X-indicator

WTI OIL US OIL Bureau of Labor Statistics today published CORE PPI DATA REPORT,

the core ppi Measures the Change in the price of finished goods and services sold by producers, excluding food and energy;'Actual' greater than 'Forecast' is good for currency;

Frequency Released monthly, about 13 days after the month ends and the Next Release will be Sep 10, 2025

the Producer Price Index (PPI) data for July 2025 came in much stronger than expected:

The headline PPI increased by 0.9% month-over-month, compared to the forecast of just 0.2% and a flat 0.0% reading in June. This is the largest monthly gain since June 2022.

Core PPI, which excludes food and energy prices, also surged by 0.9% month-over-month, well above the forecast of 0.2% and no change the prior month.

On a year-over-year basis, the headline PPI rose 3.3%, up from 2.4% in June, while core PPI climbed to 3.7%, the highest core producer inflation level since March 2025.

The price increases were broad-based, with significant rises in goods prices (especially food, steel, aluminum) and service prices (such as machinery wholesaling, hotels, freight).

This sharp rise in producer inflation is partly attributed to the delayed effects of import tariffs, which producers have largely absorbed so far but are starting to pass through into prices.

The strong PPI figures have raised concerns about increasing inflationary pressures, making near-term Federal Reserve interest rate cuts less likely. Markets have adjusted expectations, with the probability of a September rate cut slightly declining.

Labor market data showed initial unemployment claims slightly better than expected at 224,000, indicating continuing labor market strength alongside rising inflation.

In summary, this unexpected surge in wholesale inflation signals growing inflation pressures that could complicate the Federal Reserve's policy decisions moving forward. It suggests inflation at the producer level is escalating after a period of moderation, challenging hopes for near-term rate relief.

At 3:10pm, St. Louis Federal Reserve President and FOMC member Alberto Musalem spoke about U.S. economic conditions and monetary policy. Key points from his statements include:

Tariffs are feeding through into inflation, which is running close to 3%.

Most of the tariff impact on inflation is expected to fade within 6 to 9 months, but there is a chance the impact could be more persistent.

The U.S. economy is around full employment, though there are some early signs of weakening in the labor market.

Musalem favors a meeting-by-meeting approach for monetary policy decisions, emphasizing the need for an open mind as new data arrive.

He revised his view slightly with labor market risks seen as somewhat higher and inflation risks somewhat lower.

Economic growth is slightly below 1%, creating downside risks for the job market.

So far, businesses are not indicating imminent layoffs.

Musalem stressed the Fed's role to listen to businesses and main street rather than political views on monetary policy.

He suggested a patient approach is best, with further rate adjustments dependent on inflation and labor market developments, keeping an eye on whether inflation becomes more persistent or the labor market weakens.

U.S. natural gas storage reported 56 billion cubic feet available, higher than the previous 53 billion, indicating ample supply.

U.S. mortgage delinquencies improved slightly to 3.93% from 4.04%, showing some easing in mortgage stress.

#OIL

BITCOIN BULLS ARE GONNA DO THIS NOW!!!! (Fakeout Wick) Yello Paradisers! In this video, I've been updating Bitcoin price action and the Elliot Wave theory. I've been doing lots of advanced technical stuff. We've been going through channeling and updating ourselves about the most important support and resistance levels. We've been taking a look at the MACD histogram, the RSI, and the stochastic RSI. We've been professionally analyzing the volume; we've understood who is in power right now and what's going to happen next with the highest probability.

We've also been taking a look at what kind of confirmations we are waiting for in order for us to be able to open long or short positions.

Paradisers, make sure that you are trading with a professional trading strategy. Wait for confirmations, play tactically, and focus on long-term profitability, not on getting rich quick.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

CROSS CURRENCY CORRLEATIONS tell you which pair to trade!All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. The specific facts we look at in this vid are correlations between currency pairs. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

Gold Futures – Bearish Target Hit… But the H4 Gap Still WaitsYesterday’s sessions made their move for the higher bearish target, leaving the H4 & Daily FVG untouched below. This sets up an interesting scenario: will price roll over to fill the gap next, or keep hunting liquidity above?

Key levels and volume profile zones are adjusted for today.

Premium supply zone reached ✅

H4/Daily FVG still in play 📉

Watching London Killzone for impulsive confirmation

Patience is the edge — no clean setup, no trade.

Review and trade setup for 14th August 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Skeptic's Night Byte: 3 Hacks to Beat a Losing StreakHey, it’s Skeptic 👋

We’ve all been there — losing streaks suck, but they don’t have to wipe you out.

In under 60 seconds, I’ll show you 3 quick hacks that make a huge difference:

Build friction into your trading decisions

Stop letting news events wreck your win rate

Use higher time frames to avoid the noise

Simple moves. Massive impact.

If this helped, hit that boost so I know to drop more tips like this.

iCurlyCae | Free Trade IdeaDisclaimer: I am not a financial advisor and this is, in no way, financial or trading advice. I am simply sharing options trading strategies that I use, and have been successful with in the stock market. This presentation is for entertainment and educational purposes only. There are significant financial risks involved with trading and I am not responsible for your losses in the market should you decide to utilize the information and/or strategies discussed within this presentation. By choosing to proceed you are acknowledging your understanding of this disclaimer.

BITCOIN PREDICTION: THIS FIBONACCI SPIRAL WILL BLOW YOUR MIND!! Yello Paradisers! I've revealed to you the secret Fibonacci spiral target. We have been going through multi-timeframe analysis as professional traders. We have been going through the high timeframe chart. We have understood that we are trading inside of that ABC zigzag. Right now, we are in the C wave and we are creating the five moves that are upside. That might take us towards $135,000.

We are right now in the first wave of that fifth wave. We are having bullish divergences on the high timeframe chart. All important indicators like stochastic RSI, RSI, and MACD are having bullish signs, and we have successfully reclaimed the volume profile point of control from resistance into support.

Then, we are turning our focus on the medium timeframe. We are again going through the Elliot wave. We are taking a look at the contracting triangle; the deviation there happened, we are seeing the bullish divergence, and we are updating the Fibonacci spiral. Then we are moving our focus to the low timeframe where we are concluding the Elliot wave count of smaller waves and understanding that the fifth one might be extended.

Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

EURUSD GBPUSD and DXY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

ETHEREUM Ethereum is showing strong bullish momentum with growing investor interest and positive market dynamics, but as always, price fluctuations and profit-taking could happen near resistance zones.

but i want to see a push into 5000-5100 ascending trendline before correction. Its in a zone and will have to update the supply roof and take out the current all time high,

Gold Futures: Low ADX Signals Liquidity Play Before TrendGold Futures (MGC) continues to consolidate with ADX below 25 across all timeframes up to the Daily, signaling that the market is not ready to trend just yet.

Yesterday’s session was mostly sideways, building liquidity on both sides of the range. With the H4 and Daily FVG overlap still in play, I’m watching for a potential sweep of yesterday’s low into the Daily FVG zone before any sustained attempt higher.

However, low ADX conditions mean price is more likely to rotate between liquidity pools than run in a clean, one-sided trend. That opens up the possibility of:

Scenario A: Direct sweep of yesterday’s low → fill the Daily FVG → bounce toward midrange.

Scenario B: Fake bullish breakout into untested supply (3,410–3,420) before the low sweep.

Scenario C: Overshoot of the low into the 3,350 HVN before any meaningful reaction.

Plan:

Stay patient, focus on killzone impulsive displacement after liquidity is taken, and keep profit targets tighter — aiming for midrange or HVN instead of chasing extended moves.

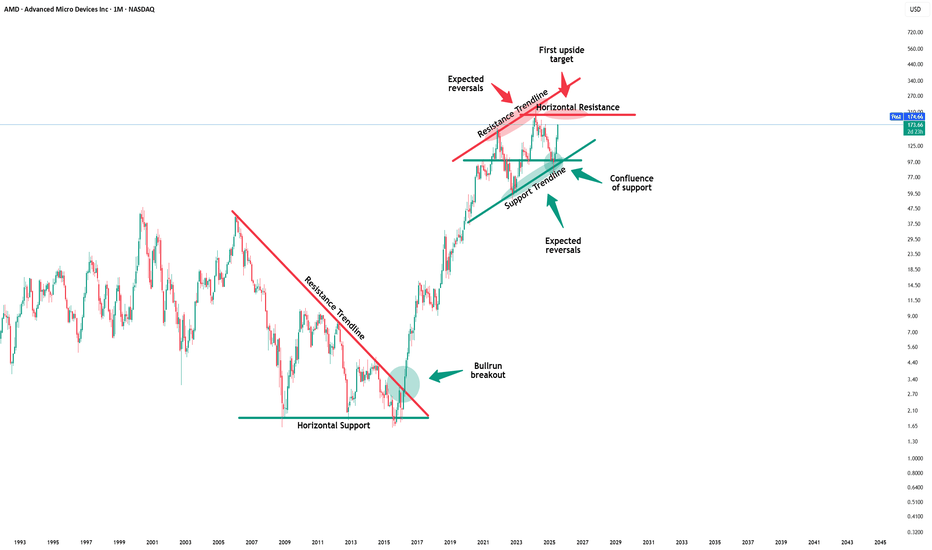

Amd - New all time highs will follow!🪠Amd ( NASDAQ:AMD ) rallies even much further:

🔎Analysis summary:

After Amd perfectly retested a major confluence of support a couple of months ago, we saw a textbook reversal. This retest was followed by a rally of more than +100% in a short period of time. But considering all the bullish momentum, Amd is far from creating a top formation.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Review and plan for 13th August 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results analysed.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT