📌Fibonacci & FIBO retracement❗✳️The author of the Fibonacci series of numbers was the Italian mathematician Leonardo Pisano. The series has been known for centuries for this series of numbers: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89 and so on until infinity. The number is calculated by the sum of the two previous numbers.

This numerical relationship has also been used on the financial markets for a century.The number Phi is of particular importance. Phi was created from the golden ratio. The golden ratio is the ratio of two numbers, the higher number is the numerator and the lower number is the denominator. The result is always around 1.618. Below is an example:

a = 0.618

b = 0.382

0.618/0.382 = 1.618

Golden Ratio: 0.618 + 0.382 = 1,000

🔶🔷It's all about resistance and support:

The Fibonacci retracement is a method of finding potential resistance and support zones in an underlying asset. It is based on the idea that a predetermined portion of a move from a price will bounce back. After that, the price will continue in the “real” direction. Often a correction corrects a Fibonacci percentage of a previous wave. From experience, the most common retracement levels are 38.2%, 50%, and 61.8%. These levels are watched by most analysts because they represent potential market reversal points.

🔴As an example, this chart depicts the rally of BITCOIN towards its ATH . The price drops right back to the 23.6%, after which the price stabilizes and continues in the uptrend

🔵The next chart shows the ETHUSDT on the 4H chart. As we see, the price is going back to the 23.6% and then 38.2% zone, but it failed to stabilize and falls to the next 50% retracement level and returned . Prices recovered and made a new high, continuing the previous uptrend.

⚪Fibonacci Analysis allows you to determine the support and resistance levels of a price correction and more importantly helps you find price targets and potential reversal points Almost in any market

for instance in the past rally for ADAUSDT, I used Fibonacci to determine the possible targets, and it exactly worked:🎯🏹

🔰How to draw Fibonacci retracements on the chart:

It is best to use candlestick shadows so that the analysis includes the extremes of market sentiment. Most of the time the difference is not significant, but sometimes it is crucial. The example below shows how the Fibonacci retracement was drawn to the shadows of the candlesticks from the trend low to high.

The measurement should be in the same direction as the price movement. After the measurement, the horizontal lines can be seen in the chart. These lines are potential support and resistance levels.

🔰Fibonacci retracement as part of trading strategy:

Fibonacci retracements can be very efficient for timing a trend. This method is often used by traders as part of trend strategy. With this strategy, traders monitor key price levels within a trend. This means they buy when the market is going up and sell when it is going down. Traders try to place orders in the same direction as the original trend (less risk). In this scenario, you assume that the price has a certain probability of bouncing off the Fibonacci levels and moving back in the direction of the main trend. In our example, the price dropped to the 38.2% level before correcting again. The probability of a turning point in the market increases sharply,

🔰Powerful and sometimes useful:

Fibonacci retracement is a powerful tool and useful because it often marks reversal points with uncanny accuracy. Because of this, it should be used in conjunction with other indicators to identify potential trading opportunities. also There are five types of trading tools that are based on Fibonacci's discovery: arcs, fans, retracements, extensions, and time zones and ... . The lines created by these Fibonacci studies are believed to signal changes in trends as the prices draw near them.

Fibonacci

Take Profit Screener Tutorial (EN)Hi all,

I'm going to introduce you to the Take Profit Screener tool.

It allows you to manually scan your watchlist so to determine at a glance the assets that would give you the best profitability potential.

It is a 2 in 1 tool that allows you to :

identify where your Take Profit ratios are located whether you are in SHAD or Cycle Strategy

identify the potential reward percentages when approaching the key Fibonacci levels

Thanks for watching

Waiting for your feedback.

enjoy ;-)

Take Profit Screener tool v2Hi all,

I'm going to introduce you to the Take Profit Screener tool.

It allows you to manually scan your watchlist so to determine at a glance the assets that would give you the best profitability potential.

It is a 2 in 1 tool that allows you to :

identify where your Take Profit ratios are located whether you are in SHAD or Cycle Strategy

identify the potential reward percentages when approaching the key Fibonacci levels

FHZN - The power of elliot waves | Volume 2The zurich airport is tough, but in the coming months this toughness will be tested once again! SIX:FHZN

Our last analysis on this share was published on January 12, in which we warned about a potential sell-off.

In this analysis we highlighted the importance of the wedge formation to our subscribers. In the last days the stock fell by more than -20% and we have now left this formation.

Today zurich airport published its earnings and based on them we can evaluate the progress of the company.

The airport was able to slightly reduce its net loss in the past year but disappointed investors with lower revenues than expected .

Revenues were just under 680 million , which is about half of what they were before the Corona crisis. The management announced that a full recovery to the pre-crisis level of 2019 is not expected until the end of 2025. Investors will have to be patient with the company and as most assumed there won't be a dividend payout again this year. This however gives the management the opportunity to direct the money to where it's most needed.

Overall, the airport is recovering in small steps from the shock of the Corona crisis.

The upcoming years will bring further difficulties, but the management will concentrate on navigating the company back to profitability.

Technical explanation of the elliot wave structure:

As mentioned above, the share price has fallen by almost -20% since we last warned of a sell-off. We as Mendenmein Capital see this as another confirmation of our calculations.

Nevertheless, we assume that the share has now expanded a first downward impulse in the white wave (1) and in the coming weeks a slight recovery must be expected in the white wave (2). This wave will lay the foundation for further sell-offs and the target for the next year is located at just 95 swiss francs. The white wave (3) should be able to reach this target without any problems.

After a short recovery in the white wave (4), a final wave (5) will continue to correct towards our final target of 80 swiss francs. We assume that this downward impulse will occupy us in the coming months and years.

In the long term however, we are extremely bullish and the formations of the last years point towards a very large wave I / wave II super cycle. This means that we have a multi-year bull market ahead of us after the completion of wave II, our subscribers are familiar with this term by now. The long-term price target for this stock is 450.- and we at Mendenmein Capital are extremely confident in our optimistic views.

On our website investors can learn more about the zurich airport share and other stocks! www.mendenmein-capital.com

Disclaimer:

According to legal regulations, Mornau-Research is not a certified or legally recognized financial advisor and any transactions based on published content are at your own risk.

Mornau-Research cannot be held liable for any losses whatsoever according to the legal regulations in it's country of residence.

===============================================================================================================

If you have questions related to a specific stock or the Elliot Wave theory, feel free to contact us.

The 6-Candle RuleThe 6-Candle Rule can be applied to any time frame chart of the traders choosing. 60 minute chart means that we have 6 hours for this trade to start moving. If the short is entered in that area and price doesn't begin to move down, we'd then make the adjustment. If the level is identified on a 15 minute chart, then we’d manage the trade after 90 minutes (6 15-minute candles).

One of the biggest questions that I hear often from traders are questions about finding the perfect entry, and a close second is how to place stops and targets once that order has been entered. While entries, stops, and targets are of the utmost importance, something that I’m typically missing is how to manage the trade once I’m in and before it hits either the stop or the target. Ultimately, this comes back to understanding the power of time.

Any trader who's ever gotten into a position that has “stalled” after entry knows what I’m about to describe. The feeling of dread that creeps in, leaving only a sliver of hope because everything in their gut tells them it’s all about to go against them. This is the point where many traders stay in, having a rule that says to stay in no matter how long it takes to hit the stop or target. This then causes emotional stress that’s only compounded when the stop is hit and the trader feels like they should have gotten out earlier. Over time it may cause a trader to jump out because they feel like they’ve gotten burned, only to see price just before it makes the move you thought it was going to make anyway.

If this sounds like you, don’t feel alone! I’ve seen this in more people that I can count, but there’s a rule to help fix it. The rule is called the 6-Candle Rule. The 6-Candle Rule is pretty simple and consists of 3 parts:

1. Upon entry of the trade, if 6 candles on the entry timeframe have passed without price starting to move in the direction of the target, we have to make an adjustment.

2. If the trade is currently profitable, this is the time to move the stop to breakeven and leave the trade open. This gives the trade time to work, but removes the risk of the position.

3. If the trade is currently in the negative but has not yet hit the stop, close the position and move on.

The 6-Candle Rule can completely transform your trading . The rules will take some discipline to implement, but it can be a total game changer to your trade management. The rules are not set in stone set for you to follow but the idea is if you implement a framework for trade management of current open positions, the impact will be a positive one! This will be different for every individual trader/TF/Risk tolerance etc etc etc

FX:EURUSD

👍

how does the price move? 📖💡The movement of the price is depending on supply and demand

What is supply?

Amount of the product or output that the seller wants to sell with the certain price

What is demand?

Amount of the product or output that the buyer wants to buy with the certain price

for a better understanding of the concept of supply and demand, let's start with a simple explanation and example for home auction and after that, we will explain more for financial markets

first scenario

one seller and more than one buyer

in this scenario, demand will surpass the supply and make competition for better and more price of buying for one product

and this competition of the increasing of the price continues till one of the buyers still be willing to buy the product with a higher price

second scenario

one buyer and more than one seller for the same product

in this term, supply surpassed the demand and make competition for the lower price of selling the same product

and this competition of decreasing the price continues tills none of the sellers be willing to sell the product with lower price

and there are some exceptions that are none of our concern

about the financial market, we are dealing with a double auction

in this term, we are dealing with more than one seller and more than one buyer of the product or output

that both groups offering the price for their desire so at the same time we have a different price for one stock and the way to have successful buy or sell position is that buyers increase their price to reach to the seller's price or sellers decrease their price to reach to buyer price

and our other option can be

that traders decide to buy or sell without any paying attention to orders, lines, and price and just wants to be entered or exit to the market

so

with every available price automatically, they reach their request

we will explain more in our next tutorial

Please, feel free to ask your question, write it in the comments below, and I will answer.🐋

TYPES OF FIBONACCI's & WHEN TO USE THEM 📐📏

Hey traders,

In this article we will discuss two very popular Fibonacci tools:

Fibonacci retracement and extension.

1️⃣Fib.Retracement tool is applied to identify a completion point of a retracement leg within an impulse.

As you know price action has a zig-zag form.

For example, in a bullish trend, the price tends to set a higher high then retrace and set a higher low before going to the next highs.

In a bearish trend, the price tends to set a lower low and retrace to a lower high.

With retracement levels, we are trying to spot the point from where the next impulse in a bullish or bearish trend will initiate based on the last impulse leg.

Fib.levels that we will apply are:

✔️0.382

✔️0.5

✔️0.618

✔️0.786

The retracement levels will be drawn based on XA impulse leg.

From its low to high if the impulse is bullish

and from its high to low if the impulse is bearish.

From one of the above-mentioned levels, a trend-following movement will be expected.

One should apply different techniques to confirm the strength of one of these levels.

2️⃣Fib.Extension tool is applied to identify a completion point of the impulse.

In a bearish trend, the extension levels will indicate a potential level of the next lower low based on the length of the last bearish impulse.

Fib.levels that we will apply are:

✔️1.272

✔️1.414

✔️1.618

The extension levels will be drawn based on XA impulse leg.

From its low to high if the impulse is bullish

and from its high to low if the impulse is bearish.

From one of the above-mentioned levels, a retracement leg will initiate.

One should apply different techniques to confirm the strength of one of these levels.

Of course other ways of application Fib.Retracement and Extension levels exist. However, these two are the most common.

How do you use these levels?

❤️Please, support this idea with like and comment!❤️

USDT.D Daily Analysis🟢USDT's dominance bounced from the uptrend line support to form a twin floor pattern and is now above the neckline of this pattern, which also acts as a support. If the retest is successful, it is expected to move upwards, which will be a sign of decline for the market because the USDT and BTC dominance are inversely related to each other.

Use the appropriate loss limit for your trades, which has a very high possibility of emotional movement in the market.

⚠ This Analysis will be updated.

Amir Hossein

📅 02.19.2022

⚠️ (DYOR)

Stochastic Retracement Lines

Welcome Back

Please support this idea with LIKE if you find it useful.

**********************************************************

Hello....

after I tested this new indicator a lot .. and i found it very useful to find the best key lines on the chart I decided to share it here....

the indicator is depending on stochastic momentum to collect the strongest lines on the chart and draw the lines depending on it ....

and I found this stochastic retracement on this level:

0.9

0.5

0.2

0

-0.2

-0.5

-0.9

and this levels can lead us to get that confirmation to open our new positions....

===========================================================================

and it works with all time frame ....

The Power of using NPOCS on your Charts BTC/USDA Naked Point of Control is an untested point of control which is either time based or volume based and exists in the current market structure.

These NPOCS can serve as excellent targets for trades as well as potential areas of support and resistance dependent upon the NPOC's profile distribution.

I have marked this Bitcoin Chart with Daily , Weekly and Monthly NPOCs and using the boxes I have demonstrated how powerful NPOCS can be

when incorporated into a trading strategy for Scalps Daytrades and Swing setups.

I use NPOCS with other confluences mainly Fib levels and order flow and the respect for these levels is well worth noting .

I hope this information helps you define a strategy for your trading as utilizing these correctly will boost your ROI.

Whatever the case thanks for viewing my work and be sure to like and follow .

Two Types of Elliot Wave CorrectionsWhen it comes to Elliot Wave Theory, we know of two different correction patterns .

On the left you can see the classic correction, which is less common in real market situations. On the other hand, the flat correction (right) occurs more frequently in the market, since modern price action is often characterized by fakeouts . In this case, a fakeout looks like a wave B making a new high above wave A. In most cases, traders would open a trade here due to a structural break, which then runs against them (bull or bear trap).

In the following table you can see how the respective correction patterns differ from each other and what you need to pay attention to.

It is very important that you learn how to use Fibonacci tools correctly so that you can calculate the wavelength properly. Maybe I'll do a separate educational post on the proper use of those tools in future.

Thank you very much for your attention,

Your RT

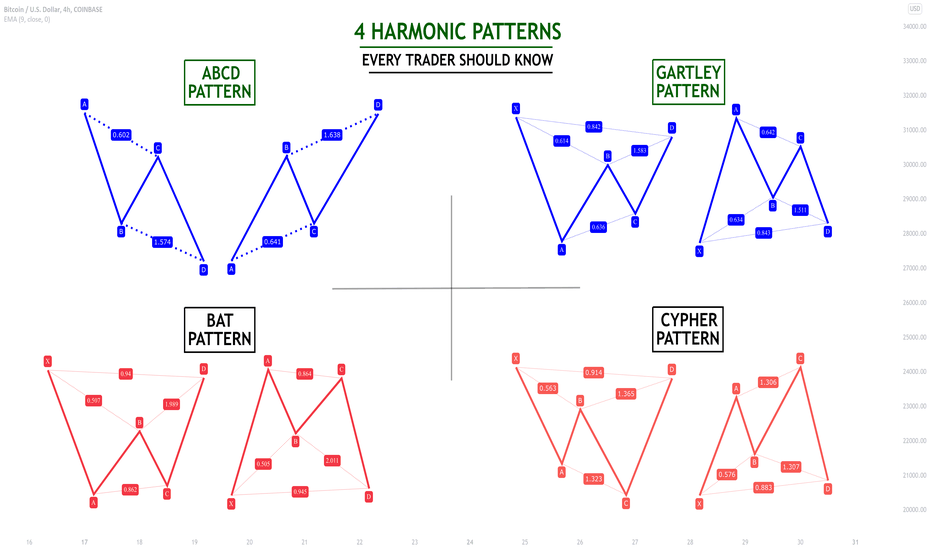

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️

NYSE Comp: Broadening Top Potential Macro WarningThe NYSE composite has spent the last year building a classic broadening top pattern. The pattern develops as strong hands distribute to weak hands, and when it occurs, often marks a transition from bull to bear.

1. Broadening formations are relatively rare and because the pattern itself is difficult to trade systematically (as the boundaries are continually moving farther apart) aren't given a lot of attention in literature.

a. Edwards and Magee in their seminal "Technical Analysis of Stock Trends" suggest that the broadening top, as a rule, only appears near the end or in the final phases of long bull markets.

b. Shabacker in his classic "Technical Analysis and Stock Market Profits" also remarks that the pattern is rare, but extremely important, often marking an important transition from bull to bear.

2. In my experience both Shabacker and Edwards and Magee are correct. They are rare and generally very hard to trade (so I don't bother) but they do offer an important warning of a potential phase transition.

3. Note that the pattern isn't always well defined, with overthrows and underthrows of the pattern boundaries occuring regularly. This is what makes it hard to trade or design a trading strategy around.

a. The pattern is extremely compelling when it appears in individual equity charts.

As I see it, these are the important chart elements.

1. The composite broke the trendline from the March 2020 low. This changed the weekly trend from up to neutral.

2. After breaking the trendline, the Comp spent most of the next year moving laterally and tracing out a clear broadening formation, warning of a potential phase transition.

3. Over the last few weeks the Comp violated the rising trend line (marked on the chart) along the last three internal trend line lows, and accelerated to the lower boundary of the pattern.

4. I have included the 10 and 40 week moving averages. The two averages are roughly equivalent to the 50 and 200 day averages. Note that the 10 has rolled over and is moving to meet the flattened out 50. Often a narrowing between two moving averages marks an important market decision point. Its interesting that it is occuring at the very moment when the broadening formation appears to be nearing a conclusion.

5. If the market does begin to breakdown there are several initial move targets that can be constructed. I like to look for confluences of move targets and chart supports. The more the merrier.

a. I like to overlay the .382, .500 and .618% retracement targets first.

b. Next I locate chart supports. In this case, the area around the 14183 high from early 2020 can be expected to generate at least some buying interest.

c. There is also a measured move target that can be generated using the width of the broadening top, it projects to roughly 14400.

d. 14089 is the .382% Fibonacci retracement.

6. The support confluence provided by the pivot, the Fibo and the measured move suggest an initial support zone between 14089 and 14400. I would clearly watch this roughly 2% wide zone for reversal behaviors to either reduce shorts or perhaps, if the right behaviors develop, consider new longs.

But again, the MAIN point is not so much generating trading targets as recognizing the pattern as potentially a harbinger of an important trend change. This is particularly important against the context presented in the macro overview posts of the last few weeks.

Good Trading:

Stewart Taylor, CMT

Chartered Market Technician

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

Pulse of an asset via Fibonacci: NDX dip at minor Impulse Redux"Impulse" is a surge that creates "Ripples", like a pebble into water.

"Impulse Redux" is returning of wave to the original source of energy.

"Impulse Core" is the zone of maximum energy, in the Golden Pocket.

Are the buyers still there? Enough to absorb the selling power?

Reaction at Impulse is worth observing closely to gauge energy.

Rejection is expected on at least first approach if not several.

Part of my ongoing series to collect examples of my Methodology : (click links below)

Chapter 1: Introduction and numerous Examples

Chapter 2: Detailed views and Wave Analysis

Chapter 3: The Dreaded 9.618: Murderer of Moves

Chapter 4: Impulse Redux: Return to Birth place <= Current Example

Chapter 5: Golden Growth: Parabolic Expansions

Chapter 6: Give me a ping Vasili: one Ping only

.

.

Ordered Chaos

every Wave is born from Impulse,

like a Pebble into Water.

every Pebble bears its own Ripples,

gilded of Ratio Golden.

every Ripple behaves as its forerunner,

setting the Pulse.

each line Gains its Gravity .

each line Tried and Tested.

each line Poised to Reflect.

every Asset Class behaves this way.

every Time Frame displays its ripples.

every Brain Chord rings these rhythms.

He who Understands will be Humble.

He who Grasps will observe the Order.

He who Ignores will behold only Chaos.

Ordered Chaos

.

.

.

want to Learn a little More?

can you Spend a few Moments?

click the Links under Related.

Get major S&P trading levels through Pitchfan!Hey everyone, how are you all?

Let’s discuss Pitchfan and Fibonacci Channel on S&P 500. There are some bearish news in the market. The news includes Federal Reserve’s stance on increasing the interest rates, making investors shifting into the bond markets. Netflix down by 22%. Your trades should always respect the fundamental analysis. Don’t try to go against it.

Market Condition:

S&P Index has been in a massive uptrend, giving around 120% returns from its previous low on 20 March 2020. It has been in uptrend since March 2020, having few corrections. But, with Pitchfan, we can catch all these corrections with high accuracy.

Pitchfan

Pitchfan is a mixture of Fibonacci Fan and Pitchfork. It uses both of their levels and has some features of Gann Fan too. The red coloured line is the median line which is the main support and resistance line. The other lines have importance according to Fibonacci’s rules. Main lines are 0.382, 0.5, 0.618. We have kept 0.25 because it is the median of the red line and the 0.5 level of Fibonacci. You can use my levels through the picture in the chart.

How to draw a pitchfan?

Pitchfan is drawn at the starting of a trend. Here, the market was consolidating before entering into the uptrend. A is the the first low of the trend, B is the next high and C is the next low. It can be drawn on the higher timeframes. Refer to the image below.

How to trade these levels?

These lines are the major points where the trend reverses on the lower timeframes. We can use these levels to trade. You need to check two things to get the direction of the trade:

The current trend matches on both the higher timeframes and the lower timeframes.

The news is in the same direction as your trade.

After this, you have to get the best entry. For this, you need to get these three confirmations:

Candlestick Pattern

Fibonacci Retracement or any Chart Pattern

RSI or any other Oscillator

Check out the below chart image to get the perfect entry:

Observations:

Price will touch these lines in 70% of the cases. Price might not touch these lines in 30% of the cases due to sentiments or any other driving factor.

When price passes by any major level, it will always take a pullback on the lower timeframes. You may trail your stop loss or enter into the trade by checking out the pullback.

Targets?

Target can be the next line coming in the direction of the trade. Always have RR of 3 or more. You can always trail the stop loss after checking out for the pullback on the lower timeframes.

Always check the news before carrying your positions overnight.

S&P might bounce back from the yellow level, from the blue demand zone. If it breaks it, our target will be the red median line.

Fibonacci Channel:

Fibonacci channels gives the major turning levels too. Here, you can see the price is bouncing back from the 0.5 to 0.618 levels, and it has happened multiple times. You can take confirmations on the lower timeframes and take the trades accordingly. Do let me know if you want to learn how to make it.

Looking at the Forest, not the trees.Currently we're at a secular resistance level where the prices have reached the top of the uptrend channel. Signaling a painful, but necessary correction.

Price Structure.

The SPX has had a solid uptrend right after the recovery from 2009, this sets the start of the Bull market, so the 0.0 Fib level. Consequently it sets the the 0.618Fib level at the peak reached in 2007.

Four main Fibonacci levels:

2007 : 1652 (0.618 Fib)

2015 : 2243 (1.0 Fib)

2019 : 3105 (1.618 Fib)

2021 : 4400 (2.618 Fib)

Important Support/Resistance Levels to watch in the leg range (2191 - 4818):

0.764 Fib: 4171

0.618 Fib: 3792

0.5 Fib : 3485

After the market downturn and the recovery in 2009 an uptrend started that reached a new All Time Highs (ATH) in 2013, when the market tested the double top and broke out the range (RBO) to the upside to continue its path to a new ATH. It reached 1.0 Fib on 2015 when the perception of the market was that it was stalling, 2016 was a presidential election year, and Trump was gaining terrain but the market kept an eye on the events to take a decision. After the election the market resumed its uptrend, making HH-HL, and reaching new ATH. The trend was meaningfully dipped twice, which basically it was a retesting of the support through a painful correction that wiped off the four year gains. The current leg started after the near Zero interest rates set by the Fed. The level is currently at 2.618 Fib referred to the start of this Bull market in 2009. This usually signals a resistance and a test of the 1.618 Fib levels and everything in between, depending on how the markets are still wanting to buy the dip, which has been the constant since 2009.

There are some curious facts I found on this analysis, from 2004 and until until 2007 the market entered a rally, the interest rates were raised until it reached 1500 points, where the interest rates started to go down, unemployment started to go higher and the market hit an ATH. I set this point in the chart as 0.618Fib. When it hit bottom in 2009 the interest rates were at near zero and it started the bull market we're at in this moment. The interest rates started to go higher when the unemployment was at 5%, which signals a recovery. It was on 2015 when it peaked and it coincidentally hit the 1.0Fib referred to the previous ATH in 2007. The market continued and when the interest rates stopped going higher the market hit a new ATH in 2019, at this time the market hit a 1.618 Fib, the unemployment was at its very low level of 3.50, which again signals a very well recovered economy, and all of a sudden the pandemic put a halt in the economy and the unemployment spiked to 14.70, and the interest rates backed down to 0.25%. This market did the "V Shape recovery" and skyrocketed to 2.618Fib (4,500) where it has been dancing around.

If the pattern repeats itself then we could expect a technical level where the interest rates should start to go higher, this market should make a necessary correction and continue its uptrend. I forecast a correction back to 3000, where the technical level of 1.618 was reached. I have seen this kind of acceleration pattern before, as you can see the slope, which can be spotted in the middle line of the uptrend channel goes at a speed of 2.5 points per week and the legs had a slope of 7.2 points per week, meanwhile after the V shape recovery it accelerated to a speed of 26 points per week, almost 3x what it had been the normal speed, and it jumped from the lower part of the uptrend channel to the top of the upper resistance trend channel. Usually when we see this behavior the pattern is that it goes back to retest the previous resistance level, which basically would take it back to 3000. Of course several economic and monetary factors have to be involved for the market to do this kind of correction, it depends on the Fed who has to assess the unemployment rate, the inflation, GDP, fiscal policies, there's no magic number.

This market needs a correction so new buy opportunities at a discount can be created and this market smells like it's the time to cash out. These are not predictions, those are patterns and patterns tend to repeat in time.

"Patterns repeat, because human nature hasn't changed for thousand of years".

~ Jesse Livermore

Illustration of Logarithmic Fibonacci LevelsThis chart illustrates the differences between the linear Fibonacci retracement levels that are generated by the TradingView tool and the Fibonacci retracement levels generated logarithmically (in orange).

For example, retracing 61.8% from the high is computed using the following:

e^(((ln(high) - ln(low)) * (1-phi)) + ln(low))

The two blue lines are computed logarithmically against the 0.04958 -> 0.739 movement from last year -- the higher line is 50% retraced, the lower line is 61.8% retraced. (One of these were mentioned in the linked related idea.)

More than anything, this chart shows that there is a significant difference for values at DOGE/USD's fraction-of-a-dollar level, but that price still seems to respect both.

When you're doing Fibonacci analysis on something below a price value of a couple of dollars, like the current DOGE/USD value, keep in mind that this little extra computing by-hand can provide deeper insights into movements!

Bearish Entry ExampleThis kind of price action happens all the time, you just have to spot it while it's happening so that you can plan your trade and execute. I have put this together to give you an idea of the type of things I look for in the hope that it can help you too.

Once price action has made a clear impulse to the upsides and taking out previous structure that's our first sign that the buyers are stepping in. Once we see some corrective price action we can place our fib from the high to low, mark out previous structure and identify the pattern that price is making to build a picture of where price is most likely to reverse giving us the best possible entry.

📚#e⏭️06 : Ultra Bond Futures Are Super Boring🥱💤Don't Click💡💫An Education🎓

Series Continuation

Prior Episodes Found

In The Content Below

❔ What Are Bonds

Bonds Are The Foundation

Of A Debt Based Monetary

System

Bonds Define The Cost Of

Money Over Time

Put Simply Bonds Are

Future Dollars

Read That Again🔂

US Treasury Bonds Are

Future US Dollars Deliverable

At A Specified Time

In The Future I.e

30 Years Henceforth

By Purchasing A

US Treasury Bond

You Enter Into A

Legal Contract With

The Treasury Wherein

You Will Receive

The Principle Or

"Face Value" Of The

Bond Plus The Rate

Of Interest Specified

At The Time Of Purchase

❔ A Traders Role

To Make Money I Hear You Say

Well Yes Of Course

But What Exactly As Bond Traders

Are We Getting Paid For ?

To Provide A Service

Our Collective Actions

Expressed Through The

Trading Of Bond Instruments

Determine The Cost Of Money

Yes💡

Regardless Of Your Trading

Size We Are All Interacting

With The Free Market

Our Role :

To Correctly

Price The Value

Of Future Money

When We Trade Bonds

Profitably

We Win The Game

We Have Kept The

Flame🔥

We Have Served

A Most Important

Mission

We Fulfill A

Founders Vision

d-MR96nBa

nvrBrkagn

❔ Why Else Ultra Bonds

Low Operation Costs

Regardless Of Trade Size

Only Pay Spread Fee

As Futures Contracts

Zero Overnight Cost To Carry

Quarterly Rollover Spread Only

Operation Costs Will

Kill A Trader In Time

On Time

Every Time

Same As Any Business

📔 Rules Of The Rodeo

Trend Is Dearest

Life-Long Friend

Bond Bull Market

40 Years Strong

So We Will

Mostly Trade Long

Positions Actively

Managed

Entry Orders Executed

At The Market

Trading 0.01 Unit

At A Time

ℹ️ CME Group Official

Ultra Bond Trader Site

www.cmegroup.com

Starblazers 🌠

Dreamscapers 🧙🏼♂️

Rebellion 🧗🏻♀️

Join Me On A Journey Of Mastery

Utilising The Instruments

Symbolising Our Servitude

Slaves Become Masters

Masters Serve Slaves

Behold.. The

Ultra Bond Future 🗽

US 30 Year Yields📊

CBOT:UB1!

TVC:US30Y

📚#e04 :

📚#e03 :

📚#e02 :

📚#e01 :