Elon candle| BTC massive trend reversal after Elon Musk's tweetIn this post, we are exploring the effect of "humorous tweets" by the Billionaire entrepreneur and CEO of Tesla, Elon Musk. In the recent past, his tweets had created quite a stir in the crypto universe. DOGEUSD had skyrocketed massively. Bitcoin tanked terribly after he tweeted that Tesla stopped accepting Bitcoin payments.

Just a few hours back, he has taken another humorous jab at BTC maxis by asking how many are needed to change a light bulb. Michael Saylor, Dan Held, Peter McChivo, and many more giants quickly joined the twitter frenzy to respond to Musk.

Many critics are calling out the SEC to take notice of his actions, terming them to be a clear case of market manipulation. The SEC is probing hard into the crypto realm, with the investigation with Ripple.

Elon had earlier stated that his company still holds $1.5 billion dollars worth of Bitcoins. It remains to be seen whether the tweets turn out to be the premise for a regulatory investigation.

As of now, BTC has already lost more than 4.2% of its market capitalisation post the tweet! And that does worry out the investors!

----------------------------------------------------------------------------------------

Any feedback and suggestions would help in further improving the analysis! If you find the analysis useful, please like and share our ideas with the community. Keep supporting :)

Bitcoin (Cryptocurrency)

BTC Consolidation... Then off to the moon! Bitcoin is consolidating at the same price range as it did back in January. Once we broke that STRONG Resistance, it flipped to Support while BTC Ranged up.

Now that same critical level is back to being a Resistance Area. The longer a coin/token consolidates, the stronger the Breakout will be. Think of it as a wall, and the more times we hit it in a short period, the more likely it is to break. Right now, Bitcoin is coiling up, ready to strike.

The bulls stepped in with force and held the line $29,500.

If you are newer to crypto and just got into the market this year, then you've only experienced up, and this is your first significant drop.

You won't ever forget this, I'm sure of it.

Take the lessons presented during these events and forge them into your psyche as they will continue to benefit you over and over the longer, you stay in this market.

Remember, the market must cause the most amount of people the maximum amount of pain.

When you invest and pull a 2-3X, take your initial $ out of the position.

Always cover your ass and manage your risk.

For now, we stay range-bound from $30k-$42k.

We are in no way out of the woods just yet, but we dodged a massive nuke in the market.

Depending on what your strategy is, continue to DCA into BTC and strong adults.

It's not about timing the market; it's about TIME IN THE MARKET.

Bitcoin SyndromeBitcoin Syndrome

Also known as Obsessive Bitcoin Disorder

By Dr. Pumpeet Upderr

- New Journal of Rekt Medicine, 2023

According to the DSM-13, Bitcoin Syndrome (BS) is “a mental disorder characterized by continuous, obsessive, or intrusive thoughts about the price of Bitcoin.”

Many BS sufferers obsess over the price of Bitcoin for the majority of their waking hours, causing disruptions like loss of focus, poor job performance, decreased motivation, relationship problems, and substance abuse disorders.

Those with BS are known to check the price of Bitcoin up to 100 times per hour. Similar to those with gambling disorders, Bitcoin traders are known to consume alcohol and smoke cannabis to alleviate the symptoms of Bitcoin Syndrome.

Some BS sufferers reported dreaming about Bitcoin price movements, most often during turbulent market conditions. We note the highest spike in reports of Bitcoin Syndrome immediately following a price increase or decline of 10 percent.

The physiological effects of Bitcoin Syndrome are similar to anxiety, depression, and panic disorder:

fear, uneasiness

restlessness

elevated heart rate

irregular heartbeat (palpitations)

muscle tension

hyperventilation

perspiration

insomnia

brain fog

substance abuse (alcohol, cannabis, stimulants, psychedelics)

intensely avoiding either Bitcoin bulls or bears who hold opposing views on the market

Overall, our researchers noted four broad categories of secondary psychological affects developed by those investing, trading, or analyzing cryptocurrencies and blockchain tokens. Amongst our study participants, the worst BS symptoms were experienced by Group 1 and Group 2, while the least severe symptoms were observed in Group 4.

Group 1 – The Icarus Newcoiners: New participants to the market who experience significant portfolio gains during a bull cycle. Icarus Bitcoiners are known for developing a sense of overconfidence that leads to reckless decision making and gambling behaviour.

Common symptoms:

narcissistic personality disorder

gambling disorder

substance abuse

risky sexual behaviour

Notable examples: Elon Musk, Michael Saylor, your Zoomer relative that won’t stop talking about Bitcoin at family events.

Group 2 – The Late Buyers: Latecomers to the market who buy blockchain tokens near the top of the cycle and only experience portfolio declines, often leading to irrational villainization and scapegoating (Elon Musk followers that bought Dogecoin). Many in Group 2 develop sudden depressive disorder and a loss of personal confidence during market downturns.

Common symptoms include:

Depression

Insomnia

Anxiety

Loss of focus

Substance abuse

Decline in sexual activity

Notable examples: Kevin O’Leary, Marc Cuban, Elon Musk cultists

Group 3: Non-participants: Also referred to by the Bitcoin community as “Nocoiners,” these people follow Bitcoin price movements while holding casual contempt for participants who invest in blockchain technology. We were not able to collect sufficient data from the Nocoiners.

Common symptoms include:

Emotional outbursts

Anger

Antisocial behaviour towards those with opposing viewpoints

Notable examples: Peter Brandt, Jamie Dimon, Donald Trump

Group 4: OG-Crypto

This group includes market participants who have experienced at least one complete markup phase (bull market) and one complete markdown phase (bear market).

The experiences of our Group 4 participants varied wildly; the only commonality gleaned from our data was recreational cannabis use and a philosophically-driven “buy and hold” strategy.

Common traits exhibited in Group 4 include:

High testosterone

Increased muscle mass

Enlarged pen

Notable examples: Andres Antonopoulos, Arthur Hayes, Charlie Lee

Note: There is no known treatment available for Bitcoin Syndrome, but early experiments show promise from charting abstinence, regular exercise, and mindfulness meditation. If you know somebody suffering from Bitcoin Syndrome, contact your healthcare provider.

The bread and butter of global macroBefore you trade stocks, bitcoin, FX, bonds or anything you have to try and understand how our monetary system works not to miss the big picture.

This video helps you by providing a 10.000 foot view of the global macro landscape. Don't miss the forest for the trees.

Tune in and enjoy!

EURCHF - How To Trade This BreakoutEURCHF is within a descending channel of an ascending channel... pretty confusing I know but have a look at the chart and you can see which way price will be heading. What we need to do now is find the best entry which is safe and clean.

From the diagram in the chart, you can see that our entry will only be after the break of the descending channel and after a bullish correction such as a bull flag. We need to make sure that price has the momentum to move up so we will be waiting for a breakout of the bullflag before entering with stops below the correction.

Goodluck and trade safe!

EURCHF - How To Trade This BreakoutEURCHF is within a descending channel of an ascending channel... pretty confusing I know but have a look at the chart and you can see which way price will be heading. What we need to do now is find the best entry which is safe and clean.

From the diagram in the chart, you can see that our entry will only be after the break of the descending channel and after a bullish correction such as a bull flag. We need to make sure that price has the momentum to move up so we will be waiting for a breakout of the bullflag before entering with stops below the correction.

Goodluck and trade safe!

BTC;Criticality &Phase Transition; Thermodynamics of SpeculationThis is just a quick take on how markets , and more specifically Speculation - in it's most general, universal sense -, is informed by similar critical dynamics as those found underlying other social interactions. (The math is hidden. You're welcome.) What this is Not , is a ready-to-use model since the specific parameters or the full model description are not part of the proceeding.

The following "As is ..." ;

This statistical–mechanical model is based on the Boltzmann–Lotka–Volterra (BLV) method.

BLV models involve two components: a fast equilibration, Boltzmann , component and a slow dynamic, Lotka–Volterra , component. The Boltzmann component applies maximum entropy principle to derive the static flow patterns of instruments (or their utility , as is the case). The Lotka–Volterra component evolves the spatial distribution (Price & Time; i.e.the chart) and the flow pattern of a information according to generalized Lotka–Volterra equations for distributed information.

The resultant dynamics exhibit critical regimes, interpreted as phase transitions , where a small variation in suitably chosen (control) parameters changes the global outcomes measured via specific aggregated quantities (order parameters).

The main take-away here is that this is in line with the idea that, despite the complexity of such a system (as depicted) only few parameters may be necessary to understand drastic macroscopic changes.

The maximum entropy method has been applied to a variety of collective phenomena (E.g., Speculation; Yours Truly) suggesting a formal analogy between complex, socio-economic systems and thermodynamic systems.

We use a clear thermodynamic interpretation of the Fisher information as the second derivative of free entropy. Specifically, we investigate the minimum work required to vary a control parameter and trace configuration entropy and internal energy, according with the first law of thermodynamics. The thermodynamic work is defined via Fisher information and thus can be computed solely based on probability distributions estimated from available data.

Once we introduce the concept of thermodynamic efficiency as the ratio of the order gained during a change to the required work (information transmission), it can be rather easily demonstrated that it is maximized at criticality .

Note; The above further illustrates the common observation that Technical Analysis fails, in most cases, to capture (forecast) Finite-time Singularities - i.e the sudden appearance of exponential price increases or price collapses ( crashes ).

A "Welcome to" Pinescript codingThis simple idea is an intro to @TradingView & @PineCoders

Nothing fancy or complex, if you are already coding - you can skip this.

simple MA build walk through & adding a second MA.

If you want to get into coding, then here's the basic introduction.

FYI - I am not a coder, 21 years trading experience and know a bit about the instruments - but new to actual coding, especially in Pine.

Hope it helps someone!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

THE REASON WHY CRYPTOS AREN'T PERFORMING WELL LATELY.AS I MARKED, THIS BIG MONTHLY CANDLE PRINTED BY THE DXY IS SHOWING A LOT OF STRENGTH BY THE $DOLLAR WHICH COULD THEORETICALLY PUMP A BIT HIGHER BEFORE I REALLY START TO WORRY, IF WE BREAK THE TL AT AROUND 93.00 THEN I'LL BE EVEN MORE SKEPTICAL THAT CRYPTOS CAN RECOVER THE DIP EASILY.

THE CORRELATION BETWEEN THE DXY AND THE CRYPTOS IS REALLY SIMPLE: CRYPTOS ARE THE HEALTHIER ALTERNATIVE OF THE DOLLAR AND THE CURRENT FINANCIAL SYSTEM, IF THE DOLLAR KEEPS ON PERFORMING WELL THERE IS NO REASON TO SWAP WORLD CURRENCY FOR A DIGITAL ONE. I PERSONALLY BELIEVE THERE ARE MANY REASONS TO STILL OPT FOR BTC INSTEAD OF THE $ BUT THE MARKET REACTS DIFFERENTLY, IT DOESN'T HAVE BRAIN NOR SOUL.

CRYPTOS FOR THE LONG HAUL ARE GONNA FULFIL OUR DEEPEST DREAMS BUT FOR NOW WE JUST GOT TO SURF THE WAVE UNTILL IT LASTS.

PAY ATTENTION ON THE DXY AND HOW IT WILL BEHAVE IN THE SHORT TERM TO HAVE A TRUE HINT OF HOW THE CRYPTOSPACE WILL MOVE IN THE SHORT TERM.

DON'T FORGET TO LIKE AND FOLLOW FOR MORE CONTENT.

Elliot Waves Complete Guide | Chapter 4.2 - "Channeling"Hello Traders. Welcome to Chapter 4.2, where we will be learning about channeling in Elliott Waves (also known as, parallel channels) - something that many of you are probably already doing in your daily technical analysis, but probably have not known that it could be used within the Elliott Wave theory. This method is going to give us an extra edge when it comes to pinpointing the end of certain waves in certain patterns, basically a way to predict the future in some ways by reducing some of the probabilities of unknown trajectory of waves.

📚 Chapter 4 Glossary:

4.1 Alternation

📖 4.2 Channeling

4.3 Psychology

4.4 Fib-Ratio

4.5 Motive Wave Multiples

4.6 Corrective Wave Multiples

-----

What is Channeling, or Parallel Channels?

One of the major guidelines or rules within in the Elliot Wave theory is that two of the impulse waves (please refer to chapter 1) in a five-wave basic structure will tend to be equal. This is true in a normal five-wave basic structure or in a basic structure where we have one extended wave. In even more simpler terms, we almost always will have two impulse waves that will be similar in length. When we have the relationship between two waves inside the parallel structure, the ends of these waves can be calculated in points or percentages of extensions like the 127.2%, 161.8% (the golden fib zone! - more on the fibs in the next chapter). Most of the time these two waves will be equal in length, and if one wave was 100 points longer, then there is a very high probability that another wave will be 100 ticks long (also known as a measured move). And of course you already know that if the first wave is 90 points and the second wave is 100 points, there’s a high probability that the fifth wave will be an extended wave, and etc. Again, if you are lost, I highly recommend you go back to reading chapters 1 and 2.

So since we have an arithmetic relationship (or equality) within the structure in terms of line connections, the upper and lower boundaries of the impulse waves can be marked by two major trendlines. EW Traders will often draw a temporary channel when enough data is given, and what we have here is actually a temporary channel in the chart above. This is not a fancy term - this merely means you are drawing the channel ahead of time since you have a rough idea of the 3rd wave already being drawn out. You then can visually predict by connecting two or three of the major points to create a channel to help you assume where the next possible wave will end by simple support. You can see that the next wave will be a down move and then we have to complete the 4th wave. We don’t know if we are in a five-wave basic structure just yet, but the channel will help us validate this idea.

Furthermore, since the two waves inside of the structure tend to be equal and the longest wave here is the third wave, you can see that we can have a predicted fourth wave that will bounce at the channel support due to the 'temporary' channel support line we created as we can see in the chart, and the fifth wave will be equal in length of the wave 1, and will end up most likely at the channels resistance in the upper boundary.

What makes a parallel channel invalidated? Well, that's easy - if price breaks the channel prematurely, and continues to fall, this will invalidate our count and the idea of channeling. If the fourth wave doesn’t end at a point touching the lower boundary of the support line channel, you must reconstruct it by connecting the ends of wave 2 and 4, to correctly estimate the end of wave 5. Then draw a parallel line for the upward boundary from the end of wave 3.

Parallel channels help INCREASE your probability of wave counts, and also have a good direction of where simply support may be!

Using Risk Management to Not Lose Money Risk Management

In this article we are going to talk about the most exciting topic of risk management!

Sarcasm aside, this is probably the single most important lesson that any trader or investor can ever learn.

Warren Buffett famously said: "Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1."

So, if it is good enough for the most successful investor of all time, it is good enough to write a post about.

Now, this quote does not apply to every single trade; no one trades without taking losses. But this is more about mindset, how to strategize, and your performance overall.

In fact, with what you are about to learn, you will see that it is actually possible to lose more trades than you win while STILL being a profitable trader.

We will get to the actual math/strategy in a moment. First, a short word about psychology.

Nothing makes a trader lose more money than not having a well thought out plan or not sticking to it.

We need to make our strategy first so that we can do it logically, and without emotion. This is easier to do beforehand because we haven’t actually put any money in the market yet.

So, what is it that we need to know?

What is my total account size?

What am I willing to lose per trade?

What is my Stop Loss?

What is my Position Size?

What is my Risk to Reward Ratio?

If you cannot answer these questions then it is not a good idea to click the “buy” button! Unless you just want to gamble and throw money away.

Question 1 - What is my total account size?

Probably the easiest question for you to answer.

Account size is the amount of money that you have in the market.

Personally, I like to split my total account size into two parts. One part for longer term HODLing. One part for short-mid term swing trading.

For my calculations, I forget about the HODL account and only look at the money in the trading account.

I personally do not day trade. If I get into a position, I expect to be in it for 1-4 weeks. Obviously, this rule is flexible based on market conditions.

Question 2 - What am I willing to lose per trade?

This one is a bit more subjective because it comes down to how risk averse you are.

It is generally accepted that you should risk between 1-5% of your account per trade.

For me, anything above 3% is higher than I like, so I stick to 1-2% and sometimes 3.

So, if you have a trading account of $10,000 and you want to risk 1%, you are risking $100:

$10,000 x .01 = $100

To be clear – Risking 1% of your account does NOT mean using 1% of your account each trade. You are not spending $100 on each trade. Risk =/= position size.

Risking 1% means that if your Stop Loss gets hit you lose $100.

Question 3 - What is my Stop Loss?

Firstly, what is a Stop Loss?

A Stop Loss is an order that is placed to automatically close you out of a position should the price be hit.

You should place your Stop Loss order right after you open your position.

This is also a good time to place another order to close out your position at your target price.

But where do you put the Stop Loss?

A Stop Loss is best placed at a price that invalidates the reason you got into the trade in the first place. Sometimes this is, very creatively, called the “Invalidation Level”.

For example, if you are trading a breakout to the upside, and then the price of your crypto shoots down in the other direction past your support levels, it is no longer a breakout and you should exit the position.

To restate this in a different way, this level should not be arbitrary. There is no reason to automatically put your Stop Loss at 6.7138%, or any other random number, of your entry.

The level you chose should be based on Technical Indicators; like a base of support, a Fibonacci level, or a previous high.

This is because the market does not care about your arbitrary values. The market is made up of people and whales (who, believe it or not, are also people), and they, the ‘Market’, care about TA.

Here is another example of a more short term trade to the downside. You could be more aggressive with the Price Target considering the resistance was so weak, but this is just an example to illustrate my point.

(MACD looks nice there too. Learn more about that HERE )

Question 4 - What is my position size?

In order to calculate position size we need to know a two different things:

Risk Per Trade - 1 to 5%

Distance from entry to the Stop Loss in percentage terms

So the equation is Position Size = (Total Trading Account Size X Risk Percentage)/Distance to Stop Loss from entry

For example, if you have a $10,000 account and you want to risk 2% while your Stop Loss is 10% away from your entry:

($10,000 X .02)/.1 = $2,000 Position Size while only risking $200.

One thing to note here is that the closer your Stop Loss is to your entry, the larger Position Size you can trade with.

So if you move the stop up to 5% away from your entry:

($10,000 X .02)/.05 = $4,000 Position Size while still only risking $200.

Naturally, a larger position gives you more potential profit. (Don’t take this to mean use margin. I personally don’t use margin for Crypto and would recommend that most people don’t either.)

Now that we have the position size, we should determine if the trade is worth getting into by finding your Risk to Reward Ratio.

Question 5 - What is My Risk to Reward Ratio?

The Risk Reward Ratio, sometimes simply known as R, is the ratio between your potential profit and potential loss.

Reward/Risk = R

So if you open a position where you can potentially lose $100, and you can potentially profit $300, then your trade has an R of 3.

If you click on the Long or Short Position button in TradingView, you can move the sliders up and down and see what your R will be in real time. Double clicking on this will take you to the settings where you can input exact values.

Since you set your Stop Loss at a logical point, one based on TA and not a whim, you should do the same with your Price Target.

So why is having a high and, more importantly, realistic R a good thing?

Because then you can actually lose MORE trades than you win and STILL be profitable.

If you know your average R you can easily calculate the minimum win rate you must have to stay profitable over the long term:

(1 / (1+R)) X 100

Let’s say your average R per trade is 2.5:

(1/(1+2.5)) X 100 = 28.5%

Meaning that you only need to win 28.5% of the time to not lose money overall.

Because of the nature of this equation as your R increases, your required winrate to stay profitable decreases.

Final Thoughts

So, now that you have asked yourself, and have answered, the five big questions you are ready to open a trade.

Remember why we do this. We should not expect to win every trade. But you must set yourself up so that when you do lose there is minimal damage to your account.

Understanding the basics of Risk Management is the tool you need to keep your losses small, and account intact.

Please let me know if you have any questions and if you like it, please hit the thumbs up and be sure to follow for more!

Links to my Fibonacci Retracement, RSI, and MACD guides are below. Give them a read for more information!

EMAS ARE YOUR BEST TRADING FRIEND TRADE TIPAlthough EMAs lagg but every trader at every level needs to have a combination of several that they use

they are a vital tool for every trader and a must have

the right EMA after the right market move can be your crystal ball to the next few weeks direction of a pair or as in this case Bitcoin

in this chart you will see a cross of our 2 favorite emas after a few bearish 8 hour sessions

this was a signal to us to short and this gave us 24,000 Bitcoin monkey nuts

Its all about finding the right pair the right time frame and the right ema crossing

this is especially important in Crypto currency trading where have little confluentual history to go on

have a great trading week

EDUCATION - Rising & Falling Wedges - Reversal PatternsWhat is an ascending/descending correction?

The most common reversal pattern is the rising and falling wedge, which typically occurs at the end of a trend. The pattern consists of two trendiness which contract price leading to an apex and then a breakout appears.

Rising Wedge – Bearish Reversal

The ascending reversal pattern is the rising wedge which consists of higher highs and higher lows whilst losing momentum to the upside. Price contracts and eventually has a bearish break.

Falling Wedge – Bullish Reversal

The falling wedge reversal pattern occurs at the end bear run and indicates that price is ready to reverse. Again, price contracts and then eventually breaks out upwards.

There are 2 types of ways we can trade wedge patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

__________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the third touch of the trendline (as indicated in the chart above). Price may have the potential to go past the trendline for a deeper correction before moving up hence why this is called a risk entry. Whereas for the safe entry, the confirmation would be the break of the wedge.

How to trade using Risk Entry:

Wait for price to bounce off the trendline and then enter with stops below/above the correction depending on whether it’s a rising wedge or falling wedge.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and have massive gains!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. One of the confirmations of the safe entry is the third touch bounce and then another confirmation is when price breaks the correction which confirms that the structure has changed and that we are in a reversal.

How to trade using Safe Entry:

For a safe entry, enter when price has broken the correction with stops above/below the correction. Please note that with this entry method, the stoploss will be greater.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

RISING WEDGE EXAMPLES

RISK ENTRY

SAFE ENTRY

FALLING WEDGE EXAMPLES

RISK ENTRY

SAFE ENTRY

The Basics - Trend LinesTrend lines are used in technical analysis to define an uptrend or downtrend. Traditionally, uptrend lines are made by drawing a straight line through a series of ascending higher troughs (lows). ... With downtrends, trend lines are formed by drawing a straight line through a series of descending lower highs.

In an uptrend, the “imaginary line” acts as support and in a downtrend, the line connecting the points at swing highs become the resistance.

Although we can go into what and why – the logic for trend line, is to keep it simple. It’s another subjective area and people like to spot patterns. It’s human nature.

This shows in it's most basic form the concept of a trend line.

In an uptrend we want to see, higher highs as well as higher lows as shown below;

And in a down trend, the opposite is true - Lower highs & lower lows to create the pattern as per main image of this post.

Many other techniques and indicators use this concept, and perhaps the most famous being Elliott waves.

Here's a post on Elliott basics;

This then all points back to Dow Theory - where markets have 3 cycles and 3 waves (another lesson for another time) in short;

Here's also a post covering the Dow basics;

You can also use Moving averages as part of "working out the trend"

And her is another simple guide to MA's (moving Averages)

We thought it would be interesting to post, more of a beginners post that our usual stuff. Hope this helps some of the newer traders.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

An intuitive way of understanding the nature of PRICE DISCOVERYThis is an idea that I have an probably will keep working on for a long time. I haven't shared any ideas in a while, and this idea will be a detailed and one of my best ones so far. The aim is to provide the guidelines on how to improve the decision making of your next trade or investments. I will try to keep it as simple and short as possible. As the chart above is mostly explained, I will focus on other complementary explanations. The idea is based on well known decision tree methods, however what most textbooks do not state is how should they be effectively applied in practice. The diagram is a visual representation of the methodology.

A snapshot of the idea that is not altered by the tradingview frame dimensions.

The most essential rule or the truth is that almost all of asset pricing is based on guess work, as markets are forward looking. However, guesses can differ by the amount of information that they hold. Consequently, the aim is to come to the most educated guess about the paths that the future prices could take, which may not simple be the most probable outcome (i.e optimization doesn't work as intended, because markets are not always rational). To come up to the best guesses, an understanding of the price discovery process is essential. Price discovery is related to the timing and efficiency of updating of investors expectations, which in theory should be immediately reflected by the ensuing price action.

Following this train of thought, I decided to formalize the ideas that I already had from my experience of following the markets. The best way to understand new ideas is always with the help of examples:

To further explain the steps, few complementary things must be elaborated:

1. Firstly, are you investing or trading? For trading purposes only trade(speculate or bet) based on your beliefs of the probability of an event. Whereas, for investments consideration of a multitude of events that are usually codependent is almost always required. For a more refined investment process, see CFA's investment policy statement (IPS) guidelines. Generally, more complex decision trees are required for investments, and only simple trees are required for trading. For options this is a relatively given due to the option maturity, although such a choice of a timeline is actually contained in the choice of maturity and strike.

2. When you are distinguishing the timeline of the events, it is of crucial importance that the events are likely to occur in your holding period horizon. For instance, there are all these talking heads such as Peter Schiff and the likes that have been blabbering about the collapse of the monetary system for the past 10 years, which is obviously inevitable (at least from a historical stand point). However, if you are planning to hold gold or bitcoin in the next year, there is almost zero percent that such an event would take place, in which case there is a mismatch between your holding period and the event that you are trading(speculating) on. The idea here is, do not come too early to the party.

3. Catalysts hold the same meaning as in a chemical context, but only now instead of substances, they are events that can speed up the pricing of certain events. They are usually unanticipated by the broad market players, hence the swiftness of the corresponding market reaction. Catalysts are in a sense hitting the jackpot, the fastness and easiest money can be made if the trade is based on such catalytic events. Given that catalysts are by default unanticipated events they are to be separately considered and not part of the diagram above. Catalysts are similar to the concept of swans from Taleb, although he focuses on events of high impact magnitude.

4. Here is a simple example of other slightly more complex variation of decision trees.

The basic idea here is to consider the timeline of the price discovery process of each event, it's conditionality to other events and whether it is a part of a cycle.

To conclude this idea, it is important to know the timelines of events and their conditionality to other events. The probability and values of their outcomes are mostly a guess work, where probabilities are usually extracted from the observed prices. So in this respect just have an idea of potential targets outcomes in each scenario which usually can be done from a historical perspective, other comparable transactions, or using technical/trend patterns. By knowing the targets, you can estimate whether the trade or investment is worthy according to your risk appetite. Likewise, if you reckon that the probability of an event is different than the priced in probabilities of the market, you are also in a position to earn nearly riskless profits, assuming the market is wrong and you are right.

Each market has its own specific price dynamics, stocks are valued using different methods (DCF, comparable ratios, etc..) to commodities, bonds or currencies, but overall it is best to focus on a particular segment. The eternal problem here is that you might miss out on opportunities that arise in other markets, especially in periods that are not volatile. Overall, all methods are based on certain set of unavoidable assumptions, even quantitative methods such as simulating price paths (media.springernature.com) are at least based on an assumed drift or the distribution parameter of the residual term (depending on the model used, which is by itself a biased choice). An additional disadvantage to such methods and the use of technical patterns is that they do not consider other "soft" public or private information that is an integral part of discretionary fundamental strategy. This is why a combination of methods with choices that are rightly justified is the most consistent way to break out of the zero sum game.

Clearly many books have been written on this subject and this idea can go on in extreme details, however for now I reckon that all the principal points are covered in this idea. Thank you for taking the time to read!

-Step_ahead_ofthemarket

________________________________________________________________________________________

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well-informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up and follow is greatly appreciated!

Disclosure: This is just an opinion, you decide what to do with your own money. For any further references or use of my content- contact me through any of my social media channels.

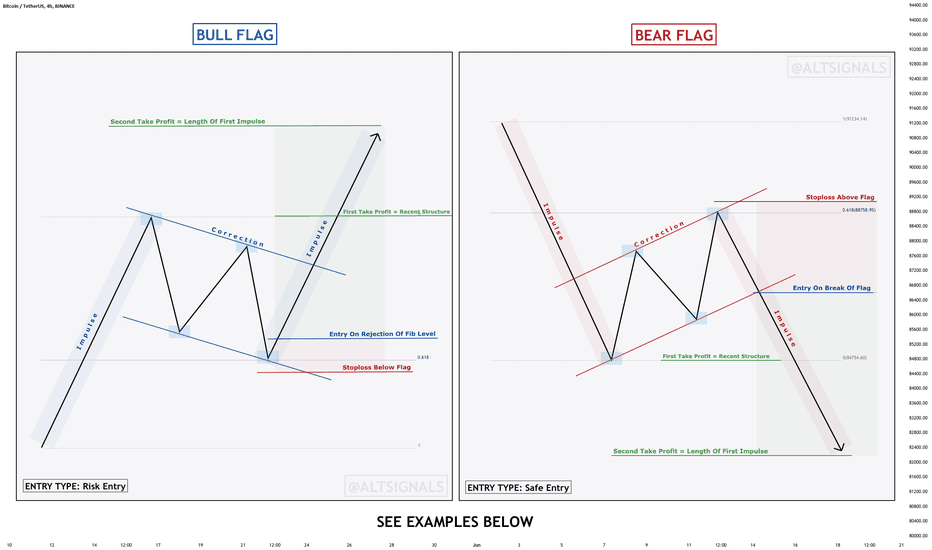

EDUCATION - Identifying & Trading Flag Patterns In this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

Bitcoin in context of price action and volume.I'm contributing some conscious thought to my trading education, and I am trying to get volume in there as a different voice to help me out. Volume is touted as one of the best clues you can use. Unlike every other indicator out there, volume is not a derivative of price. It is a totally seperate voice, that when combined with price action, supposedly, can result in really good opportunities and higher level of understanding what the market is really up to.

I have countered the need to learn volume in my own strategy by trading only futures during the new york hours when volume is relatively great, but like every other thing on this wonderful planet, there are different facets to volume the deeper you go. This is my attempt to lean on it a little harder and see what pushes back.

The Great men of the trading worldAs a trader of over 20 years, there has been a lot of trial and error. A lot of learning, it’s still continuing! I wanted to share some interesting pointers with the community;

People see charts really look deeper than that.

I regard a couple of men in trading terms as the “Greats” Would there be others you consider? Why?

Let’s start – the only order is the age (timestamp) rather than preference to their work.

Charles Henry Dow (November 6, 1851 – December 4, 1902) was an American journalist who co-founded Dow Jones & Company. Little known fact, Dow also co-founded The Wall Street Journal, which has become one of the most respected financial publications in the world. He also invented the Dow Jones Industrial Average as part of his research into market movements. This guy has his own chart.

He developed a series of principles for understanding and analyzing market behavior which later became known as Dow theory, the groundwork for technical analysis.

Dow theory explained

The Dow theory is based on the analysis of maximum and minimum market fluctuations to make accurate predictions on the direction of the market.

According to the Dow theory, the importance of these upward and downward movements is their position in relation to previous fluctuations. This method teaches investors to read a trading chart and to better understand what is happening with any asset at any given moment. With this simple analysis, even the most inexperienced can identify the context in which a financial instrument is evolving.

Furthermore, Charles Dow supported the common belief among all traders and technical analysts that an asset price and its resulting movements on a trading chart already have all necessary information already available and forecasted in order to make accurate predictions.

Based on his theory, he created the Dow Jones Industrial Index and the Dow Jones Rail Index (now known as Transportation Index), which were originally developed for the Wall Street Journal. Charles Dow created these stock indices as he believed that they would provide an accurate reflection of the economic and financial conditions of companies in two major economic sectors: the industrial and the railway (transportation) sectors.

------------------------------------------------

This is another interesting topic in it’s own right, but not for this article.

“Pride of opinion has been responsible for the downfall of more men on Wall Street than any other factor.” Charles Dow.

------------------------------------------------

Many of our modern techniques fit into Dow theory in some way, shape or form and most people do not realise this.

=====================================================================================================================================

R.N Elliott – Elliott waves to most

Ralph Nelson Elliott (28 July 1871 – 15 January 1948) was an American accountant and author, whose study of stock market data led him to develop the Wave Principle, a form of technical analysis that identifies trends in the financial markets. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves.

Elliott Said “The forces that cause market trends have their origin in nature and human behaviour” as well as “Forces travel in waves, as demonstrated by Galileo, newton and other scientists.”

--------------------------------------------

Wave Theory

In the early 1930s, Elliott began his systematic study of seventy-five years of stock market data, including index charts with increments ranging from yearly to half-hourly. In1938, he detailed the results of his studies by publishing his third book, The Wave Principle.

Elliott stated that, while stock market prices may appear random and unpredictable, they actually follow predictable, natural laws and can be measured and forecast using Fibonacci numbers. Soon after the publication of The Wave Principle, Financial World magazine commissioned Elliott to write twelve articles (under the same title as his book) describing his new method of market forecasting.

In the early 1940s, Elliott expanded his theory to apply to all collective human behaviors. His final major work was his most comprehensive: Nature's Law –The Secret of the Universe published in June, 1946, two years before he died.

In the years after Elliott's death, other practitioners (including Charles Collins, Hamilton Bolton, Richard Russell and A.J. Frost) continued to use the wave principle and provide forecasts to investors. Frost and Robert Prechter wrote Elliott Wave Principle, published in 1978 (Prechter had come across Elliott's works while working as a market technician at Merrill Lynch; his prominence as a forecaster during the bull market of the 1980s helped bring Elliott's wave principle its greatest exposure up to that time).

I wrote a few months back an article on the application of Elliott (Click the image for the link.)

=============================================================================================================================

Richard Wyckoff

This method has had a lot of popularity recently on social media and in @TradingView

Richard Demille Wyckoff (1873–1934) was an early 20th-century pioneer in the technical approach to studying the stock market. He is considered one of the five “titans” of technical analysis, along with Dow, Gann, Elliott and Merrill. At age 15, he took a job as a stock runner for a New York brokerage. Afterwards, while still in his 20s, he became the head of his own firm. He also founded and, for nearly two decades wrote, and edited The Magazine of Wall Street, which, at one point, had more than 200,000 subscribers. Wyckoff was an avid student of the markets, as well as an active tape reader and trader. He observed the market activities and campaigns of the legendary stock operators of his time, including JP Morgan and Jesse Livermore. From his observations and interviews with those big-time traders, Wyckoff codified the best practices of Livermore and others into laws, principles and techniques of trading methodology, money management and mental discipline.

From his position, Wyckoff observed numerous retail investors being repeatedly fleeced. Consequently, he dedicated himself to instructing the public about “the real rules of the game” as played by the large interests, or “smart money.” In the 1930s, he founded a school which would later become the Stock Market Institute. The school's central offering was a course that integrated the concepts that Wyckoff had learned about how to identify large operators' accumulation and distribution of stock with how to take positions in harmony with these big players. His time-tested insights are as valid today as they were when first articulated.

Although it seems complex – the logic still holds strong and has been seen even in recent Bitcoin moves. (click article – below) to see the types of Schematics.

---------------------------------------------

Wyckoff said “Successful tape reading is a study of Force; it requires ability to judge which side has the greatest pulling power and one must have the courage to go with that side.”

================================================================================================================

WD Gann

William Delbert Gann (June 6, 1878 – June 18, 1955) or WD Gann, was a finance trader who developed the technical analysis methods like the Gann angles and the Master Charts, where the latter is a collective name for his various tools like the Spiral Chart (also called the Square of Nine), the Hexagon Chart, and the Circle of 360 Gann market forecasting methods are purportedly based on geometry, astronomy and astrology, and ancient mathematics. Opinions are sharply divided on the value and relevance of his work. Gann authored a number of books and courses on shares and commodities trading.

There are several techniques using Gann methodology;

Here’s one on Gann Fans

Gann said “Time is more important than price. When time is up price will reverse.”

=====================================================================================================================

Another great man worth a mention, purely on these quotes 😉

If everyone is thinking alike, then no one is thinking.

Benjamin Franklin

Wyckoff would call this composite man logic!

Make yourself sheep and the wolves will eat you.

Benjamin Franklin

And this is how I feel the crypto market is currently looking.

Any others you think should be on the list, mention in comments and why?

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Crypto, EV, SPAC Bubble are related!Most Cryptocurrency believers justify their investment by bragging about how decentralized cryptocurrencies are.

But I believe it is very centralized because Elon Musk's tweets can cause a new wave in this market, any minute.

I believe Elon Musk and all other legendary investors like Ray Dalio, Carl Icahn, or whoever tweets or conduct interviews to support Bitcoin or the cryptocurrency market made a big miscalculation.

What is the most important miscalculation Cryptocurrency investors made?

Whenever any asset class reaches a high level of population penetration in a short timeframe, a bubble will be created.

As soon as this rate slows down a little the bubble will burst and the deflation process begins, and the cryptocurrency market is no exception..!

Cheatsheet to avoid the deflation phase of any bubble:

In most cases, average investors do not analyze data and invest based on their instinct and feeling of missing out (FOMO). But there is a simple trick that can save you and your investment just before any bubble burst!

What is that simple Trick???

Whenever you see an asset experience a parabolic price pattern and everyone talks about it, if you see it slows down a little it is the best time to sell..! Don't wait for the bearish trend, it will act so fast that makes you quadriplegic!

Sounds crazy, but works..!

Now I would like to teach Elon Musk who thinks he has "Diamond Hands" some physics..!

Diamonds can't withstand crushing pressures above 600 gigapascals (6 million atmospheres).

How this is related to the Cryptocurrency market???

Let's review the physics behind it:

Pressure is the force applied perpendicular to the surface of an object per unit area over which that force is distributed.

P= F / A

P: pressure

F: Force

A: Area

In physics, a force is any interaction that, when unopposed, will change the motion of an object. A force can cause an object with mass to change its velocity, i.e., to accelerate. Force can also be described intuitively as a push or a pull. A force has both magnitude and direction, making it a vector quantity

F = m a (kg·m/s2)

m: mass

a: acceleration

The force on an object is equal to the mass of the object multiplied by its acceleration: F=m*a.

The acceleration due to gravity is more or less assumed to be constant for surface-of-the-Earth calculations: a=g, so F=m*g.

In our study, the mean hand area in adult male was 146.50 cm2,

In our study, the mean hand area in adult males was 146.50 cm2. (Area)

Total Cryptocurrency Market Cap: at its max was 2.577 Trillion.

United States one-hundred-dollar bill = 1g

We have all the data we need to build a model (Fantasy):

Total Cryptocurrency Market Cap: at its max was 2.577 Trillion

2,577,000,000,000 = 25,770,000,000 United States one-hundred-dollar bills

United States one-hundred-dollar bill = 1g

2.577 T= 25.77 B 100$ USD = 25,770,000 kg

Value of g (m/s2) at Earth's surface 6.38 x 106 m =9.8

F = 25,770,000 * 9.8 = 252,546,000

Mean hand area in adult male was 146.50 cm2,

146.5+146.5 = 293 cm2, = 0.0293 m2 (estimated surface for hands of Elon Musk)

A: 0.0293 m2

P=252,546,000/0.0293= 8,619,317,406.143345 kg/m2

1 kg/m2 = 9.81 Pascals

Crypto currency market Bubble pressure just before burst: 84,555,503,754.26621 Pa

Diamonds can't withstand crushing pressures above 600 gigapascals (6 million atmospheres).

How many diamond hands (pairs) are needed to tolerate the pressure???

84,555,503,754.26621/600,000,000 = 140.9258395904437

This means we need almost 141 Elon Musk and we are 140 Elon Musk shy.

This false feeling of having "Diamonds hands" is related to the 56.1 million followers he has on Twitter.

To tolerate this level of pressure his diamond hands need 7.9 Billion followers..!

I believe the EV, SPACs, and crypto Frenzy in the past year directed by a team of 3 major players:

Elon Musk

Cathie Wood (Catherine Duddy Wood is the founder, CEO, and CIO of Ark Invest, an investment management firm.)

Chamath Palihapitiya (venture capitalist, engineer, SPAC sponsor, and the founder and CEO of Social Capital. Former Facebook's vice president of operations )

Fortunately, they are trapped in a self-created bubble, and 10 years from now you will see how trustworthy these people are in the financial world.

These people used the power of social media like Twitter and Youtube to their benefit and left many in tears..!