DOLLAR INDEXDepartments Responsible for Each Economic Report

Indicator Responsible Department/Source

Average Hourly Earnings m/m U.S. Bureau of Labor Statistics (BLS), part of the Department of Labor

Non-Farm Employment Change BLS (Establishment Survey)

Unemployment Rate BLS (Household Survey)

Final Manufacturing PMI S&P Global/Markit (private company)

ISM Manufacturing PMI Institute for Supply Management (ISM, private sector)

ISM Manufacturing Prices Institute for Supply Management (ISM)

Revised University of Michigan (UoM) Consumer Sentiment University of Michigan (private/public university)

Construction Spending m/m U.S. Census Bureau, Department of Commerce

Revised UoM Inflation Expectations University of Michigan

How the Federal Reserve Interprets “Greater Than” or “Lower Than” Forecast

1. Average Hourly Earnings,

2.Non-Farm Payrolls,

3. Unemployment Rate

Higher than forecast (stronger labor market):

Tight labor markets (higher wages, more jobs, lower unemployment) suggest inflationary pressure.

The Fed may view this as a signal to keep rates higher for longer, as wage and job growth could fuel inflation.

Lower than forecast (weaker labor market):

Signals cooling in employment and wage growth, reducing upward pressure on inflation.

The Fed may see this as justification to consider easing policy or at least pausing further rate hikes.

2. Manufacturing PMIs (ISM, S&P)

Above 50: Signals expansion in manufacturing; below 50 indicates contraction.

Higher than forecast: Points to stronger economic momentum; the Fed may see upside risks to inflation.

Lower than forecast: Indicates weaker manufacturing activity; a possible sign of slowing demand, which could support rate cuts or dovish policy if persistent.

3. ISM Manufacturing Prices

Higher than forecast: Suggests inflationary pressures in manufacturing input costs; Fed interprets this as a reason for vigilance on inflation.

Lower than forecast: Implies easing input price pressures, supporting a dovish outlook if inflation remains subdued.

4. University of Michigan Consumer Sentiment & Inflation Expectations

Stronger than forecast sentiment: Consumers are more optimistic, often a sign of solid spending potential. May amplify inflation if this leads to greater demand.

Higher inflation expectations: If consumers expect higher future inflation, this can become self-fulfilling and the Fed may maintain tighter policy.

Weaker sentiment/lower inflation expectations: Reduces inflation risk, gives the Fed more flexibility to ease if needed.

5. Construction Spending

Higher than forecast: Indicates resilient investment and demand in the real economy.

Lower than forecast: Suggests cooling real estate and infrastructure spending; may support a dovish Fed outlook if sustained.

Summary Table

Data Surprises Interpretation for Fed Policy

Higher-than-forecast More hawkish; raises risk of persistent inflation

Lower-than-forecast More dovish; reduces pressure to hold rates higher

The Fed looks at the overall pattern across these data. Persistent upside surprises heighten concerns about inflation, supporting tighter policy. Downside surprises suggest cooling economic momentum and may encourage future rate cuts or pauses. The relative impact depends on which indicators surprise and the broader economic context.

#DXY #DOLLAR

Harmonic Patterns

USOIL WTIWest Texas Intermediate (WTI) oil is a major benchmark for crude oil pricing, known for its high quality—being both light and sweet due to its low sulfur content and low density. WTI is sourced primarily from inland Texas and is the underlying commodity for oil futures traded on the New York Mercantile Exchange (NYMEX). The main physical delivery point is Cushing, Oklahoma, a critical U.S. oil storage and trading hub.

Current Price (as of August 1, 2025)

WTI crude oil is trading around $69.15–$69.36 per barrel.

Recently, WTI prices have seen volatility due to global economic factors, including U.S. tariffs, OPEC+ production, and shifts in oil demand. Despite a small decline on the day, oil prices have posted their strongest weekly performance since June, rising over 6% for the week.

Market and Outlook

Recent price movement reflects concerns about global trade tensions, new tariffs, and their impact on economic growth and energy demand. At the same time, supply risks remain due to geopolitical factors such as potential sanctions on Russian oil and U.S.-China trade developments.

Analyst forecasts for the remainder of 2025 suggest continued volatility, with WTI potentially ranging between $56 and $73 per barrel, influenced by demand, OPEC+ decisions, and geopolitical events.

Quick Facts Table

Feature Detail

Type Light, sweet crude

Benchmark NYMEX (U.S.), major global reference

Main Delivery Point Cushing, Oklahoma

Latest Price (Aug 1, 2025) $69.15–$69.36 per barrel

Typical Drivers U.S. tariffs, OPEC+ decisions, trade policy, supply risks, global demand

WTI oil plays a central role in global energy markets, serving as a benchmark for North American and international oil pricing. Its price reflects both supply fundamentals and broader macroeconomic and geopolitical developments.

#OIL #WTI

BLACKBERRY BBBREAKOUT OF DESCENDING TRENDLINE COULD SEE 22$-24$

BlackBerry today is a Canadian technology company specializing in cybersecurity software and Internet of Things (IoT) services for enterprises and governments worldwide. Formerly renowned as a mobile device manufacturer, BlackBerry Limited (formerly Research In Motion, RIM) exited the smartphone business in 2016 and now focuses on secure communications, endpoint management, and embedded systems, especially for industries like automotive, healthcare, and government.

Company Profile & Business

Headquarters: Waterloo, Ontario, Canada

Core products: Cybersecurity solutions, BlackBerry Unified Endpoint Management (UEM), QNX operating systems, secure messaging (BlackBerry Messenger Enterprise, BBMe), and automotive software platforms.

Global presence: Products and services are sold worldwide across the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Recent Financials & Stock

Stock ticker: NYSE/TSX: BB

Recent price: As of July 30, 2025, BlackBerry closed at $3.74 per share, reflecting a decline from earlier in the month. Price targets for the company now range from $2.71 to $4.75, with analysts citing positive revenue growth and the company's first positive cash flow in three years after its recent quarterly results.

Business momentum: The company recently posted about 10% higher revenue compared to forecasts for the third quarter fiscal year 2025, with a shift to positive earnings and cash flow—highlighting improvements in its cybersecurity and IoT software businesses.

Notable News & Developments

End of smartphones: BlackBerry-branded mobile devices are officially discontinued. The company fully exited the hardware business by 2018 and stopped supporting BlackBerry 10 in 2022.

Nostalgia revival: In 2025, a separate company (Zinwa Technologies) is reviving classic BlackBerry devices (like the BlackBerry Classic and Passport) by retrofitting them with modern Android internals. These are not officially affiliated with BlackBerry Limited, but appeal to enthusiasts for the classic design and QWERTY keyboard, albeit with privacy caveats due to non-BlackBerry software.

Enterprise focus: BlackBerry remains a leader in secure software for businesses, including automotive OS (QNX), endpoint security, and secure messaging. Major clients include automotive OEMs, financial corporations, and government agencies.

Quick Facts Table

Aspect Details

Industry Cybersecurity, IoT software, enterprise services

Founded 1984 (as Research In Motion, Canada)

Consumer Phones Discontinued; brand revived unofficially by others

Current Stock Price $3.74 (July 30, 2025)

Latest Product Focus Automotive software, secure endpoint management

BlackBerry is no longer a phone maker, but remains a significant player in secure enterprise and automotive software, with stock prices and business outlook reflecting its transition into these fields.

Zinwa Technologies is a Chinese technology company that has gained attention in 2025 for its project to revive classic BlackBerry smartphones, specifically the BlackBerry Classic (also known as the Q20), under its own branding. Unlike BlackBerry Limited (which no longer makes hardware), Zinwa has purchased batches of old BlackBerry Q20 devices—both new-old-stock and used units from supply chains in Hong Kong—and is refurbishing them with entirely new internal components while retaining the iconic design features such as the physical QWERTY keyboard and 720x720 touchscreen.

Key Details on Zinwa Technologies’ BlackBerry Revival:

Project Name/Models: The updated phone is called the Zinwa Q25 (2025 is referenced in the model name). Zinwa is also planning to modernize other BlackBerry devices, including the KEYone (“K25”) and the Passport (“P25” or “P26”).

What’s Modernized?: The original shell, keyboard, notification LED, and display remain, but Zinwa installs a new motherboard with a MediaTek Helio G99 processor, 12GB RAM, 256GB storage (expandable), a 50MP rear camera, 8MP front camera, a new 3,000mAh battery, and global 4G LTE support. There is a USB-C port, headphone jack, microSD support, and the phone runs Android 13 (with no confirmed plans for updates to later Android versions).

How It’s Sold: Two options are offered—a fully assembled Zinwa Q25 smartphone for $400, or a $300 conversion kit for those who already own a BlackBerry Classic and want to upgrade themselves. Both are expected to ship in August 2025.

Nostalgia Meets Modern Tech: The initiative targets fans of physical keyboards and retro gadgets as well as a new wave of Gen Z users seeking “digital detox” devices. The device is positioned as a niche product for enthusiasts rather than a mass-market flagship.

No Connection to BlackBerry Limited: Zinwa Technologies has not acquired the BlackBerry brand or company; its project is independent and relies on recycling and upgrading old BlackBerry hardware.

Future Plans: Zinwa has stated it may refresh additional BlackBerry models based on demand and feedback, following the Q25 release.

In sum, Zinwa Technologies is bringing back the BlackBerry Classic as a refreshed, Android-powered device for technology enthusiasts and nostalgia seekers, reflecting a trendy intersection of retro design and modern smartphone capabilities in 2025.

#BB

Alibaba - A remarkable reversal!🛒Alibaba ( NYSE:BABA ) reversed exactly here:

🔎Analysis summary:

Recently Alibaba has perfectly been respecting market structure. With the current bullish break and retest playing out, there is a very high chance that Alibaba will rally at least another +20%. But all of this chart behaviour just looks like we will witness a major bottom formation soon.

📝Levels to watch:

$110, $135

🙏🏻#LONGTERMVISION

Philip - Swing Trader

DOLLAR INDEX DXYThe latest U.S. economic data released on July 30, 2025 shows:

ADP Non-Farm Employment Change: Actual increase of 104,000 jobs, significantly above the forecast of 77,000. This marks a strong rebound from the previous decline of -23,000 in June and indicates solid labor market momentum, particularly in services sectors like leisure/hospitality, financial activities, and trade/transportation. However, education and health services saw job losses. Wage growth remains steady at 4.4% year-over-year for job-stayers.

Advance GDP q/q Growth: Actual growth came in at 3.0%, beating the forecast of 2.5% and improving sharply from -0.5% previously. This suggests that the economy is expanding robustly in the second quarter

Advance GDP Price Index q/q (Inflation measure): Actual was 2.0%, slightly below the forecast of 2.2%, and down from 3.8% previously, indicating easing inflation pressures .

Interpretation of this data for Federal Reserve policy:

The stronger-than-expected job growth and GDP expansion signal a resilient economy, which may reduce the immediate likelihood of Fed rate cuts, as these indicators support sustained economic momentum.

The slightly softer inflation reading on the GDP Price Index suggests inflation pressures are continuing to moderate, which could offer some flexibility to the Fed.

Overall, the Fed is likely to view this data mix as supportive of a cautious, data-dependent approach, possibly maintaining current rates in the short term without rushing to cut, but monitoring to ensure inflation stays on a downward path.

If the Fed prioritizes strong growth and a resilient labor market, rate hikes or holds are more likely than cuts. If inflation remains subdued, it could permit a gradual easing down the line but probably not immediately.

Let me know if you want a detailed outlook on market reactions to this release or the potential Fed communication following today’s data.

#GOLD

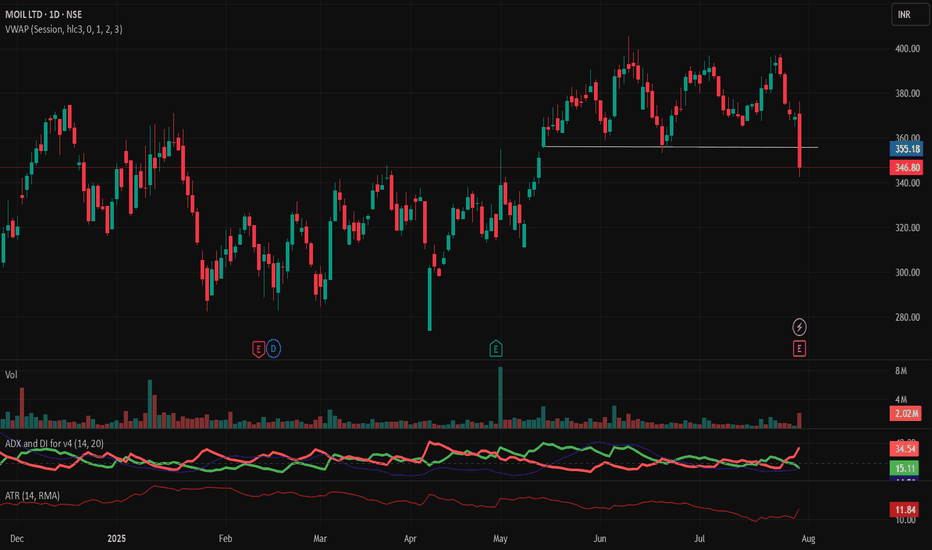

Review and plan for 31st July 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

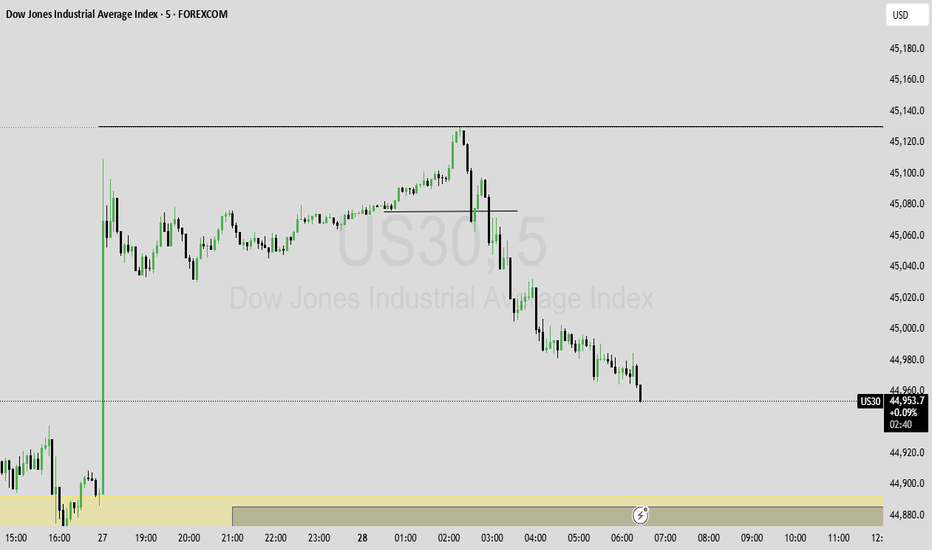

EURUSDEUR/USD Exchange Rate

Current Rate: About 1.1525

Government Bond Yields

U.S. 10-Year Treasury Yield: 4.328%

Eurozone 10-Year Government Bond Yield: Last reported at 2.686%

Economic Data Reports for Today

U.S. Data:

1:15pm

USD

ADP Non-Farm Employment Change

82K -33K

1:30pm

USD

Advance GDP q/q

2.4% -0.5%

USD

Advance GDP Price Index q/q

2.3% 3.8%

3:00pm

USD

Pending Home Sales m/m

0.3% 1.8%

3:30pm

CAD

BOC Press Conference

USD

Crude Oil Inventories

-3.2M

7:00pm

USD

Federal Funds Rate

4.50% 4.50%

USD

FOMC Statement

7:30pm

USD

FOMC Press Conference

Market Focus Today: The Federal Reserve announces its policy decision.

Eurozone Data:

GDP Growth (Q2): Eurostat reports second-quarter growth at 0.1% quarter-on-quarter (QoQ) and 1.4% year-on-year (YoY). Germany and Italy contracted by 0.1% QoQ, France rose 0.3%, and Spain outperformed at 0.7%.

Outlook: The Eurozone economy faces headwinds from new U.S. tariffs and tepid industrial output, though Q2 was somewhat better than feared.

Current Interest Rates

Area Main Rate (July 2025) Policy Outlook

U.S. 4.25% – 4.50% Fed expected to hold steady

EU 2.15% (main refi rate) ECB in data-dependent pause

2.00% (deposit rate)

U.S.: The Federal Reserve is widely expected to hold rates in the 4.25%–4.50% range at today's FOMC meeting, reflecting a cautious approach in light of current growth and inflation figures.

Eurozone: The ECB last held its main refinancing rate at 2.15% and the deposit facility at 2.00% as of the July 24, 2025 meeting, emphasizing a meeting-by-meeting, data-driven stance.

Key Takeaways

EUR/USD is subdued just above 1.15 as the euro weakens on modest Eurozone growth and broad dollar strength ahead of the Fed.

10-year yields remain elevated in both regions, reflecting stable but cautious outlooks.

Today’s U.S. and ECB meetings/data are critical: Markets are watching for central bank reactions to new economic data and the ongoing effects of tariffs and global uncertainty.

This overview captures the most significant developments relevant to currency, rates, bonds, and economic trends for July 30, 2025.

#EURUSD #DOLLAR #EURO

DOLLAR INDEX The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is approximately 4.25% to 4.5%.

The federal funds rate is a key benchmark that influences broader interest rates across the economy, including loans, credit cards, and mortgages. When the Fed changes this rate, it indirectly affects borrowing costs for consumers and businesses. For example, increasing the rate makes borrowing more expensive and tends to slow down economic activity to control inflation, while lowering the rate stimulates growth by making credit cheaper.

The Fed adjusts this rate based on economic conditions aiming to maintain stable prices and maximum employment. It is a vital tool of U.S. monetary policy, impacting economic growth, inflation, and financial markets.

In summary:

It is the overnight lending rate between banks for reserve balances.

It is set as a target range by the Federal Reserve's FOMC.

It influences many other interest rates in the economy.

Current range (July 2025) is about 4.25% to 4.5%.

1. ADP Non-Farm Employment Change (Forecast: +82K, Previous: -33K)

Above Forecast:

If ADP employment is much stronger than expected, the Fed would see this as a sign of ongoing labor market resilience. Robust job growth would support consumer spending, potentially keep wage pressures elevated, and could make the Fed less likely to ease policy soon. This reinforces the case for holding rates steady or staying data-dependent on further cuts.

Below Forecast or Negative:

If ADP jobs gain falls short or is negative again, the Fed may interpret it as a weakening labor market, raising recession risk and reducing inflationary wage pressures. This outcome could increase the chances of a future rate cut or prompt a more dovish tone, provided it aligns with other softening indicators.

2. Advance GDP q/q (Forecast: +2.4%, Previous: -0.5%)

Above Forecast:

A GDP print above 2.4% signals surprisingly strong economic growth and likely sustains the Fed’s view that the U.S. economy is avoiding recession. The Fed may delay rate cuts or take a more cautious approach, as stronger growth can support higher inflation or at least reduce the urgency for support.

Below Forecast or Negative:

Weak GDP—especially if close to zero or negative—would signal that the economy remains at risk of stagnation or recession. The Fed may then pivot to a more dovish stance, become more willing to cut rates, or accelerate discussions on easing to avoid a downturn.

3. Advance GDP Price Index q/q (Forecast: 2.3%, Previous: 3.8%)

Above Forecast:

A significantly higher-than-expected GDP Price Index (an inflation measure) points to persistent or resurgent inflationary pressures in the economy. The Fed might see this as a reason to delay cuts or maintain restrictive rates for longer.

Below Forecast:

If the Price Index prints well below 2.3%, it suggests that inflation is cooling faster than anticipated. This outcome could allow the Fed to move toward easing policy if other conditions warrant, as price stability is more clearly in hand.

Bottom Line Table: Data Surprises and Likely Fed Reaction

Data Surprise Fed Outlook/Action

All above forecast Hawkish bias, rate cuts delayed or on hold

All below forecast Dovish bias, higher chances of rate cut

Mixed Data-dependent, further confirmation needed

Summary:

The Fed’s interpretation hinges on how these figures compare to forecasts and to each other. Stronger growth, jobs, and inflation = less rush to cut; weaker numbers = lower rates sooner. If growth or jobs are especially weak or inflation falls sharply, expect more dovish Fed commentary and a greater likelihood of future easing. Conversely, if the data all surprise to the upside, hawkish (rate-hold) messaging is likely to persist.

The U.S. Dollar Index (DXY) is a financial benchmark that measures the value of the United States dollar relative to a basket of six major foreign currencies. It provides a weighted average reflecting the dollar's strength or weakness against these currencies. The DXY is widely used by traders, investors, and economists to gauge the overall performance and health of the U.S. dollar on the global stage.

Key Features of the DXY:

Currencies included and their weights:

Euro (EUR) – 57.6%

Japanese Yen (JPY) – 13.6%

British Pound (GBP) – 11.9%

Canadian Dollar (CAD) – 9.1%

Swedish Krona (SEK) – 4.2%

Swiss Franc (CHF) – 3.6%

It was established in 1973 after the collapse of the Bretton Woods system to serve as a dynamic measure of the dollar's value.

The index reflects changes in the exchange rates of these currencies versus the U.S. dollar, with a higher DXY indicating a stronger dollar.

The DXY influences global trade dynamics, commodity prices (like oil and gold), and financial markets.

It is calculated as a geometric mean of the exchange rates weighted by each currency's significance in U.S. trade.

#DXY

In essence, the DXY is a crucial tool to assess how the U.S. dollar is performing against its major trade partners’ currencies, helping market participants make informed decisions in foreign exchange and broader financial markets.

EURAUD THE CURRENT PRICEACTION OF EURAUD IS WATCHED.

EU10Y=2.689%

ECB RATE 2.0%

AU10Y= 4.348%

RBA RATE =3.85%

RATE AND BOND YIELD DIFFERENTIAL FAVOR AUD .

The recent fluctuations in the EUR/AUD exchange rate are primarily driven by factors including:

Monetary Policy and Interest Rate Differentials:

Decisions and outlooks from the European Central Bank (ECB) and the Reserve Bank of Australia (RBA) strongly impact EUR/AUD. Hawkish (tightening) or dovish (easing) policy stances influence demand for each currency, affecting the exchange rate. For example, higher interest rates or hawkish tones usually strengthen a currency, while easing weakens it. Differences in inflation rates and inflation expectations also play a part, as central banks adjust rates accordingly.

Economic Indicators and Growth Outlooks:

Economic performance disparities between the Eurozone and Australia—such as GDP growth, trade balances, and industrial versus commodity exports—drive currency strength or weakness. The Eurozone’s economy is more industrial and technological, while Australia's economy is strongly commodity-driven, especially by prices of iron ore and gold. Changes in global commodity prices or demand can cause the AUD to fluctuate vs the EUR.

Commodity Prices, Especially Gold:

Since Australia is a major gold producer, AUD tends to correlate positively with gold prices. Rising gold prices support AUD strength, which may lower EUR/AUD rates, and vice versa.

Global Risk Sentiment and Geopolitical Events:

Global market sentiment—whether investors seek risk or safe-haven assets—affects both currencies. The Euro and AUD react differently to geopolitical developments and trade tensions. For instance, increased risk appetite can strengthen AUD vs EUR and vice versa depending on circumstances.

In summary, the recent EUR/AUD fluctuations reflect the interplay of ECB and RBA policies, divergent economic data between Europe and Australia, commodity price movements (notably gold), and shifting global risk sentiment.

This explains why EUR/AUD rates move as they do: when the Eurozone outlook improves or ECB signals tightening while Australian commodity prices weaken or RBA signals easing, EUR tends to strengthen against AUD, and the pair rises. Conversely, stronger Australian growth, rising commodity prices, or hawkish RBA moves can push the pair lower.

#EURAUD

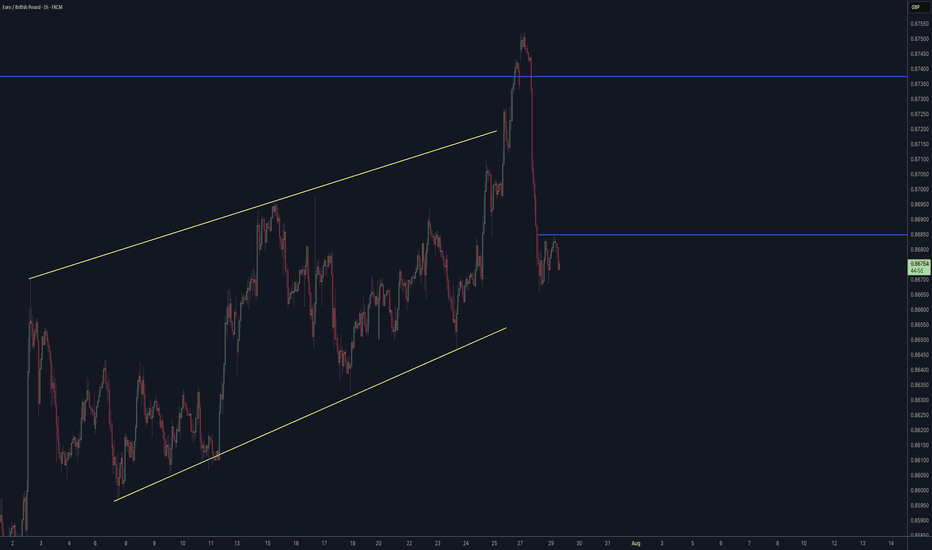

GBPUSD - GBPJPY - USDJPY Trade Recaps 28.07.25Three positions taken last week. Some vital findings within my self-review process which showed a stop loss error with GBJPY causing me to miss a solid 4% trade, and a manual close on GBPUSD to bank a little extra profit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

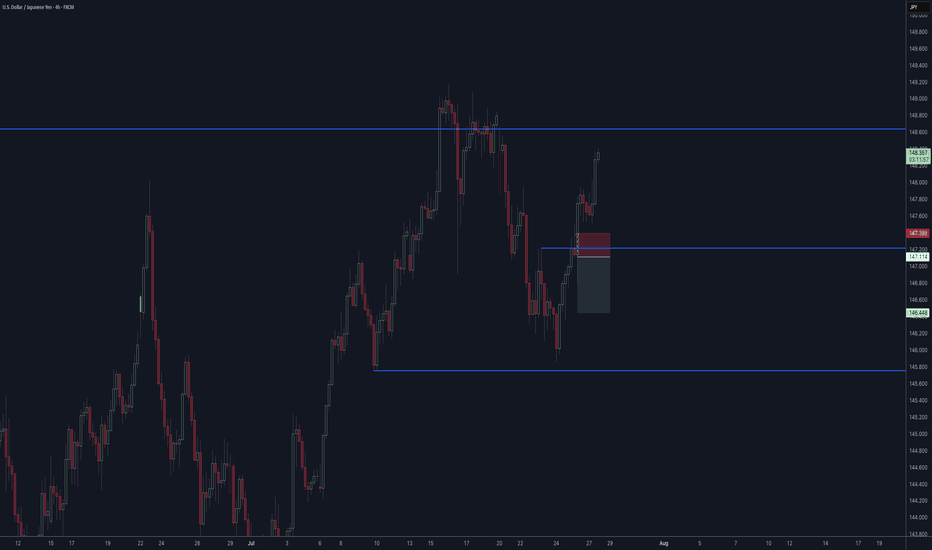

EURJPYBank of Japan (BOJ) — July 28, 2025: Latest Overview

Policy Rate and Recent Moves

Short-term policy rate: Remains at 0.5%, the highest since 2008.

Decision timing: This rate was set in January 2025 (up from 0.25%) and has been maintained

Policy Outlook and Economic Backdrop

Inflation: Tokyo's core CPI is running above the BOJ’s 2% target (2.9% YoY in July), primarily due to external price pressures like energy and currency movements, not strong domestic demand.

Growth trends: The BOJ has trimmed its growth outlook, noting headwinds from higher U.S. tariffs and yen weakness, but still expects a moderate recovery if global trade remains stable.

Bond Purchases: The BOJ is scaling back its massive holdings of Japanese government bonds—targeting a 400 billion yen quarterly reduction through March 2026, then lowering to 200 billion yen in subsequent quarters.

Potential rate path: Market consensus and BOJ commentary indicate a possible hike to at least 0.75% by year-end 2025 if above-target inflation persists and downside global risks do not intensify.

Key Drivers and Central Bank Signals

U.S.-Japan trade: The new trade pact has reduced some uncertainties, supporting the possibility of policy tightening if inflation and yen trends remain stable.

Inflation’s nature: The BOJ stresses that any additional rate hikes will depend on seeing sustained, demand-driven price increases and wages, rather than just external cost pressures.

Governor Ueda’s message: The BOJ is maintaining a cautious, data-dependent approach, prioritizing stability and careful evaluation of global and domestic risk factors.

Quick Fact Table

Indicator Latest (July 2025) BOJ’s Signal

Policy Rate 0.5% Steady for now; another hike possible in 2025

Tokyo Core CPI (YoY) 2.9% Sustainable above-target inflation

Next Meeting July 30–31 Hawkish bias; likely no immediate change

Bonds (JGB reduction) -400B yen/Q Gradual unwinding through March 2026

Rate Outlook Stable, with upside Hike to 0.75% possible by year-end if justified

Summary:

The BOJ remains in a cautious, data-driven policy stance at 0.5% as of late July 2025, with inflation still above target and moderate growth. The central bank is slowly reducing bond purchases and may raise rates again by year-end if the current economic trends persist, but no change is expected at the imminent July meeting.

European Central Bank (ECB) — July 2025: Latest Policy and Economic Update

Key Interest Rates and Current Stance

Deposit Facility Rate: 2.00%

Main Refinancing Operations (MRO) Rate: 2.15%

Marginal Lending Facility Rate: 2.40%

These rates were set after a 25 basis point cut in early June 2025 and have now been held steady as of the ECB’s July 24, 2025 meeting.

Monetary Policy Context

Policy Pause: The ECB ended a year-long easing cycle which saw rates cut from 4% to 2%. The current pause reflects the ECB’s “wait-and-see” approach as inflation has now stabilized at its 2% target and global trade tensions—especially over U.S. tariffs—add significant uncertainty.

No Commitments: The Governing Council is explicitly not pre-committing to any future rate path, emphasizing a data-dependent, meeting-by-meeting stance.

Asset Purchases: The ECB’s asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP) portfolios are being reduced gradually, with no reinvestment of maturing securities.

Inflation and Economic Outlook

Inflation: Now at 2% (its target). The ECB expects it to remain near target for the period ahead. Wage growth continues but is slowing, and underlying price pressures are easing.

Ecoomic Growth: The eurozone economy grew more strongly than expected in early 2025, but trade uncertainty and a stronger euro are holding back business investment and exports. Higher government spending, especially on defense and infrastructure, is expected to support growth over the medium term.

Loans and Credit: Borrowing costs are at their lowest since late 2022. Households are benefiting from strong labor markets and growing wages, but banks are cautious in their lending due to uncertainty and global trade tensions.

Risks and Forward Guidance

The ECB is focused on safeguarding price stability amid exceptional uncertainty due to global trade disputes and policy risks.

There is no forward guidance for the next rate change. Markets are pricing only one possible additional cut for 2025, and a potential return to tightening in late 2026 if inflation stays below target.

Summary Table: ECB at a Glance (July 2025)

Policy Rate 2.15%

Deposit Rate 2.00%

Marginal Lending 2.40%

Inflation (Jun 25) 2% (target achieved)

GDP Growth (2025) 0.9% (projected)

Policy bias Cautious, data-dependent pause

The ECB’s current stance is one of caution, monitoring the effects of prior easing and global trade risks while inflation stabilizes at target. No further near-term cuts are planned unless significant data surprises emerge. The approach is flexible, with decisions made meeting-by-meeting in response to evolving economic and financial conditions.