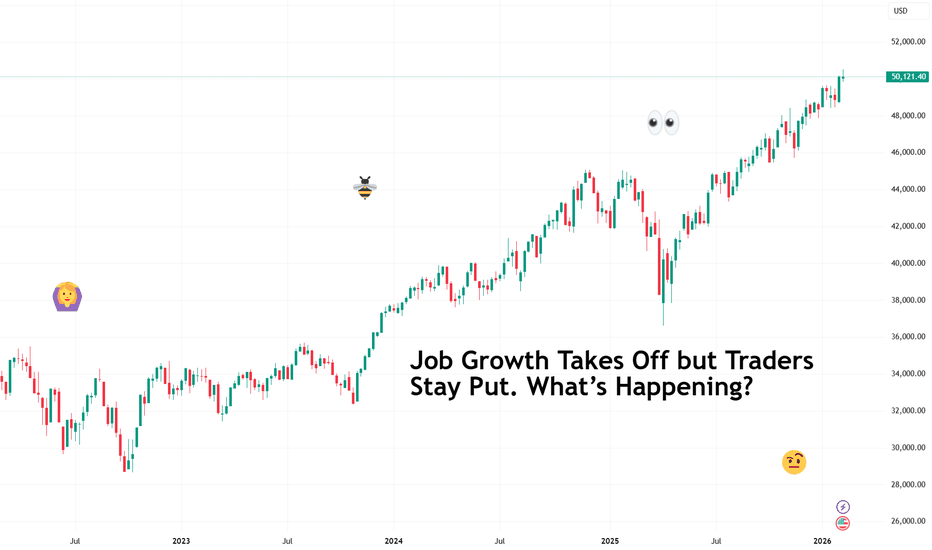

Job Growth Takes Off but Traders Stay Put. What’s Happening?Are these jobs in the room with us right now?

📊 A Blockbuster Headline

The delayed January jobs report arrived Wednesday. Nonfarm payrolls ECONOMICS:USNFP showed 130,000 new hires , more than double the 55,000 estimate. On paper, that looked like a strong start to the year.

Wall Street’s re

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

$TAO Sitting on a Level That Has Never FailedGETTEX:TAO is sitting on a major long-term support level and this isn’t the first time.

If we look at the last three times we touched this support, we bounced strongly.

We may see some drop to form a wick below the support, just as we’ve seen in the last three instances. However, in each case, we

BTC: The "Invisible Wall" at $70k (Why We Flush to $59.8k)The retail narrative is that Bitcoin is "consolidating" at $70k. The On-Chain data says Bitcoin is DISTRIBUTING . We just hit an "Invisible Sell Wall" driven by three massive structural failures. This is not a dip to buy; it is a Rational Deleveraging triggered by a $6.3B supply shock that the ma

Silver Under Pressure – Sellers Are in ControlXAGUSD is currently clearly leaning toward a short-term BEARISH trend, as both recent news and the technical structure fail to support a sustainable bullish move.

From a news perspective , silver is facing pressure from profit-taking after the previous strong rebound , while the U.S. dollar and

S&P 500: Late-Cycle Signals Are BuildingThe S&P 500 is still holding near highs, but under the surface, things are starting to weaken. Both the chart and the economy are sending warning signs that are easy to miss if you only look at price.

Weekly Bearish Divergence

On the weekly chart, price made higher highs, but momentum did not .

EURUSD Buyers in Control After Corrective Move, Eyes on 1.1930Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD previously traded within a strong bullish environment, supported by a well-defined rising trend line. During this phase, price consistently formed higher highs and higher lows, confirming sustained

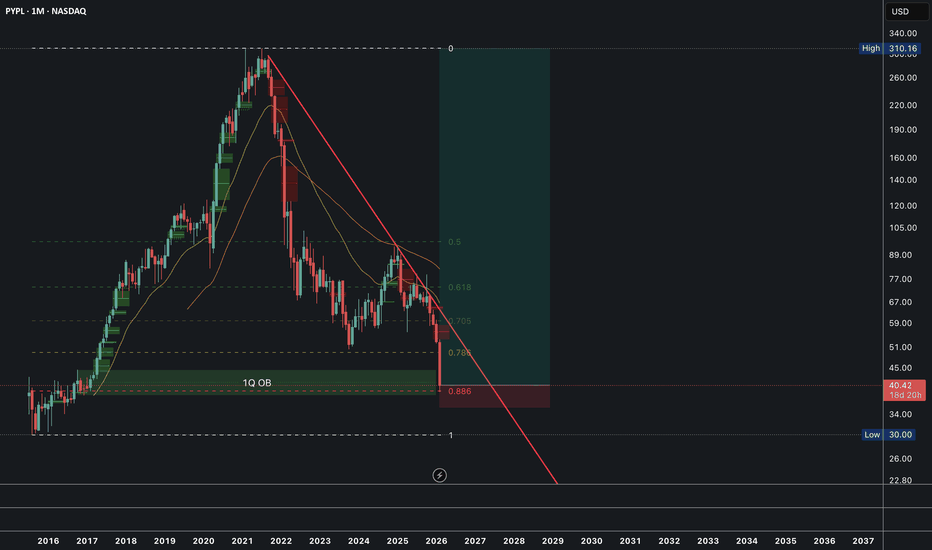

Paypal Bottom is in ?! Long from herePayPal Holdings (PYPL) is currently trading at approximately $40.42 (as of the latest close, +1.30% on the session), marking a continuation of the multi-year downtrend from its 2021 peak of ~$310–$340.

The chart applies a Fibonacci retracement drawn from the 2021 high (~$310.16) to the post-peak lo

$PL - RACE TO SPACE!This reported merger proposal between SpaceX and xAI, along with the broader industry moves toward orbital AI data centers, represents a bold and high-stakes strategic gambit in the escalating global AI infrastructure race. Here’s a structured analysis of the implications, motivations, and challenge

Bitcoin Back Above $70,000. Here Are Key Levels to Watch NowA trip to $60,000 and back before coffee.

Bitcoin BITSTAMP:BTCUSD spent the end of last week doing what it does best: reminding traders that fire-breathing dragons aren’t in fairytales only.

After a sharp drop to $60,033 on Thursday torched thousands of long positions, the world’s largest crypt

An At Market & Future Trading Opportunity on GOLDWhat’s Really Going On With Gold?

Gold took a sharp hit to close out last week—but let’s keep things in perspective. This market has been on a massive bullish run, and after a move like that, consolidation isn’t a surprise… it’s normal.

Barring any unexpected geopolitical headlines, the most logic

See all editors' picks ideas

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

See all indicators and strategies

Community trends

Netflix - Finally approaching support!🎥Netlix ( NASDAQ:NFLX ) will soon reverse higher:

🔎Analysis summary:

The recent -40% correction on Netflix was totally expected. But slowly, Netflix is approaching a major confluence of support at the previous all time high. If we see a final -15% drop, Netflix can then reverse towards the up

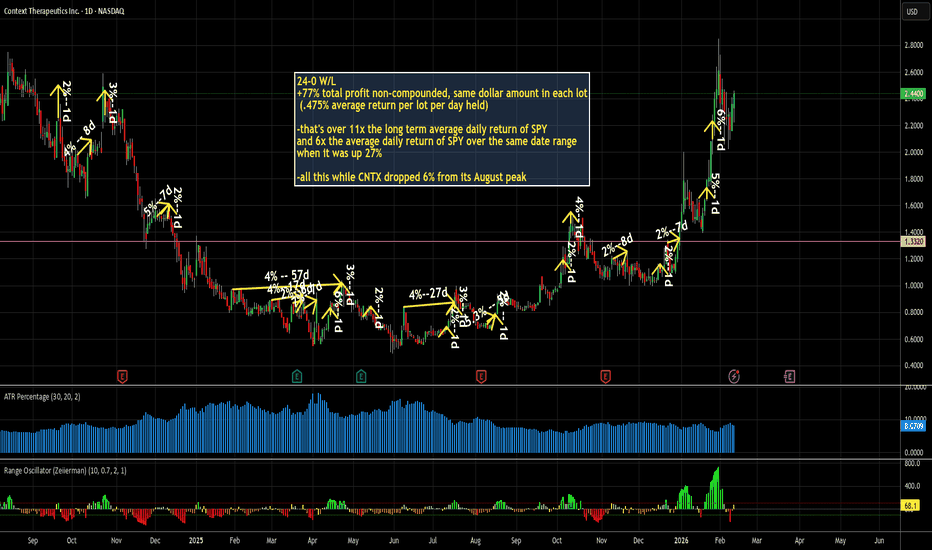

Throw out (almost) everything you know about how I trade.Chances are, virtually the only people who will see this idea are followers of mine. And that is just fine with me. You deserve this more than anyone else. But I have to warn those of you who have been following me for a long time - this is NOT my normal trading style. So make sure you are sitti

Netflix - preparing for successful ATH Revenue projection & Subscribers continue to grow

Netflix continues to demonstrate robust revenue growth:

Q4 2025 revenue of ~$12.05 B, up roughly 17–18% YoY, beating expectations slightly. Global paid subscribers topped ~325 M, a record.

Advertising revenue is gaining traction, growing more tha

AGX: Power for AI – Cup & Handle BreakoutThe Setup:

While everyone focuses on the chips (Nvidia) and the data centers (Vertiv), Argan ( NYSE:AGX ) builds the actual power plants that keep the lights on. They are a premier contractor for natural gas and renewable energy plants—critical infrastructure as AI drives electricity demand to recor

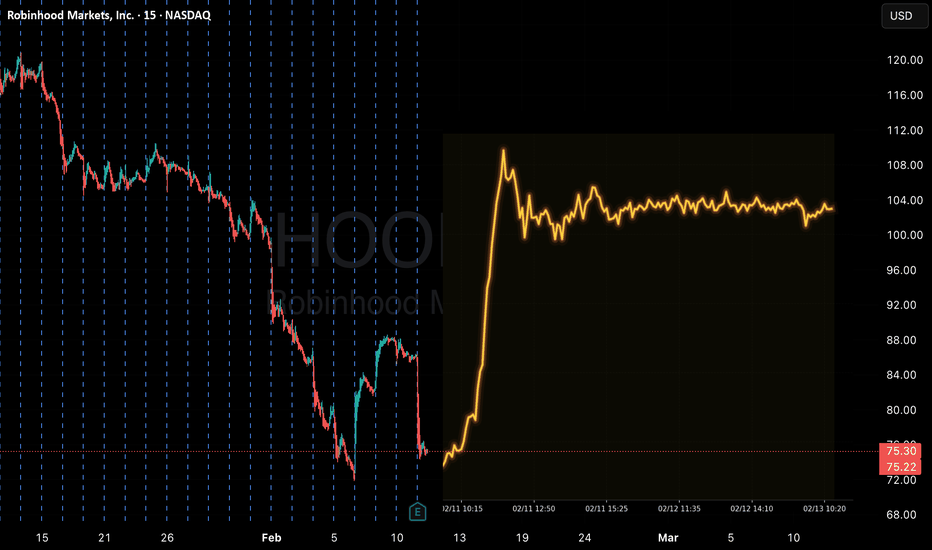

HOOD Approaching Capitulation — Opportunity FormingHOOD QuantSignals V4 Weekly 2026-02-11

CORE THESIS: Capitalizing on an extreme oversold technical condition (RSI < 30) paired with blowout Q4 fundamental news and record prediction market volume to drive a mean-reversion move toward $84.

⬢ KATY AI: MULTI-DAY VECTOR

Bias: Bullish | Probability: 65

MP - Still watching for another high into the boxNothing much to add to my analysis. Price will either continue to grind higher to the target box, or B is complete and it is soon to head lower to the low $40's. Currently, I have a three wave move off of the $47.18 bottom. Technically, that could be all she wrote and we could be headed lower from h

ASTSThis has been a really strong performer over the last 18 months or so and still has a lot going for it, so I'm not 100% sure if this harmonic will hit or we get a meaningful pullback.

At this point in time we have some bearish divergence and one to keep an eye on around the golden pocket for any re

SCHWAB - Trying to Find SupportRight now, buyers might try to establish support around the $96 level after a swift selloff from $107.

This level coincides with the 0.618 of the micro trend that started with the low in November 2025.

The daily RSI is also about to reach the green line which is where we have seen strength start

See all stocks ideas

Feb 12

GRABGrab Holdings Limited

Actual

0.04

USD

Estimate

0.01

USD

Feb 12

TRIPTripAdvisor, Inc.

Actual

0.04

USD

Estimate

0.15

USD

Feb 12

NVCTNuvectis Pharma, Inc.

Actual

−0.31

USD

Estimate

−0.32

USD

Feb 12

CHKPCheck Point Software Technologies Ltd.

Actual

3.40

USD

Estimate

2.76

USD

Feb 12

PCGPacific Gas & Electric Co.

Actual

0.36

USD

Estimate

0.36

USD

Feb 12

GELGenesis Energy, L.P.

Actual

0.04

USD

Estimate

0.28

USD

Feb 12

LNCLincoln National Corporation

Actual

2.21

USD

Estimate

1.90

USD

Feb 12

WSTWest Pharmaceutical Services, Inc.

Actual

2.04

USD

Estimate

1.83

USD

See more events

Community trends

Bitcoin - More blood coming! Buy 57k (extremely strong support)Bitcoin is currently in a very sharp decline, because the price dropped in the past 4 months by 53%. A lot of people didn't expect such high volatility because they are even new to the market, or they thought that ETF would reduce the overall volatility of this market. The truth is that the market i

ETH/USD Decision Points for Next MoveEthereum is currently exhibiting a textbook bullish reversal structure as it stabilizes within a high-confluence demand zone between $1,800 and $1,900. After a period of bearish dominance, the price action is shifting from a sequence of lower lows to a potential Market Structure Shift (MSS), evidenc

BTCUSDT: Bullish Scenario While Above 66.3K SupportHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT was previously trading inside a well-defined descending channel, where price consistently respected the falling resistance and support boundaries. This structure was characterized by a sequence of lower hig

$TAO Sitting on a Level That Has Never FailedGETTEX:TAO is sitting on a major long-term support level and this isn’t the first time.

If we look at the last three times we touched this support, we bounced strongly.

We may see some drop to form a wick below the support, just as we’ve seen in the last three instances. However, in each case, we

BTC: The "Invisible Wall" at $70k (Why We Flush to $59.8k)The retail narrative is that Bitcoin is "consolidating" at $70k. The On-Chain data says Bitcoin is DISTRIBUTING . We just hit an "Invisible Sell Wall" driven by three massive structural failures. This is not a dip to buy; it is a Rational Deleveraging triggered by a $6.3B supply shock that the ma

BTCUSDT Short: Bearish Structure Holds - Focus on 65,000 DemandHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT has been trading within a well-defined descending channel, reflecting sustained bearish pressure and consistent seller control. Throughout this phase, price respected the channel boundarie

BITCOIN Cycle bottom fractals map the rest of 2026 towards $40k.Bitcoin (BTCUSD) continues to be under heavy pressure despite having the 1W MA200 holding the crash last week. Having long lost its 1W MA50 (blue trend-line), which confirmed the Bear Cycle, we are now approaching its 2nd Phase, which is the bottoming process.

This doesn't mean that the bottom is h

2500% possible with BERA token? - February 2026As market participants continue to capitulate hand over fist without understanding why a return to the 9 to 5 is inevitable (Read 7am to 10pm if you’re in Mur’ca), they’re unwittingly showering smart traders with opportunity.

On the above er 3 day chart price action has corrected 95% in the last 12

Bitcoin Bored Range… Big Bounce Loading? (66K Zone)Over the past four or five days, Bitcoin ( BINANCE:BTCUSDT ) has been moving within a range, which might have made some traders a bit bored.

Right now, BTC is moving inside a heavy support zone($78,260-$64,850) and, in the past couple of days, seems to be inside a small descending channel.

From

SOL Rejection at Resistance – Breakdown Toward 70?SOL Rejection at Resistance – Breakdown Toward 70?

SOL is showing clear weakness after failing to reclaim the mid-range resistance around 83–84.

Price rejected the horizontal resistance and continues to respect the descending trendline from the recent highs, confirming short-term bearish structur

See all crypto ideas

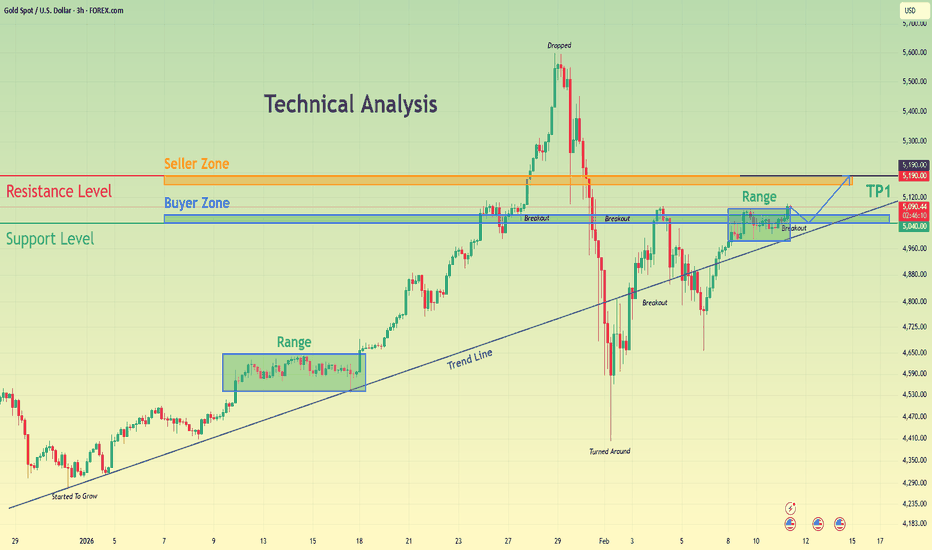

XAUUSD Builds Strength Above Demand - Next Target $5,190Hello traders! Here’s my technical outlook on XAUUSD (3H) based on the current chart structure. Gold is trading within a broader bullish market structure, supported by a well-defined rising trend line that has guided price higher over time. Earlier in the move, price entered a consolidation phase, f

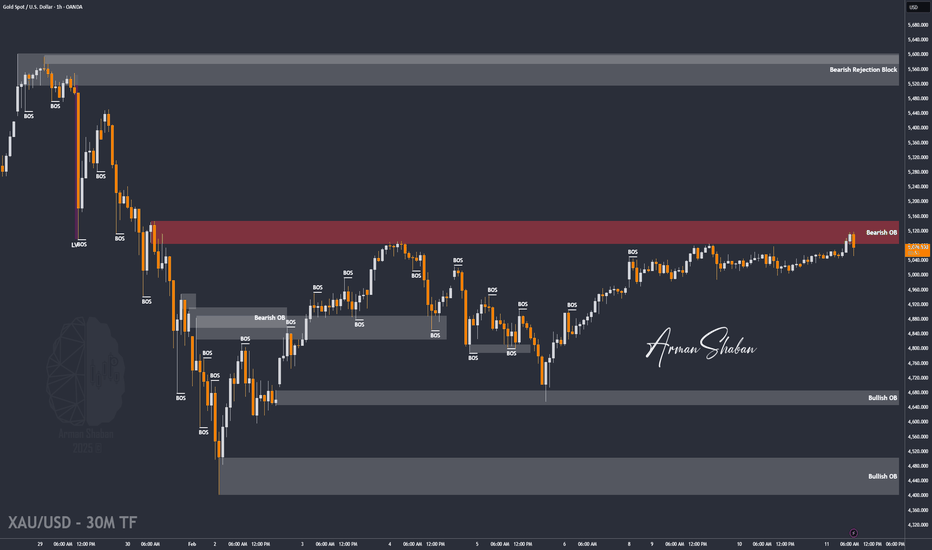

XAU/USD | Gold Breaks $5086, Now Testing Key Zones Again!By analyzing the #Gold chart on the 1-hour timeframe, we can see that after a small pullback yesterday, price made a strong move toward the $5086 resistance. Gold successfully broke this level and rallied up to $5121.

After reaching this important zone, price faced selling pressure and is now tradi

Gold 30-Min Engaged ( Bullish Reversal Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 5057 Area

☄️B

Elise | XAUUSD · 30M – Demand Hold → Bullish ContinuationOANDA:XAUUSD

Gold swept sell-side liquidity earlier, reacted strongly from the lower demand zone, and transitioned into a controlled bullish structure. Price is now consolidating above a well-defined support base, suggesting absorption rather than distribution. As long as price holds above the dem

SILVER XAGUSD ANALYSIS ( MUST READ IT )Hello traders

Here's my first idea about SILVER XAGUSD and what do think about it ? Kindly share your idea about SILVER XAGUSD with me in comment section

Key Points 😊

Support zone : 66.700 / 64.500

First Target 92.000

Second Target 106.000

Don't forget to share this with your friends and famil

Gold Consolidates Before NFP – What Comes Next?Gold Consolidates Before NFP – What Comes Next?

Gold has been waiting in this area for about 3 days now awaiting the NPF data.

The current area near 5080 has held the price all week, indicating the market’s reluctance to break into this area ahead of the NPF data.

The January jobs report is expe

GOLD(XAUUSD): Distribution Started Price Heading Towards $5400?Dear Traders,

Gold has completed accumulation phase and its now has started the distribution phase which is likely to take price to $5400 where we could see strong resistance. So use the accurate risk management while trading gold and other financial instruments.

Like and comment for more!

Team

XAUUSD: Range Holding Strong - Upside Expansion PossibleHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously experienced a strong bearish impulse, breaking decisively below a key support area and triggering an acceleration to the downside. This sell-off marked a clear loss of bullish control and led to a

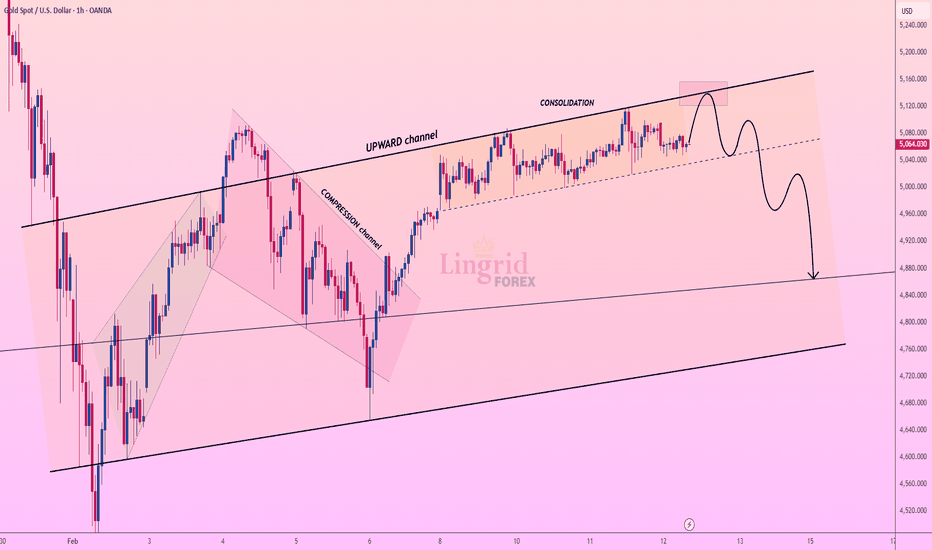

Lingrid | GOLD Weakening Price Action Suggests ExhaustionOANDA:XAUUSD has been respecting the upward channel, but recent price action shows signs of exhaustion as the market approaches the upper boundary of the channel. The recent rally has failed to break through the key resistance zone, forming a lower high. This suggests that the bullish momentum is w

Gold Price Analysis – Resistance and Support LevelsThis chart highlights crucial price levels for gold, including Key Resistance Level at 5,440.457, where a breakout or price rejection may occur. The Minor Resistance at 5,112.237 could lead to a potential reversal. The Support Zone around 5,062.548 is being tested, with the expectation for price sta

See all futures ideas

EURUSD Price Update – Clean & Clear ExplanationEUR/USD is trading within a short-term bullish structure on the 30-minute timeframe, supported by a well-respected ascending trendline that has guided price higher over the past sessions. After a strong impulsive rally, the pair entered a consolidation phase, forming higher lows while gradually push

GBPUSD - Daily CLS - Model 1 - Full Range TPHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

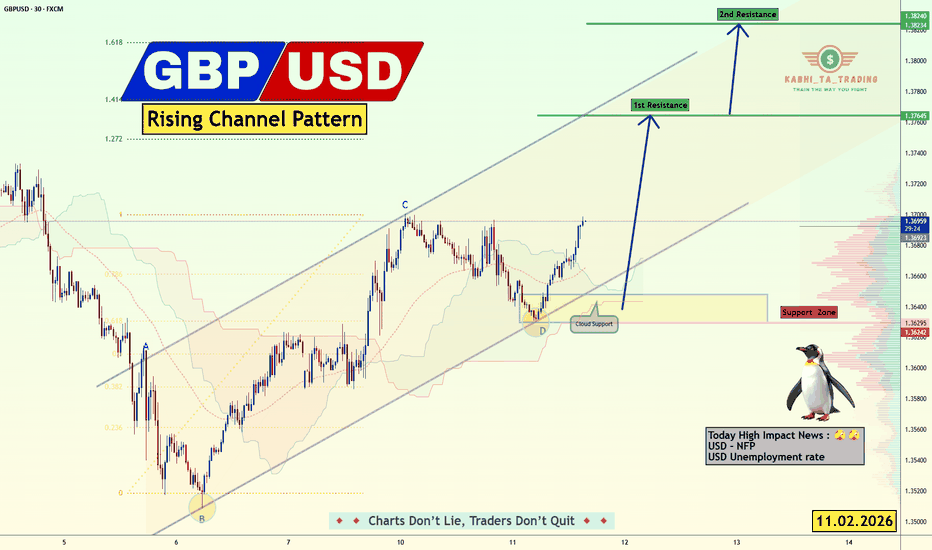

GBP/USD - Rising Channel Pattern (11.02.2026)📝 Description 🔍 Setup OANDA:GBPUSD

GBP/USD is respecting a rising channel structure, with price recently bouncing from the cloud support + channel base confluence (Point D).

Key observations:

✅Clean reaction from Fibonacci zone

✅Higher low formation inside the channel

✅Price reclaiming short-

USDJPY 30Min Engaged ( Bearish & Bullish Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — LONG / Reversal 153.110 Ar

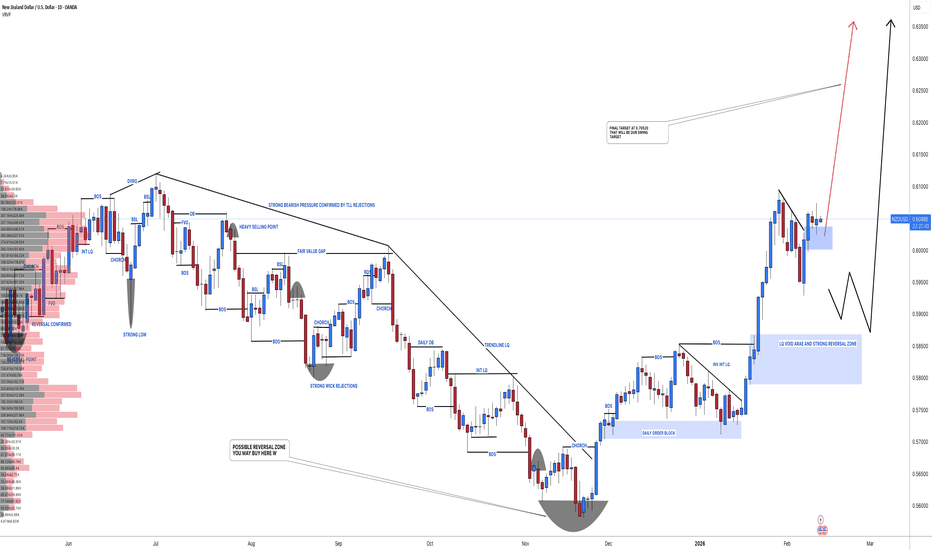

#NZDUSD:+1050 Pips Possible Intraday+Swing Buying OpportunityDear traders,

We have a great opportunity with NZDUSD. The price could hit 0.7050 soon. There are two buying options:

1. **Risky Option:** Buy at the red line marked with a blue zone. This is a risky zone but the current price momentum suggests it could work out well.

2. **Safer Option:** If the

EURUSD Compressing Above Demand - Next Move IncomingHello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. The pair is trading within a broader bullish environment, supported by a clearly defined rising support line that has guided price higher over time. Earlier in the move, EURUSD entered a consolidation pha

EURUSD Short: Corrective Pullback Into Demand Zone 1.1850Hello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current market structure visible on the chart. EURUSD previously printed a strong impulsive bullish move that topped at a well-defined pivot high, where buying momentum began to weaken and sellers stepped in aggressively.

EURUSD Euro ANALYSIS ( MUST READ IT )Hello traders

Here's my first idea about EURUSD EURO and what do think about it ? Kindly share your idea about SILVER EURUSD with me in comment section

Price is moving with clear market structure, confirming a valid BOS (Break of Structure) and strong institutional reaction from marked zones.

L

USDJPY Under Pressure as BOJ Resumes Forex InterventionUSDJPY Under Pressure as BOJ Resumes Forex Intervention

In our previous analysis posted on January 16th, USDJPY fell rapidly by almost -700 pips in just 3 days. This move was only related to the aggressive Forex intervention that the BOJ made in the market, as USDJPY depreciated a lot.

This week,

EURUSD - Will it break the resistance?EURUSD is currently trading within a well-defined 4-hour structure, where both support and resistance are clearly mapped by fair value gaps. After a strong recovery from the lows, price has entered a consolidation phase just below a key resistance zone. The market is now reacting precisely to higher

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.