

BTCUSD Breakout from Downtrend, Eyeing FVG Refill & 70K Target

This 1H **BTCUSD** chart shows price breaking out of a descending trendline after a prolonged consolidation range. Following the breakout, price has pushed higher and is now pulling back into a marked **FVG (Fair Value Gap)** area, which aligns with the Ichimoku cloud acting as dynamic support. As

Bitcoin flashing traditional accumulation signals (alt season?)TL:DR

Bitcoin is finding a bottom but probably still has some downside. Strong hand are probably accumulating Bitcoin and especially alts.

Introduction

Bitcoin is flashing multiple accumulation signals. But this downtrend has been so gradual and lacking in volatility it barely feels like a bea

#ETHUSDT: Bullish Volume is Visible Has The Big Move Started?Dear Traders,

I hope you’re doing well and had a great trading week.

We’ve identified two potential bullish entry zones for ETH. The first is where the price could continue its uptrend, but there’s also a chance it could drop around $1975 before the bulls push it to the $3000 mark.

Our first tar

Elise | BTCUSD – 30M – Supply Reaction Below External LiquidityBITSTAMP:BTCUSD

After sweeping sell-side liquidity near 65K, BTC delivered a sharp impulsive recovery. However, this recovery is approaching a previous distribution zone. Without a strong breakout above 69K, this move appears to be a retracement into supply within a broader bearish framework.

Key

Bitcoin Rejects Resistance, Eyes Support Test Around $65KHello traders! Here’s my technical outlook on BTCUSDT (1H) based on the current chart structure. Bitcoin previously traded within a well-defined descending channel, where price respected both the resistance and support boundaries, confirming controlled bearish pressure rather than impulsive selling.

See all crypto ideas

Elise | XAUUSD – 30M – Demand Rejection with Bullish RecoveryOANDA:XAUUSD

After consolidating near 5,040 supply, gold delivered an aggressive sell-off into higher timeframe demand. The immediate rejection confirms institutional buying interest. Current structure suggests a potential continuation toward internal resistance before testing higher supply near 5

XAUUSD Stop Hunt Completed – Liquidity Sweep Before Major Move? The recent XAUUSD price action suggests a classic stop hunt and liquidity sweep scenario. Price briefly broke below a key support zone, triggering sell-side liquidity and stop-loss orders from retail traders, before sharply reversing back into the previous range.

This move appears less like a true

Gold Short Trigger — PRZ Rejection or One More Push?This Gold( OANDA:XAUUSD ) idea is focused on the 15-minute timeframe and is in line with the previous 1-hour idea I shared, where the first target was reached.

Now, let’s see if on the 15-minute chart we can spot a short trigger for gold—stay with me!

Gold appears to be moving within an ascendi

GOLD - Consolidation ahead of the news? Will the trend continue?FX:XAUUSD is attempting to recover to $5,000 after a sharp 3.5% drop on Thursday. There are no clear reasons for this. All market attention is focused on today's US inflation report - CPI.

Yesterday's gold sell-off was caused not only by technical factors, but also by capital flight to the dol

Gold Reclaims Ground After CPI, $5K Level in FocusGold just got its CPI moment here’s what actually matters now 👇

CPI came in softer, and that immediately cooled the dollar strength narrative.

Markets were already leaning toward rate cuts this year, and this data keeps that story alive which is why gold is trying to stabilize again after that sha

XAUUSD Long: Rebounds From Support - Buyers Target 5,100Hello traders! Here’s my technical outlook on XAUUSD (2H) based on the current chart structure. Gold was previously trading inside a well-defined ascending channel, where price respected both the rising support and resistance boundaries, forming a steady sequence of higher highs and higher lows. Thi

#XAUUSD(GOLD): +7350 Pips Swing Buy From A Safe Zone! Dear traders,

I hope you’re doing well.

Gold, after consolidating for a week or two, finally dropped significantly, indicating a strong bearish presence in the market. Currently, the bulls are still struggling to push the price higher. A possible scenario is to wait for the price to drop further

Gold next move (selling continued)(13-02-2026)Plz Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (13-02-2026)

Current price- 4970

"if Price stays below 5040 then next target is 4920, 4860, 4760 and 4580 and above that 5170 and 5270".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBI

XAUUSD (H1) – Weekly Outlook | LiquidityXAUUSD (H1) – Weekly Outlook | Liquidity Rebuild Before Expansion

Gold has recovered strongly from the sharp sell-off into 4,900 and is now rotating back toward the upper range. The current structure shows a classic liquidity rebuild phase after a stop run — and next week will likely decide whether

GOLD DAILY CHART ROUTE MAPHey Everyone,

Please see our Daily chart idea, which had a strong candle body close above the 5030 axis level on Monday opening the long-range upside target at 5198.

On Tuesday, we saw a small corrective move back to test the EMA5, which acted as dynamic support. The bounce from EMA5 aligned perfe

See all futures ideas

EURUSD is Nearing a Decent Support!Hey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.18200 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend a 1.18200 support and resistance area.

Trade safe, Joe.

EUR/USD - Triangle Breakout | Sellers in Control📊 Technical Overview TICKMILL:EURUSD

EUR/USD formed a clear symmetrical triangle pattern on the M30 timeframe, showing consolidation after a strong impulsive move.

✅Price rejected precisely from a higher-timeframe bearish order block, confirming strong supply in that zone.

✅The recent break be

#AUDNZD: Buy From Point Of Interest! 300 to 500 Pips! Dear Traders,

I hope you had a great trading week and a wonderful weekend.

The AUDNZD pair is currently in a strong bullish trend. The AUD is particularly bullish due to gold, but we’re seeing a price correction. After analysing all potential areas, we believe the marked area holds more potentia

USD/JPY | Potential Distribution USDJPY appears to be transitioning from a mature bullish trend into a corrective phase, with price currently testing a key institutional demand zone between 152.00 and 152.70. After months of impulsive upside within an ascending channel, the recent break in short-term structure suggests momentum is

USDJPY 30Min Engaged ( Bearish & Bullish Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — LONG / Reversal 152.515 Ar

EURUSD - Will it break the resistance?EURUSD is currently trading within a well-defined 4-hour structure, where both support and resistance are clearly mapped by fair value gaps. After a strong recovery from the lows, price has entered a consolidation phase just below a key resistance zone. The market is now reacting precisely to higher

Selena | EURUSD · 4H – Bullish Channel StructureFX:EURUSD

After sweeping liquidity near 1.1600, buyers reclaimed control and pushed price back into the upper half of the channel. Current compression beneath 1.1950–1.2000 resistance suggests accumulation before potential breakout. Structure remains bullish unless channel support fails.

Key Scen

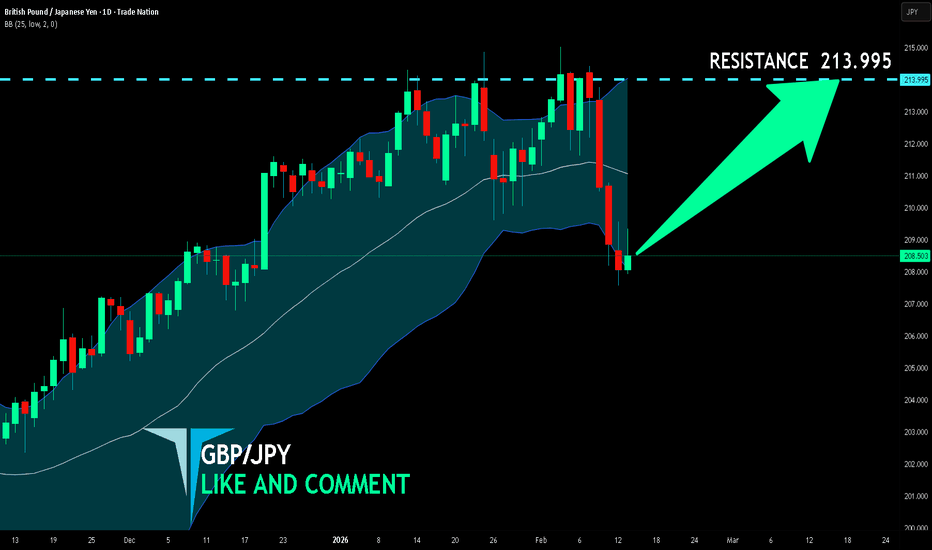

GBP/JPY BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

GBP/JPY is trending up which is clear from the green colour of the previous weekly candle. However, the price has locally plunged into the oversold territory. Which can be told from its proximity to the BB lower band. Which presents a beautiful trend following opportunity for a l

GBPUSD - Trend Still IntactGBPUSD has been overall bullish, printing higher highs and higher lows inside the rising blue channel.

Now price is pulling back into a key intersection:

• The lower bound of the blue trendline

• The green support zone

As long as this confluence holds , we’ll be looking for trend-following long

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.