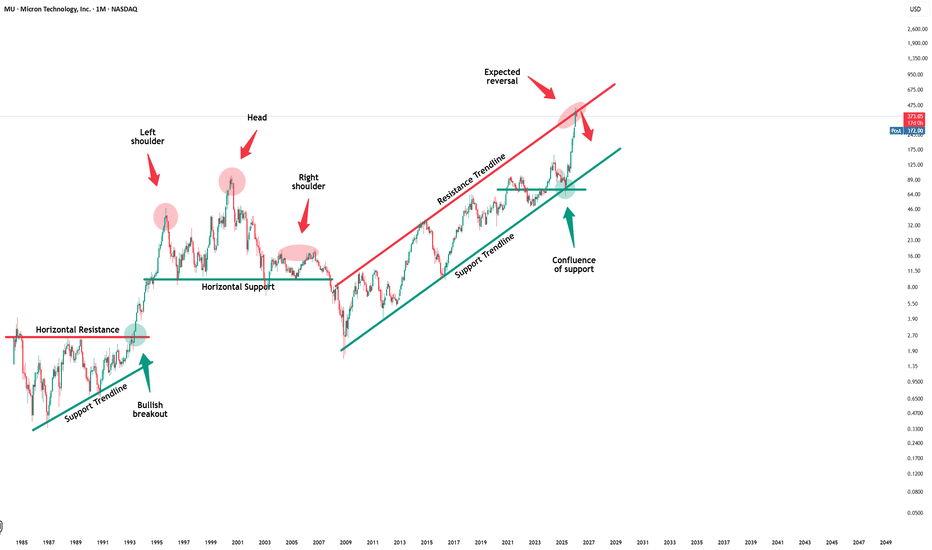

Micron Technology - This was the last all time high!🍾Micron Technology ( NASDAQ:MU ) creates a textbook reversal:

🔎Analysis summary:

Micron Technology rallied an expected +500% over the past couple of months. But now, Micron Technology is totally overextended and ready for a correction. And with the current retest of the final resistance trend

BITF Bitfarms Could Be the Next IREN Limited Bitfarms has publicly stated that it is winding down Bitcoin mining and reallocating capital toward AI and high-performance computing data centers. This is not a vague narrative shift — it involves concrete steps: redeveloping existing sites, leveraging contracted power, and targeting long-term AI c

STRATEGY The collapse continues..Strategy (MSTR) completely lost its 1W MA200 (orange trend-line) last week, making its losses at more than -80% from its November 2024 All Time High (ATH), continuing to outperform even Bitcoin in losses. Given that the Bear Cycle on stocks hasn't started yet, this can only get (much) worse, somethi

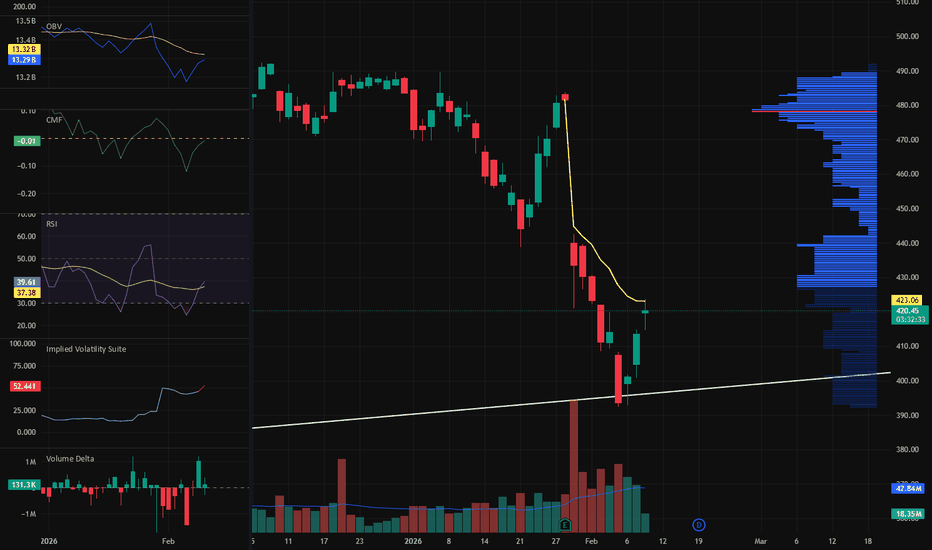

It's a time for MSFT - 15 % potential profit - 480 USDMicrosoft shares are currently in a clear phase of strong sell-off following the peak in October/November 2025 (~$540–550+), where a classic breakout occurred followed by a breakdown of the uptrend. The decline from the high has already reached ~24–25%, and in 2026 alone the stock has lost more than

MSFT 424 Is the Real Test for BuyersJust like I mentioned earlier, 424 is the real test for buyers, and today’s action confirms it. Buyers were much more aggressive yesterday, but once sellers showed up again at 424, the bid clearly softened. That tells me this level is being actively defended and remains the most important area for s

Applied Digital (APLD) - Value "Buy The Dip" Area

Applied Digital (APLD) builds massive data centers that power AI, cloud computing, and high-performance computing. As AI usage explodes, companies need huge computing facilities, and APLD rents that space and power to them.

🏢 What APLD Actually Does

Think of APLD as building giant computer w

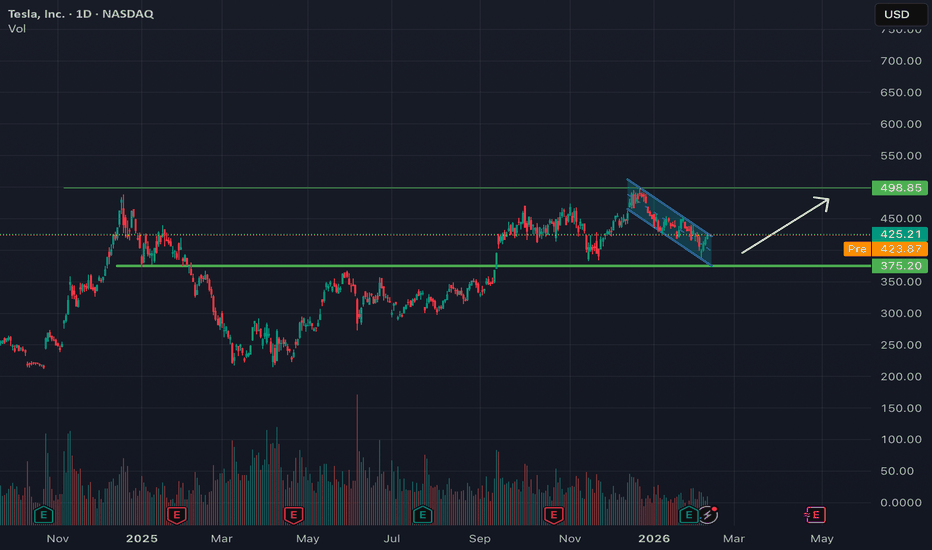

Tesla to potentially retest $500, needs Nasdaq strengthDaily chart showing NASDAQ:TSLA sitting at support inside a downtrend channel, sort of resembling a flag pattern. There is potential that Tesla may bounce off the support, and find its way to breakout of the downtrend channel in a bullish move towards $500.

This is of course is completely depende

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activePre-market gainersPre-market losersPre-market most activePre-market gapAfter-hours gainersAfter-hours losersAfter-hours most activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksPink sheetOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Today

TBNTamboran Resources Corporation

Actual

—

Estimate

−60.85

USD

Today

FLNGFLEX LNG Ltd.

Actual

0.43

USD

Estimate

0.43

USD

Today

LADLithia Motors, Inc.

Actual

6.74

USD

Estimate

8.11

USD

Today

VRTVertiv Holdings, LLC

Actual

1.36

USD

Estimate

1.29

USD

Today

HLTHilton Worldwide Holdings Inc.

Actual

2.08

USD

Estimate

2.02

USD

Today

RDWRRadware Ltd.

Actual

0.32

USD

Estimate

0.30

USD

Today

HUMHumana Inc.

Actual

−3.96

USD

Estimate

−4.00

USD

Today

GNRCGenerac Holdings Inc.

Actual

1.61

USD

Estimate

1.77

USD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Electronic Technology | ||||||||

| Technology Services | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Producer Manufacturing | ||||||||

| Consumer Non-Durables | ||||||||

| Energy Minerals | ||||||||

| Consumer Durables | ||||||||

| Non-Energy Minerals |