X-indicator

New Week on Gold! Will the Bullishness continue?I was bullish on gold and price ended up doing as expected last week and looking for it to continue this week. But i have to sit on hands for now to see how they want to play Monday. Will they move to create a Low for the week first? or will they break out to start early on new highs? I have to see some type of confirmation first. Then we can get active.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Review and plan for 14th July 2025 Nifty future and banknifty future analysis and intraday plan.

Results - analysed.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

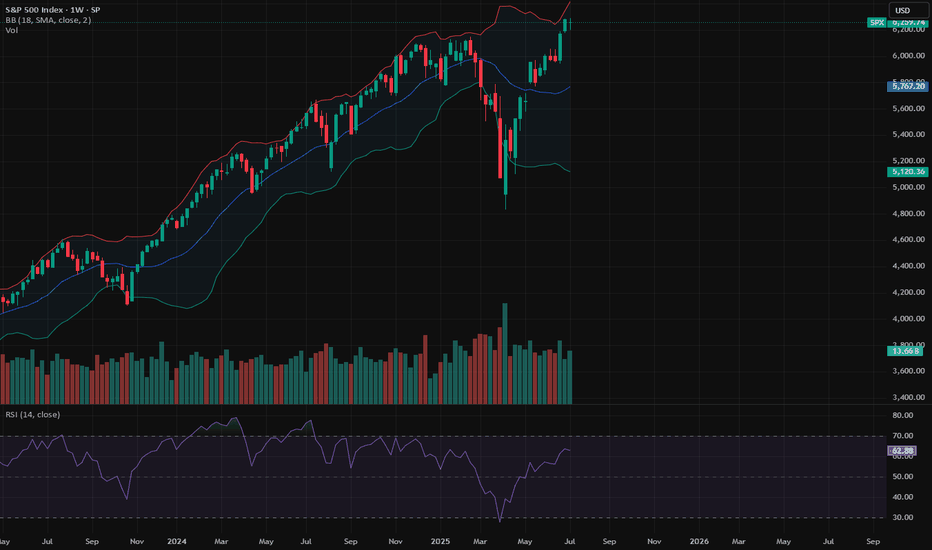

IS THE STOCK MARKET HEADING INTO DOT COM BUBBLE 2.0?In this video we look at the 3 month chart of SP:SPX using the traders dynamic index & Fibonacci retracement levels to put together a bullish case for the overall stock market to go on a monster rally over the next 7 years

We also theorize about how over the next 2 years the SP:SPX can indeed hit 7200+ by Q3 2026 and have pullbacks to 5800-6100, but how that could just be the "consolidation move in price" of the overall stock market before we get what could end up being the largest stock market rally we have ever seen in the 21st century

The Return Of The Rocket Booster Strategy Part 1This strategy is the reason of how my audience grew on tradingview.

Its my favorite strategy

and looking at it in hind sight, has been a blessing and a curse.

One of these days am going to share with you how i mastered this strategy.

Something not nice happened to me

i broke up with my girlfriend and this forced

me to study this strategy

For 6 weeks every single day.

Without missing a day.

The pain of the break up forced me into this isolation

where i was forced to study this

strategy because of having no more money

and losing my girlfriend to another man.

Watch this video

to learn more about my flagship strategy

Called " The 3-Step Rocket Booster Strategy. "

Rocket Boost This Content To Learn More.

Disclaimer:Trading is risky please learn risk management and profit taking strategies.Also feel free to use a simulation trading account before you

trade with real money.

EURAUD The current head of the European Central Bank (ECB) is Christine Lagarde. She has been serving as ECB President since November 2019, Lagarde has emphasized her commitment to steering the ECB through complex economic challenges, including inflation control and adapting monetary policy to evolving global conditions.

the current key interest rates set by the European Central Bank (ECB) are as follows:

Deposit Facility Rate: 2.00%

Main Refinancing Operations Rate: 2.15%

Marginal Lending Facility Rate: 2.40%

These rates were last adjusted on June 11, 2025, when the ECB lowered the key interest rates by 25 basis points (0.25%) to reflect the updated inflation outlook and economic conditions.

Additional Context:

Inflation in the Eurozone is currently around the ECB’s medium-term target of 2%.

The ECB’s Governing Council decided on the rate cut based on a downward revision of inflation projections for 2025 and 2026, partly due to lower energy prices and a stronger euro.

The next ECB interest rate decision is scheduled for July 24, 2025.

ECB Executive Board member Isabel Schnabel recently indicated that the bar for further rate cuts remains “very high” as the economy is holding up well.

Summary Table of ECB Key Rates (as of June 11, 2025)

Rate Type Interest Rate (%)

Deposit Facility Rate 2.00

Main Refinancing Rate 2.15

Marginal Lending Rate 2.40

the Reserve Bank of Australia (RBA) cash rate remains at 3.85%. This decision was made at the RBA’s July 8, 2025 meeting, where the board chose to hold rates steady despite widespread market expectations of a cut to 3.6%

Key Points:

The RBA has signaled that an easing cycle is likely coming, but it wants to wait for the release of the full quarterly inflation data at the end of July to confirm that inflation is on track to decline sustainably toward the target range (2–3%).

Inflation has moderated, with trimmed mean inflation at 2.4% in May, within the target band.

The board was divided: six members voted to hold rates, while three favored a cut.

Market expectations now price in about an 85% chance of a 25 basis point cut to 3.60% at the next meeting on August 12, 2025.

RBA Governor Michele Bullock emphasized that the bank is reacting to domestic inflation and employment data and is prepared to adjust policy as needed, but is not holding rates high “just in case.”

Summary Table

Date Cash Rate (%) Board Decision Next Meeting Expectation

July 8, 2025 3.85 Hold rates steady Likely 0.25% cut at August 12, 2025

Additional Context

The RBA’s cautious approach reflects the need to confirm inflation trends before easing.

The decision surprised markets that had anticipated an immediate cut due to slowing consumer spending and inflation within the target range.

Governor Bullock acknowledged the challenges for borrowers but noted that housing prices, not just interest rates, affect affordability.

EURAUD TRADE MATHE

EU10Y=2.686%

ECB RATE =2.0%

AU10Y= 4.362%

RBA RATE =3.85%

INTEREST RATE DIFFERENTIAL= EUR-AUD=2.0-3.85=-1.85% EURO BASE CURRENCY AND AUD QUOTE. FAVOUR AUD CARRY TRADE.THE TARRIF HAMMER ,AUDSTRALIA AND CHINA TRADE REMAINS A KEY TOOL FOR AUD STRENGTH.

BOND YIELD DIFFERENTIAL= EURO-AUD =2.686%-4.362%=-1.676 FAVOUR AUD .

BUT EURO ZONE ECONOMIC OUTLOOK WILL OFFSET YIELD AND BOND ADVANTAGE AS CHINA AUSTRALIA COMMODITIES MARKET IS DEPENDING MORE ON CHINA ,SO GLOBAL RESTRICTION ON EXPORT WILL GIVE EURAUD LONG POSITION.

#EURAUD

BITCOIN Bitcoin and the Potential Move to $136,000 based on my price action +sma+ema advanced strategy.

Current Market Context

Bitcoin (BTC) is trading near all-time highs, recently surpassing $117,000-118000

The market is characterized by strong institutional inflows, robust ETF demand, and bullish technical momentum.

Is a Move to $136,000 Possible?

Analyst and Model Forecasts

Bitwise Asset Management and several market analysts see a 30% rally possible in July, which could push Bitcoin to the $136,000 level. This projection is based on:

Historical post-crisis rallies (average 31% gains after macro/geopolitical shocks).

Institutions buying more BTC than miners can supply.

Global rate cuts increasing liquidity and risk appetite.

Quantitative models and technical forecasters also predict a range between $136,000 and $143,000 as a potential 2025 high, with some models extending targets to $151,000 and beyond.

Other major banks and analysts (e.g., Standard Chartered, Bernstein, Fundstrat) maintain even higher year-end targets ($150,000–$200,000), but $136,000 is seen as a key intermediate technical and psychological level.

Technical Analysis

Bullish momentum is confirmed across short, medium, and long-term timeframes.

Key resistance levels to watch: $120,000 (psychological), $130,000 (round number), and $136,000 (target zone highlighted by several analysts).

Sustained trading above $112,000–$118,000 would support a move toward $130,000–$136,000, especially if ETF inflows and institutional demand remain strong.

Drivers Supporting the $136K Scenario

ETF and Institutional Inflows: Demand from US spot Bitcoin ETFs and corporate treasuries remains robust.

Macro Tailwinds: Expectations of US Federal Reserve rate cuts and a weakening dollar are fueling risk-on sentiment.

Supply Dynamics: The recent Bitcoin halving has reduced miner supply, amplifying the impact of new demand.

Technical Breakouts: Bull flag and breakout patterns suggest further upside, with $136,000 cited as a technical extension target.

Risks and Considerations

Volatility: Bitcoin remains highly volatile; sharp pullbacks are possible even in a strong uptrend.

Regulatory and Macro Risks: Changes in regulatory stance or a major shift in macro conditions could impact the trajectory.

Profit-Taking: Approaching major round numbers like $130,000 or $136,000 could trigger profit-taking and temporary corrections.

Summary Table: Bitcoin 2025 Price Targets

Source/Model 2025 Target Range $136K Move Outlook

Bitwise, Polymarket $136,000 (July 2025) High probability if current trends persist

Coinfomania AI Model Up to $143,440 $136K within model range

Investing Haven $80,840–$151,150 $136K within bullish scenario

Changelly, CoinDCX $100,000–$150,000 $136K is a key resistance

Standard Chartered $120,000–$200,000 $136K as a stepping stone

Conclusion

A move to $136,000 for Bitcoin is considered plausible in 2025 by my market structure advanced strategy , This scenario is supported by strong institutional demand, favorable macro conditions, and bullish technical patterns. However, volatility and macro/regulatory risks remain, so price action should be monitored closely as BTC approaches key resistance levels at 120k and 136k level

#bitcoin #btc

Bitcoin: Final Push in the 60-Day Cycle?Bitcoin appears to be making its final move higher within the current 60-day cycle. We could potentially see a push into the $121K–$122K range before a sharp correction takes us down to around $110K–$112K toward the end of the month, driven by the 3-day cycle timing.

After that, we’re likely to form a new 60-day cycle low, which could set the stage for a renewed move to the upside.

Is it time to go long?

At this point, the risk/reward doesn’t look favorable for new longs. Personally, I’m watching for one final push above $120K to consider opening a short position into the expected cycle low.

Gap down is likely a bear trap - SPYSo the gap down looked bearish but the technicals are not confirming it. One more high is likely today or Monday. Gold is at resistance here. OIl found support and looks like a long. BTC rallied and can go higher but it's putting in daily bearish divergences. Natural Gas looks like it will bounce.

PORTALUSDT CHART ANALYSİS ISTRADING CRYPTO PROFITABLE?

Crypto trading is profitable but only if done correctly. Follow the

steps, strategies, and tips shared throughout our guide, and you will be

in a better position to make profitable trades. And a golden rule:

Plan your trade, trade your plan.

Never Forget: 90/90/90 trading rule.

90% of traders will lose 90% of their account value within 90

days.

1. No matter how much profit you make; what matters is how

much you keep.

2. No matter how much you keep, what matters is how much you

re-invest.

3. No matter how much you re-invested, what matters is your

total return on investment (ROI).

Quick take on the S&P500From the very short-term perspective, the SP:SPX is currently stuck in a tight range. Waiting for a little breakout.

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

BITCOIN ABOUT TO CRASH HARD!!!!? (Be careful with your longs)I am sharing with you in this video the next CRYPTOCAP:BTC important resistances and support levels.

Together with the confirmations, it is said that if triggered, Bitcoin will start crashing hard, so be careful if you have overleveraged long positions opened right now!

Remember to always trade only with professional trading strategies and tactics, and make sure that your money management is tight!

CADJPY; Heikin Ashi Trade IdeaIn this video, I’ll be sharing my analysis of CADJPY, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Big Deal in RARE EARTHS space with MP! USAR, TMC, CRML next!Big deal with the DOD and MP yesterday. I am looking at some other plays here in sympathy. Neither had much action yesterday USAR, TMC, CRML but if we take out yesterdays intraday highs on these I think we could play some catch up!

Lets dig into the levels im watching and the overall setups on these! Metals stocks are not always the best stocks to trade they can fart around a lot intraday vs tech stocks so be careful with your entries and make sure the volume is there!

Nothing changes while price is below 8.01CYBN continues to reject form 4hr EMA12, bulls need to break above this in the next few trading sessions or it will continue to decline and knock the price below support, which would be a big step backwards and would be a clear signal that CYBN is not enjoying the same series of bullish signals that ATAI and MNMD are giving