Harmonic Patterns

Litecoin (LTC): Seeing Good R:R Trades Here | $300 Incoming!Litecoin has been one of our favorite coins, with the price being in a healthy bullish trend, and the smaller timeframe is currently showing us good upside movement signs—$300 is the main target here!

More in-depth info is in the video—enjoy!

Swallow Academy

BITCOIN BTC BITCOIN ,THE STRUCTURE ON 4HR provided an ascending trendline and we have seen buyers keeping that dynamic support for buy .

we will monitor the current supply roof breakout for better buy confirmation after seeing a 2hr ascending trendline cross providing a support that took us to 118k if correction into 116-117k hold and the broken supply becomes demand than 123k all time high retest is on the desk.

trading is 100% probability.

manage your risk.

#btcusdt #bitcoin #tbc #crypto

BITCOIN the rejection around $117,576 fits into the current volatile but evolving Bitcoin market, where prices near these peaks face resistance amid institutional inflows, ETF impacts, and changing cycle patterns. Ongoing market sentiment, regulatory developments, and macroeconomic factors will continue to influence whether these resistance levels are eventually broken or retested further.

its critical to know that further capital inflow could see 130K-135K and we will see massive correction.

and on a flip side a break out of the 4hr ascending trendline will be looking at 99k-100k zone .

#btc #bitcoin

TRADING RECAP ON AUDJPY AND EURUSDHey, my people, I have made a quick video on the trades I took from last week, and I hope that I have shared some lessons that would be useful for you all to take on board and I hope that by the end of this video, you will have clarity on what the trade probability would look like.

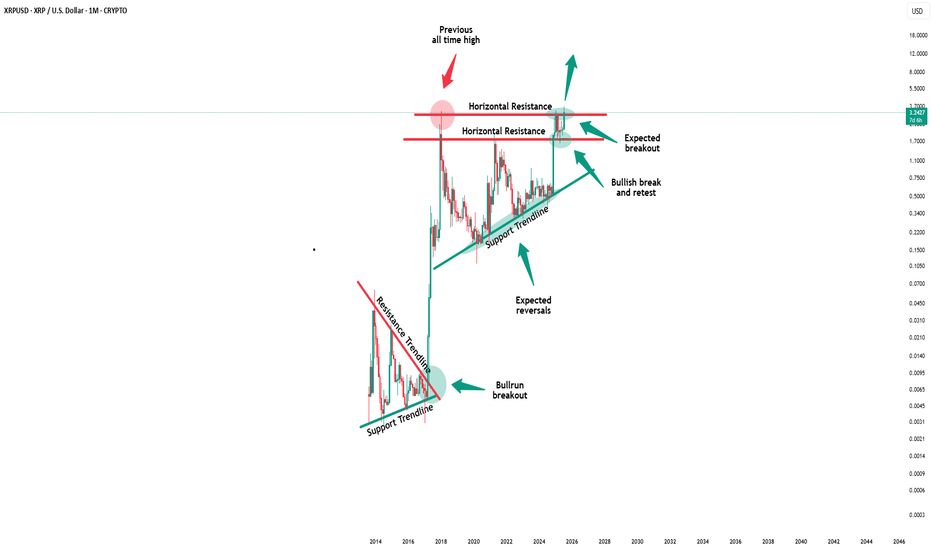

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION