EURUSD Buyers in Control After Corrective Move, Eyes on 1.1930Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD previously traded within a strong bullish environment, supported by a well-defined rising trend line. During this phase, price consistently formed higher highs and higher lows, confirming sustained

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

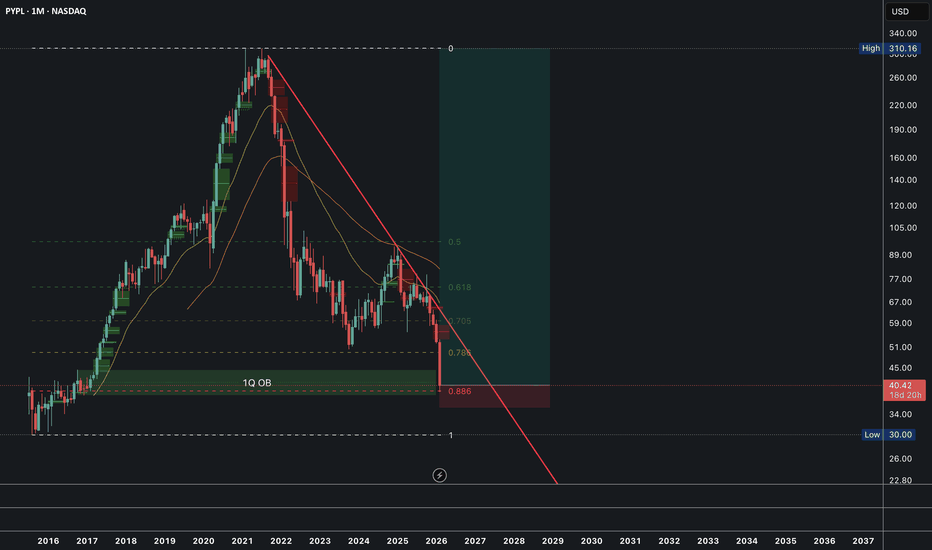

Paypal Bottom is in ?! Long from herePayPal Holdings (PYPL) is currently trading at approximately $40.42 (as of the latest close, +1.30% on the session), marking a continuation of the multi-year downtrend from its 2021 peak of ~$310–$340.

The chart applies a Fibonacci retracement drawn from the 2021 high (~$310.16) to the post-peak lo

$PL - RACE TO SPACE!This reported merger proposal between SpaceX and xAI, along with the broader industry moves toward orbital AI data centers, represents a bold and high-stakes strategic gambit in the escalating global AI infrastructure race. Here’s a structured analysis of the implications, motivations, and challenge

Bitcoin Back Above $70,000. Here Are Key Levels to Watch NowA trip to $60,000 and back before coffee.

Bitcoin BITSTAMP:BTCUSD spent the end of last week doing what it does best: reminding traders that fire-breathing dragons aren’t in fairytales only.

After a sharp drop to $60,033 on Thursday torched thousands of long positions, the world’s largest crypt

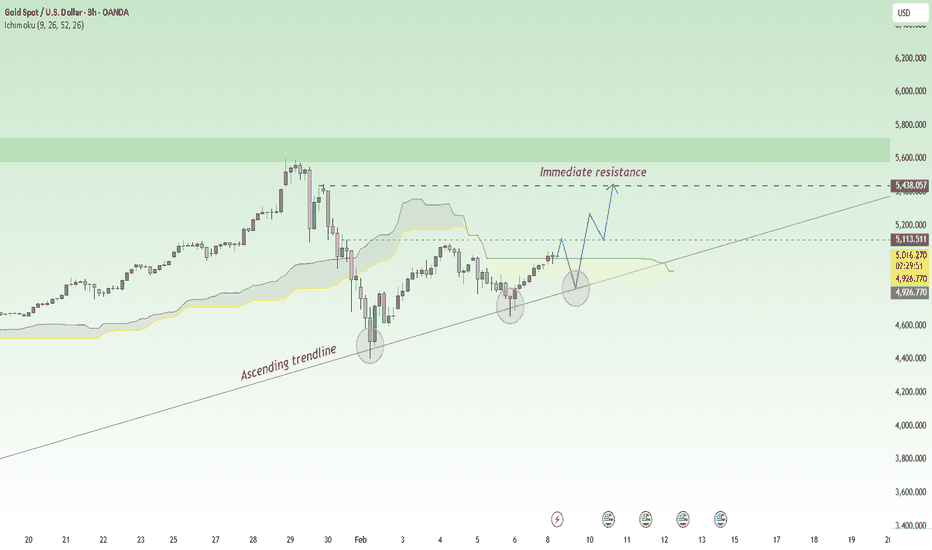

An At Market & Future Trading Opportunity on GOLDWhat’s Really Going On With Gold?

Gold took a sharp hit to close out last week—but let’s keep things in perspective. This market has been on a massive bullish run, and after a move like that, consolidation isn’t a surprise… it’s normal.

Barring any unexpected geopolitical headlines, the most logic

RIOT: Looking for bottoming formationThe overall equity and crypto market crash didn't do any favor to RIOT stock. Despite a lot of good things happening for the company, the short-term headwinds are propelling much of the selling. The rapid selling across the markets has a strong signature of capitulation. Which means, I am now lookin

This Isn’t a Reversal — It’s Only Phase Two. $BTC>65k Thank you for your attention! This is exactly what you've been hearing since September 2025. Next, we'll form the bottom, and reaccumulate until October.

A smart person told me to stop posting publicly. Make everything private, but I continue to publish my thoughts for you.

There are no entry point

Silver: From -47% to Bullish Momentum: Silver’s Chaotic WeekSilver: From -47% to Bullish Momentum: Silver’s Chaotic Week

In the first sell-off that silver experienced, the price fell by almost -40%.

After a correction these days, we saw silver move lower overnight creating another structural low.

Just yesterday, silver fell by almost -21%, adding to the

Oracle - The worst drawdown ever!💣Oracle ( NYSE:ORCL ) will ends its bearmarket soon:

🔎Analysis summary:

Over the past five months, Oracle has been correcting more than -60%. And while we can clearly witness a major selloff, Oracle is also approaching a major support area. And if we see bullish confirmation in the near futur

XAUUSD: Breakdown & Retest Signals Bearish ContinuationHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously traded within a well-defined consolidation range, where price moved sideways for an extended period, indicating balance between buyers and sellers and gradual liquidity accumulation. This range eve

See all editors' picks ideas

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

See all indicators and strategies

Community trends

Amd - Higher and higher this stock goes!🎁Amd ( NASDAQ:AMD ) still remains totally bullish:

🔎Analysis summary:

Amd just remains one of the most bullish stocks at the moment. And while the recent correction of -30% was totally expected, this stock is already back at support. Either here or at the next support lower Amd will create a

Very bearish on NVDA!OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

BITF Bitfarms Could Be the Next IREN Limited Bitfarms has publicly stated that it is winding down Bitcoin mining and reallocating capital toward AI and high-performance computing data centers. This is not a vague narrative shift — it involves concrete steps: redeveloping existing sites, leveraging contracted power, and targeting long-term AI c

Applied Digital (APLD) - Value "Buy The Dip" Area

Applied Digital (APLD) builds massive data centers that power AI, cloud computing, and high-performance computing. As AI usage explodes, companies need huge computing facilities, and APLD rents that space and power to them.

🏢 What APLD Actually Does

Think of APLD as building giant computer w

STRATEGY The collapse continues..Strategy (MSTR) completely lost its 1W MA200 (orange trend-line) last week, making its losses at more than -80% from its November 2024 All Time High (ATH), continuing to outperform even Bitcoin in losses. Given that the Bear Cycle on stocks hasn't started yet, this can only get (much) worse, somethi

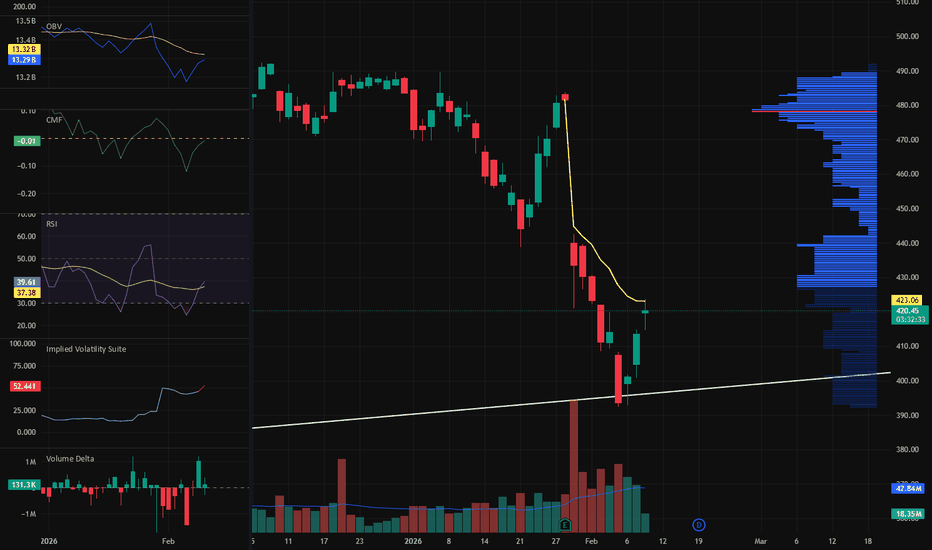

MSFT 424 Is the Real Test for BuyersJust like I mentioned earlier, 424 is the real test for buyers, and today’s action confirms it. Buyers were much more aggressive yesterday, but once sellers showed up again at 424, the bid clearly softened. That tells me this level is being actively defended and remains the most important area for s

Netflix ($NFLX) — odds are becoming favorable for a reversal.Netflix ( NASDAQ:NFLX ) — odds are becoming favorable for a reversal.

Why:👇

A small base is forming near the 2025 lows.

The extended downtrend is becoming increasingly unsustainable.

The $100 big round number often acts as a long-term magnet.

The entry was shared earlier today with members. I’l

DELL GEX - Curling off the lows...🔶 DELL – Holding Above Put Support, Attempting Breakout Above HVL 🔶

On the daily chart, DELL has repeatedly found strong support around the 110 put support level , with multiple successful bounces confirming it as a key downside anchor . 🔴

Currently, price is trading above the High Volatility

See all stocks ideas

Today

TBNTamboran Resources Corporation

Actual

—

Estimate

−60.85

USD

Today

FLNGFLEX LNG Ltd.

Actual

0.43

USD

Estimate

0.43

USD

Today

THCTenet Healthcare Corporation

Actual

—

Estimate

4.09

USD

Today

VRTVertiv Holdings, LLC

Actual

—

Estimate

1.29

USD

Today

GNRCGenerac Holdings Inc.

Actual

—

Estimate

1.72

USD

Today

HLTHilton Worldwide Holdings Inc.

Actual

—

Estimate

2.01

USD

Today

RDWRRadware Ltd.

Actual

—

Estimate

0.30

USD

Today

SITESiteOne Landscape Supply, Inc.

Actual

—

Estimate

−0.20

USD

See more events

Community trends

Bitcoin - More blood coming! Buy 57k (extremely strong support)Bitcoin is currently in a very sharp decline, because the price dropped in the past 4 months by 53%. A lot of people didn't expect such high volatility because they are even new to the market, or they thought that ETF would reduce the overall volatility of this market. The truth is that the market i

BTCUSDT Compression Below Resistance Signals Expansion To 71,800Hello traders! Here’s my technical outlook on BTCUSDT (4H) based on the current chart structure. Bitcoin previously traded within a well-defined range, where price respected both the upper and lower boundaries for an extended period. This consolidation phase reflected balance between buyers and sell

Bitcoin Price Update – Clean & Clear ExplanationBitcoin remains under strong bearish pressure on the 2-hour timeframe. After forming a lower high near the 72,000 / 73,000 supply zone, price failed to sustain upside momentum and continues to trade below the key resistance structure.

The market is currently moving inside a rising corrective channe

XRPUSDT - Hunting for liquidity before the fallBINANCE:XRPUSDT looks very weak, losing 69% from its high. As part of the downtrend, the coin may experience sharp local spikes in search of liquidity before falling.

Bitcoin is consolidating below 70K without the ability to break through the key level. The market is stagnating after a sharp d

This Is the Bitcoin Situation for the Next 3 YearsThis is the Bitcoin Situation for the Next 3 Years

Since last August I warned that the $108,000 level could not be lost in Bitcoin or else we entered a bearish cycle and it was going to be hard.

I am not a guru nor do I have a crystal ball.

But I try to get informed and I dedicate a lot of t

Selena | BTCUSD · 30M – Ascending Channel | Range Expansion BITSTAMP:BTCUSD BINANCE:BTCUSD

After a strong impulsive move from the sell-side liquidity sweep near the lows, BTC formed a controlled range between demand and supply. Current price action shows compression inside the range, suggesting an upcoming expansion either through a bullish continuation

Privacy token Horizen (ZEN) to print Explosive returns? - Feb 26Remember that whole business about “ returning to base ” in the recently published OTHERS idea? Where is the liquidity going? Ring a bell?

No? Tough.

For those of you that do remember: These are the examples you’re looking for.

1. Price action has returned to base.

2. Price action has prints su

BTC/USDT | Bull or Bear ? (READ THE CAPTION)By analyzing the #Bitcoin chart on the weekly timeframe, we can see that price continued its bullish expansion and successfully rallied up to the $71,300 level. After this strong move, Bitcoin is currently trading around the $68,500 area, which can be considered a healthy corrective phase within the

BITCOIN POSSIBLE MOVEMENT ( MUST READ IT )Hello Traders hope everyone is good 👍🏻

Here's my first idea on BITCOIN and what do you think about my BTC analysis? Please share in comment section and follow me for more updates on BITCOIN

Price is moving with clear market structure, confirming a valid BOS (Break of Structure) and strong instit

Elise | BTCUSD · 30M – Range Support ReactionBITSTAMP:BTCUSD

After the sharp sell-off and liquidity sweep, BTC rebounded strongly and entered a consolidation phase. The market is now retracing from the range high back into support. This behavior suggests a healthy correction rather than trend failure. As long as price holds above the demand

See all crypto ideas

Gold Price Analysis – Key Support and Resistance LevelsThis chart outlines the key support and resistance levels for gold prices. The Key Resistance Level at 5,431.175 is a potential rejection zone, where price may face resistance. The Support Zone at 5,040.060 is being tested, and if price holds, a bounce or reversal is expected. The Critical Support a

XAUUSD: Liquidity Grab Below Support, Expansion Ahead To $5,110Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold has been trading within a well-defined bullish environment, previously respecting a clean ascending channel, where price consistently formed higher highs and higher lows. This structure reflected strong buyer d

Elise | XAUUSD · 30M – Bullish Continuation from Channel SupportOANDA:XAUUSD

Gold sold off aggressively, sweeping liquidity before reversing strongly from demand. The recovery leg was clean and impulsive, followed by controlled consolidation inside a bullish channel. Current price is holding above key support, suggesting buyers remain in control. As long as pr

Gold Isn’t Rushing Lower – What Is the Money Flow Telling Us?If we view the gold market as a flowing stream, XAUUSD is moving upward in a controlled and orderly manner —not aggressively, but with clear conviction. After the prior sharp shakeout, gold did not collapse ; instead, it quickly regained balance , signaling that underlying buying pressure remain

GOLD Price Update – Clean & Clear ExplanationGold is a strong bullish structure after forming a clear higher high–higher low sequence. Price has respected multiple demand zones, confirming sustained buying interest after the earlier in the session.

The recent breakout above the 5,040–5,050 resistance zone signals strength. Price is now pullin

XAU/USD | Gold At a Critical Short-Term Decision Zone!By analyzing the #Gold chart on the 30-minute timeframe, we can see that right after our last analysis, gold moved higher again and delivered more than 1,500 pips of profit, pushing price up to $5,047. Gold is now trading around $5,012.

If price fails to hold above $5,050 within the next 4 hours, w

GOLD - Consolidation before the rally. Focus on 5090FX:XAUUSD is storming 5089 as part of a bullish trend. There is a high probability of a breakthrough, but before that, the market may form a correction. Tomorrow is NFP...

The dollar is falling, and against this backdrop, gold looks like a strong asset in terms of buyer interest.

The projecte

Gold at Key Resistance — Is This the End of the Correction?Gold( OANDA:XAUUSD ) is currently moving near its resistance zone($5,191-$5,097).

From an Elliott Wave perspective, it appears Gold is completing the microwave 5 of the main wave C, with the corrective upward structure likely a Zigzag correction (ABC/5-3-5).

Also, we can see a negative Regular Di

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

RED BOXES:

BREAK ABOVE 4970 for 4989✅, 4999✅, 5002✅, 5010✅ and 5016✅ in extension of the move

BREAK BELOW 4950 for 4038, 4933, 4920 and 4006 in extension of the move

We had another bullish open which was expected, but unfortunately, we didn't get that lowe

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

After a strong bearish rejection from the previous high, Gold entered a deep corrective phase and declined into the highlighted demand zone, where strong bullish reaction and buyer participation were observed.

Subsequently, price formed a higher low,

See all futures ideas

EURUSD: Market Structure Flip Signals Upside Potential To 1.1970Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a clearly defined downward channel, marked by consistent lower highs and lower lows. This structure reflected controlled bearish pressure, where sellers maintained dominance but

GBPNZD Testing Deep Support as Reversal Pressure Starts to BuildGBPNZD has been in a steady, grinding decline, and the structure on the 4H chart shows a clean sequence of lower highs and lower lows. What stands out now is location: price is pressing into a well-defined support zone after a corrective channel breakdown. When a pair stretches this far in one direc

EURUSD Buyers in Control After Corrective Move, Eyes on 1.1930Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD previously traded within a strong bullish environment, supported by a well-defined rising trend line. During this phase, price consistently formed higher highs and higher lows, confirming sustained

Hellena | EUR/USD (4H): LONG to 1.19523 (Nearest target).Colleagues, following on from the previous forecast, I believe it is necessary to come up with a new idea that does not contradict the old plan.

The price shows a resumption of the upward movement, and I think that now we need to highlight two main levels:

1) 1.17663 - if the price updates this leve

USDJPY Buy Zone ActiveToday, I want to share with you a long position on the USDJPY ( FX:USDJPY ) currency pair. In this idea, I will analyze USDJPY from a fundamental and technical perspective .

Stay with me.

This long isn’t just technical for me — the fundamentals still lean USD-positive vs JPY.

1) Yield/rate gap

GBP/JPY | Up and down (READ THE CAPTION)By analyzing the hourly chart of GBPJPY, we can see that after yesterday's drop, it didn't go lower than the 212.13 to sweep the liquidity below and by hitting the Feb 2nd NWOG High, it bounced back up and it is being traded at 212.66.

If it holds up above the Feb 6th NDOG, I believe it can go up t

EURJPY (2H chart pattern)...EURJPY (2H chart pattern).

Bias: Short / Sell (price rejected from resistance & broke trendline)

📍 Sell Zone

185.20 – 185.35 (my marked sell zone)

🎯 Targets

Target 1: 183.60 – 183.70 (first demand / dashed line)

Target 2: 182.40 – 182.50 (next major support)

❌ Stop Loss

Above 186.00 (above resistan

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

After retesting the previously broken zone, EUR/USD has resumed its bullish move. This area has successfully acted as a strong support following the breakout.

As long as price holds above this support zone, we expect the bullish momentum to contin

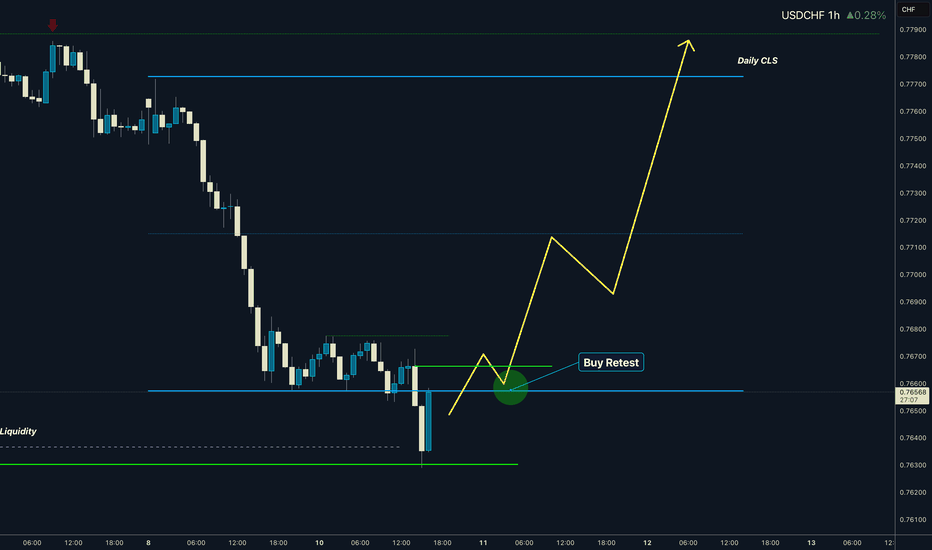

USDCHF - Daily CLS - Model 1 - KL - OBHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.