Everyone is talking about yields inverting and the recession that follows it. Here I am going to do a quick rundown on how to actually use this information to your advantage.

It is not the yields INVERTING that is cause for concern. This is only the first step of a potentially long process. It is when yields start STEEPENING that there is real cause for concern.

There is no question that yields inverting is a recession signal, it has historically proven itself to be since the 1970s. But if you think the market is ready for a recession right at this moment of inversion, you are misinformed.

Pay close attention to when the yield first inverts, to where/when the market actually enters a recession. It is not until after yields STEEPEN is when there is real downside.

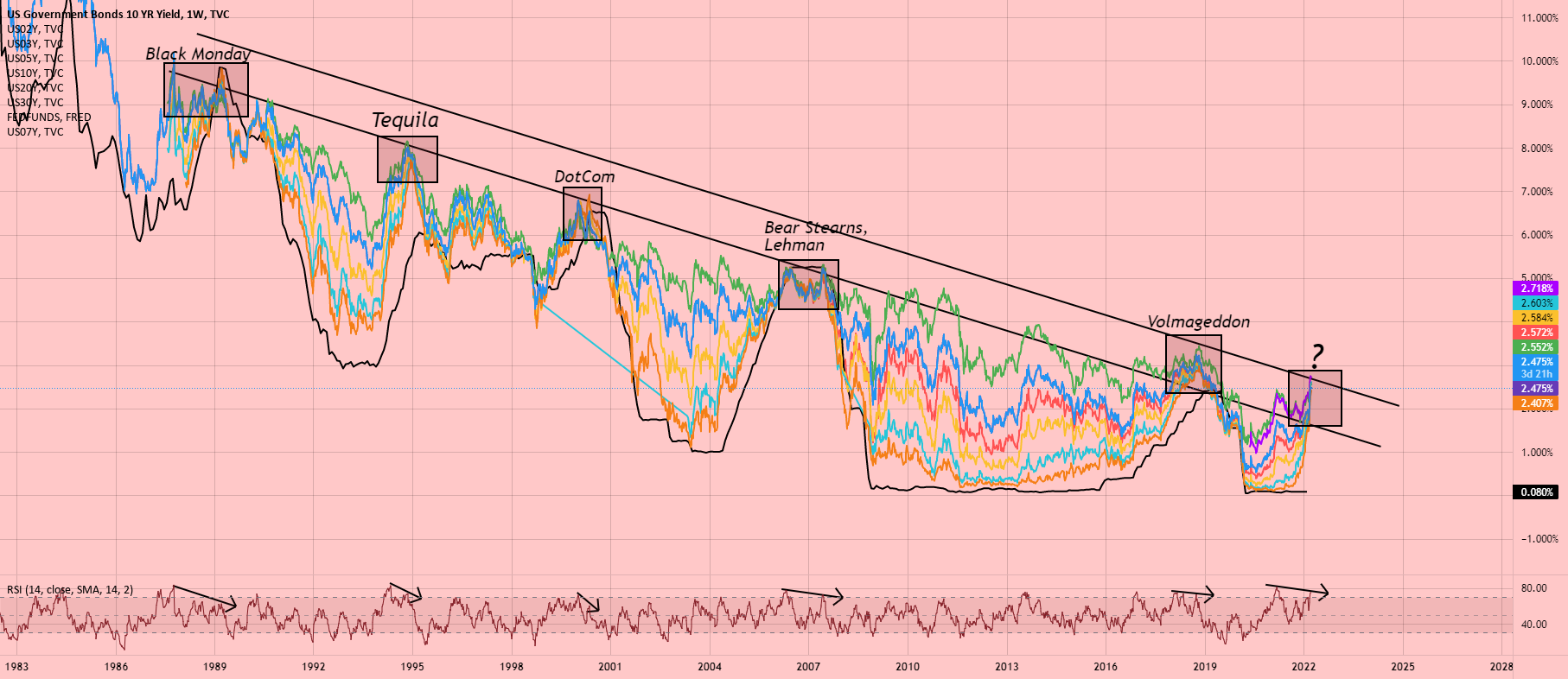

Now, this brings us to the chart, where we are potentially seeing the first signs of steepening. Not only from the yields themselves but from the Bullish Divergence on the RSI.

As yields have inverted (gone down), the RSI has trended up, showing a clear divergence. Also, notice how far yields have deviated from the 200MA.

If you compare it to 2000, it is potentially showing a very similar picture

Even in august of 2019 we see the same divergence which signaled yields to begin rising. Which told us it was really time to pay attention in the coming months.

These are just a few insights to hopefully help you understand what this all means in the bigger picture. Right now more than ever is the time to pay attention and to stay vigilant.

Hope this helps!

Here is my initial analysis on yields tightening, as well as the Yield Inversion in relation to the SPX:

It is not the yields INVERTING that is cause for concern. This is only the first step of a potentially long process. It is when yields start STEEPENING that there is real cause for concern.

There is no question that yields inverting is a recession signal, it has historically proven itself to be since the 1970s. But if you think the market is ready for a recession right at this moment of inversion, you are misinformed.

Pay close attention to when the yield first inverts, to where/when the market actually enters a recession. It is not until after yields STEEPEN is when there is real downside.

Now, this brings us to the chart, where we are potentially seeing the first signs of steepening. Not only from the yields themselves but from the Bullish Divergence on the RSI.

As yields have inverted (gone down), the RSI has trended up, showing a clear divergence. Also, notice how far yields have deviated from the 200MA.

If you compare it to 2000, it is potentially showing a very similar picture

Even in august of 2019 we see the same divergence which signaled yields to begin rising. Which told us it was really time to pay attention in the coming months.

These are just a few insights to hopefully help you understand what this all means in the bigger picture. Right now more than ever is the time to pay attention and to stay vigilant.

Hope this helps!

Here is my initial analysis on yields tightening, as well as the Yield Inversion in relation to the SPX:

Comment:

We have officially seen a break up from that level of caution. Here is my update;