Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.71 USD

3.22 B USD

46.40 B USD

1.16 B

About Nike, Inc.

Sector

Industry

CEO

Elliott J. Hill

Website

Headquarters

Beaverton

Founded

1964

IPO date

Dec 2, 1980

Identifiers

3

ISIN US6541061031

NIKE, Inc engages in the design, development, marketing, and sale of athletic footwear, apparel, accessories, equipment, and services. It operates through the following segments: North America; Europe, Middle East & Africa; Greater China; Asia Pacific & Latin America; Global Brand Divisions; Converse; and Corporate. The North America; Europe, Middle East & Africa; Greater China; and Asia Pacific & Latin America segments refers to the design, development, marketing, and selling of athletic footwear, apparel, and equipment. The Global Brand Divisions represents NIKE Brand licensing businesses. The Converse segment designs, markets, licenses, and sells casual sneakers, apparel, and accessories. The Corporate segment consists of unallocated general and administrative expenses. The company was founded by William Jay Bowerman and Philip H. Knight on January 25, 1964 and is headquartered in Beaverton, OR.

Related stocks

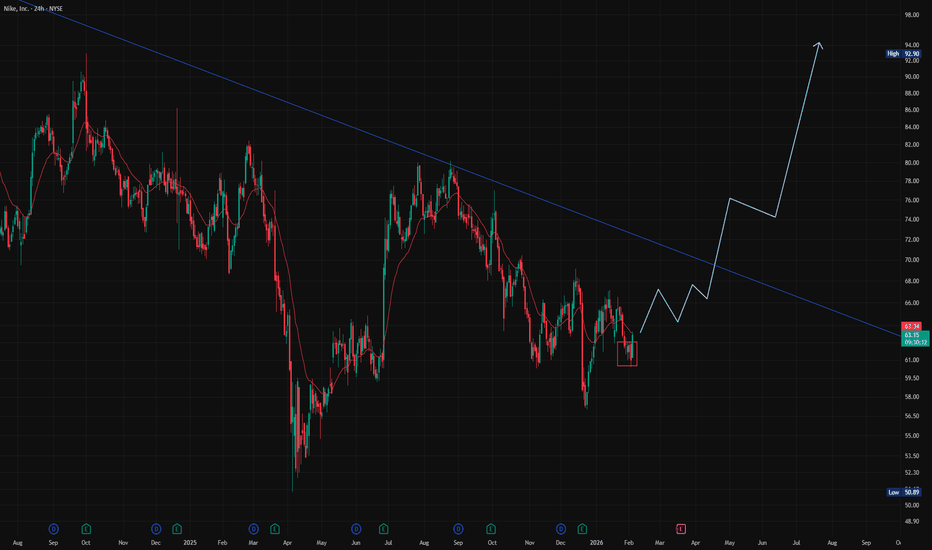

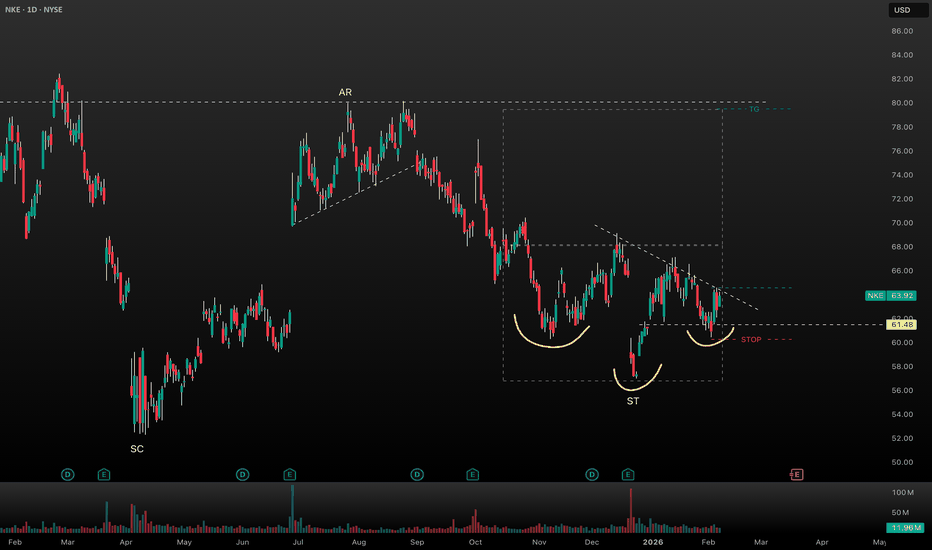

Is This a Wyckoff Secondary Test? A High Risk–Reward ZoneIf we are currently in a Wyckoff Accumulation phase, then what we are likely seeing now is a series of Secondary Tests.

To trade this area properly, I believe we should combine Wyckoff analysis with an additional technical setup in order to better define our risk-reward profile.

In this case, the

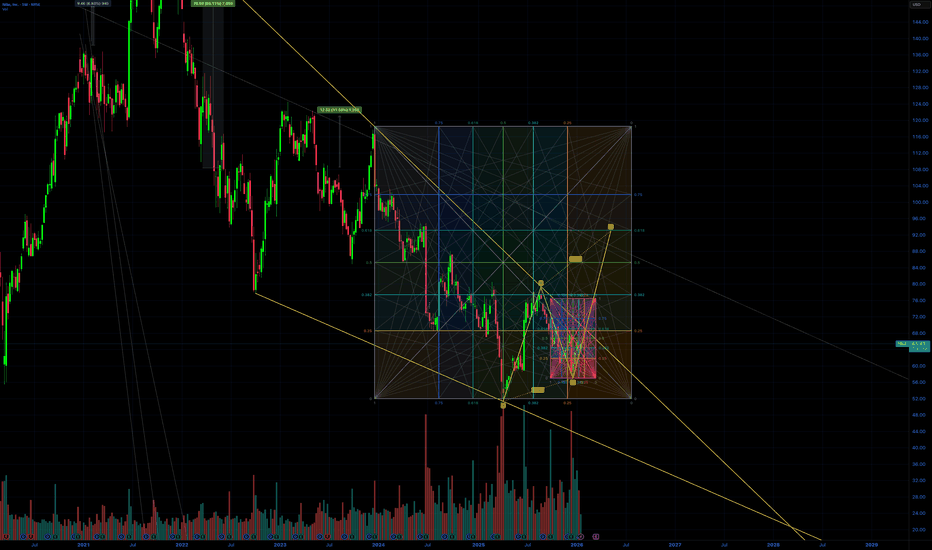

Bullish Deep Crab + Double Bottom at PCZPattern Identified: Bullish Deep Crab (0.886B/1.618XA with 2.0 BC Projection Confluence) with strong confluence at Potential Reversal Zone (PRZ).

Key Confluence:

Retracement Profile: Dual 0.886 retracements at B and C indicate powerful but potentially exhausted counter-trend momentum

Perfect Crab R

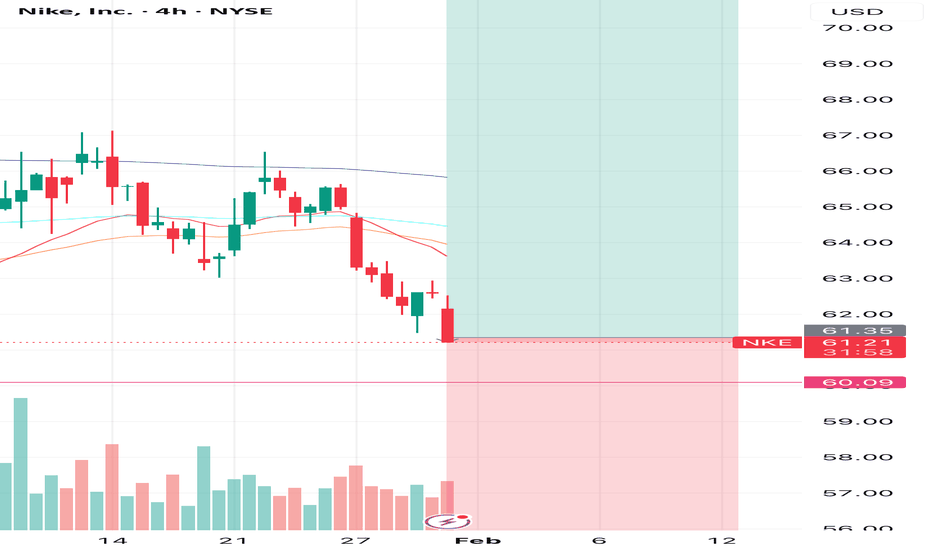

NIKE : Long From Demand Zone With Target at $75Nike is trading near the lower end of its recent range after a sharp pullback, approaching a clear demand zone where selling pressure is starting to fade. The downside move looks corrective rather than impulsive, with price stabilizing after flushing late sellers.

From a sentiment perspective, Wall

Nike's Contrarian Setup: Political Noise vs. Brand ResilienceThe sportswear giant (NKE) is trading near multi-year lows following EEOC investigation headlines, creating a classic disconnect between political optics and underlying brand economics. While the stock faces near-term headwinds, the risk/reward asymmetry at current levels warrants attention for inco

LONG SETUP: Nike, Inc. (NKE)📈 LONG SETUP: Nike, Inc. (NKE)

Hunters, the sentiment is flipping! 🚀 After recent consolidation, Nike is serving up a clean and clear "easy trade" opportunity on the long side.

Nike stock ( NYSE:NKE ) has successfully defended a crucial price level, and the market structure is now favoring the b

45% minimum by May?Nike has delivered strong earnings, even with the imposition of tariffs, but what could be the catalyst for a rally that allows it to recover value over the next four months? Perhaps the new acquired economies generated by Trump’s actions, I am referring to Venezuela. These artificial expansions of

$NKE: The "Repair Job" in Progress for NIKE👟👟

Nike is currently like a classic sneaker getting dusted down and cleaned up.

It’s not quite "dead money," but it’s definitely not back to full speed yet.

The "Hype" (Why Bulls like it)

The Big Bosses are Buying: CEO Elliott Hill and even Tim Cook (Apple CEO/Nike Board) just dropped millions

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NKEB

NIKE, Inc. 3.875% 01-NOV-2045Yield to maturity

5.51%

Maturity date

Nov 1, 2045

US654106AG8

NIKE, Inc. 3.375% 01-NOV-2046Yield to maturity

5.50%

Maturity date

Nov 1, 2046

NKEA

NIKE, Inc. 3.625% 01-MAY-2043Yield to maturity

5.45%

Maturity date

May 1, 2043

NKE4971170

NIKE, Inc. 3.375% 27-MAR-2050Yield to maturity

5.25%

Maturity date

Mar 27, 2050

NKE4971169

NIKE, Inc. 3.25% 27-MAR-2040Yield to maturity

5.16%

Maturity date

Mar 27, 2040

NKE4971168

NIKE, Inc. 2.85% 27-MAR-2030Yield to maturity

4.03%

Maturity date

Mar 27, 2030

US654106AF0

NIKE, Inc. 2.375% 01-NOV-2026Yield to maturity

3.98%

Maturity date

Nov 1, 2026

NKE4971167

NIKE, Inc. 2.75% 27-MAR-2027Yield to maturity

3.66%

Maturity date

Mar 27, 2027

See all NKE bonds

Frequently Asked Questions

The current price of NKE is 62.35 USD — it has decreased by −1.40% in the past 24 hours. Watch Nike, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Nike, Inc. stocks are traded under the ticker NKE.

NKE stock has risen by 0.70% compared to the previous week, the month change is a −4.74% fall, over the last year Nike, Inc. has showed a −11.65% decrease.

We've gathered analysts' opinions on Nike, Inc. future price: according to them, NKE price has a max estimate of 120.00 USD and a min estimate of 35.00 USD. Watch NKE chart and read a more detailed Nike, Inc. stock forecast: see what analysts think of Nike, Inc. and suggest that you do with its stocks.

NKE stock is 3.78% volatile and has beta coefficient of 1.14. Track Nike, Inc. stock price on the chart and check out the list of the most volatile stocks — is Nike, Inc. there?

Today Nike, Inc. has the market capitalization of 93.32 B, it has decreased by −3.75% over the last week.

Yes, you can track Nike, Inc. financials in yearly and quarterly reports right on TradingView.

Nike, Inc. is going to release the next earnings report on Mar 19, 2026. Keep track of upcoming events with our Earnings Calendar.

NKE earnings for the last quarter are 0.53 USD per share, whereas the estimation was 0.37 USD resulting in a 41.46% surprise. The estimated earnings for the next quarter are 0.30 USD per share. See more details about Nike, Inc. earnings.

Nike, Inc. revenue for the last quarter amounts to 12.43 B USD, despite the estimated figure of 12.21 B USD. In the next quarter, revenue is expected to reach 11.23 B USD.

NKE net income for the last quarter is 792.00 M USD, while the quarter before that showed 727.00 M USD of net income which accounts for 8.94% change. Track more Nike, Inc. financial stats to get the full picture.

Yes, NKE dividends are paid quarterly. The last dividend per share was 0.41 USD. As of today, Dividend Yield (TTM)% is 2.55%. Tracking Nike, Inc. dividends might help you take more informed decisions.

Nike, Inc. dividend yield was 2.59% in 2024, and payout ratio reached 72.55%. The year before the numbers were 1.53% and 38.91% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 12, 2026, the company has 77.8 K employees. See our rating of the largest employees — is Nike, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Nike, Inc. EBITDA is 3.63 B USD, and current EBITDA margin is 9.21%. See more stats in Nike, Inc. financial statements.

Like other stocks, NKE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Nike, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Nike, Inc. technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Nike, Inc. stock shows the sell signal. See more of Nike, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.