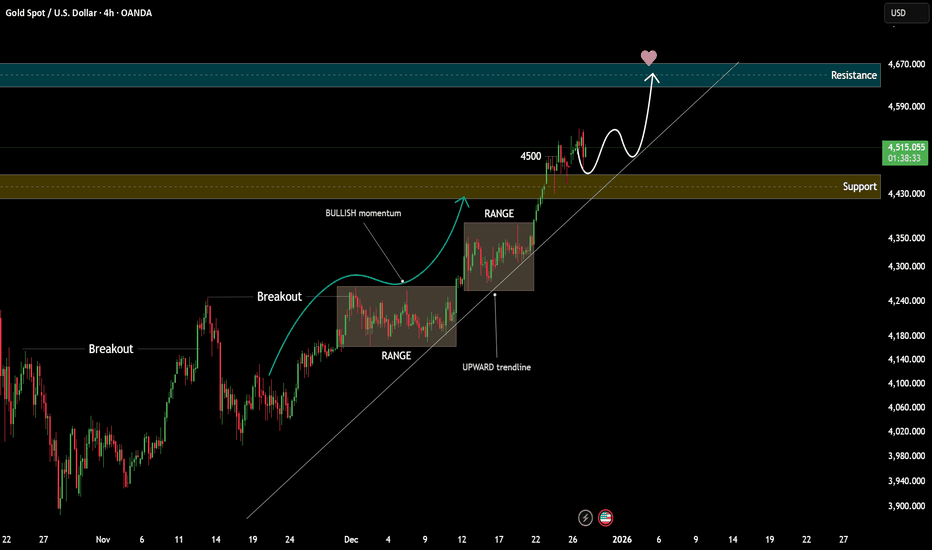

XAUUSD Sellers Defend Resistance, Eyes on PullbackHello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold remains in a bullish structure after breaking above a descending resistance line, confirming a shift in control to buyers. Price then consolidated in a clear range, showing balanced market activity b

Futures market

XAUUSD respecting descending channel structure.Price is trading inside a well-defined descending channel and is currently reacting from the lower boundary.

The support zone has previously held multiple times, suggesting a potential bullish response if structure remains intact.

A break and hold below support would invalidate this view.

Waiting

XAUUSD – Retesting Support Before the Next Upside MoveHello, I'm Camila.

Observing the H4 chart, I can see that gold has proactively pulled back to rete afterhow the market is reacting at lower prices. Instead of continued selling pressure, the current candles show a clear loss of bearish momentum, while buying interest is beginning to re-emerge. Thi

Lingrid | GOLD Weekly Outlook: Consolidating for the ClimbOANDA:XAUUSD perfectly played out my previous weekly idea . Gold push toward $4,500 has stalled as bullish momentum wanes ahead of year-end, with price now testing the upper boundary of its recent range near $4,530. 4H chart clearly shows the market is losing steam, hinting at a short-term pullbac

Silver’s 2025 Explosion — How High Can It Go?In 2025, Silver ( OANDA:XAGUSD ) has experienced a remarkable surge, making it one of the most notable assets of the year. As we approach the end of 2025, I’ve decided to analyze silver to see how far its bullish trend might continue. So, stay with me as we delve into the reasons behind silver’s ri

Gold Preparing for Impulsive Move After Range HoldMarket Structure: Strong higher highs & higher lows → bullish trend intact.

Price Action: Gold is compressing just below key resistance, indicating breakout pressure.

Liquidity: Equal highs liquidity resting above → likely stop-hunt → continuation.

Channel: Price respecting the ascending channel, no

XAU/USD)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of XAUUSD (Gold) – 1H chart using SMC + Fibonacci OTE + trend-channel continuation.

⸻

Market Context

• Bias: Bullish continuation

• Price is respecting a well-defined ascending channel

• Market structure remains higher highs & higher lows

• EMAs

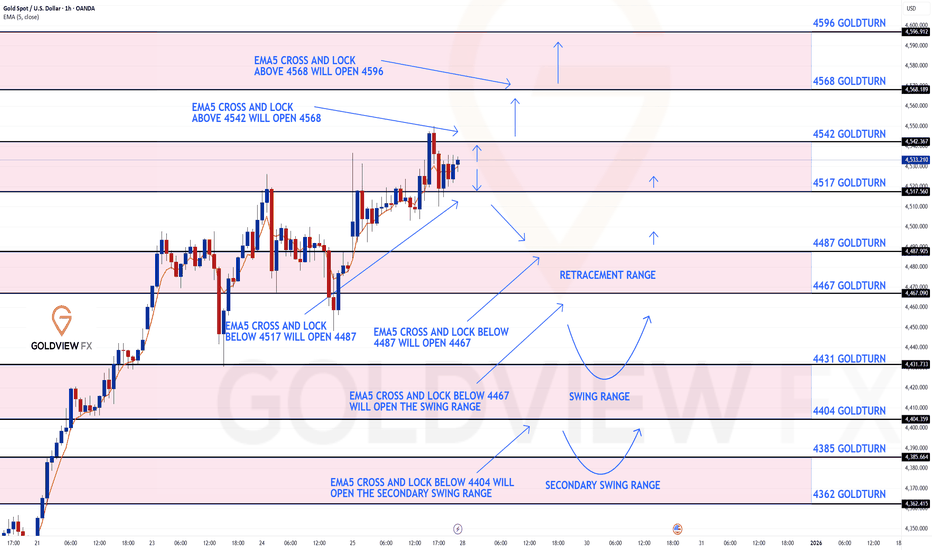

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 4542 and a gap below at 4517, as support. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will se

Gold Price Update – Clean & Clear ExplanationGold is currently trading within a rising channel but showing clear signs of selling pressure near the upper range. After failing to sustain above the 4500 psychological resistance, price faced a sharp rejection, confirming sellers’ dominance at higher levels.

The market is now trading below 4500,

XAUUSD – Bullish Continuation Setup (30M)Buy Zone: 4,520 – 4,530

Stop Loss:Below 4,500

Targets

TP1: 4,550

TP2: 4,600 – 4,610

Price is holding above ascending trendline and key demand. Bullish structure remains intact. A clean break and hold above resistance can trigger continuation toward the upper target zone.

See all popular ideas

Quotes

Futures collections

Frequently Asked Questions

A futures contract is a legal agreement to buy or sell an asset (such as a commodity or security) at a set price on a specific future date. The buyer agrees to purchase and receive the asset when the contract expires, while the seller agrees to deliver it at that time.

Most futures contracts are traded through centralized exchanges like the Chicago Board of Trade and the Chicago Mercantile Exchange (CME). But there's no need to leave TradingView to trade futures — you can do it right from your charts. Just check out the list of our integrated brokers and find the best one for your needs and strategy.

Before you start, it's crucial to do you research: perform technical analysis on the chart, evaluate risks, and test your strategy.

Before you start, it's crucial to do you research: perform technical analysis on the chart, evaluate risks, and test your strategy.

Energy futures are contracts tied to energy commodities — they're aimed at facilitating the trading of specific quantities of crude oil, natural gas, gasoline, etc. Energy futures allow producers, consumers, and traders to manage price volatility in energy markets or capitalize on future price movements.

Explore a wide range of energy futures with detailed stats directly on TradingView.

Explore a wide range of energy futures with detailed stats directly on TradingView.

Agricultural futures are derivative contracts with agricultural commodities (wheat, corn, soybeans, etc.) as the underlying. They're widely used to trade standardized quantities of commodities, allowing farmers, food producers, and traders to hedge against price fluctuations or to profit from expected price changes in the agricultural market.

Browse a full list of agricultural futures with detailed stats directly on TradingView.

Browse a full list of agricultural futures with detailed stats directly on TradingView.

Futures market is a bustling place with many interested parties. Here are some key participants to keep in mind:

- Hedgers (traders using futures to protect their existing positions or trades from risk caused by market volatility or direction)

- Speculators (traders executing trades based on their price predictions)

- Arbitrageurs (traders trying to win from market inefficiency and price difference by buying and selling the underlying in different markets)

- Institutional investors

- Retail investors

- Hedgers (traders using futures to protect their existing positions or trades from risk caused by market volatility or direction)

- Speculators (traders executing trades based on their price predictions)

- Arbitrageurs (traders trying to win from market inefficiency and price difference by buying and selling the underlying in different markets)

- Institutional investors

- Retail investors

Futures markets are platforms where traders gather to buy and sell futures contracts. In the past, trading was performed physically: traders would come to a 'pit' in the trading floor and conduct trading by shouting and actively gesturing. But today, this is all done electronically.

In a futures market, buyers and sellers post margin to secure their positions, and profits or losses are settled daily through mark-to-market. At expiration, contracts are settled in cash or through physical delivery, though most traders close positions beforehand. Since futures offer flexibility and leverage, futures markets attract diverse participants: hedgers, speculators, arbitrageurs, institutional and retail investors.

Some of the largest futures markets today are the New York Mercantile Exchange (NYMEX), the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBoT), and the Cboe Options Exchange (Cboe). They're registered with the Commodity Futures Trading Commission (CFTC), the main body in charge of futures markets regulation in the US. In other countries, futures markets are regulated by a corresponding national body.

In a futures market, buyers and sellers post margin to secure their positions, and profits or losses are settled daily through mark-to-market. At expiration, contracts are settled in cash or through physical delivery, though most traders close positions beforehand. Since futures offer flexibility and leverage, futures markets attract diverse participants: hedgers, speculators, arbitrageurs, institutional and retail investors.

Some of the largest futures markets today are the New York Mercantile Exchange (NYMEX), the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBoT), and the Cboe Options Exchange (Cboe). They're registered with the Commodity Futures Trading Commission (CFTC), the main body in charge of futures markets regulation in the US. In other countries, futures markets are regulated by a corresponding national body.

Open interest is the total number of active futures contracts that haven’t been closed or expired. It reflects how much interest or participation exists in a market.

Traders use open interest to gauge market strength. For example, declining open interest often signals that traders are closing positions — a possible sign of a weakening trend.

Traders use open interest to gauge market strength. For example, declining open interest often signals that traders are closing positions — a possible sign of a weakening trend.

Futures prices are mainly driven by supply and demand, economic indicators, and central bank policies. Disruptions like droughts or geopolitical tensions can affect supply, while inflation or interest rate changes shape investor expectations. These shifts influence how traders value future prices relative to current conditions.

Market sentiment and speculation also play a big role, with traders often reacting to news or forecasts before fundamentals change. Factors like storage costs, inventory levels, and contract expiration impact pricing too, especially in commodities. Seasonal trends, government policies, and even new technologies can further sway futures markets.

Market sentiment and speculation also play a big role, with traders often reacting to news or forecasts before fundamentals change. Factors like storage costs, inventory levels, and contract expiration impact pricing too, especially in commodities. Seasonal trends, government policies, and even new technologies can further sway futures markets.

It's always best to test you skills in futures trading before going to the real markets. You can do it right on TradingView thanks to our Paper Trading functionality — just find the Paper trading icon on the trading panel and put your ideas to the test. You can also check out our Bar Replay feature — it simulates past price movements for strategy testing.