Microsoft: a major technical support at $350–$400Should Microsoft stock once again be considered in a DCA zone, after having corrected on the stock market since last November and now being the most expensive (in valuation terms) among the Magnificent 7 stocks?

This is the question I will address in this new analysis on TradingView. Feel free to f

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Job Growth Takes Off but Traders Stay Put. What’s Happening?Are these jobs in the room with us right now?

📊 A Blockbuster Headline

The delayed January jobs report arrived Wednesday. Nonfarm payrolls ECONOMICS:USNFP showed 130,000 new hires , more than double the 55,000 estimate. On paper, that looked like a strong start to the year.

Wall Street’s re

$TAO Sitting on a Level That Has Never FailedGETTEX:TAO is sitting on a major long-term support level and this isn’t the first time.

If we look at the last three times we touched this support, we bounced strongly.

We may see some drop to form a wick below the support, just as we’ve seen in the last three instances. However, in each case, we

BTC: The "Invisible Wall" at $70k (Why We Flush to $59.8k)The retail narrative is that Bitcoin is "consolidating" at $70k. The On-Chain data says Bitcoin is DISTRIBUTING . We just hit an "Invisible Sell Wall" driven by three massive structural failures. This is not a dip to buy; it is a Rational Deleveraging triggered by a $6.3B supply shock that the ma

Silver Under Pressure – Sellers Are in ControlXAGUSD is currently clearly leaning toward a short-term BEARISH trend, as both recent news and the technical structure fail to support a sustainable bullish move.

From a news perspective , silver is facing pressure from profit-taking after the previous strong rebound , while the U.S. dollar and

S&P 500: Late-Cycle Signals Are BuildingThe S&P 500 is still holding near highs, but under the surface, things are starting to weaken. Both the chart and the economy are sending warning signs that are easy to miss if you only look at price.

Weekly Bearish Divergence

On the weekly chart, price made higher highs, but momentum did not .

EURUSD Buyers in Control After Corrective Move, Eyes on 1.1930Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD previously traded within a strong bullish environment, supported by a well-defined rising trend line. During this phase, price consistently formed higher highs and higher lows, confirming sustained

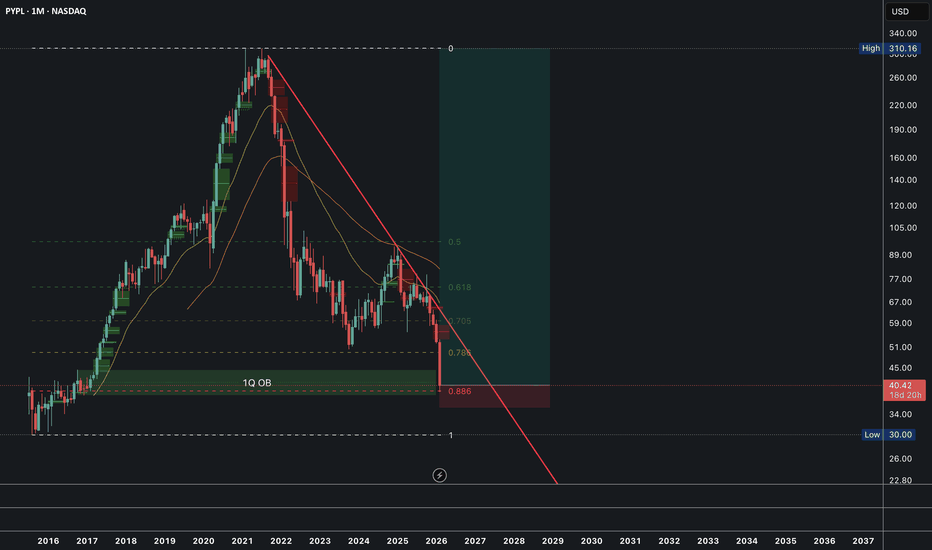

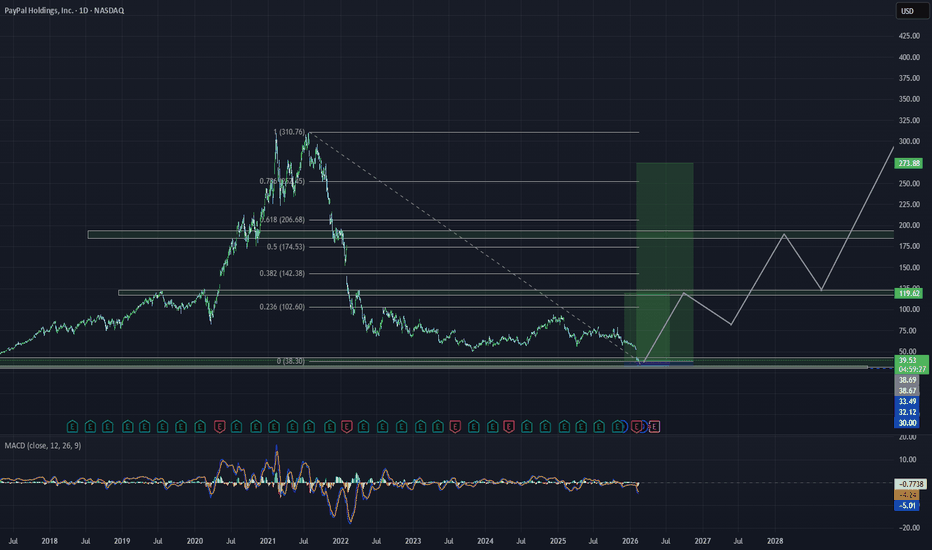

Paypal Bottom is in ?! Long from herePayPal Holdings (PYPL) is currently trading at approximately $40.42 (as of the latest close, +1.30% on the session), marking a continuation of the multi-year downtrend from its 2021 peak of ~$310–$340.

The chart applies a Fibonacci retracement drawn from the 2021 high (~$310.16) to the post-peak lo

$PL - RACE TO SPACE!This reported merger proposal between SpaceX and xAI, along with the broader industry moves toward orbital AI data centers, represents a bold and high-stakes strategic gambit in the escalating global AI infrastructure race. Here’s a structured analysis of the implications, motivations, and challenge

Bitcoin Back Above $70,000. Here Are Key Levels to Watch NowA trip to $60,000 and back before coffee.

Bitcoin BITSTAMP:BTCUSD spent the end of last week doing what it does best: reminding traders that fire-breathing dragons aren’t in fairytales only.

After a sharp drop to $60,033 on Thursday torched thousands of long positions, the world’s largest crypt

See all editors' picks ideas

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

See all indicators and strategies

Community trends

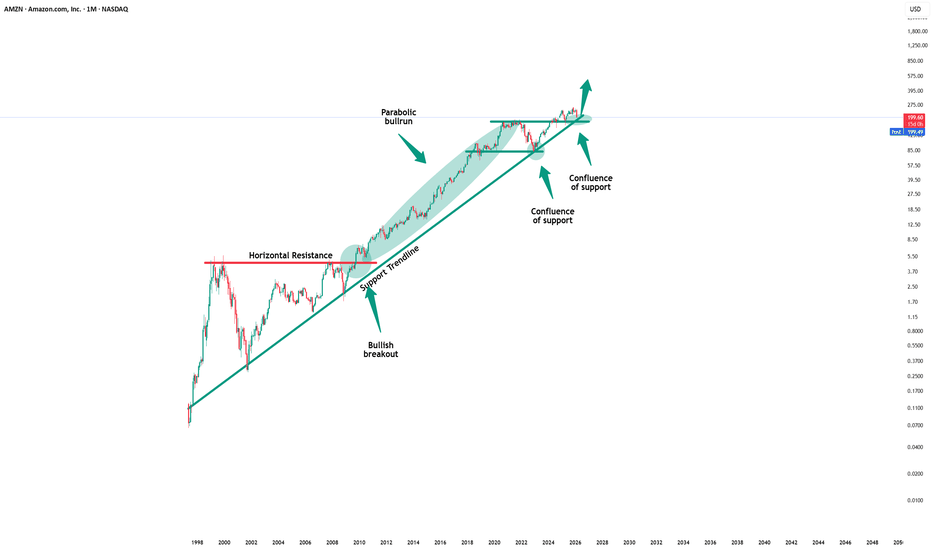

Amazon - This stock is still 100% bullish!🎉Amazon ( NASDAQ:AMZN ) just remains totally bullish:

🔎Analysis summary:

This month alone, Amazon is down about -15%. But looking at the higher timeframe, the underlying uptrend still remains incredibly strong. And even if Amazon drops another -15%, it will retest a significant support and su

750% Upside Potential! Only Green From HereFrom a technical standpoint:

The stock has retraced nearly the entire 2020–2021 move. Price is testing deep Fibonacci retracement levels (~0.886). Prior consolidation in the $45 - $50 zone now acts as resistance.

Sentiment is extremely bearish — which historically aligns with long-term opportunity

Microsoft: a major technical support at $350–$400Should Microsoft stock once again be considered in a DCA zone, after having corrected on the stock market since last November and now being the most expensive (in valuation terms) among the Magnificent 7 stocks?

This is the question I will address in this new analysis on TradingView. Feel free to f

COINBASE $150 Target hit. Bear Cycle now enters Phase 2 to $55.More than 2 months ago (December 04 2025, see chart below), we gave a massive Sell Signal on Coinbase (COIN) as it was testing for several weeks its 1W MA50 (blue trend-line) without breaking above it:

Last week's dramatic sell-off finally hit our $150 mid-term Target and this week despite its

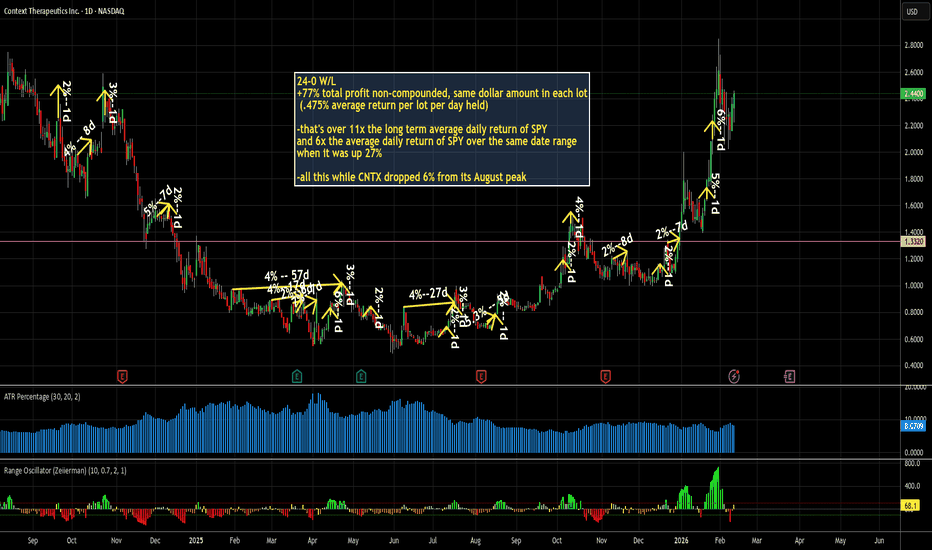

Throw out (almost) everything you know about how I trade.Chances are, virtually the only people who will see this idea are followers of mine. And that is just fine with me. You deserve this more than anyone else. But I have to warn those of you who have been following me for a long time - this is NOT my normal trading style. So make sure you are sitti

ONDS 1D: Drones at the structural runwayOn the daily chart Ondas continues to develop within a rising channel after a deep but technically healthy pullback. Price is holding the higher timeframe trendline that has supported the move since the initial impulse and is now returning to the 7.85–8.00 area, where prior accumulation was visibl

QS V4 Alert: APLD Bullish Momentum Ready to Surge!APLD QuantSignals V4 Weekly 2026-02-12

Trend / Signal: CALLS (Bullish)

Conviction: Moderate

Alpha Score: 68

Time Horizon: Weekly (Expires Feb 13, 2026)

Instrument: $38.0 Call

Core Thesis

APLD is maintaining strength near its 52-week high.

Supported by a bullish Put/Call ratio (0.75) and inst

Spotify appears to be searching for a floor around the $95 area.Spotify appears to be searching for a floor around the $95 area.

After the recent sharp breakdown from the upper trendline, price has accelerated to the downside with strong momentum, suggesting a shift from distribution to corrective pressure. The $95 zone stands out as a potential technical suppo

See all stocks ideas

Today

BAPCredicorp Ltd.

Actual

5.91

USD

Estimate

6.50

USD

Today

ESNTEssent Group Ltd.

Actual

1.60

USD

Estimate

1.72

USD

Today

AAPAdvance Auto Parts Inc.

Actual

0.86

USD

Estimate

0.41

USD

Today

ATMUAtmus Filtration Technologies Inc.

Actual

0.66

USD

Estimate

0.56

USD

Today

SXTSensient Technologies Corporation

Actual

0.72

USD

Estimate

0.77

USD

Today

CTORCitius Oncology, Inc.

Actual

−0.06

USD

Estimate

−0.04

USD

Today

MRNAModerna, Inc.

Actual

−2.11

USD

Estimate

−2.54

USD

Today

PAMTPAMT CORP

Actual

−1.40

USD

Estimate

−0.20

USD

See more events

Community trends

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

After the recent sharp decline, Bitcoin has entered a clear consolidation range. The upper and lower boundaries of this range are marked on the chart.

As long as price remains inside this range, we should not expect a strong directional move. In

Elise | BTCUSD · 30M – Liquidity Reaction StructureBITSTAMP:BTCUSD

After taking external liquidity above 71,000 earlier, BTC shifted bearish and compressed into HTF demand. The recent sweep below 66,000 triggered a strong reaction, suggesting short-term upside toward internal resistance. Upside remains corrective unless structure breaks above 69,0

ETHUSD 2H ANALYSIS ( MUST READ IT )Hello traders

Here's my first idea about ETHEREUM ETHUSD and what do think about it ? Kindly share your idea about ETHEREUM ETHUSD with me in comment section

Key Points 😊

Resistance zone : 2.030/2.040

First Target 1,855

Second Target 1,780

Don't forget to share this with your friends and famil

Bitcoin 10X Long with 689% profits potentialIt's been several days since Bitcoin hit bottom, six days now.

The drop that started 14-January 2026 was composed of strong bearish momentum; it was lower, followed by lower and then more lower. The longest stop was one or two days, never more than that. There was nothing weak about the drop.

Bitc

ETH/USD Decision Points for Next MoveEthereum is currently exhibiting a textbook bullish reversal structure as it stabilizes within a high-confluence demand zone between $1,800 and $1,900. After a period of bearish dominance, the price action is shifting from a sequence of lower lows to a potential Market Structure Shift (MSS), evidenc

BTCUSDT Short: Bearish Structure Holds - Focus on 65,000 DemandHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT has been trading within a well-defined descending channel, reflecting sustained bearish pressure and consistent seller control. Throughout this phase, price respected the channel boundarie

BITCOIN Cycle bottom fractals map the rest of 2026 towards $40k.Bitcoin (BTCUSD) continues to be under heavy pressure despite having the 1W MA200 holding the crash last week. Having long lost its 1W MA50 (blue trend-line), which confirmed the Bear Cycle, we are now approaching its 2nd Phase, which is the bottoming process.

This doesn't mean that the bottom is h

DOGE – At Weekly Support… But Not Bullish YetDOGE is currently approaching a major weekly support zone $0.08 – $0.05 .

This area has previously acted as a strong demand zone, so it’s definitely a level to watch. However, structure still matters.

Price remains bearish, trading inside the falling red channel with clear lower highs and lower lo

ADAUSDT - Short squeeze before falling to 0.22BINANCE:ADAUSDT , after breaking through the global support zone of 0.275 and updating its lows to 0.22, entered a phase of correction and consolidation below key levels. Another short squeeze could trigger a decline.

Bitcoin is falling after a correction, which generally indicates a weak mar

SOL Rejection at Resistance – Breakdown Toward 70?SOL Rejection at Resistance – Breakdown Toward 70?

SOL is showing clear weakness after failing to reclaim the mid-range resistance around 83–84.

Price rejected the horizontal resistance and continues to respect the descending trendline from the recent highs, confirming short-term bearish structur

See all crypto ideas

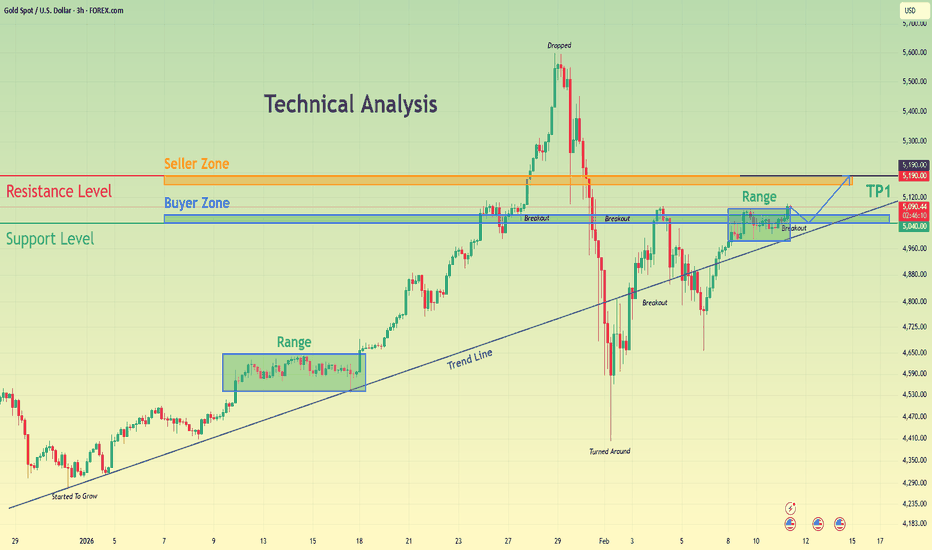

Gold next move (huge selling is on the cards)(11-02-2026)Plz Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (11-02-2026)

Current price- 5080

"if Price stays below 5130 then next target is 5000, 4950, 4900 and 4800 and above that 5200 and 5300".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBI

Gold 30Min Engaged ( Bearish & Bullish Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — LONG / Reversal 4908 Area

XAUUSD: Range Holding Strong - Upside Expansion PossibleHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously experienced a strong bearish impulse, breaking decisively below a key support area and triggering an acceleration to the downside. This sell-off marked a clear loss of bullish control and led to a

Gold Price Analysis – Resistance and Support LevelsThis chart highlights crucial price levels for gold, including Key Resistance Level at 5,440.457, where a breakout or price rejection may occur. The Minor Resistance at 5,112.237 could lead to a potential reversal. The Support Zone around 5,062.548 is being tested, with the expectation for price sta

GOLD - Consolidation ahead of the news? Will the trend continue?FX:XAUUSD is attempting to recover to $5,000 after a sharp 3.5% drop on Thursday. There are no clear reasons for this. All market attention is focused on today's US inflation report - CPI.

Yesterday's gold sell-off was caused not only by technical factors, but also by capital flight to the dol

GOLD Consolidation Both sides Phase Gold remains in a tight consolidation phase, with price action moving sideways as investors wait for a decisive breakout. The metal slipped toward the 5050 area today, trimming gains from the previous session as expectations for aggressive Federal Reserve rate cuts were slightly reduced.

Despite th

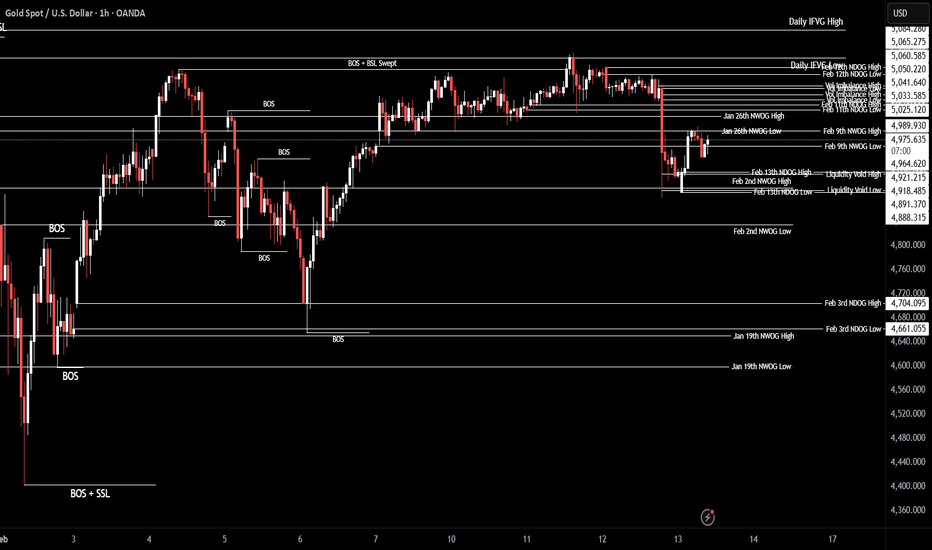

XAU/USD | Gold Facing Key $5000 Decision Level! (READ)By analyzing the #Gold chart on the 1-hour timeframe, we can see that last night price suddenly dropped more than $180 and entered the $4870 area. After that, Gold made a strong rebound and rallied back to $4999, where it reacted to the psychological $5000 resistance.

Today, after another pullback

XAUUSD Builds Strength Above Demand - Next Target $5,190Hello traders! Here’s my technical outlook on XAUUSD (3H) based on the current chart structure. Gold is trading within a broader bullish market structure, supported by a well-defined rising trend line that has guided price higher over time. Earlier in the move, price entered a consolidation phase, f

Selena | XAUUSD · 30M – Bullish Structure Inside Rising ChannelFOREXCOM:XAUUSD PEPPERSTONE:XAUUSD

After the aggressive sell-side sweep, buyers regained control and pushed price back into a structured bullish channel. The current strong consolidation under 5,100 suggests accumulation before a potential expansion move. As long as price holds above the intern

XAU/USD | Going back to 5000? (READ THE CAPTION)Just like the other forex pairs, gold experienced a massive drop in price yesterday, over 1000 pips in a few seconds! This drop made up several Volume Imbalances and Liquidity Voids and Gold went as low as 4878! But after today's NDOG, Gold made an upwards move, going as high as 4997, but failed to

See all futures ideas

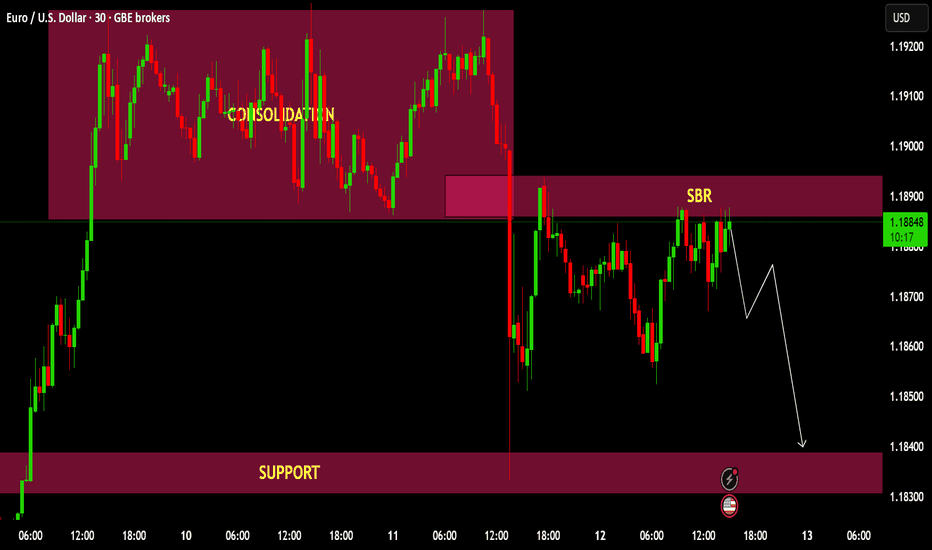

EURUSD Compressing Above Demand - Next Move IncomingHello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. The pair is trading within a broader bullish environment, supported by a clearly defined rising support line that has guided price higher over time. Earlier in the move, EURUSD entered a consolidation pha

EUR/USD at Key Zone – Support Test Incoming! (13.02.2026)📊 Description✅ Setup OANDA:EURUSD

EUR/USD is reacting from a higher-timeframe resistance zone after a strong bullish move.

Price is now respecting a rising trendline support, showing a slowing momentum and possible distribution.

We can see:

👉Multiple rejections from resistance

👉Trendline acti

EURUSD Daily CLS - Model 1 - HTF Reversal - SMTHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

EURUSD - Will it break the resistance?EURUSD is currently trading within a well-defined 4-hour structure, where both support and resistance are clearly mapped by fair value gaps. After a strong recovery from the lows, price has entered a consolidation phase just below a key resistance zone. The market is now reacting precisely to higher

EUR/USD - Triangle Breakout | Sellers in Control📊 Technical Overview TICKMILL:EURUSD

EUR/USD formed a clear symmetrical triangle pattern on the M30 timeframe, showing consolidation after a strong impulsive move.

✅Price rejected precisely from a higher-timeframe bearish order block, confirming strong supply in that zone.

✅The recent break be

EURUSD is Nearing a Decent Support!Hey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.18200 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend a 1.18200 support and resistance area.

Trade safe, Joe.

Selena | EURUSD · 4H – Bullish Channel StructureFX:EURUSD

After sweeping liquidity near 1.1600, buyers reclaimed control and pushed price back into the upper half of the channel. Current compression beneath 1.1950–1.2000 resistance suggests accumulation before potential breakout. Structure remains bullish unless channel support fails.

Key Scen

EURUSD Price Update – Clean & Clear ExplanationEUR/USD is trading within a short-term bullish structure on the 30-minute timeframe, supported by a well-respected ascending trendline that has guided price higher over the past sessions. After a strong impulsive rally, the pair entered a consolidation phase, forming higher lows while gradually push

EURUSD Trapped at Reclaimed Supply — Continuation or Failure?EURUSD broke down from consolidation with clear displacement.

That range has now flipped from support into resistance.

Price is currently retesting that SBR zone. This is not strength — it is a corrective retracement into prior distribution.

If this level rejects, the draw on liquidity sits below

EURUSD: Bearish Pressure Building Inside TriangleHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a clearly defined downward channel, where price respected both the resistance and support boundaries while forming consistent lower highs and lower lows. This structure confirmed

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.