X-indicator

BITCOIN BULLS ARE GONNA DO THIS NOW!!!! (Fakeout Wick) Yello Paradisers! In this video, I've been updating Bitcoin price action and the Elliot Wave theory. I've been doing lots of advanced technical stuff. We've been going through channeling and updating ourselves about the most important support and resistance levels. We've been taking a look at the MACD histogram, the RSI, and the stochastic RSI. We've been professionally analyzing the volume; we've understood who is in power right now and what's going to happen next with the highest probability.

We've also been taking a look at what kind of confirmations we are waiting for in order for us to be able to open long or short positions.

Paradisers, make sure that you are trading with a professional trading strategy. Wait for confirmations, play tactically, and focus on long-term profitability, not on getting rich quick.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

CROSS CURRENCY CORRLEATIONS tell you which pair to trade!All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. The specific facts we look at in this vid are correlations between currency pairs. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

Gold Futures – Bearish Target Hit… But the H4 Gap Still WaitsYesterday’s sessions made their move for the higher bearish target, leaving the H4 & Daily FVG untouched below. This sets up an interesting scenario: will price roll over to fill the gap next, or keep hunting liquidity above?

Key levels and volume profile zones are adjusted for today.

Premium supply zone reached ✅

H4/Daily FVG still in play 📉

Watching London Killzone for impulsive confirmation

Patience is the edge — no clean setup, no trade.

Review and trade setup for 14th August 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Skeptic's Night Byte: 3 Hacks to Beat a Losing StreakHey, it’s Skeptic 👋

We’ve all been there — losing streaks suck, but they don’t have to wipe you out.

In under 60 seconds, I’ll show you 3 quick hacks that make a huge difference:

Build friction into your trading decisions

Stop letting news events wreck your win rate

Use higher time frames to avoid the noise

Simple moves. Massive impact.

If this helped, hit that boost so I know to drop more tips like this.

iCurlyCae | Free Trade IdeaDisclaimer: I am not a financial advisor and this is, in no way, financial or trading advice. I am simply sharing options trading strategies that I use, and have been successful with in the stock market. This presentation is for entertainment and educational purposes only. There are significant financial risks involved with trading and I am not responsible for your losses in the market should you decide to utilize the information and/or strategies discussed within this presentation. By choosing to proceed you are acknowledging your understanding of this disclaimer.

BITCOIN PREDICTION: THIS FIBONACCI SPIRAL WILL BLOW YOUR MIND!! Yello Paradisers! I've revealed to you the secret Fibonacci spiral target. We have been going through multi-timeframe analysis as professional traders. We have been going through the high timeframe chart. We have understood that we are trading inside of that ABC zigzag. Right now, we are in the C wave and we are creating the five moves that are upside. That might take us towards $135,000.

We are right now in the first wave of that fifth wave. We are having bullish divergences on the high timeframe chart. All important indicators like stochastic RSI, RSI, and MACD are having bullish signs, and we have successfully reclaimed the volume profile point of control from resistance into support.

Then, we are turning our focus on the medium timeframe. We are again going through the Elliot wave. We are taking a look at the contracting triangle; the deviation there happened, we are seeing the bullish divergence, and we are updating the Fibonacci spiral. Then we are moving our focus to the low timeframe where we are concluding the Elliot wave count of smaller waves and understanding that the fifth one might be extended.

Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

EURUSD GBPUSD and DXY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

ETHEREUM Ethereum is showing strong bullish momentum with growing investor interest and positive market dynamics, but as always, price fluctuations and profit-taking could happen near resistance zones.

but i want to see a push into 5000-5100 ascending trendline before correction. Its in a zone and will have to update the supply roof and take out the current all time high,

Gold Futures: Low ADX Signals Liquidity Play Before TrendGold Futures (MGC) continues to consolidate with ADX below 25 across all timeframes up to the Daily, signaling that the market is not ready to trend just yet.

Yesterday’s session was mostly sideways, building liquidity on both sides of the range. With the H4 and Daily FVG overlap still in play, I’m watching for a potential sweep of yesterday’s low into the Daily FVG zone before any sustained attempt higher.

However, low ADX conditions mean price is more likely to rotate between liquidity pools than run in a clean, one-sided trend. That opens up the possibility of:

Scenario A: Direct sweep of yesterday’s low → fill the Daily FVG → bounce toward midrange.

Scenario B: Fake bullish breakout into untested supply (3,410–3,420) before the low sweep.

Scenario C: Overshoot of the low into the 3,350 HVN before any meaningful reaction.

Plan:

Stay patient, focus on killzone impulsive displacement after liquidity is taken, and keep profit targets tighter — aiming for midrange or HVN instead of chasing extended moves.

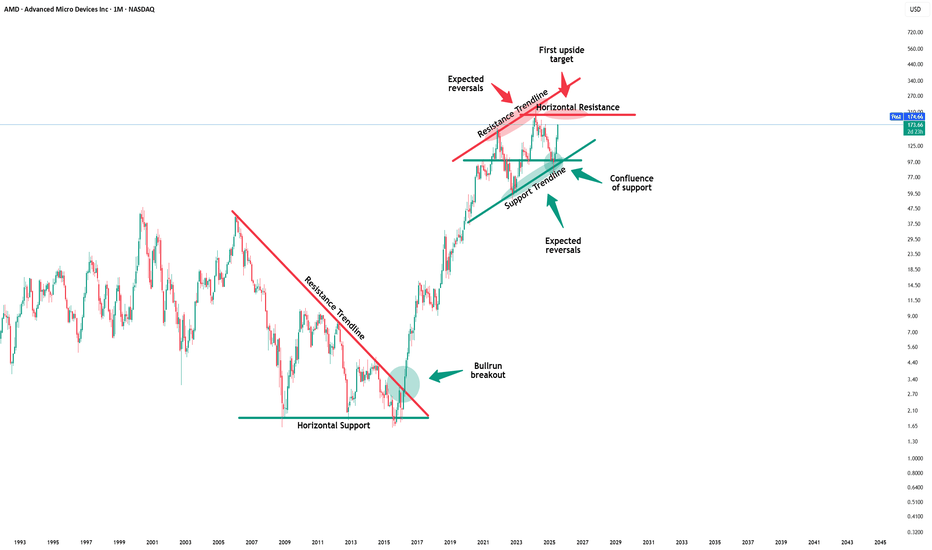

Amd - New all time highs will follow!🪠Amd ( NASDAQ:AMD ) rallies even much further:

🔎Analysis summary:

After Amd perfectly retested a major confluence of support a couple of months ago, we saw a textbook reversal. This retest was followed by a rally of more than +100% in a short period of time. But considering all the bullish momentum, Amd is far from creating a top formation.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Review and plan for 13th August 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results analysed.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Weekly trading plan for DOGE Last week, BINANCE:DOGEUSDT showed strong growth and is now in a correction. At the moment, the price reacted from the moving averages and has impulsively broken this week’s pivot point at 0.225 . Therefore, as long as we stay above 0.218 , the target remains the 0.2440–0.257 range.

If support breaks, I’ll be watching the 0.205–0.193 zone.

More details are in the idea video. Also, let me know which format you prefer — photo with description or video format?

How to use Quantity aka Volume Indicators for high profits.There are 3 data sets that are using in technical analysis of a stock, index, or ETF BTC chart.

Price, Time, and Quantity.

Two of these data are required for an indicator.

Using volume bars completes the data for candlestick chart patterns. It is easy to learn how to read and understand the relationship between price action and volume.

When volume has a fading volume pattern, then the run up or down is at risk of suddenly reversing.

When volume surges to the top of the chart, this warns of either extreme panic, or extreme euphoric speculation, OR that HFTs or MEMEs or Hedge Funds are instigating a surge of activity that most retail traders will chase and lose money.

It is important to learn to read volume and quantity indicators so that you can prepare for the end of a downtrend as a bottom begins. It is important to recognize a topping formation before price gaps or runs down wiping out your profits.

There are over 250 Stock and Market indicators. Most are based on price and time. Hybrid Leading indicators are the newest indicators and combine price, quantity and time which signals a day ahead of a shift of direction.