Bitcoin - 2026 roadmap, pump to 100k, then crash to 57k!Is it possible that Bitcoin will go above 100k or 103k in the next weeks/months? And is it possible that Bitcoin will later drop heavily to 57k? Altcoin season during the rise to 103k? I will answer these questions in this post. Write a comment with your altcoin, hit the like button, and I will make

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Stocks Shake as Prosecutors Go After Fed Boss Powell. Now What?Wall Street went into the weekend riding record highs — and came back to something that felt more like a political thriller than a macro update.

US stock futures slipped after news broke that the Department of Justice has opened a criminal investigation into Federal Reserve Chair Jerome Powell, sha

A letter to myself. (Buy the dip)This is phase one of a global technological financial system. If our parents even parked a fraction of their cash here 10–20 years ago the long-term payoff would have been nice, but they didn't and it's okay because they didn't know. We now have the privilege of choosing to contribute to our financi

Meta Is Down Nearly 20% Since August. Here's What Its Chart Says"Magnificent Seven" stock Meta Platforms NASDAQ:META has fallen nearly 20% since hitting an all-time high in August, and has also trailed the S&P 500 SP:SPX in various timeframes from three months to one year. Let's see what its chart and fundamental analysis can show us.

Meta's Fundamental An

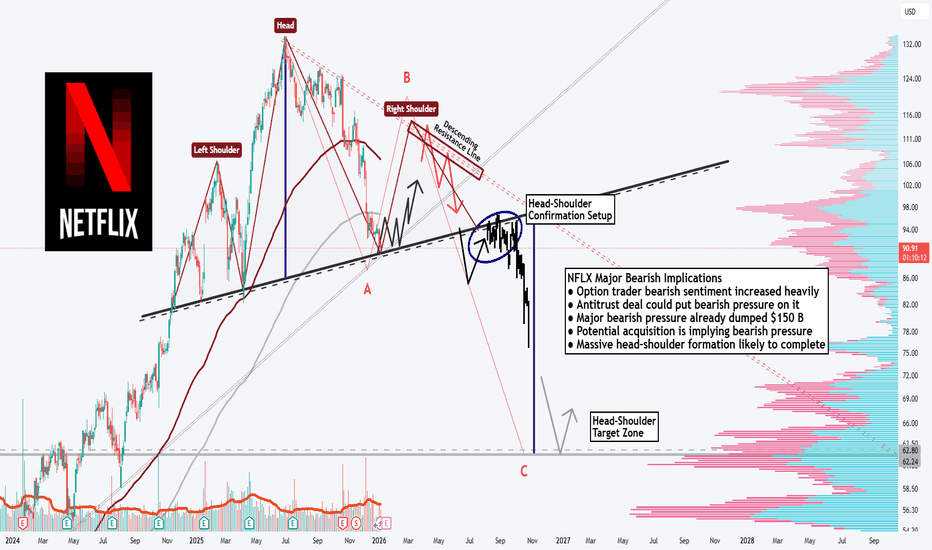

NFLX: Massive Head-Shoulder-Formation!Hello There,

welcome to my new analysis about the Netflix stock (NFLX). Recently, I spotted major underlying factors that will be highly determining for the whole upcoming price action. The stock already dumped heavily bearishly towards the downside, almost declining over $150 B in market cap. Such

Where Is Oil Heading To ? - /CL Analysis 1) Technical Perspective: Support & Resistance

~$65 was a support zone earlier (2021–2024). In 2025–26, that $65 area now often acts as resistance. Prices have come down toward $55

2) Fundamental Drivers Behind the Downtrend

Oil has been in a multi-year decline from the highs seen in 2022 afte

Dollar Off to Weak Start After Worst Year Since 2017. Now What?The US dollar rang in 2026 without much enthusiasm. No fireworks. No flex. Just a quiet shuffle out of the gate that felt eerily familiar to anyone who shoved cash in FX markets last year.

After logging its worst annual performance since 2017, the greenback has started the new year on the back foot

Gold - Control vs Patience… Who Wins Next?Gold hasn’t done anything crazy lately, and that’s exactly the point.

Zooming out, the structure is still bullish. Every dip so far has been met with buyers, and the market keeps printing higher highs and higher lows.

Right now, price is sitting inside what I like to call a decision zone. This is

SUI is on the verge of another rally (4H)From the point where we marked the green arrow on the chart, a bullish phase has started on SUI. This area acted as a key reaction zone where buyers stepped in decisively, shifting market sentiment from corrective to bullish.

Based on the current price structure, it appears that we are developing a

XAUUSD (H4) – Monday SetupGeopolitical shock risk, gold may spike | Trade liquidity and reaction zones only

Quick summary

News around Trump’s claim that Maduro has been detained, plus Venezuela’s response (they don’t know his and his wife’s whereabouts and are demanding proof of life), raises geopolitical uncertainty sharpl

See all editors' picks ideas

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

See all indicators and strategies

Community trends

NVIDIA Huge Head & Shoulders forming. $127 technical Target.NVIDIA Corporation (NVDA) is in the process of completing the Right Shoulder of a Head and Shoulders (H&S) pattern, having turned sideways since the October 29 2025 High (ATH).

With the 1D RSI on Lower Highs, i.e. a Bearish Divergence since July 17 2025, it is possible that within a month's time ma

Added to $FUBO again. The chart is setting up nicelyAdded to NYSE:FUBO again. The chart is setting up nicely — a large double bottom, sitting right at major support and near the lower end of the range. From a risk-reward perspective, it’s a clean setup.

On the fundamental side, the thesis remains intact. Sports content is a strong niche — live spo

Tesla Faces Key Resistance Near $450 – Short-Term Pullback LikeCurrent Price: 445.01 (Analysis was generated on Monday Morning)

Direction: SHORT

Confidence level: 48%(Based on mixed professional trader views, price sitting near heavy resistance, and cautious X sentiment)

Targets

Target 1: 435.00

Target 2: 425.00

Stop Levels

Stop 1: 455.00

Stop 2: 470.00

Wi

JOBY Aviation ready to fly!! All TFs Bullish except the 4h, with internal structure recently turning bullish. Most recent leg of structure gave inducement before the break and is building LQ (Looks like a bull flag) and recently gave inducement, for potential calls targeting the 4h Supply. Looking for second medium inducement

MSFT — Institutional Structure AnalysisThe Setup:

MSFT is sitting at a critical decision point. After the November breakdown from $568, price has retraced into what institutional traders call the "reload zone."

What I'm seeing:

Price trading below the Anchored VWAP (~$490)

Regime: Bearish until AVWAP reclaim

Currently inside a high-prob

Meta - Preparing a major buying opportunity!🤩Meta ( NASDAQ:META ) is clearly heading higher:

🔎Analysis summary:

Just recently Meta once again retested the major resistance trendline. This retest was followed by a decent correction of about -25%, perfectly playing out. Now, Meta is retesting major support and is already setting up for a

NVDA — Technical Analysis (1H · 15M · GEX) DEC. 12-161H – Structure first, emotion later

On the 1-hour, NVDA is still technically bearish, but the selling pressure has clearly slowed. We already got a BOS to the downside, followed by a CHoCH, which tells me sellers have done most of their damage for now.

Price is compressing under a descending trendli

Long Momentum Day Trade on $TSLA If NASDAQ:TSLA crosses the $442.75 mark at the open then it can go above 445 and 448. Eventually can reach the 452.5 mark.

Looking for the price to stay below the entry line before the market open. If the can stay below and then break the entry line at the open then I will be looking to get long

APLD: Momentum Confirms Triangle BreakoutAPLD - CURRENT PRICE : 37.68

APLD Breaks Symmetrical Triangle – Momentum Confirms Trend Continuation

Applied Digital Corporation (APLD) continues to trade within a strong long-term uptrend, with price holding well above the rising EMA 200 , signaling sustained institutional support and a struc

See all stocks ideas

Jan 12

ANIXAnixa Biosciences, Inc.

Actual

−0.09

USD

Estimate

−0.09

USD

Jan 12

ALTSALT5 Sigma Corporation

Actual

—

Estimate

−0.36

USD

Jan 12

WLTHWealthfront Corporation

Actual

0.21

USD

Estimate

0.10

USD

Today

BKThe Bank of New York Mellon Corporation

Actual

—

Estimate

1.91

USD

Today

DALDelta Air Lines, Inc.

Actual

—

Estimate

1.53

USD

Today

LFCRLifecore Biomedical, Inc.

Actual

—

Estimate

−0.14

USD

Today

LOOPLoop Industries, Inc.

Actual

—

Estimate

−0.06

USD

Today

JPMJP Morgan Chase & Co.

Actual

—

Estimate

4.85

USD

See more events

Community trends

Bitcoin - 2026 roadmap, pump to 100k, then crash to 57k!Is it possible that Bitcoin will go above 100k or 103k in the next weeks/months? And is it possible that Bitcoin will later drop heavily to 57k? Altcoin season during the rise to 103k? I will answer these questions in this post. Write a comment with your altcoin, hit the like button, and I will make

BTCUSDT: Consolidates Above Support, Bulls Preparing Next MoveHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT previously traded inside a well-defined range, where price moved sideways for an extended period, indicating balance and accumulation between buyers and sellers. This consolidation phase ended with a clean

A letter to myself. (Buy the dip)This is phase one of a global technological financial system. If our parents even parked a fraction of their cash here 10–20 years ago the long-term payoff would have been nice, but they didn't and it's okay because they didn't know. We now have the privilege of choosing to contribute to our financi

Bitcoin Under Pressure - H1-Bearish Flag (10.01.2026)📝 Description 🔍 Setup (Market Structure) COINBASE:BTCUSD

BTC/USDT - Bitcoin is forming a classic Bearish Flag pattern on the H1 timeframe after a strong impulsive sell-off (flagpole). Price is consolidating upward in a tight channel while staying below EMA and Ichimoku cloud resistance, indica

Bitcoin Consolidates Above Key Support 90KBitcoin Consolidates Above Key Support 90K

Bitcoin is currently consolidating after a strong impulsive move higher, with price holding above the key support zone around 90,000.

This area previously acted as resistance and is now being retested as support, which is a constructive sign for the bul

BTCUSDT Long: Demand Holding at 90,100 - Eyes on 92,200 SupplyHello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a strong bearish move, BTC formed a clear pivot low, from which price transitioned into a bullish recovery phase. From this pivot point, the market developed a well-defined ascending channel

BTCUSDT: Compression Before the Move (IH&S Inside Triangle)Hi!

Price is still moving inside a symmetrical triangle, showing clear compression and indecision. An inverse head & shoulders is visible, but the breakout so far is weak and needs confirmation.

Short-term expectation:

A push-up is likely toward the gray resistance zone around 91,330. From there

Elise | BTCUSD – 30M | Post-BOS Reaction from HTF DemandBITSTAMP:BTCUSD

After a sharp impulsive drop, BTC tapped into HTF demand and produced a short-term BOS, indicating a potential relief move. However, momentum remains corrective rather than impulsive. The current structure suggests a retracement-based bounce, not a confirmed trend reversal, unless

Bitcoin: Higher Lows Lead To Higher Highs Watch Longs.After rejecting the 95K key resistance, Bitcoin is now testing the 90K area (old resistance / new support) and is poised to establish a higher low for the coming week. From here the key is to identify bullish reversal patterns in this area, and wait for them to confirm. Upon confirmation risk/reward

BITCOIN drops by more than -60% when this signal flashes.Bitcoin (BTCUSD) has closed the last 2M candle on a MACD Bearish Cross. Every time this has happened historically (2 times), Bitcoin has dropped by -67.66% and -68.75% from he top of that candle.

If history is repeated, a new -67.66% would deliver $36500 as the bottom of the current Bear Cycle. Thi

See all crypto ideas

Gold Defends Buyer Zone, Upside Toward 4,550 in FocusHello traders! Here’s my technical outlook on XAUUSD (3H) based on the current chart structure. Gold previously traded inside a well-defined range, where price moved sideways for an extended period, showing balance between buyers and sellers. This consolidation acted as an accumulation phase and mar

Gold Strengthens as Geopolitical Risk IncreasesGold Strengthens as Geopolitical Risk Increases

Gold continues to respect a bullish market structure, with price developing a clear impulsive sequence followed by shallow corrective waves. The recent pullback found support near the 4,400 zone (wave iv), and price is now pushing higher again, confi

Gold Weekly Levels: Break above 4555 → 4625/4635🔱 GOLD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Bulls remain in control as price transitions into the Wave-5 extension sequence

🟡 Key unlock level: 4555 — a clean break/acceptance above opens continuation fuel

🚀 Wave-5 extension target: 4625–4635 (primary upside objective / price discovery ceiling)

THE KOG REPORT - Weekly Update THE KOG REPORT - WEEKLY CHART

Quick update on the weekly chart.

Key level here of support stands at the 4385 which is the level needed to break structure and turn bearish. The high here at the moment is looking like the potential for 4565 but we will need a close above it.

Please do support us

Gold Uptrend Strengthens, New Expansion Phase BeginsOver the past week, gold has continued to advance in a very “textbook” manner. What stands out is not how far price has moved, but how it has moved: steady, controlled, and consistently supported by both technical structure and the macro backdrop. On the H4 chart, this is the type of bullish behav

GOLD Trending Higher - Can buyers push toward 4,700?Hello. I'm Camila.

Gold is trading within a clearly defined ascending channel, with price action consistently respecting both the lower and upper boundaries. This behavior confirms that the overall trend structure remains intact. The strength of the most recent impulsive move reflects firm buying

XAUUSD – Breakout After 33% Correction, Trend ContinuationHi!

Gold is moving inside a clear ascending channel and remains firmly bullish. After a healthy 33% correction, the price reclaimed and broke above a key resistance zone, which is now acting as support.

The reaction after the breakout is clean, showing strong buyer control and continuation momentu

ATH at 4600. Momentum Dominates Despite Overextended StructureLast week was an eventful one for Gold traders. After touching 4500, price finally started to correct — but the move stalled around 4400, where buyers stepped back in aggressively.

That reversal forced me to close my short position with ~500 pips profit, instead of the 1,000+ pips initially targete

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 4530 and a gap below at 4505, as support. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will se

See all futures ideas

EURUSD Liquidity Trap Short: Sweep 1.1700–1.1710 → Sell the Rip🔱 EURUSD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ EURUSD positioned in a sell-the-rip environment

📍 Current context: price is below your premium sell liquidity pocket, favoring corrective rallies into resistance

🧱 Fresh sell-side liquidity: 1.1700 – 1.1710

💧 Fresh buy-side liquidity: 1.1600

📉 Bias: b

EURUSD Long: Bulls Defend 1.1620 Demand, Targeting Supply 1.1680Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. EURUSD initially traded within a well-defined range, where price moved sideways for an extended period, reflecting a balance between buyers and sellers. During this consolidation phase, the market

USD/CAD: More Growth Ahead!The USDCAD pair successfully breached and important daily resistance level last week, confirming a bullish Break of Structure (BoS).

Following this, a retest of the previously broken structure was observed on Friday, leading to subsequent consolidation.

A bullish breakout above its intraday resis

EURUSD Price Action - Support Holds at 1.1670, TP Near 1.1720Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. After trading inside a clearly defined range, EURUSD broke to the upside, showing initial buyer strength. However, this bullish move failed to sustain, and price turned around, transitioning into a descen

Elite | GBPUSD – 4H | Bullish Structure in Corrective PhaseFPMARKETS:GBPUSD

GBPUSD pushed impulsively higher, then entered a corrective phase while respecting the ascending structure. Price is now reacting near a mid-channel demand area, where buyers previously stepped in. However, this is a reaction zone, not confirmation — continuation requires bullish

Lingrid | EURUSD Bullish Setup from Key Support AreaFX:EURUSD has reacted sharply from the lower boundary of the descending channel, forming a clean bounce from the support zone. Price has already reclaimed short-term range resistance and is now attempting to stabilize above the broken structure, hinting that bearish momentum may be fading rather th

USDJPY Price Update – Clean & Clear ExplanationUSD/JPY is trading inside a clear ascending channel, showing that the overall trend is still bullish. Price has respected the trendline support multiple times and is now moving higher from the lower-mid area of the channel.

The grey zones represent strong supply and demand areas. Previously, price

AUDUSD is Nearing an Important Support!Hey Traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.66600 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.66600 support and resistance area.

Trade safe, Joe.

GBPJPY: Breaking Another High 🇬🇧🇯🇵

GBPJPY is breaking another high after a consolidation

and accumulation within a horizontal channel on a daily.

The market will most likely continue rising.

The next strong resistance will be 213.5.

For extra confirmation, I recommend waiting for a daily

candle close above the underlined structu

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.