The Christmas Silver Finally Breaks FreeFor decades, Silver has celebrated the holidays the same way 🎄

Strong rallies.

Rising excitement.

And a familiar ceiling.

🎄 Christmas 1980

Silver climbed like a Christmas tree, fast, vertical, and emotional.

The star was reached at the $50 level.

And just like that, the lights went out ✨

The

Your 2025 space mission is here

Suit up and get ready to explore every highlight of your trading galaxy.

EURUSD Long: Trend Line Support Keeps Buyers, Move to 1.8200Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. EURUSD is trading in a well-defined bullish trend, supported by a rising trend line that has guided price action from the recent pivot low. After an initial consolidation phase, price broke out of

US30 H1 | Bullish ContinuationMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 48,426.11

- Overlap support

- 38.2% Fib retracement

Stop Loss: 48,229.27

- Overlap support

Take Profit: 48,687.99

- Swing high resistance

- 100% Fib projection

High Risk Investment Warning

Stratos Markets Limited (tradu.c

Rare Double Head & Shoulders After an Uptrend Market Context

After a sustained uptrend, price started to lose momentum and formed a classic Head & Shoulders pattern. What makes this structure interesting is that the market did not reverse impulsively — instead, it developed a second Head & Shoulders formation shortly after the first one.

Silver Price Hits a Record High Near $72Silver Price Hits a Record High Near $72

On 12 December, we noted that silver had climbed above $60. It took the market less than two weeks to advance further and clear the next psychological milestone at $70.

Today, XAG/USD reached $72, extending the sharp rally that began in the autumn. Gold pr

TRU Retesting Broken Falling Wedge SupportTRU previously formed a falling wedge during a prolonged bearish phase. That structure has now resolved to the downside, with price breaking below the wedge support and accepting lower levels.

After the breakdown, price is currently retesting the former wedge support, which has now flipped into res

Nvidia (NVDA) Shares Rise On Potential Chip Shipments to ChinaNvidia (NVDA) Shares Rise On Potential Chip Shipments to China

According to Reuters sources, Nvidia has informed Chinese clients of plans to begin shipments of its H200 chips by mid-February 2026. This has been made possible by a recent change in US export policy, which allows the sale of advanced

NZDUSD H4 | Bullish Bounce Off PullbackMomentum: Bullish

Price has bounced off the buy entry, which is acting as a pullback support. This level aligns with the 38.2% Fibonacci retracement, adding significant confluence and strength to the zone.

Buy Entry: 0.5743

Overlap support

Slightly above the 38.2% Fibonacci retracement

Stop Loss:

XAUUSD (H1) – Trading by LiquidityXAUUSD (H1) – Trading by Liquidity

Price breaks the channel but buying power is weakening, wait for a pullback to the trendline to enter a trade

Summary of today's strategy

Gold has broken the price channel, but the key point is that buying power is weakening after the breakout. As the market is a

Price Is Rising Fast, but the Key Move Lies in the Pullback to 4Hello, I'm Domic.

Looking closely at the H4 chart, gold is currently in a very strong acceleration phase. A steep sequence of bullish candles has pushed price into the 4.48xx area, while both trendlines on the chart are clearly sloping upward. This confirms that the uptrend remains dominant, but i

See all editors' picks ideas

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

Breakouts & Pullbacks [Trendoscope®]🎲 Breakouts & Pullbacks - All-Time High Breakout Analyzer

Probability-Based Post-Breakout Behavior Statistics | Real-Time Pullback & Runup Tracker

A professional-grade Pine Script v6 indicator designed specifically for analyzing the historical and real-time behavior of price after strong All-Ti

See all indicators and strategies

Community trends

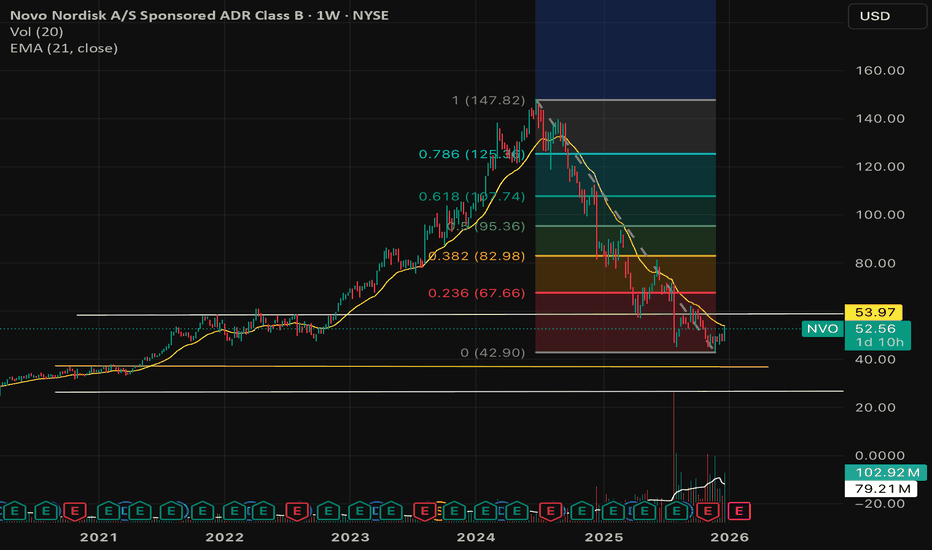

Novo Nordisk (NVO) 1WI’m looking at the weekly NVO chart as of late December 2025, and this is no longer about fear or headlines. It’s about structure and valuation. After a powerful multi year rally from 2022 to 2024, the stock went through a deep and healthy correction. In 2025, price built a strong weekly demand base

AVAV – Higher Timeframe Demand Holding While Daily Shows Early ROn the Weekly and Monthly charts, #AVAV is currently reacting from a well-defined higher timeframe demand zone (around 220–260).

This zone previously acted as a strong base before the impulsive rally, making it a high-probability support area.

Price is also hovering around the HTF 20-period moving

$NVO is 2026 top trade idea. Offers risk adjusted 50-100%- NYSE:NVO has most likely bottom and offer 50-100% upside from ~$50ish level.

- Weight loss technical addressable market is exploding. People are getting weight & fat conscious.

- Weight loss pill will make it accessible for lot of people. It's quite easy to consume than injectables.

When Fundamentals and Structure Align | EXAS Case StudyTechnical structure aligning with fundamental developments

Price first reacted from a well-defined support zone (April), where buyers stepped in following strong fundamentals. However, buying pressure was not sufficient to break the key resistance, leading to a pullback.

Price returned to the sam

NIO: Major Bullish Reversal from Key Support – Targeting $8.71Technical Analysis: NIO is showing strong signs of a bottoming formation after a long corrective phase. The price is currently hovering around a critical demand zone (Support) between $4.65 - $4.90.

Key Observations:

Double Bottom / Support Hold: The chart shows a successful retest of the long-ter

$NVO Quality GIGA-LONNNNNNNGGGGG!!!This is a weekly of NVO, a global leader in pharmaceuticals addressing issues like obesity, diabetes, among other things. Ever hear of Ozempic? This company makes it. They also have other products in their pipeline which intend to capitalize on these growing epidemics, such as the recently approve

TSLA Weekly Liquidity zonesSmart money got retail traders to short below the sideways channel, me included, then they push it to new highs to get retail traders to buy so they can get their liquidity to sell into. They are using the round number 500 to trap traders as they break above and then below it. I'm expecting an ex

See all stocks ideas

Today

CTXRCitius Pharmaceuticals, Inc.

Actual

−0.01

USD

Estimate

−0.43

USD

Today

RICKRCI Hospitality Holdings, Inc.

Actual

—

Estimate

1.81

USD

Today

CETXCemtrex Inc.

Actual

—

Estimate

—

Today

IMMRImmersion Corporation

Actual

—

Estimate

0.10

USD

Today

BNEDBarnes & Noble Education, Inc

Actual

—

Estimate

—

Dec 31

JVACoffee Holding Co., Inc.

Actual

—

Estimate

—

Jan 1

LFCRLifecore Biomedical, Inc.

Actual

—

Estimate

−0.14

USD

Jan 1

PKEPark Aerospace Corp.

Actual

—

Estimate

—

See more events

Community trends

Bitcoin - Channel no one talks about! (new Year's crash!)Bitcoin's price and development (code) are completely controlled by banks and government. They already have a roadmap on Bitcoin price, so they know what the price will be in 2030. Bitcoin technology is great for total control because all transactions are public. How to profit from that? First of al

SOLUSDT may continue its trend after correctionSOL is falling. Downward trend. A cascade of resistance is forming. At the moment, the price is testing the 121 level from D1. I expect a pullback due to a local change in the imbalance of forces after a false breakout of support and a subsequent fall from the 123-124 zone to 116.

Any upward pullba

BTC/USDT | More Downside Ahead? Let's Discuss in the Comments!Bitcoin climbed back to $90,500, tapped resistance, and is now trading around $87,800. This bounce looks more like a classic liquidity grab than a trend reversal. I’m still leaning bearish. As long as $90,000 doesn’t flip into solid support, we’re likely heading lower. My next downside targets: $85,

BITCOIN Merry Christmas with symmetry at its very best!First of all allow me to wish everyone Merry Christmas with Tradingshot's best wishes to everyone for great health and prosperity!

Now as far as Bitcoin (BTCUSD) is concerned, this chart on the 1W time-frame displays once more its symmetry among Cycles at its very best.

They key component here is

Elise | BTCUSD | 30M – Distribution → BOS → Liquidity SweepBITSTAMP:BTCUSD

The sell-side liquidity sweep produced a technical bounce; however, price has failed to reclaim key structure or break descending resistance. This indicates a corrective retracement, not accumulation. Until a bullish structure shift occurs, downside continuation remains the higher-

Bitcoin Price Update – Clean & Clear ExplanationBitcoin is currently showing weak price behavior after failing to hold above key resistance levels. Earlier, the market was in an uptrend, supported by a rising trendline. However, price has now broken below this trendline, which is an early sign that bullish momentum is fading.

The price faced str

BTCUSDT: Buyers Defend 86K Support, Upside in FocusHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT has shifted its structure after breaking out of a prolonged Downward Channel, signaling a loss of bearish control and the start of a stabilization phase. Following the breakout, price entered a broad range,

BTC/USD Analysis – December 24, 2025HI!

Bitcoin is showing signs of potential bearish pressure, but confirmation will depend on how price behaves around the critical support zone.

Key Observations:

Critical Support Zone: The blue area on the chart (~$78k–$79k) represents a major support level. A breakdown below this zone could

After Intense Selling Pressure, Bitcoin Starts to StabilizeHello, Camila here!

Observing the chart at the current moment, Bitcoin remains in a short-term downtrend. Price has gone through a strong and decisive sell-off, and after being firmly rejected at a key resistance zone, the market has started to move sideways and consolidate, showing early signs of

See all crypto ideas

GOLD - Hunting for liquidity ahead of growth. Focus on 4475FX:XAUUSD reached a new historic high of around $4,525. However, profit-taking is causing a correction, with the 4,475-4,470 range being the area of interest in the bull market.

The dollar is weakening, with the market anticipating two rate cuts in 2026. Geopolitical risks are supporting deman

XAUUSD Maintains Support – Buyers Eye $4,560Hello traders! Here’s my technical outlook on XAUUSD (Gold, 2H) based on the current chart structure. Gold continues to trade within a well-defined ascending channel, confirming a sustained bullish market structure. After a prolonged consolidation phase (range) on the left side of the chart, price s

Lingrid | GOLD Compression Then Acceleration in Bull MoveOANDA:XAUUSD remains firmly inside a rising channel after breaking above the previous all-time high, with the former resistance now acting as dynamic support. Price recently paused near 4520, but the structure still shows higher highs and higher lows, suggesting continuation rather than distributio

Gold Hits ATH Before Christmas — Is a Correction Coming?🎄🎄🎄 Merry Christmas, Traders! 🎄🎄🎄

Wishing you a joyful Christmas filled with good vibes, calm markets, tight stop-losses, and charts that respect your levels😄.

May you spend this season with your family, loved ones, and everyone who truly matters — away from stress, noise, and overtrading.

Enjoy

Gold 1H – Smart Money Traps Form Near 4540–4450 Range🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (23/12)

📈 Market Context

Gold remains structurally bullish on the higher timeframes, but price is now trading inside a compression zone after a clear impulsive expansion. With year-end liquidity thinning and traders positioning ahead of fres

XAUUSD: Bullish Trend Holds FirmLooking at the XAUUSD H3 chart at the current moment, I can clearly see that the bullish trend remains well intact. The previous upward moves were not random but supported by active buying flow, as reflected in the market’s ability to consistently maintain higher highs and higher lows. After each pu

Gold Continues to Maintain Its Bullish Streak Into Year-EndHello everyone,

Today, OANDA:XAUUSD is taking a pause during the Christmas holiday period, currently trading around 4,479 USD. Although slightly lower than the previous session, gold continues to hold a strong high-price base after a powerful rally, driven by rising safe-haven flows, escalating

XAUUSD: Buyers Defend Structure – Retest 4,520 Resistance AheadHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a strong bullish structure after successfully breaking out of a descending triangle and confirming a shift in market control from sellers to buyers. The initial breakout was followed by a cons

Elise | XAUUSD | 30M – Trend ExhaustionOANDA:XAUUSD

After failing to hold above recent highs, XAUUSD formed lower highs and lower lows on the 30M timeframe. Price remains capped below descending resistance, suggesting sellers are active during pullbacks while buyers are stepping aside temporarily.

Key Scenarios

❌ Bearish Pullback Cont

(USOIL) 2H – Bullish Continuation After Trend ReversalThis 2-hour chart of WTI Crude Oil (USOIL) shows a clear transition from a prior downtrend into a structured bullish recovery. After forming a base near the mid-$55 area, price breaks structure (BOS) and establishes a steady uptrend, guided by an ascending channel.

The Ichimoku Cloud supports the b

See all futures ideas

EURUSD Long: Trend Line Support Keeps Buyers, Move to 1.8200Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. EURUSD is trading in a well-defined bullish trend, supported by a rising trend line that has guided price action from the recent pivot low. After an initial consolidation phase, price broke out of

Rare Double Head & Shoulders After an Uptrend Market Context

After a sustained uptrend, price started to lose momentum and formed a classic Head & Shoulders pattern. What makes this structure interesting is that the market did not reverse impulsively — instead, it developed a second Head & Shoulders formation shortly after the first one.

EURUSD: The Uptrend Remains Intact – BUY Still Holds the AdvantaHello everyone, below is my view on today’s EURUSD outlook.

From a fundamental perspective, the overall backdrop continues to support the euro. The U.S. dollar remains under pressure as expectations for U.S. interest rates weaken, despite occasional short-term technical rebounds. The key point is t

EURUSD H1 OutlookEURUSD H1 Outlook – Bullish Continuation While Holding 1.177 Support (Key Levels + Trade Plans)

EURUSD on the H1 chart is trading in a bullish continuation phase after a clean impulse leg from the 1.170 base. Price has transitioned into a tight consolidation under the recent highs, and the market is

EURUSD: Bullish Structure Holds Inside Upward ChannelHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD has confirmed a bullish structure after breaking out of the previous Downward Channel. This breakout shifted market control to buyers and initiated a steady move higher. Price is now trading within a well-def

EUR/AUD Daily Outlook – Key Technical Setup 📈🔥

The EUR/AUD pair has been moving sideways on the daily timeframe, trading within a falling wedge pattern 🔻. Recently, price action bounced strongly from the lower boundary of the wedge, coinciding with a key support zone at 1.7444—a reaction that adds weight to a potential bullish reversal.

📌 B

Lingrid | AUDCAD Bullish Entry in Sideways MarketFX:AUDCAD perfectly played out my previous trading idea . Price has completed a corrective drop from the 0.9245 supply zone, unwinding bullish momentum and sliding back into the 0.9130 demand area. The decline stalled near the rising trendline, where price printed a higher low, hinting that sellin

AUDUSD – H4 Analysis ....AUDUSD – H4 Analysis (based on My chart)

Market Structure

Clear uptrend (higher highs & higher lows).

Price is above the trendline and above Ichimoku cloud → bullish continuation.

Previous resistance zone has flipped into support (yellow zone).

📈 Buy Setup

Buy Zone: 0.6680 – 0.6710

🎯 Target Points

T

USDJPY Approaches Key Sell Zone at 156.60!!Hey Traders,

In today’s trading session, we’re closely watching USDJPY for a potential selling opportunity around the 156.600 zone.

From a technical perspective, the pair remains in a clear downtrend. Price is currently in a corrective rebound, retracing toward a key trendline and support/resistan

EURUSD Awaiting Confirmation Before Bearish ContinuationQuick Summary

EURUSD has rallied strongly in recent days leaving a clear liquidity void below price .. A break above 1.18039 is expected first After that a bearish structure is required to confirm that the upside move is complete and that price is ready to target lower levels

Full Analysis

After

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.