SUPPORT AND RESISTANCE // ENTRY AND EXIT EXAMPLEJust a quick example of looking at previous structure to determine new support/ resistance levels and entry/exit points. Hope you gain some value :)

Technical Analysis

BTC/USD and The Remoras Theory part one.Monday Monday, so good to me ... Monday morning it was all I hoped it will be...

Thinking about this past weekend price movement and reading most of the analysis that mention the undoubtful whale's presence in the crypto markets, my intention here is to try to develop a 'theory' that inquiries the high volatility in the bitcoin market and the presence of whales and other players in the market. I mean, there must be more players than just buyers and sellers, or bulls and bears. The trading market just like life itself, isn't binary. If you think it is, try looking at things thru a kaleidoscope.

This is the 'Remoras Theory' part one.

Looking at the four hours chart, btc has been moving between the 100-MA and 50-MA. It isn't weird that the price bounced from 7.4k to 7.7k and then dropped from 7.7k to 7.5. But the way it did it, just like many times before, it's, to say the least, rare. If there's whales in the market looking for leveraged traders to liquidate, there must be remoras too.

Taking the Merriam-Webster dictionary's definition, a remora is "any of a family (Echeneidae) of marine bony fishes that have the anterior dorsal fin modified into a suctorial disk on the head by means of which they adhere especially to other fishes". In other words, "remoras (also called suckerfish) literally stick to the sharks’ skin and when a bigger fish attacks and eats prey, the remora will detach itself and feast on the remains once its host is done" ( National Geographic , 11 Aug. 2017). I will get back later to this quote, to explore a trading strategy based on this mother nature's behavior.

Having said that, this morning in less than five minutes, the most important crypto-currency dropped almost what had gained in two or three days. I'm not judging whether that's normal or not -I guess it is-, my point is that the whales ate the remoras right away. Maybe because leveraged traders are naive or rookies, but the fact is that whales ate bullish and bearish remoras indistinguishably, whether because they were confuse or unaware of the whale's way of life. All in all, that seems to be a constant behavior in the market, either a bullish or a bearish market, and we could take some tips from it -to be developed.

First, there are more than two players in the market.

Second, Whales eat remoras all the time with or without subtle manners.

Third, remoras get confused and panic too often and whales know it.

Fourth, maybe I'm too stoned and I'm too wrong with this, but I will develop this Remoras Theory, reading and mixing TA and biology together.

Peace!

Top 7 magic Crypto Indicators: #3 IchimokuDear Cryptuminati,

Many beginners wonder which indicators to use. That's why I started this series with the 7 best indicators. It is not just any indicators, but those that are best suited for crypto trading.

#3 Ichimoku Kinko Hyo

Today I want you to meet a crazy indicator. Ichimoku is a complete trading system from Japan. I'm sure you've seen this strange cloud before. At first glance, it causes enormous confusion and looks very complicated. Don't worry, it's very easy to interpret Ichimoku. I use this indicator primarily to detect trend changes.

My areas of application:

- Trend directions: If the course is above the cloud, this is positive. Below the cloud there is a downward trend.

- Trend strength: The thicker the cloud, the stronger the trend. A change in cloud colour must be interpreted as positive (green) or negative (red) according to the new colour.

- Entry and exit: A breakthrough in the cloud indicates a change in trend, which you can use for buys or sales.

- Stop-loss / partial sales: At the edge of the cloud or in case of a breakthrough.

Ichimoku actually consists of several lines. However, I have trimmed the indicator to the cloud visible above. For me, the Ichimoku cloud is a secret chart technical weapon! The other lines are not so important in my eyes.

Example:

In the upper chart you see two situations. The buy was made when the trend direction changed. I waited until the first candle opened in a new direction.

(1) In the first case, the trade did not work. The red cloud was very thick, which can be interpreted negatively. The course hadn't finished downstairs.

(2) The second trade was a complete success. The cloud was much thinner, so Bitcoin could easily break through it. The cloud quickly turned green, which is another positive feature.

What's the problem?

A breakthrough through the cloud can be very dynamic. This leads to further losses. Alternatively, you can use the cloud line as an exit, but often there are turns.

For this reason you should include additional chart technical elements!

My tips for Ichimoku:

- Combine the Ichimoku cloud with trend lines (support and resistance). This will give you a better idea of how likely a trend change is. You can also use the trend line to buy or sell.

- Moving averages (MAs) are another trend indicator. You can use them as support. I often work with MAs 14 and 50, the classic setting is MA 50 and 200. I have linked my guide to MAs below.

- The Supertrend helps you to recognize a change of trend and to make partial sales.

- Look at the higher time level. If you speculate on a rising price in the 4-hour chart, you should look at the daily chart. There you may be able to determine a suitable price target.

Conclusion

The Ichimoku is an independent trading system. But I only use the cloud. It is a powerful weapon for trend changes. This is very interesting for crypto currencies, as a change of trend often results in larger movements. To get a good time to sell, you can also work with trend lines and MAs.

Always include other factors in the trade! This can be an indicator or a technical chart element (support, resistance, Fibonacci).

The Eye of the Cryptuminati has spoken.

+++++

Did you like the article?

Follow me if you like my work and you want me to go on. I post updates on my trades and analyses several times a week!

Thank you very much!

Risk note: Everything is possible, nothing is necessary. All information is not a buy or sell recommendation.

Seven CursesHey cryto-traders!

Looking at the Daily Chart, the MA-50 (in yellow) is working as support for Bulls and resistance for Bears. In the hourly sessions, the last down trends have been rejected by it and the .5 Fibonacci Retracement placed from this year lowest and highest. Still the 8.3k zone is a support zone and bulls could be come up with power and gain momentum, as the MACD is heading north.

Maybe I'm too stoned, but the bearish reversal isn't over and the current daily candle speaks for itself and doesn't need much more. But up in smoke is where I wanna be, pero no siempre se puede llegar.

I was going to publish this post maybe half and hour ago, but I was... puff puff pass it over man,

Peace folks!

Part 2: Principles of the Dow-TheoryOne of the most influential instruments for analysing the financial markets is the Dow theory from Charles Dow. This theory has six principles:

1. everything is processed in the indices or market averages;

2. the market has three trends;

3. each primary trend consists of three phases;

4. the market averages must confirm each other;

5. the volume must confirm the trend;

6. a trend remains intact until there are definitive signals that it is reversed.

@1: everything is processed in the indices or market averages

All the information is processed within the prices. The historical price is the only objective information what the technical analyst has.

@2: the market has three trends;

Primary trend: longer than 1+ year

Secondary trend: correction within the primary trend

Mino trend: Shorter than three weeks

upward trend : This are series of higher higs;

downward trend : Serie lower lows;

@3. each primary trend consists of three phases;

1. the first phase/accumulation phase : big investors buying in, the market is not well known yet

2. second phase (all prices starting to rise): trend-folowwing investors steps in

3. third phase/distribution phase (when there is more positif news, the not initiated investor steps in): In this phase nobody wants to sell because the prices are rising very hard, only the big investor takes their profit in this phase.

@4. the market averages must confirm each other;

The market averages has to confirm each other. I'm looking at the total market movement.. When u follow the market u see that the average of the market is moving the same direction.. This confirms the trend direction..

@5. the volume must confirm the trend;

If the primary trend goes up, the volume should increase, downward corrections will take place with less volume. A decrease in the primary trend is usually accompanied by more volum, while we should see less volume with the upward corrections.

@6. a trend remains intact until there are definitive signals that it is reversed.

The next figures shows the end of the trend.

When to Sell??

"failure swing" : The new top B is not capable of getting higer than the previous top A. After that the price is getting down , when it reaches S this is an signal for selling!

Nonfailure swing : C becomes higher tan previous top A. But after that it goes down under B. S1 is the first position where to sell youre share. If you missed S1 then take S2 for stepping out.

Now whe know when we have to sell, but we know when to buy before we can sell.. This figures shows our first buying target... This is how we can search our buying target!!

When to buyl??

"Failure swing bottom" : This image shows how you can recognize an uprising trend. The price sets for the first time a higher low (C is higer than A), we set our buying target on B. After the price goes above B the uprising trend will start.

"Nonfailure swing bottom" : Here we see the price is getting lower (C is lower than A), but after that the price goes above the stopover (B)..

In this case u can see this as the first signal for a bullish market, place buy order at B1.. If you want confirmation (this could lead for missing B1) of an bullish market, then wait for E.. When E is higher tan A, this is an confirmation of bullish market.. Then place your Buy orders...

This are all signals what u can use for finding the trend withing the market. It is hard to say when the market is turned. There are a lot of different opninios about the trend and charts by using technical analysis... The dow theory does not give you any certainty or guaranty.. This is just a tool to get a signal for the market.. It is up to u what to do with it.

Part 1: What is Technical Analysis? Starters guide for investingDear investor,

Welcome to my blog, where i am trying to learn investing with technical analysis (TA). I will share my studies and investings ideas with you, so we can discuss with each other.. First off all i'll investigate a theoretical studie. After this i'll try the theoretical studie on cryptocurrencies. This blog is for everyone who wants to start investing, but does not know how to begin.

Why cryptocurrency?

The volatility makes it more attractive to invest in Cryptocurrencie. Because of the volatility we can invest in short and long term targets.

My opinion: do not invest money what u can't loose and make youre own strategy on how much money you can invest.

What is TA and prognosis?

Technical analysis is an anlysis method whereby we will make an prognose by watching historical price.

From this sentence we can conlcude that all our prognoses are related on just one piece of information: the historical price movement. For the technical analyst the price movement is the only objective information what he has. All other informations are subjective and can be interpreted in different ways.

Another important word in the previous sentence is prognose . This word prognose is carefully chosen, because making of an prognose is not the same as predicting. Predicting suggest any certainty, but this is not possible. My analysis can be verry good, however it can be wrong because of all kinds of unexpected external/internal factors. The course is never unclear: it rises or goes down . This can not bi disputed.

With prognosing we sketch the most likely scenario, with targets and stop loss. Targets are my selling points. I'll not sell all my coins in just 1 target, but spread it in 1/4 part on each target. The stopp-loss is the level where i will get off my coins with loss. When reaching this level, i say that my analyse is wrong and i have to step out with loss timely before i'll have bigger problem (If i do not step out at this level, a will have a bigger loss what means i have to wait to long time to get my money back). When finishin my investing scenario, i'll make an counter scenario with the possible movement if my scenario fails.

(This is just an example on how to note targets and stopp-loss on youre charts, not an trade idea. Finding the target areas and stopp-loss are will be studied in another part..)

Summary:

For the technical analyst the price movement is the only objective information what he has;

Making of an prognose is not the same as predicting. Predicting suggest any certainty, but this is not possible;

The course is never unclear: it rises or goes down;

With prognosing we sketch the most likely scenario, with targets and stop loss

In the following parts i'll write about charttechincal and statistically analyse. I'll studie Elliot wave and combine this with indicators to prognose an scenario. If you like to know more about investing with TA please follow me and feel free to place youre comment.

One generation passeth away, another generation cometh, but the earth abideth forever. The sun also ariseth, and the sun goeth down, and hasteth to his place where he arose.

The wind goeth toward the south, and turneth about unto the north; it whirleth about contunually, and the wind returneth again according to his circuits. All the rivers run into the sea; yet the sea is not full; unto the flow from whence the rivers come, thither they return again...

The thing that hat been, it is that which shall be; and that which is done is that which shall done; and there is no new thing under the sun..

Source: Elliot Wave Principle, Key to Market Behavior.

The books i mostly use and reccomend are:

- Elliot Wave Principle, Charles J. Collins

- Investing with technical analysis, H.J. Geels (Dutch)

The big issue with technical analysis. In this video I give a few minutes of preview before discussing what I see on this weekly time frame. Bear with me as you'll see where I'm heading.

In the second half of the video I show how I estimate the big probability from the weekly time frame. I'm not interested in being right in this. That's not what I want to get across.

Whilst technical analysis is a useful 'tool', I assert that there is a bigger issue of individual psychology in the background that is hardly ever spoken about.

Loads of new traders especially, will spend a disproportionate amount of time on indicators and fail. They're missing where the big issues are, and it's nothing to do with charts or technical analysis.

So, I'm saying that all new traders really need to dig deeper. Yes - learn about technical indicators, but focus on the unseen i.e. biases, emotions, justifications, coping with loss etc.

I'd be delighted if other traders out there can share their experiences (good or bad ones). Come on be brave!

XAUUSD - ABCD PatternHow to trade the ABCD pattern

This is an example of a bullish ABCD pattern.

Ideally, Point C should be Fibonacci retracement between 61.8% to 78.6% of the A-B leg.

Point D should be a Fibonacci extension between 127% to 161.8% of the B-C leg.

Stop loss should be below D or previous low.

Take profit can be at the 38.2% and 61.8% Fibonacci retracement of the C-D leg.

Bitcoin at support, may revisit 6000 thou.Bitcoin price holds above 8080 trend line support, and 7680 pattern support two resistance levels that prove to be strong for now to hold the price in place for resurgence. Breaking the levels price poised to revisit low 6000s again. Mt.Gox influence still visible. Caution!

REPEATING OLD HABITS - Box strategyPRICE IS KING:

I removed all my indicators for this analysis. I just want to focus on price. Price, after all, is king, and every indicator (RSI, Money Flow, moving average) is just a derivative of price.

Price is also a reflection of supply and demand, and the human behavior (fear and greed) behind supply and demand.

PRICE HAS MEMORY

Sometimes price has a memory and repeats its old behaviors - It's hard to teach an old dog new tricks, and people repeat their habits.

Therefore, that's why we see price patterns repeat themselves, because humans repeat themselves. Technical Analysts are partly like psychologists, looking for behavioral patterns that repeat themselves. Unlike psychologists, we want to take advantage of those behaviors to make money.

FORMING A BOX - Box 1

I have created two boxes on the chart. The first BOX 1 has borders based on the support and resistance levels between roughly 2000 and 3000. Bitcoin climbed to 3000 for new all time highs back in June, but sold off quickly and fell to below 2000 by mid-July. It didn't stay for long at those low levels, however, and shot back up to 3000, where it rested until finally breaking out in early August on it's climb to new all time highs at 5000. But in BOX 1, we see the price bouncing between the upper and lower bounds, between 3000 and 2000.

HOW TO TRADE A BOX

Within the box it is a mess, and it's difficult predict a trade, because the price is just bouncing around, almost randomly as buyers and sellers adjust their positions.

But there ARE good buying opportunities at the bottom of the box, or on the breakout of the box (to the upside OR downside).

BITCOIN'S BOX 2:

BOX 2 is a box in formation. We see a similar pattern, with all time highs at 5000, then a quick pullback. Box 1 had a pullback of 30% from it's top boundary resistance to bottom boundary support (3000-2000 = 1000, 1000/3000 = 30%). If we see a similar 30% pullback in Box 2, then we can expect the bottom box boundary at 3500 (5000 - 3500 = 1500, 1500/5000=30%)

HOW TO TRADE A BOX 2:

In the second box, we can make a trade by buying in at the bottom of the box's range, selling at the top of the range, OR waiting to buy a breakout of the box to new all time highs.

CONCLUSION

Boxes are a nice way to look at consolidation patterns that may seem too disorderly to place in the category of a flag, triangle, or other tight technical pattern. Boxes define a range, and we can either play the range OR wait for a range to breakout to the upside or downside.

WHICH BOOKS DID YOU READ? I don't see anyone talking about trading books so I'd like to share a few books that I read over the years and invite you to comment below with yours.

Regardless of whether you are a novice or an experienced trader every book has something to teach and it is quality time to spend off the charts.

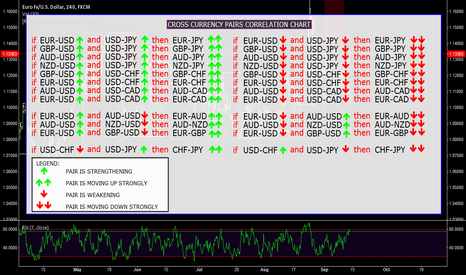

CROSS CURRENCY PAIRS CORRELATION - ADVANCED ANALYSIS Hi all, I wanted to share this chart with you - I am hoping it works when I publish it and the arrows stay inline with the text - something very interesting we all know about currencies moving in tandem with each other to some degree different economic events causing them to stop moving together but eventually they will again.

As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs correlation, because of two main reasons:

1- You avoid taking the same position with several correlated currency pairs at the same time and so you do not increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- If you know the currency pairs correlations, it may help you predict the direction and movement of a currency pair, through the signals that you see on the other correlated currency pairs.

If you would like more information describing the affects - reply with a short note and I will paste a URL