Bitcoin flashing traditional accumulation signals (alt season?)TL:DR

Bitcoin is finding a bottom but probably still has some downside. Strong hand are probably accumulating Bitcoin and especially alts.

Introduction

Bitcoin is flashing multiple accumulation signals. But this downtrend has been so gradual and lacking in volatility it barely feels like a bea

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Bitcoin: Is the WXYXZ Correction Setting Up Wave C?Bitcoin: Is the WXYXZ Correction Setting Up Wave C?

During the last 5 days BTC declined by nearly 5% from 72250 to 65170

Looks like the B wave has more a corrective movement and is expanding as WXYXZ pattern. If the price manages to move above the previous X near 68300 it will add the chances t

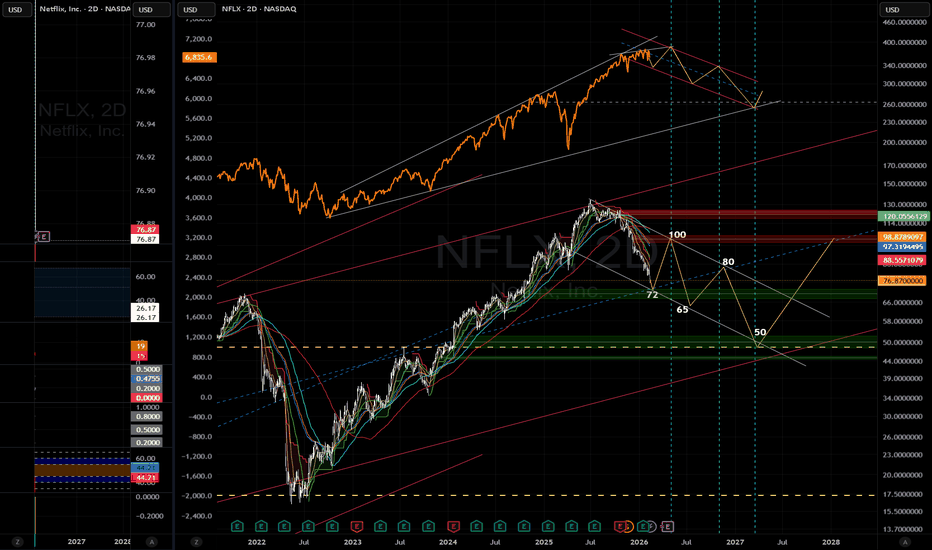

Microsoft: a major technical support at $350–$400Should Microsoft stock once again be considered in a DCA zone, after having corrected on the stock market since last November and now being the most expensive (in valuation terms) among the Magnificent 7 stocks?

This is the question I will address in this new analysis on TradingView. Feel free to f

Job Growth Takes Off but Traders Stay Put. What’s Happening?Are these jobs in the room with us right now?

📊 A Blockbuster Headline

The delayed January jobs report arrived Wednesday. Nonfarm payrolls ECONOMICS:USNFP showed 130,000 new hires , more than double the 55,000 estimate. On paper, that looked like a strong start to the year.

Wall Street’s re

$TAO Sitting on a Level That Has Never FailedGETTEX:TAO is sitting on a major long-term support level and this isn’t the first time.

If we look at the last three times we touched this support, we bounced strongly.

We may see some drop to form a wick below the support, just as we’ve seen in the last three instances. However, in each case, we

BTC: The "Invisible Wall" at $70k (Why We Flush to $59.8k)The retail narrative is that Bitcoin is "consolidating" at $70k. The On-Chain data says Bitcoin is DISTRIBUTING . We just hit an "Invisible Sell Wall" driven by three massive structural failures. This is not a dip to buy; it is a Rational Deleveraging triggered by a $6.3B supply shock that the ma

Silver Under Pressure – Sellers Are in ControlXAGUSD is currently clearly leaning toward a short-term BEARISH trend, as both recent news and the technical structure fail to support a sustainable bullish move.

From a news perspective , silver is facing pressure from profit-taking after the previous strong rebound , while the U.S. dollar and

S&P 500: Late-Cycle Signals Are BuildingThe S&P 500 is still holding near highs, but under the surface, things are starting to weaken. Both the chart and the economy are sending warning signs that are easy to miss if you only look at price.

Weekly Bearish Divergence

On the weekly chart, price made higher highs, but momentum did not .

EURUSD Buyers in Control After Corrective Move, Eyes on 1.1930Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD previously traded within a strong bullish environment, supported by a well-defined rising trend line. During this phase, price consistently formed higher highs and higher lows, confirming sustained

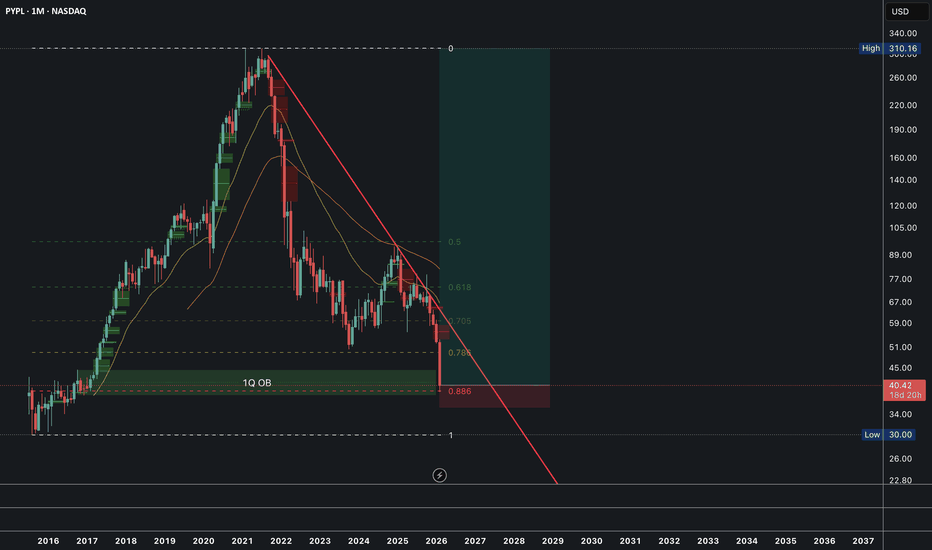

Paypal Bottom is in ?! Long from herePayPal Holdings (PYPL) is currently trading at approximately $40.42 (as of the latest close, +1.30% on the session), marking a continuation of the multi-year downtrend from its 2021 peak of ~$310–$340.

The chart applies a Fibonacci retracement drawn from the 2021 high (~$310.16) to the post-peak lo

See all editors' picks ideas

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

See all indicators and strategies

Community trends

$RIME Technical AnalysisNASDAQ:RIME had a huge run on heavy volume in the last 2 hours of trading on Friday, Feb 13, 2026.

In order to maintain its uptrend look for price to maintain above 2.50 area for a test of highs and possible further breakout to the upside.

Rumors about buyouts as well as fund raising fuel senti

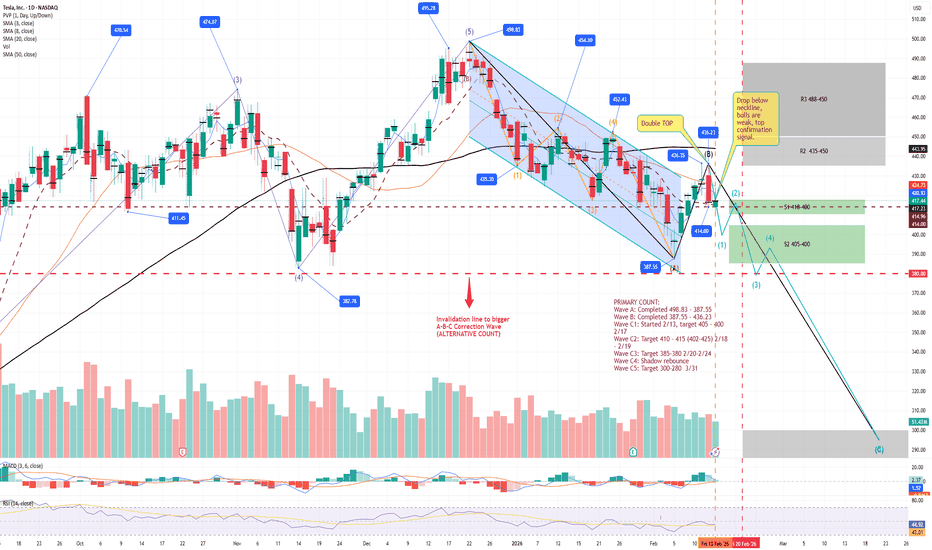

TSLA: DoubleTop Confirmed–BWave Ends 436, CWave target 395-380TSLA from 498 high unfolded a major A-B-C correction.

Primary Count:

- Wave A completed at 387.55. Wave B rallied to 436.35 forming a double top (Feb 11-12).

- Feb 13 CPI day closed with a spinning top, confirming B wave end.

- C wave started from 436, Wave C1 underway.

-- Short-term Wave C1

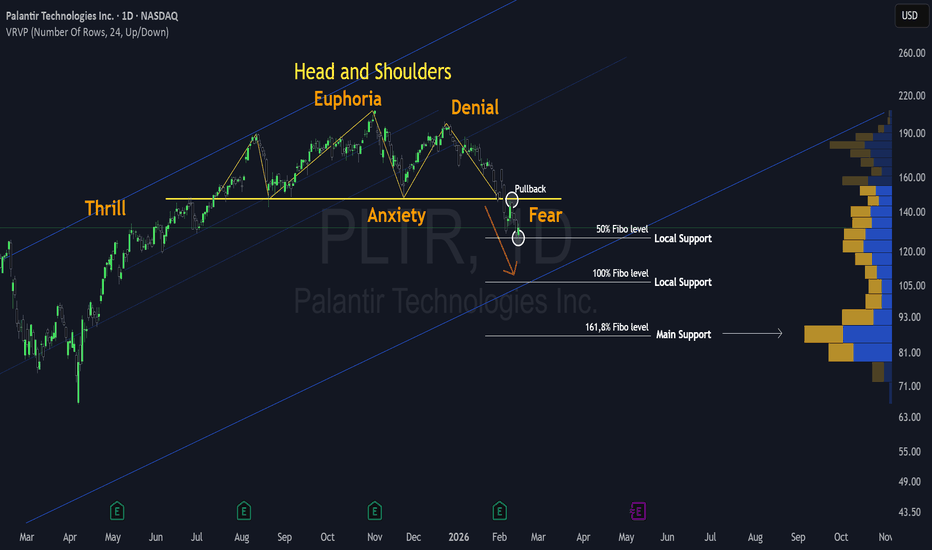

Palantir is Starting the Fear PhasePalantir is Starting the Fear Phase

Wall Street has seen several popular stocks lately.

NASDAQ:NVDA is the clear leader but we've recently seen a Head and Shoulders pattern unconfirmed, but there is a high risk to break it!

We cannot forget Palantir as another leader. The market believes t

Tesla head and shoulders Tesla looks to be forming a large head and shoulders on the weekly. I believe this would be good for the markets. Select over valued stocks can dump and bring be index down a bit without tanking the entire market. There is a large potential head and shoulders in NVDA as well, and Apple looks pretty

UAMY 1D: Antimony Testing Its BackboneUnited States Antimony is a U.S.-based producer of antimony and related metals, a raw materials asset with pronounced cyclicality and high sensitivity to industrial demand. The company operates in the strategic materials segment, which makes it particularly attractive during commodity cycle upswing

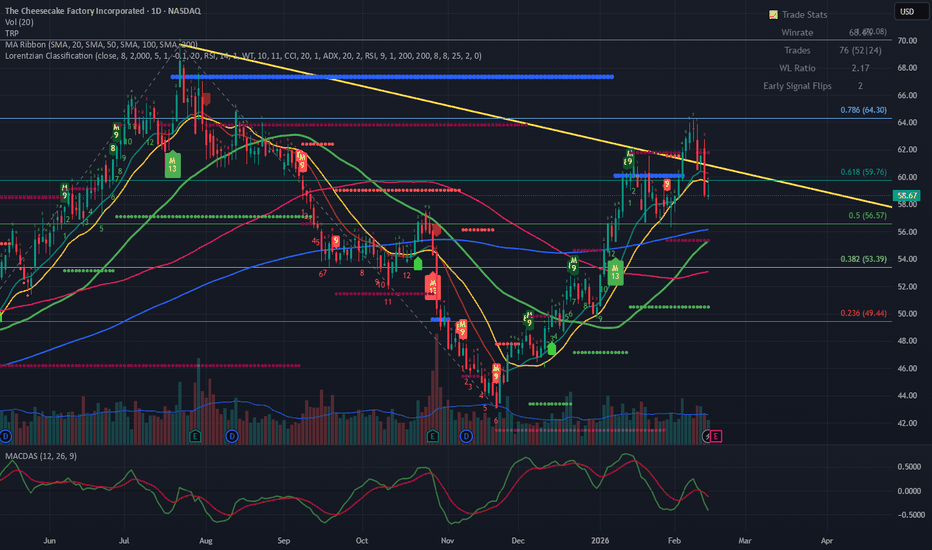

CAKE Ahead of Earnings: Breakout or Volatility Trap?Hello Everyone, followers,

CAKE is the last one from my side for this week.

Let's drill down:

📊 Technical Overview

CAKE has recovered strongly from its recent lows and is now testing a descending trendline resistance. Price is also approaching a key Fibonacci cluster.

The technical structure

See all stocks ideas

Today

CMBMCambium Networks Corporation

Actual

—

Estimate

0.10

USD

Today

DNOWDNOW Inc.

Actual

—

Estimate

0.15

USD

Today

VTSVitesse Energy Inc.

Actual

—

Estimate

0.24

USD

Today

SSTKShutterstock, Inc.

Actual

—

Estimate

0.53

USD

Today

IRWDIronwood Pharmaceuticals, Inc.

Actual

—

Estimate

−0.07

USD

Today

QMCOQuantum Corporation

Actual

—

Estimate

−0.45

USD

Today

ULBIUltralife Corporation

Actual

—

Estimate

0.24

USD

Today

GMGIGolden Matrix Group, Inc.

Actual

—

Estimate

0.01

USD

See more events

Community trends

Bitcoin at Strong Demand Zone – Next Big Move Loading!📊 Description✅ Setup BINANCE:BTCUSDT

BTC has been in a clear downtrend, respecting a descending trendline with multiple rejections.

Now price has reached a strong support/demand zone and we’re seeing a reaction.

Confluences on chart:

✔ Descending trendline break attempt

✔ Strong horizontal de

Bitcoin: Is the WXYXZ Correction Setting Up Wave C?Bitcoin: Is the WXYXZ Correction Setting Up Wave C?

During the last 5 days BTC declined by nearly 5% from 72250 to 65170

Looks like the B wave has more a corrective movement and is expanding as WXYXZ pattern. If the price manages to move above the previous X near 68300 it will add the chances t

BTCUSDT: Range Compression Signals Incoming Move To $72,300Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT previously traded inside a clearly defined range near the highs, where price moved sideways while forming equal highs and lows. This structure reflected temporary balance between buyers and sellers rather t

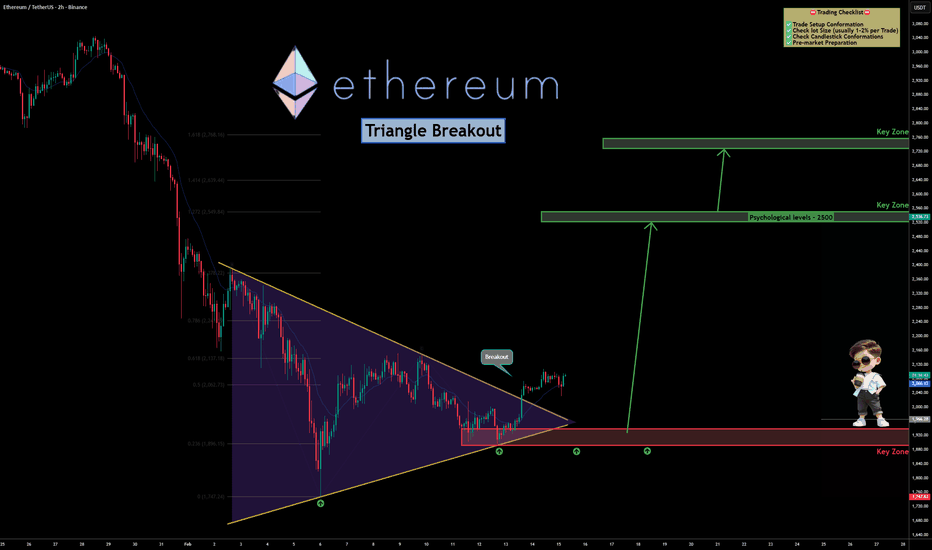

Ethereum Ready for Expansion? Structure Shift Confirmed📊 Technical Overview BINANCE:ETHUSD

Ethereum formed a clear symmetrical triangle pattern on the H2 timeframe after an extended corrective move.

Price respected both the descending resistance and ascending support multiple times, confirming valid compression. The recent break above the triangle

PEPE: Trendline Break & Bullish Reclaimhi!

Price has successfully broken the descending trendline and is now showing early signs of bullish momentum. The recent impulsive move also engulfed the last supply area, which suggests buyers are gaining short-term control.

From a market structure perspective, this looks like a potential shift

Pippin, the perfect short (Major crash in the making!)Timing is of the essence. Here we have a perfect chart setup for a massive short, one that cannot be missed.

PIPPINUSDT went ultra hyper bullish recently hitting a new all-time high. This bullish move just now is running its course. It is over.

After a strong rise comes a major correction—the perf

BTCUSDT – 1H Premium Short-Side Observation (Educational)Price is currently trading inside a descending channel, respecting the structure with lower highs and lower lows. Recent price action shows rejection near the upper channel trendline, which also aligns with a previous supply / resistance zone.

Key observations:

The descending channel structure is

Bitcoin - Weekly Outlook: Smart Money Defends the WickMarket Context

Bitcoin recently delivered an aggressive move lower, printing a large weekly wick that immediately signaled strong participation from buyers. Instead of allowing price to drift deeper, the market reacted precisely around the midpoint of that wick, an area that often acts as a technic

See all crypto ideas

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 5085 and a gap below at 4954, as support. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will se

Gold Weekly Levels: Bears will target Liquidity: 4800 → 4900🔱 XAUUSD — GOLD WEEKLY OUTLOOK Price now: 5042

⬛ ProjectSyndicate FREE TradingView Smart Money Concepts Indicators

🩶 Want to get all key levels marked up on your gold chart Automatically?

🩶 Get the latest FREE SMC 2026 PS script via link below.

🩶 Add to your Favorites List and then just add to

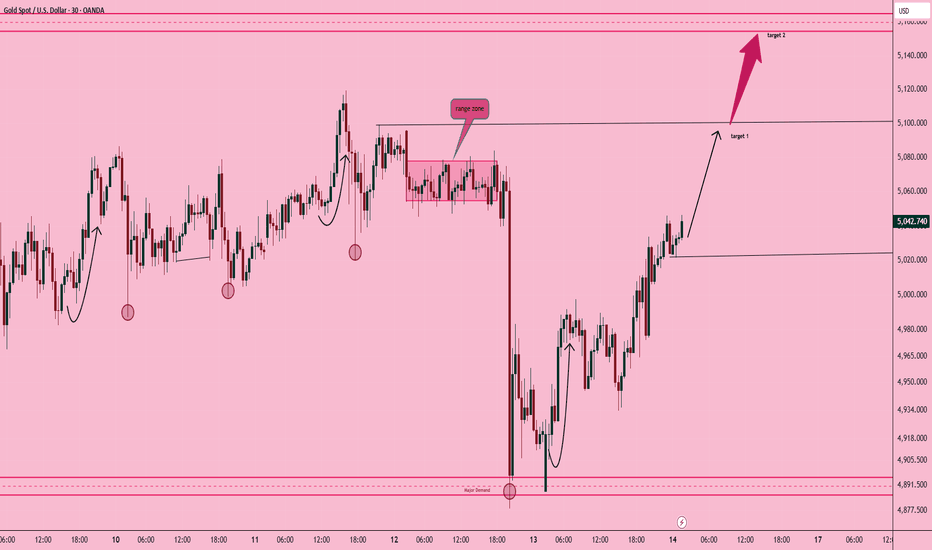

Elise |XAUUSD – 30M – Bullish Continuation After Demand ReactionOANDA:XAUUSD

After liquidity grab below 4,900, gold reacted aggressively from higher timeframe demand. The sharp displacement confirms buyer presence. Current structure suggests continuation toward the 5,100 range high, with external liquidity resting above 5,140. Momentum remains bullish unless 5,

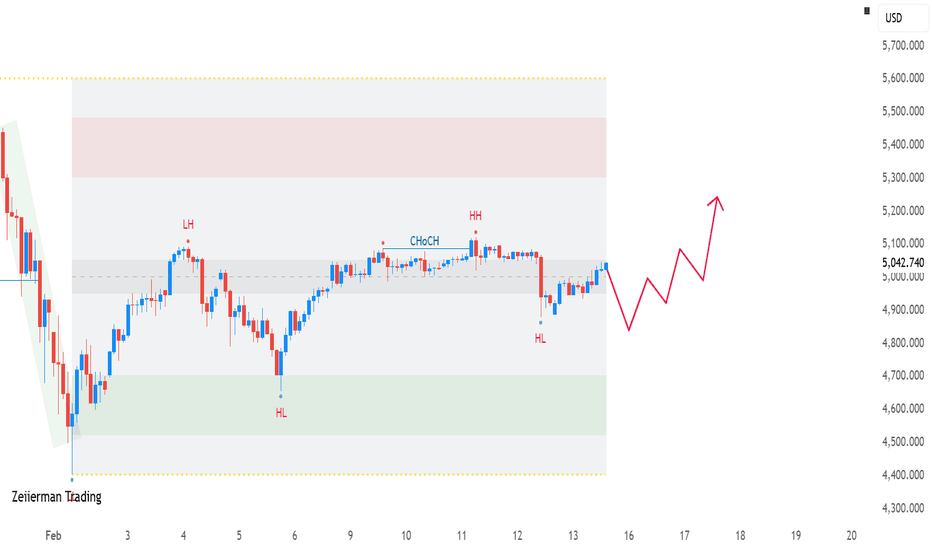

XAUUSD Bullish Break: Higher Low Confirms Gold UpsideGold (XAUUSD) is currently trading around the 5,040 – 5,050 zone, holding above a key internal support area after printing a clear Change of Character (ChoCH) followed by a Higher Low (HL).

The structure shows:

Previous Lower High (LH) formation

Break in structure → ChoCH

Formation of Higher Hig

Gold Holding Support - Path Toward 5,150 OpensHello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold previously traded within a steady bullish structure, moving inside a clearly defined ascending channel where price respected both the dynamic support and resistance boundaries. This phase showed cons

XAUUSDHello Traders! 👋

What are your thoughts on Gold?

Gold is currently moving within a well-defined ascending channel. In the short term, price is expected to continue fluctuating inside this channel structure. A breakout above the channel and the previous swing high resistance appears unlikely at thi

XAUUSD Long: Rebounds From Support - Buyers Target 5,100Hello traders! Here’s my technical outlook on XAUUSD (2H) based on the current chart structure. Gold was previously trading inside a well-defined ascending channel, where price respected both the rising support and resistance boundaries, forming a steady sequence of higher highs and higher lows. Thi

Lingrid | GOLD Weekly Outlook: Coiling for Next Leg Up ?OANDA:XAUUSD week of indecision—oscillating between $4,900 and $5,080—reflects a market testing buyer resolve amid conflicting signals. The price action remains trapped in a tight range as traders debate whether the recent pullback is a pause or a reversal, with multiple resistance and support leve

GOLD - Bulls in the game? Attempting to break through 5100...Last week was volatile for FX:XAUUSD : it rose to $5,100, then fell sharply by 3%, and then rebounded on the back of new US inflation data. Technically and fundamentally, the outlook is positive.

The CPI, which traders had been eagerly awaiting, slowed more than expected, which boosted buyer i

XPTUSD 1H — Bounce in progress, looking for a short1) Chart & context

The hourly chart suggests Platinum is approaching a sell-side opportunity, but I’m not looking to short immediately — I’m watching for the correction to mature first. 🕒

2) Structure (Elliott Wave read)

• We can see a clear 5-wave decline from ~2923 to ~1816.

• After a complete

See all futures ideas

GBPUSD Rebounds From Demand Bullish Move....

On the 1-hour chart, GBPUSD is trading inside a descending channel where overall structure remains bearish. However, price reacted strongly from the marked demand zone and climbed back above the Ichimoku cloud support, showing short-term bullish momentum. The market is now pushing into a supply/FVG

EURUSD Short: Bearish Triangle Building Below SupplyHello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD was previously trading within a well-defined descending channel, where price respected both the dynamic resistance and support boundaries while forming consistent lower highs and lower lows. This s

GBPJPY Range Accumulation – Risky Long Setup Toward 210.15GBPJPY Range Accumulation – Risky Long Setup Toward 210.15

GBPJPY is showing signs of accumulation after multiple rejections from the 207.60–207.90 demand zone.

Price is currently consolidating above support while forming higher lows, suggesting bullish pressure is building.

Immediate resistanc

#AUDNZD: Buy From Point Of Interest! 300 to 500 Pips! Dear Traders,

I hope you had a great trading week and a wonderful weekend.

The AUDNZD pair is currently in a strong bullish trend. The AUD is particularly bullish due to gold, but we’re seeing a price correction. After analysing all potential areas, we believe the marked area holds more potentia

EUR/USD - Triangle Breakout | Sellers in Control📊 Technical Overview TICKMILL:EURUSD

EUR/USD formed a clear symmetrical triangle pattern on the M30 timeframe, showing consolidation after a strong impulsive move.

✅Price rejected precisely from a higher-timeframe bearish order block, confirming strong supply in that zone.

✅The recent break be

EURUSD: Bearish Pressure Building Inside TriangleHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a clearly defined downward channel, where price respected both the resistance and support boundaries while forming consistent lower highs and lower lows. This structure confirmed

AUDJPY: Higher Highs And Higher lowsAUDJPY is having a similar analysis with AUDUSD, both have almost same upward structure and formation. here the pair positioned on a higher highs and lows channel, with the zones being respected as the pair continues its bullish movement. the price is at the trendline resistance as we expect a possi

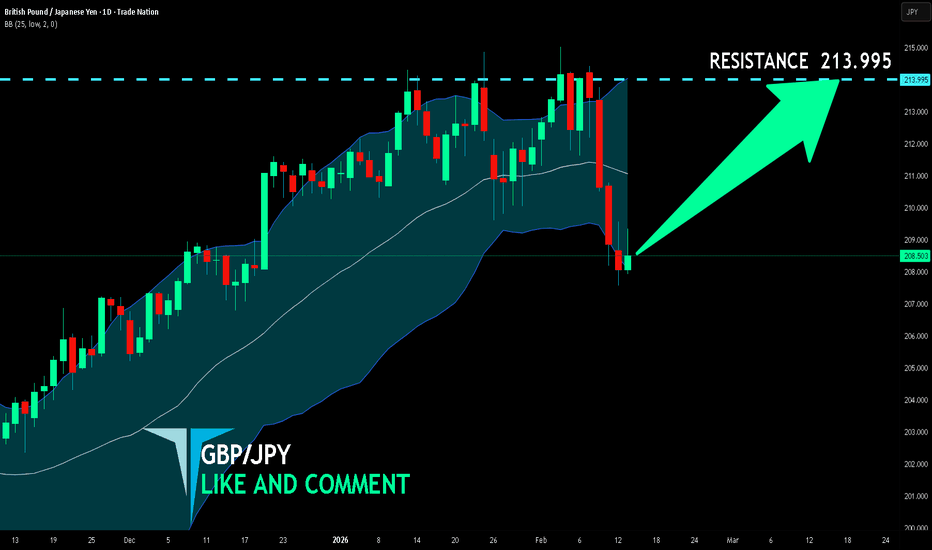

GBP/JPY BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

GBP/JPY is trending up which is clear from the green colour of the previous weekly candle. However, the price has locally plunged into the oversold territory. Which can be told from its proximity to the BB lower band. Which presents a beautiful trend following opportunity for a l

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.