POPCAT/USDT – Weekly Chart TAPOPCAT/USDT – Weekly Chart TA

Price abhi bhi falling channel ke andar trade ho raha hai, lekin support zone se bounce ka chance hai.

Key Support Zones:

0.2536 – 0.2500 USDT

0.1567 USDT (major last defense)

Breakout Confirmation:

Agar price 0.4290 ke upar close deta hai toh pehla target 0.5301 USDT hoga.

Iske baad potential rally ka agla phase open ho sakta hai.

Possible Scenarios:

Bullish – Channel break + retest → rally towards 0.53 → 0.70 → 1.30

Bearish – Support break → 0.1567 retest

📌 Weekly timeframe par patience zaroori hai.

⚠️ Spot safe, leverage par sirf breakout confirmation ke baad hi entry lo.

Quote: "The market is a device for transferring money from the impatient to the patient." – Warren Buffett

X-indicator

AMD stock up over 20% off the lows- outperform NVidia?AMD is still cheap relative to its growth and still way down from all time highs.

Seeking alpha analysts expect 25-30% annual growth in earnings yearly. The stock is still in the low 20s PE. Stock can double and still be a good business worth owning for the long term and let compounding earnings work.

Low rsi and bollinger bands gave us the signal to buy, we bought with leverage, now we are in the shares unlevered.

Target would be all time highs over the next 2-3 years.

BITCOIN BTCUSDTTHE STRUCTURE of bitcoin will be watched to see what buyers do at 117k-117,300k zone after one retest on a supply roof .

Am looking up to retest in that zone and tomorrow united states data report will be put into perspective for forward guidance.

12th the consumer price index 14th core ppi and unemployment claims will be critical as traders are waiting .

trading is 100 % probability ,risk management is key.

Gold Futures: Short-Term Bounce Before Bigger Play?Gold Futures (MGC) has now reached the H4 + Daily FVG confluence zone we’ve been tracking over the past few days. Price action has been decisively bearish, breaking key intraday supports and targeting liquidity below the weekly low.

On the 1H & 4H, the ADX > 25 confirms strong short-term momentum, but the higher timeframes (8H+) still lack the directional conviction for the “big play.” This suggests the current move may be part of a broader setup still in development.

Here’s the scenario I’m watching:

Asian Session: Potential bullish retracement toward the POC in the volume profile as buyers step in from current FVG support.

London Session: Opportunity for shorts if price tags the supply zone around 3,430–3,447 and fails to reclaim higher levels.

NY Session: Possible reaction inside the remaining bullish FVGs, especially if USD news catalysts shake up momentum.

📊 Key Levels:

Support: 3,397 (W-L), 3,385–3,350 (lower FVG & HVN).

Resistance: 3,432–3,447 (supply), 3,466 (D-H).

Bias: Short-term bounce → London short setup → watch for NY session reaction.

Tomorrow’s USD-heavy news cycle could be the volatility driver that determines whether we get a deeper drop into the 3,350s or a reclaim back toward the mid-3,400s.

CMPS had a little bear break - does that change our outlook?A little daily downtrend has confirmed but bulls bought the dip and closed above the daily EMA12. Weekly timeframe is about to get an EMA bull cross and we're rangebound within 3.92 - 4.79. Within this range nothing really changes for me. After making this video I am slightly more bullish on this than I was at market close an hour ago.

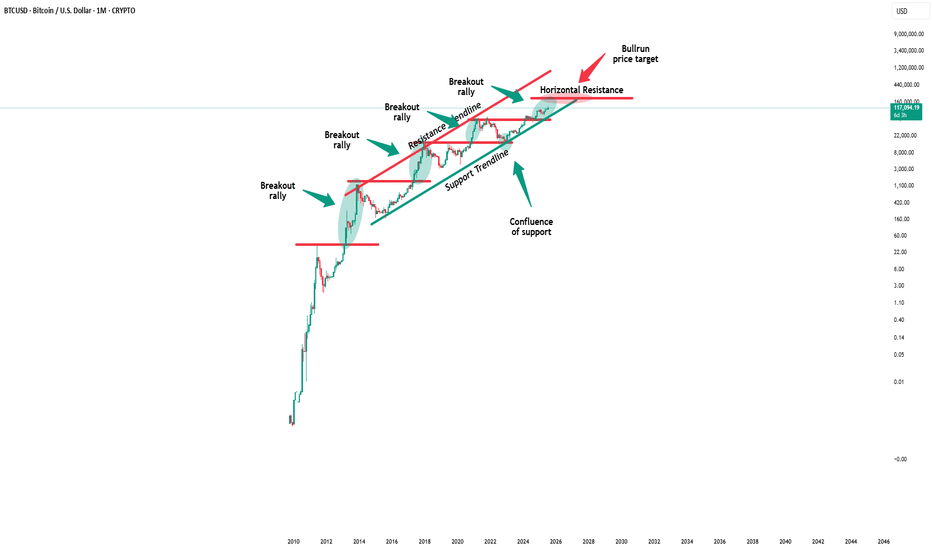

Bitcoin - The cycles are playing out!⚔️Bitcoin ( CRYPTO:BTCUSD ) just repeats another cycle:

🔎Analysis summary:

Following all of the previous all time high breakouts, Bitcoin will now further extend the rally. After some simple calculation, we can see that Bitcoin will rally another +50% in order to reach the overall price target. However there will be volatility along the way so make sure to remain calm.

📝Levels to watch:

$200.000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

MDMA forming a daily bullflag setupThis is a daily bullflag unless bears prove otherwise. Bulls trying to hold 13c as the new daily higher low. Daily EMA12 is catching up to us and anticipated to also provide support. Backtest on the pullback found support at the daily 50SMA which has been an important moving average in the past.

MNMD finally gets the $10 closeBig weekly bull break today without a lot of followthrough. Should we be concerned? I'll take you through the chart history to look at MNMD past bull breaks as well as a spot on the daily timeframe I think is similar to the one we're in now, to see how it plays out. Hourly uptrend remains our guide.

Big bear volume on teh sector ETFIt's looking like the daily eq is on the cusp of breaking bearish with a close at low of day on big bear volume. Zooming out to the weekly this is still a potential weekly bullflag setup until the bears prove otherwise. We're watching Weekly EMA12 on any pullback and it coincides with 15.31 previous resistance, potentially new support if a backtest successfully holds

BEARISH SETUP ON BTCUSDAfter a strong bullish move that took the price of bitcoin to 122478 Price close to ATH of 123300 we can see the price of the Digital Currency drifting to 119456 minor support zone during the London and New York Trading Session, with he lower Time Frame Showing a bearish build up around 120,345 price level after the break of the bullish trendline, A close of Candle below 119500 will drive the price further to 117500 - 116400

Review and plan for 12th August 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Weekly trading plan for EthereumLast week, BINANCE:ETHUSDT reached all the planned targets, moving according to the bullish scenario

Locally, we can see a support zone — as long as the price stays above it, there’s a strong chance to see a new ATH this week

If the local support breaks, there’s a higher probability of breaking the weekly pivot point and reaching 3,933 , after which we could see a new ATH

If the price fails to climb back above the weekly reversal level, a drop toward the 3,700–3,500 area becomes possible

More details are in the idea video.

BITCOIN.BITCOIN , On 4hr we found a rejection using our 4hr line chart candle close and took advantage of the sale. The secret is to chart multiple brokers ,brokers candle stick closes are 100% different from line chart perspective while trading any thing in the financial market...(stocks,bonds,crypto,forex)

since we rely on the structure of the market for forward guidance we chart multiple broker for variation in candle closes .

the price action is watched in Realtime for a close into another structural buy zone .the current break out could retest 116k-117k and set up a buy wave based on the principles of break and retest.

the goal is to see if we break and sustain above 123k and look at 124k and 130k ascending trendline acting as dynamic supply roof and resistance to upswing which the current all-time high is a victim of the top layer supply roof .

united state economic data report will give a clear direction and signal into next FOMC OUTLOOK.

THE CPI measures the Change in the price of goods and services purchased by consumers, excluding food and energy

Core CPI m/m forecast 0.3% previous 0.2%

CPI m/m forecast 0.2% previous 0.3%

CPI y/y forecast 2.8% previous 2.7%

FOMC Member Barkin Speaks

14th

the core PPI m/m measures the Change in the price of finished goods and services sold by producers, excluding food and energy

Core PPI m/m forecast 0.2% previous 0.0%

PPI m/m forecast 0.2% previous 0.0%

Unemployment Claims forecast 225K previous 226.

this DATA will affect the 10 year treasury bond yield and dollar index as the signal will be watched by FEDS.

TRADING IS 100% PROBABILTY

LOWER YOUR EXPECTATION

RISK TO REWARD RATIO SHOULD BE IN YOUR CHECKLIST AND TRADE REASON.

ANY GOOD TRADE CAN TURN TO A BAD TRADE.

A TRADER WITHOUT LIQUIDITY IS A DEMO TRADER

A HUNTER GUN WITHOUT BULLET IS A TOY GUN.(HUNTERS MINDSET)

PROTECT YOUR CAPITAL.

GOOD LUCK

#BTC #BITCOIN

EURUSD and GBPUSD based on DXY move!Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPCHF Is Waking Up — This Long Trigger Looks CleanGBPCHF just broke out of a long accumulation and is eyeing fresh bullish momentum. Here’s the exact trigger, stop-loss idea, and RSI confirmation I’m watching this week. If it helps, boost it and let’s catch the move.

Disclaimer: This content is for educational purposes only and is not financial advice. Trade at your own risk.

Gold’s Two-Zone Patience Play – Wait for the FVGs to SpeakPrice action on GC is sitting in no-man’s land, caught between two key imbalances.

Above: 1H Bearish FVG at $3,470–$3,480.

Below: H4 Bullish FVG at $3,350–$3,375, aligned with the Weekly Low.

I’m waiting for price to step into one of these “Patience Zones” before committing.

A push up into the 1H FVG during a killzone could set up shorts targeting the W-L and the H4 FVG fill.

A drop into the H4 FVG first — especially with a sweep of $3,397 — could provide the low of the week and a strong bullish reversal.

No mid-range chasing here — let liquidity do the heavy lifting.