Support and Resistance

I LOST 70% OF MY CAPITAL WITH THE SAME MISTAKE => OVERTRADINGHello Traders,

today I want show you a point of my live, that I constantly overlooked. I want sensitize you for it and also make me so a reminder for the future!

1. OVERTRADING

It's the truth: In the past I lost 70% of my capital with overtrading. If you find yourself there then I would be sensitize you to rethink your approach of trading.

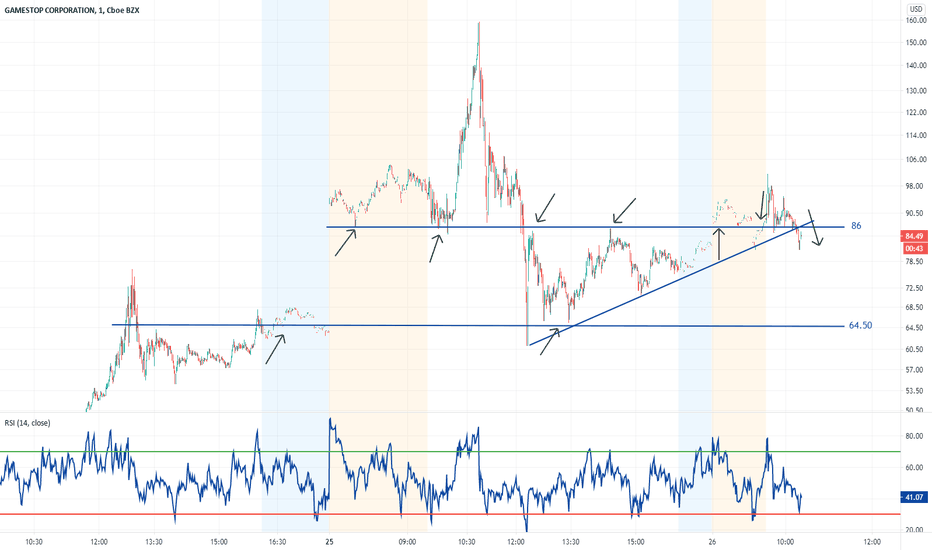

On the chart above you can see how I take at the beginning all rules what I learned before:

Only 1% of my capital I choose for risk with using StoppLoss

Support and Resistance are STOPPLOSS and TAKEPROFIT, depence on trading direction

I choose a Takeprofit more then 2 times of my risk

=> I lost the most time with this rules

But the rules are not the problem!

The problem was my overtrading. I see only "ONE" signal to take action => then it overcomes to reaction buy, no no, sell... dame, better buy and so on => always if I was in loss I tried to rethink my trade 24/7 hours in front of the screen.

2. SUPPORT AND RESISTANCE: THE WORST ENTRY POINTS EVER, BUT GOOD STOPLOSS AND TAKEPROFIT AREAS

Another thing is, that support and resistance areas are good reverse moments. Every greedy trader like I used to be, try to catch the early trade to make more money than anyone can imagine. Then back to reality: you get stopped. The market takes your money and you don't realize why!

On this moment, you have your own opinion of the market and this your mistake to believe you are right. You hadn't wait enough!

3. BE PATIENCE - TRADE LATE AND RIGHT THEN EARLY AND WRONG (MULTIPLE)

The headline above in point 3. is since my realizing the importast rule. Trade late and right!

Because the other thing of trading you can: the right risk, the winning opportunity.

Sometimes it helps to look in deeper timeframes, to get enough win-risk-ratio.

Hopefully it helps you!

Kind regards

NXT2017

HOW-TO What to look for in the MTP Volume (VS) Trade SetupIn this help Tutorial, we take a look at using the VS or Volume Spike trade setup in the MTPredictor Advanced trade setups script.

The Volume Spike or VS setup is designed to find a "fake out" when the market fails to follow though on the break of an important prior swing high or low. The idea is that professional traders look to accumulate a position in the opposite direction to the amateur traders who then get caught as the market moves sharply in the opposite direction. The MTP Decision (DP) script is used to find the level at which the reversal often occurs.

Position Sizing is used to keep the losses (and there will always be losing trades) small at -1R (one risk unit), when compared to the potential profit at the target. The profit target for the trade setup is the MTP Decision Point (DP) level from the prior swing pivot. The entry trigger is the MTP coloured reversal bar (available in the MTP Analysis script), blue for a potential buy, red for a potential sell.

The VS setup should unfold when the market "fails to follow though" to new highs or lows, after a break of a "prior important high or low", and not from a prior minor swing in the same direction.

Ideally this should unfold when the MTP Trend colour is in agreement, ie Grey, to show that the larger degree trend is in the process of making a reversal.

Please note: this is not a trade recommendation, you should all perform your own Analysis. Losses can and will unfold when Trading, please always use Stops and keep your losses small.

How To Correctly Draw Support And Resistance LinesWelcome Traders!

In today's trading episode, you will learn how to identify support and resistance levels on your chart. These are places where the price can do one of three things: hesitate, bounce, or breakout.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

Trading Mean Reversion & Rangebound MarketsIn this video, I outline the characteristics of environments where I'm looking for mean reversion and rangebound trades. I define what constitutes a rangebound market and how I should trade these setups from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

Trading Subsequent Breakouts In Trending MarketsIn this video, I outline the characteristics of environments where I'm looking to buy subsequent breakouts for a day/swing trade. I define what constitutes a breakout and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

Trading Subsequent Breakdowns In Trending MarketsIn this video, I outline the characteristics of environments where I'm looking to sell subsequent breakdowns for a day/swing trade. I define what constitutes a breakdown and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

Selling Strength In Trending MarketsIn this video, I outline the characteristics of environments where I'm looking to sell strength within an already established trend for a day/swing trade. I define what constitutes strength and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

Trading Initial Breakdowns In Trending MarketsIn this video, I outline the characteristics of environments where I'm looking to sell initial breakdowns for a day/swing trade. I define what constitutes a breakdown and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

Buying Pullbacks In Trending MarketsIn this video, I outline the characteristics of environments where I'm looking to buy a pullback within an already established trend for a day/swing trade. I define what constitutes a pullback and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

Trading Initial Breakouts In Trending MarketsIn this video, I outline the characteristics of environments where I'm looking to buy initial breakouts for a day/swing trade. I define what constitutes a breakout and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

Bitcoin Traders Beware!, Buyers Will win this War(Short Squeeze)Like And Subscribe(😊 Thanks in advance)

Why do Support and Resistance hold but sometimes break forcefully? you may ask after bitcoin recent price actions.

I am sincerely more than happy😳 to welcome our new subscribers.

My analysis are always multi-timeframes, so please do expect a full week play out of my predictions.

as a result of my busy hectic schedules, I will be making only weekly analysis every weekends on what to expect from the market through out the new week before a new weekend.

I will do my best to try to constantly update the posts during the week, to keep you updated incase we have any sudden incoming changes in price action that could affect our results.

Thanks for your constant supports and understanding.

It is crazy to know that the bull(buyer) and the bear(seller) can be same trader at any point in time in the market, and sometimes even confused of what she/he should be doing, buying or selling.

To answer the above question, first I will start by explaining what Resistance and Support truly is in the most simplest way that I can, for the sake of new born traders reading along.

what then is Support And Resistance?

For Support;

The simplest definition I can gave you is that , a Support is simply an invincible form of form(🛏)made floor area on the chart where price somehow bounces off from, this invincible floor prevents price from going farther down

when falling from a higher price range as a result of coming in contact with an invincible barrier called resistance.

Ones price comes close to the support, here it manages to find a way to bounce back to the upside after being pushed down(sold off) by sellers in the market.

this support are build or formed by unusual huge number of buyers(when you have huge number of traders willing to buy at a particular price range on the chart) .

To better understand how a support works, I will like you to see this support built floor by the buyers as a form 🛌 floor because it is breakable and can be sliced to the worst piece with no remorse when the sellers are huge in numbers.

Here is my lil secret for trading supports (secret source😉):

*See support as an area on the chart and not a line because, it is likely price breaks the line only to find buyers below your line.

* Whenever price gets closer to support, start by focusing more on the candle formations even before it comes in contact with it. If any candlestick pierces the support with a full grown body, this will most likely mean that price could go down lower more if the next two to three candles doesn't give bulls(buyers) a bounce above the support area( the last swing low that was broken). It will likely seek the next support below for assistance of a bounce(price is looking for more buyers)

* If price gets to the support and starts to go side ways, then bounce strongly with strong reversal candle stick pattern, don't jump the gun yet, wait for price to come back to confirm by forming higher low on the support, to prove the buy power on the support, price always retest a support before taking off from it(if it finds large enough strong buyers, it will make a higher stronger bounce before it even touch the support on the retest, this therefore leads to a higher low as a result of too many traders watching that support and are racing each other on the buy zone , when more buyers see this they will also jump in because now they know that the support is likely to HOLD.

*The more a support is hit 🧐,the more lower the strength of the bounce grows, the more likely price will break below it. to trade, start by watching the candle sticks forming on the area of support. This simply means that, hitting the support countlessly times leads to it breaking because it is likely that soon one candle will break the support. too much sideways on support will lead to its break or pierce also.

* Support holds, but the can also sometimes easily break as well. When supports are broken they automatically turn to new resistance.this simply means that the buyers house is now having now owners(sellers), if you understand this particular tip, it easily explains why supports got broken in the first place because the buyers at home were to small in number to defend the house so sellers killed them all🤣(bull hunt) and took over the ownership of the support there by turning it into their now home(resistance),

*Horizontal support areas are the strongest while the slanting trendline buyers are weak and more prone to break easily.

What is Resistance ?

Resistance is simply an invincible Form🛌made barrier area where price comes in contact with then starts to drop, this invincible barrier prevents price from moving upward any further, next this barrier pushes price down(sometimes even after price successfully pushes above these barriers they some how manage to get the bulls tail and drag them back down, this is also know as fake out by price action traders. just like the buyers support, these resisitance areas built by sellers can be sliced to pieces if the buyers are huge in number and out number the sellers, the barrier will be 😱 destroyed 💸 with out remorse!

Here is my lil Resistance secret source😉:

here everything is just the opposite of my tip for support.

* when price starts to gets closer to the resistance, start focusing more on the candlestick formations even before it comes in contact. if any candlestick pierce the resistance with a full grown body(make sure the candle that follows doesn't close below the resistance, it will likely go down below more if the next two to three candles doesn't give bulls(buyers) a follow through, above the that resistance area that was broken. It is most likely, price will seek to retest that resistance if it succeed in breaking through the form barriers. buyers will allow price to comeback to the top of the barrier, here they will take time to reenforce and also make sure the barrier is turned into a new support( new home owners).

The current bitcoin price is in a buy support area. in my last analysis, the vertical support line was broken and price went below it to 28900 zone still within the horizontal support area, we saw price seeking stronger buyers zone on the support . I still remain bullish o! as I believe a short squeeze is coming, and can still see a strong bull bounce before the major retest of the last breakout of 12k resistance as a result of the weekly chart.

this new week coming we are likely seeing a reaction buy from the pullback. if buyers successfully holds the 32k support and get a bounce, their first target will be 37k resistance and if they succeed to break the edge at 39k of that barrier then 46k to 60k range will be their next target before a major big dump of over 40% drop will occur in my opinion.

but what if sellers break the support area as a result of countless touch?

Trading is a game of probability so yes the chances of that happening exist . though the first option has higher chances of playing out, if the second do play out instead, here is what to expect

then we will see this play out.

Bitcoin Traders Beware!, Buyers Will win this War(Short Squeeze)Like And Subscribe(😊 Thanks in advance)

Why do Support and Resistance hold but sometimes break forcefully? you may ask after bitcoin recent price actions.

I am sincerely more than happy😳 to welcome our new subscribers.

My analysis are always multi-timeframes, so please do expect a full week play out of my predictions.

as a result of my busy hectic schedules, I will be making only weekly analysis every weekends on what to expect from the market through out the new week before a new weekend.

I will do my best to try to constantly update the posts during the week, to keep you updated incase we have any sudden incoming changes in price action that could affect our results.

Thanks for your constant supports and understanding.

It is crazy to know that the bull(buyer) and the bear(seller) can be same trader at any point in time in the market, and sometimes even confused of what she/he should be doing, buying or selling.

To answer the above question, first I will start by explaining what Resistance and Support truly is in the most simplest way that I can, for the sake of new born traders reading along.

what then is Support And Resistance?

For Support;

The simplest definition I can gave you is that , a Support is simply an invincible form of form(🛏)made floor area on the chart where price somehow bounces off from, this invincible floor prevents price from going farther down

when falling from a higher price range as a result of coming in contact with an invincible barrier called resistance.

Ones price comes close to the support, here it manages to find a way to bounce back to the upside after being pushed down(sold off) by sellers in the market.

this support are build or formed by unusual huge number of buyers(when you have huge number of traders willing to buy at a particular price range on the chart) .

To better understand how a support works, I will like you to see this support built floor by the buyers as a form 🛌 floor because it is breakable and can be sliced to the worst piece with no remorse when the sellers are huge in numbers.

Here is my lil secret for trading supports (secret source😉):

*See support as an area on the chart and not a line because, it is likely price breaks the line only to find buyers below your line.

* Whenever price gets closer to support, start by focusing more on the candle formations even before it comes in contact with it. If any candlestick pierces the support with a full grown body, this will most likely mean that price could go down lower more if the next two to three candles doesn't give bulls(buyers) a bounce above the support area( the last swing low that was broken). It will likely seek the next support below for assistance of a bounce(price is looking for more buyers)

* If price gets to the support and starts to go side ways, then bounce strongly with strong reversal candle stick pattern, don't jump the gun yet, wait for price to come back to confirm by forming higher low on the support, to prove the buy power on the support, price always retest a support before taking off from it(if it finds large enough strong buyers, it will make a higher stronger bounce before it even touch the support on the retest, this therefore leads to a higher low as a result of too many traders watching that support and are racing each other on the buy zone , when more buyers see this they will also jump in because now they know that the support is likely to HOLD.

*The more a support is hit 🧐,the more lower the strength of the bounce grows, the more likely price will break below it. to trade, start by watching the candle sticks forming on the area of support. This simply means that, hitting the support countlessly times leads to it breaking because it is likely that soon one candle will break the support. too much sideways on support will lead to its break or pierce also.

* Support holds, but the can also sometimes easily break as well. When supports are broken they automatically turn to new resistance.this simply means that the buyers house is now having now owners(sellers), if you understand this particular tip, it easily explains why supports got broken in the first place because the buyers at home were to small in number to defend the house so sellers killed them all🤣(bull hunt) and took over the ownership of the support there by turning it into their now home(resistance),

*Horizontal support areas are the strongest while the slanting trendline buyers are weak and more prone to break easily.

What is Resistance ?

Resistance is simply an invincible Form🛌made barrier area where price comes in contact with then starts to drop, this invincible barrier prevents price from moving upward any further, next this barrier pushes price down(sometimes even after price successfully pushes above these barriers they some how manage to get the bulls tail and drag them back down, this is also know as fake out by price action traders. just like the buyers support, these resisitance areas built by sellers can be sliced to pieces if the buyers are huge in number and out number the sellers, the barrier will be 😱 destroyed 💸 with out remorse!

Here is my lil Resistance secret source😉:

here everything is just the opposite of my tip for support.

* when price starts to gets closer to the resistance, start focusing more on the candlestick formations even before it comes in contact. if any candlestick pierce the resistance with a full grown body(make sure the candle that follows doesn't close below the resistance, it will likely go down below more if the next two to three candles doesn't give bulls(buyers) a follow through, above the that resistance area that was broken. It is most likely, price will seek to retest that resistance if it succeed in breaking through the form barriers. buyers will allow price to comeback to the top of the barrier, here they will take time to reenforce and also make sure the barrier is turned into a new support( new home owners).

The current bitcoin price is in a buy support area. in my last analysis, the vertical support line was broken and price went below it to 28900 zone still within the horizontal support area, we saw price seeking stronger buyers zone on the support . I still remain bullish o! as I believe a short squeeze is coming, and can still see a strong bull bounce before the major retest of the last breakout of 12k resistance as a result of the weekly chart.

this new week coming we are likely seeing a reaction buy from the pullback. if buyers successfully holds the 32k support and get a bounce, their first target will be 37k resistance and if they succeed to break the edge at 39k of that barrier then 46k to 60k range will be their next target before a major big dump of over 40% drop will occur in my opinion.

HOW-TO: Getting started with Price Finder IndicatorHello there, fellow trader!

If you are starting to use Price Finder indicator, or is just interested on knowing some of the basics, here is a brief video you may find useful.

In it I cover the overall meanings of indicator's components , how they relate and work with each other , and how to set it up to see and work with multiple time frames (multiple structures) in a single chart . This is one of the most useful and innovative features. So, make sure you check it out, and get to know it.

If you have any doubts, please let me know.

Thank you for you attention!

Best of success,

PHInkTrade

Are You Still Making These Range Trading Mistakes?Are you still making these range trading mistakes? Majority of traders always have the sense of urgency to get involved into a position, which is a trait you need to avoid at all cost. Successful traders spend 90% of their time thinking, 10% of the time taking action. Trading in a range bound condition sounds easy, especially if you are referring to the textbook stuff. But range trading in live market condition varies every time. Believe or not, majority of new traders tend to give back all of their hard earned profit by over-trading/ revenge trading during a ranging market condition, it's never just about making money but to preserve your profit. These are some of the mistakes and solutions, hopefully to give you some clarity and to master range trading, making the most out of it.

Mistakes:

1. Sense of urgency - Refer to the chart above, before the dotted black line no one has any idea the market is going to range across, this is when you must take a step back and re-assess the market condition. Let the market do whatever it wants until you have a clue about it.

2. Trading the continuation pattern - One of the biggest mistakes I realize new traders constantly make is trading the continuation pattern during a range bound condition (Eg. flag, pennant, etc.). Yes, indeed sometimes it might works, but think deeply about the concept & purpose of an exhaustion pattern, it is to catch the fresh momentum after a temporary pause in the market. Why would you take momentum patterns within a range, when buyers & sellers are clearly agreed upon certain price range? It simply doesn't fulfill the risk-to-reward in your expectation.

3. Misuse the candlestick patterns - Candlestick patterns only work when you use in the right context. Imagine you taking a short just because there's a bearish doji in a parabolic uptrend, does it make sense? Avoid overthinking about candlestick patterns, it simply tells you what happened within the time period. Always utilize it correctly.

4. Fail to identify the area of value - The most important thing about range trading is identifying the area of value (support & resistance zone). Identify where you think you could safely lean your SL against, and have a realistic target.

5. Chase the breakouts - In the live market, there'd be tons of spikes near the support & resistance zone, avoid chasing them to prevent unnecessary losses.

Solutions:

1. Trade the higher timeframe - During a range bound condition, personally I would avoid trading the lower timeframe (1min - 15min charts). Simply because a breakout on the lower timeframe could be a regular wick rejection on the 1h chart, avoid going down to lower timeframe especially if you are an aggressive trader like myself.

2. Pending order - Identify area of value where you'd like to get involved in the market, place a pending order, allow the market to come to you instead of you chasing it.

3. Widen your SL & realistic target - During a range bound condition, it is always safer to have your SL at a sensible place and have realistic target. You cannot expect to have a 1:5RR trade in a range bound condition, avoid being greedy.

Trading is never easy, but being patient allows you to have a calm mind to read the market. Trade safe.

Do follow my profile for daily fx forecast & educational content.

Trend Channel Trading GuideHello, dear subscribers!

Today we are going to discuss a very important topic of the trend trading.

The trend channel is the most reliable tool of the trading during the trends.

Here is an example of the ascending trend channel. For novice traders it is recommended to execute trades only in the direction of a trend.

First of all we should determine the trend channel. The white part of a channel is the formation phase. Here we can find multiple bounces off the lower and upper channel's bands. As a result these band are defined.

The green part of a channel corresponds to the trading time. Let's consider an example of long positions execution. We can do it when the price bounced off the lower band. For the take profit level defining we recommend to use the significant resistance level, like a green line on the chart.

We should be conscious about the potential trend channel's breakout (red point). The breakouts can be fake, but if the price faced with the rejection (red area) for the attempts to re-enter the channel it can be the sign of the potential trend reverse, as we can see at this example.

We will continue this topic with other examples of trend channel if you are interested in it.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions.

Why does technical analysis work?Introduction

If you're here on TradingView, it's probably because you believe that charts and technical analysis can give you an edge in the trading of currencies, metals, cryptocurrencies, and stocks. Granted, sometimes technical analysis doesn't work, but it works often enough to keep hundreds thousands of traders coming back here day after day. The larger question is why .

Four Reasons Technical Analysis (Sometimes) Works

To a fundamental trader like me, technical analysis can sometimes seem like voodoo. Why should lines on a chart tell me anything useful about the total value of future dividends and cash flow for a stock? I admit I especially roll my eyes at Fibonacci ratios. Personally, I feel they're about as scientific as using divination or horoscopes to buy and sell stocks.

But then again, if a lot of people believed that their horoscopes could help them win at stocks, you'd be a fool to ignore them. In fact, you could then gain a large edge by using astronomical data to forecast future horoscopes, getting tomorrow's horoscopes today. Which brings us to the first and most basic reason that technical analysis works:

It works because people believe it works. If a lot of traders believe that Fibonacci ratios apply to stock markets, then a lot of traders will set their buy and sell orders at significant Fibonacci retracement levels. And then there's another whole contingent of traders who don't believe in Fibonacci numbers, but they know that lots of other people do, so they set their buy and sell orders there anyway. It becomes a self-fulfilling prophecy. Active trading is largely about predicting what other traders will do, and technical analysis is their playbook. And predicting other people's behavior brings us to the second reason that technical analysis works:

It works because human psychology follows patterns. For instance, trend-following strategies might work, in part, because of "bandwagoning" and the "Fear of Missing Out" (FOMO). If traders see their friends getting rich off of Tesla or Bitcoin, they will fear being left behind. Speculative enthusiasm cascades through social networks until it has saturated them and everyone is leveraged long to the gills. Only when there's no one left to convert does the momentum finally stall. (Wall Street traders often quip that when their barber starts giving them stock tips, the market is saturated and it's time to sell.) As for support and resistance levels, they work partly because of regret. People remember the price they paid, or the price they wish they had paid, and that memory then shapes their behavior. For instance, if traders remember that they missed several opportunities in 2020 to buy an SPY dip to $323, then they are more likely to buy that level in the event of a future dip. What about oscillators? Well, perhaps humans distrust anything that moves too fast. Even if I'm romantically interested in someone, I'll still pull back if she proposes marriage on the first date. Plus, humans are loss-averse, so at some point we like to lock in gains.

It works because it takes time for the market to fully price in news . The advent of algorithmic trading has made it hard for traders to gain an edge by reacting to news events. Stock prices move fast the moment a headline hits, so by the time you see it, you may already be too late. That said, algorithms are pretty good at picking the direction a news event should move a stock, but not necessarily the magnitude . The initial fast news response is often followed by a slow news response as the information spreads through the human population and its implications are assessed and priced by human traders. Trend-following strategies may be able to pick up on these slower processes of repricing in light of news.

It works because today's news begets tomorrow's news . This is probably the most underappreciated of all the reasons that technical analysis works. Good news often leads to more good news. If a company posts a large positive earnings surprise, then there's also a good chance that it will get a dividend raise, analyst upgrades, or upward revisions of future estimates in the days or weeks to come. Likewise, bad news often leads to more bad news. For instance, if the company posts a negative earnings surprise, then there's an increased chance that it will need to take on debt or issue shares to sustain operations in the future. The same principle applies to industry-wide or even economy-wide news. If, for instance, the state California bans a company's product, then there's an increased chance that other states will follow suit. And if the Federal Reserve cuts or raises rates, then the next rate change is likely to be in the same direction, because Fed policy goes in cycles. The news-begets-news principle means that trend-following strategies might work, in part, because they are detecting the current direction of the news cascade.

Three Reasons Technical Analysis Sometimes Doesn't Work

I should emphasize, however, that technical analysis doesn't always work! Here are a few reasons it might not work sometimes:

Traders try to anticipate signals . The larger the number of people who know about a trading technique, the less well it works. Take supports and resistances, for instance. If I expect the rest of the market to buy at a particular Fibonacci or moving average level, then I might place my own buy order just above that level in an attempt to front-run everyone else's move. If enough people do this, then the price may not ever actually reach that level.

Whales create fake signals in order to harvest profits from technical traders. For instance, if a whale knows that a lot of people have stop loss orders set at a particular support level, then the whale might short a stock to that level in order to trigger all those sell orders, causing a price collapse and an opportunity for the whale to buy shares at a cheaper price.

Timing risk. Sometimes you can correctly identify the direction of the trend but still have bad timing. For instance, we're in an interest rate-cutting cycle by the Federal Reserve, which has caused a strong upward trend. But the reality is that we're probably near the end of that cycle. If the Federal Reserve suddenly changed its tune tomorrow and started forecasting rate hikes next year, it would take some time for that information to be fully reflected in slow-moving technical signals, and you could lose a lot of money if you sell only after those signals change. It's perhaps best, then, to have a good understanding of what's driving a technical trend so that you can get out early if you see the underlying drivers change.

Price action tradingWhat is Price Action Trading?

Price action trading is a methodology for financial market speculation which consists of the analysis of basic price movement across time. It’s used by many retail traders and often by institutional traders and hedge fund managers to make predictions on the future direction of the price of a security or financial market.

Price action trading ignores the fundamental factors that influence a market’s movement, and instead it looks primarily at the market’s price history, that is to say its price movement across a period of time. Thus, price action is a form a technical analysis, but what differentiates it from most forms of technical analysis is that its main focus is on the relationship of a market’s current price to its past or recent prices, as opposed to ‘second-hand’ values that are derived from that price history.

BALUSDT - wrong / correct break outBiko membership understand me

Push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

make your analysis before a trade

XAUUSD 4H MACD CROSSOVER TRADING STRATEGYPrice was in an uptrend.

Price bounce off a previous resistance.

Price created a Bearish Engulfing Reversal Candle.

Entered trade at the close of above candle.

MACD crossover happened at the close of the candle also.

Stop Loss placed above reversal candle.

EXITED trade after consolidation made price go sideways.