Momentum in the Markets ✅✅✅✅ I will look at the momentum to understand if price has power to move towards my take profit area or no, a perfect scenario is when i enter a long or a short order the momentum should increase from candlestick to candlestick not decreasing, increasing momentum meaning that price has fuel and it is not exhausted.

🎯 Increasing momentum - bulls/bears has power, they have fuel to push price

🎯 Decreasing momentum - bulls/bears are losing power, they dont have fuel they are exhausted.

‼️ Take a look at this concept in HTF starting from H4 - MN

Kindly see the photos attached with bullish/bearish decreasing and increasing momentum.

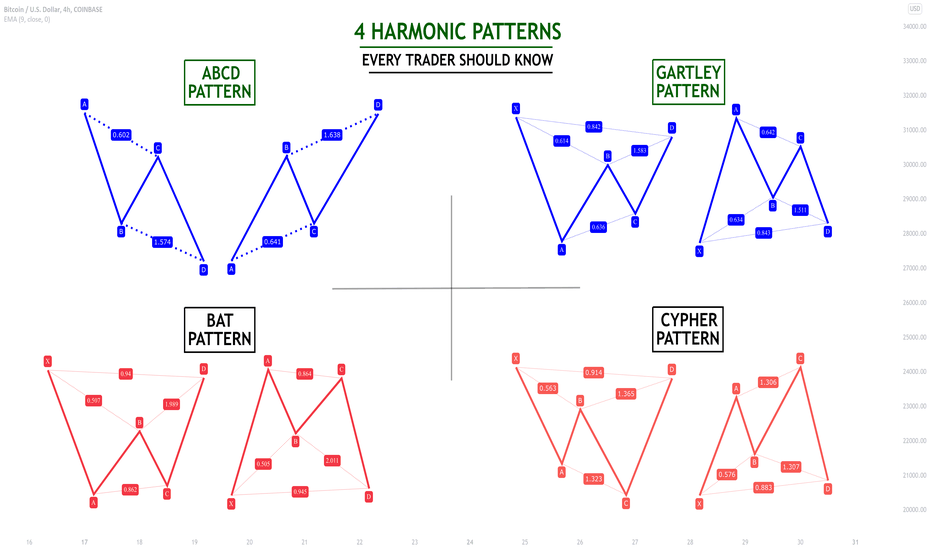

Harmonic Patterns

BOS - BREAK OF STRUCUTRE ✅✅✅🎯 WHAT IS BOS ?

BOS - break of strucuture. I will use market strucutre bullish or bearish to understand if the institutions are buying or selling a financial asset.

To spot a bullish/bearish market strucutre we should see a higher highs and higher lows and viceversa, to spot the continuation of the bullish market strucuture we should see bullish price action above the last old high in the strucutre this is the BOS.

🎯 BOS for me is a confirmation that price will go higher after the retracement and we are still in a bullish move

Kindly see attached photos

DXY EXPLAINED 📉📉📉🎯 DXY - USD Index

USDINDEX - The U.S. Dollar Index (USDX, DXY, DX, or, informally, the "Dixie") is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies, this index helps us to understand if USD is bullish or bearish on a short term or long term perspective.

🎯 DXY has two correlations one of them is positive meaning the certain assets moves like DXY and negative corelation meaning certain assets move exactly vice-versa.

✅ DXY Positive Correlations

DXY ⬆️

USDCAD ⬆️

USDJPY ⬆️

USDCHF ⬆️

USDRUB⬆️

USD XXX ⬆️

✅ DXY Negative Corelations

DXY ⬆️

EURUSD ⬇️

GBPUSD ⬇️

AUDUSD ⬇️

NZDUSD ⬇️

From a technical standpoint to have a better probability in your trades try to find entries when both DXY and for example USDCAD are in long poi (point of interest) this will increase your chance of having profits as you use inter-market correlations

HTF intention with LTF execution 📉📉📉🎯 I will try to explain how do i use HTF in order with LTF.

✅ HTF - higher time frame usually those are timeframes that are higher then H4 like D1,MN1.

✅ LTF - lower time frame usually those are timeframes that are lower then H1 like M30,MAT,M5

When i take trades i wait for price to approach a HTF POI and then zoom out on LTF to find a better risk-reward entry like the photo says HTF intent LTF execution helps you to get a better risk-reward ratio and a higher probability trade, this is working on every financial asset from crypto to forex to commodities and stock market

✅ POI - POINT OF INTERES an area in the market where price have a higher probability to go bullish then bearish lets say 70/30 % probability.

Example price come into a ,,support,, area this means we have a BULLISH POI we have a better probability to go higher then lowe

Order Types in the Markets💰💰💰🎯 In the financial market the orders are on two categories.

✅ Market Execution orders LONG - BUY SHORT - SELL meaning that you are ok with the price on the certain asset and you would like to short or long it on the other side there is

✅ Pending Orders - meaning you are not ok with the actual price and you would like to buy/sell it later in time I use pending orders when i am out of my trading office so i dont miss trading opportunities

Was this valuable, drop a comment !

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️

My Favorite Strategy For The Market Right Now(I have talked about this strategy before very frequently but it works especially well right now since we are seeing big intraday moves. This is a perfect day trade strategy for the market's current situation)

I have found extreme success with this strategy in day trading. I use it every day I trade and is most certainly the best strategy I use. Below are the details, feel free to comment if you have any questions.

Name: Opening Range Breakout

Target Stocks: This strategy is a momentum strategy so stocks with above average volume work very well. Look for stocks with over 20 million volume and above the 10 day average. Volatile stocks are great, we want to catch a big move.

Buy Trigger:

Any break up or down of the range of the first 5 minute bar(as shown above)

Stop Loss:

The opposite end of the first 5 minute bar is the stop loss. (This helps keep losses small in most cases)

Trailing stop loss:

You can use an EMA line. Some I use are: 12, 13 or 14. (Also note I like I like to be out of these trades by 12pm - 2pm EST)

Extra Notes:

Trading Views built in hot list stocks work very well with this strategy

This strategy also works very well with the 15 minute time frame

This strategy is strictly a day trading strategy, do not hold over night

Key Points:

Respect the rules of the strategy, that is what makes it work best. If you have additions to the rules that is fine but make sure when trading this you have a set of rules you follow every single time.

I hope you guys enjoy this strategy and get as much use out of it as I do. Like always, I encourage you to do your own backtesting and try it out to see if this strategy works with your style.

For more details check out Delta Trading youtube linked in Bio. (Full tutorial there)

Hope you guys enjoy!!!

HOW TO TRADE A MARKET SETUP LIKE THISLet's drop down in

LTF ( lower time frame )

& try to find potential entry

SO, Now we are monitoring market in LTF

& trying to find some good potential entry.

CASE 1

CASE 2

CASE 3

CASE 4

There are meny types of wyckoff & other types of entry too..

We will discuss that later

Like this post and share with your trading gang

& let me know in the comment section below if you want more posts like this .

WEEKLY HIGH vs WEEKLY LOW ✅I tried to show you in this example how i use weekly high / weekly low to spot intra-week reversals bearish or bullish.

Just look for a drop below previous weekly low and a bullish confirmation - intra week bullish reversal

Look for a rise above previous weekly high and a bearish confirmation - intra week bearish reversal

Plain and simple, have a great trading week. ✅✅✅

#1 Day Trading Strategy (Updated)I have found extreme success with this strategy in day trading. I use it every day I trade and is most certainly the best strategy I use. Below are the details, feel free to comment if you have any questions.

Name: Opening Range Breakout

Target Stocks: This strategy is a momentum strategy so stocks with above average volume work very well. Look for stocks with over 20 million volume and above the 10 day average. Volatile stocks are great, we want to catch a big move.

Buy Trigger:

Any break up or down of the range of the first 5 minute bar(as shown above)

Stop Loss:

The opposite end of the first 5 minute bar is the stop loss. (This helps keep losses small in most cases)

Trailing stop loss:

You can use an EMA line. Some I use are: 12, 13 or 14. (Also note I like I like to be out of these trades by 12pm - 2pm EST)

Extra Notes:

Trading Views built in hot list stocks work very well with this strategy

This strategy also works very well with the 15 minute time frame

This strategy is strictly a day trading strategy, do not hold over night

Key Points:

Respect the rules of the strategy, that is what makes it work best. If you have additions to the rules that is fine but make sure when trading this you have a set of rules you follow every single time.

I hope you guys enjoy this strategy and get as much use out of it as I do. Like always, I encourage you to do your own backtesting and try it out to see if this strategy works with your style.

For more details check out Delta Trading youtube linked in Bio. (Full tutorial there)

Hope you guys enjoy!!!

BTC 1D Chart 1.12.2022 Death Cross Is Combinate with H&S !!ONLY EDUCATIONAL

The "Death Cross" pattern is one of the most effective technical instruments in identifying a major trend reversal in any stock/index. Simply put, it explains how the negative convergence of moving averages impacts the upward trend and pushes prices into a bearish phase.

Key : The Death Cross having more moving averages converging together shows a very strong indication of a sell-off.

If the volume after the Death Cross shows a significant rise, then the downward trend is likely to gain strength.

If the price trades above the moving averages, then the selling pressure may require strong volumes to suggest a major turnaround. Otherwise, the price may hold support around the same moving averages.

If the price is below moving averages, then the impact and selling pressure is likely to be severe. In such a case, any positive corrective move will witness strong resistance at every higher level.

The first sign of selling pressure gets deteriorated as these moving averages start turning upward.

As the moving averages get closer indicating a possible Death Cross on the charts, the amount of rise in a stock price starts indicating selling pressure with higher levels showing strong resistance. This attribute helps short-sellers to gauge early indications of change in trend. One can also notice that during the formation of a Death Cross, all other technical patters start showing negative signs in their respective parameters.

Death Cross versus Golden Cross While Death cross indicates the negative crossover of moving averages, the Golden Cross depicts a positive reversal. Herein, the moving averages converge in an upward direction suggesting a strong positive upside. This upward momentum exhibits firm positive sentiments with price scaling higher levels in the subsequent sessions.

Death Cross and chart patterns Whenever the Death Cross is accompanied by chart patterns like Head and shoulder, double top, etc., the signal gives strong confirmation without any bias and the trend witnesses a steep correction in price. The price is very relevant in providing confirmation of a trend and, if supported by any other instrument like trend line breakdown, consolidation breakdown, gap down, bearish engulfing; then the weakness sees strong negative momentum with price eventually entering the bearish phase.

Indications provided by a Death Cross pattern A major shift in sentiment from bullish to bearish phase.

An ideal indication of shorting opportunities with short to medium-term perspective.

If the index of a particular sector forms a Death Cross, then the price of all those stocks in the sector will not show any rise in price, no matter whether those stocks have formed the Death cross or not.

The volumes accelerate if the counter closes in negative sessions for over three days.

Finding a bottom is highly discarded in a Death Cross formation.

Always trade Base on your Knowledge and Decision .

Like If you fund this useful.

Happy Deep Discount To Everyone

My #1 Day Trading Strategy Opening range breakout is something that I use daily for almost all of my plays. It's very simple. If the high or the low of the first five minute bar is broken. Take an entry in the way the stock broke. I have seen so much success with this strategy. There is much more that goes into it like stop losses and where to take profits. Those will all be explained in further tutorials. also this strategy is not at all a swing trade strategy, this is purely a day trade strategy that is only used in the morning as the market is opened. I challenge you guys to go through charts yourself and look for opening range breakouts. Also note this works best on the 5 minute chart or 15 minute. Hope you guys see as much success as I do with this very useful strategy!!!

📚🎬💎#e08 : An Ultra Bond Future💍Married To The⛪💫An Education🎓

Series Continuation

Prior Episodes Found

In The Content Below

❔ What Are Bonds

Bonds Are The Foundation

Of A Debt Based Monetary

System

Bonds Define The Cost Of

Money Over Time

Put Simply Bonds Are

Future Dollars

Read That Again🔂

US Treasury Bonds Are

Future US Dollars Deliverable

At A Specified Time

In The Future I.e

30 Years Henceforth

By Purchasing A

US Treasury Bond

You Enter Into A

Legal Contract With

The Treasury Wherein

You Will Receive

The Principle Or

"Face Value" Of The

Bond Plus The Rate

Of Interest Specified

At The Time Of Purchase

❔ A Traders Role

To Make Money I Hear You Say

Well Yes Of Course

Money

But What Exactly As Bond Traders

Are We Getting Paid For ?

To Provide A Service

Our Collective Actions

Expressed Through The

Trading Of Bond Instruments

Determine The Cost Of Money

The Cost Of Money

Cost Of Money

Yes💡

Regardless Of Your Trading

Size We Are All Interacting

With The Free Market

Our Role :

To Correctly

Price The Value

Of Future Money

When We Trade Bonds

Profitably

We Win The Game

We Have Kept The

Flame🔥

We Have Served

A Most Important

Mission

We Fulfill A

Founders Vision💜

d-MR96nBa

nvrBrkagn

❔ Why Else Ultra Bonds

Low Operation Costs

Regardless Of Trade Size

Only Pay Spread Fee

As Futures Contracts

Zero Overnight Cost To Carry

Quarterly Rollover Spread Only

Operation Costs Will

Kill A Trader In Time

On Time

Every Time

Same As Any Business

Ventured

C4L

📔 Rules Of The Rodeo

Trend Is Dearest

Life-Long Friend

Bond Bull Market

40 Years Strong

So We Will

Mostly Trade Long

Positions Actively

Managed

Entry Orders Executed

At The Market

Trading 0.01 Unit

At A Time

Slow Drip💧

ℹ️ CME Group Official

Ultra Bond Trader Site

www.cmegroup.com

Keep Your Bond⚔️

Watch Your Loyalty⌚

Buy Freedom To🔥

0.96 % x Cost ♋

Behold.. The

Ultra Bond Future 🗽

☔

📚#e07🩸GG :

📚#e⏭️06 :

📚#e04 :

📚#e03 :

📚#e02 :

📚#e01 :

CBOT:UB1!

TVC:US30Y

Pluto 🛰️

Hndrxx 👩🏻🎤

BTC 1D Chart . BTC Head and shoulder Dear All

This the only Educational theory and its is not financial advice .

Like the post if you fund it useful

H&S Pattern:

The head and shoulders chart pattern has become a stalwart in the arsenal of many traders over the last few decades. The reason is not difficult to find: it has proven itself to be a remarkably reliable indicator of future price movements.

As the name implies, the pattern looks very similar to a head with two shoulders on the side.

The following graph shows a typical head and shoulders pattern.

Typical Head And Shoulders Pattern Typical Head And Shoulders Pattern

Reversal Pattern

The head and shoulders pattern is what is referred to in the industry as a reversal pattern. This simply means that when a CFD trader encounters this pattern on a stock, FX or commodity chart, chances are very good that the underlying security is about to undergo a change in trend.

The pattern has two different versions, one that appears in uptrends and one that appears in downtrends. The traditional pattern pictured above appears when the uptrend is about to be reversed and a downtrend becomes a very high likelihood.

Before The Uptrend

The second version, sometimes described as the inverse head and shoulders, usually appears in a downtrend and this signals that the trend is about to reverse and that a new uptrend has become a high probability.

Note how the volume increases once the new trend gets properly underway.

Typical Inverse Head And Shoulders Pattern Typical Inverse Head And Shoulders Pattern

Similarities: Peaks And Troughs

The construction of both types of head and shoulders patterns is quite similar. Studying the chart will show a head section in the middle, two shoulders on the sides and two necklines between the shoulders and the head.

What the trader should wait for, here, is the second shoulder to form and the price to break up or down above or below the second shoulder. This is happened the point A in the Chart,

The head and shoulders together form a set of peaks and troughs. On the other hand, the neckline provides a level of support (during and uptrend) or resistance (during a downtrend).

Down's Theory

Essentially the pattern is based on an analysis of peak-and-trough analysis in terms of Down’s Theory. An uptrend can be interpreted as a series of successive rising tops and rising bottoms. Whereas, a downtrend consists of a series of lower highs and lower lows.

When the trend starts to weaken, these ‘peaks and troughs’ fail to make new highs (during an uptrend) or new lows (during a downtrend) -- hence the trademark troughs of the head and shoulders pattern. Note that the two troughs do not always fall on a horizontal line, the second one might be slightly higher or lower than the first one.

Sometimes, immediately after breaking through the ‘neckline’, the price of a security will revert back to the neckline.

Breaking Through The 'Neckline 'Breaking Through The 'Neckline'

The 'Throwback'

At the point marked ‘throwback’ the price had broken through the shoulder and then dropped back to the same level. This is no cause for alarm. All it signifies is that what previously used to be a resistance level has now changed to a support level. It actually underscores the strength of the signal.

If the price, however, drops significantly below the shoulder in what is supposed to be the start of a new uptrend, it could mean the trend has been broken and that the previous downtrend would continue.

Trad Base on Your Decision and Knowledge .

Happy trading

TRIPLE TOPHello everyone

Today I want to share with you a figure of technical analysis called the TRIPLE TOP.

This figure occurs quite often and brings excellent profit.

What does it look like?

The figure looks like three maxima, approximately at the same level.

These peaks are formed because the buyers' forces are drying up and with each new peak, the bears are getting stronger.

Very often, the third peak will be higher than the previous two - this is the last gasp of buyers, before capitulation.

How to trade?

The main criterion is the formation of three peaks, after a strong uptrend.

After that, the price makes the last spurt (the third peak) and breaks through the support.

This breakout is the first possible entry point .

Often you will observe how the price makes a retest of the level, after which it turns down.

The second possible entry point will be this retest of the level.

To calculate the potential profit point , you need to measure the height from the minimum to the maximum of the vertices.

This value, plotted below the breakout, will be a potential profit point.

The stop loss is set above the maximum of the vertices.

Conclusion

The figure is very profitable and often found.

In addition, you can find a triple bottom on the chart, which trades in the same way as a triple top, only in the opposite direction.

Very often, after a triple top, a strong downtrend begins and holding a part of the position can bring big profits.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩

HOW-TO: Auto Harmonic Projections - Ultimate [Trendoscope]Have made this video to give brief demonstration on Auto Harmonic Projections. Hope you enjoy the video and the indicator. Please let me know if you have any questions.

ready to jump Ascending Triangle: An ascending triangle is a breakout pattern that forms when the price breaches the upper horizontal trendline with rising volume. It is a bullish formation. The upper trendline must be horizontal, indicating nearly identical highs, which form a resistance level. The lower trendline is rising diagonally, indicating higher lows as buyers patiently step up their bids. Eventually, the buyers lose patience and rush into the security above the resistance price, which triggers more buying as the uptrend resumes. The upper trendline, which was formerly a resistance level, now becomes support.