A Step-by-step Guide to One of the Chart Analysis Method: VOLTASHello Friends,

Welcome to RK_Chaarts,

Today we're going to learn step-by-step guide to one of the chart analysis Method by analyzing a chart of " VOLTAS LTD. " to identify a trend change opportunity.(Educational Post).

Let's get started!

Applying Elliott Wave Theory

According to Elliott Wave theory, we can see that the high of September 20, 2024, marked the end of the wave III of the cycle degree in Red. After that, a corrective wave unfolded, which reached its low on February 1, 2025. This was the wave IV of the cycle degree in Red, with a low of 1135.

The approximately 6 months correction ended here, and now the wave V of the cycle degree in Red has begun. Within this, there will be five sub-divisions of primary degree in black, which we can label as waves ((1)) to ((5)). Of these, waves ((1)) and ((2)) are complete, and we are possibly now in wave ((3)) of the Primary degree in Black.

Within wave ((3)), there will be five sub-divisions of intermediate degree in blue, of which waves (1) and (2) are complete, and the (3)rd intermediate degree in Blue is underway. Within this, there will be five sub-divisions waves of minor degree in red, of which 1 and 2 are complete, and today we saw the breakout of the 3 of the (3).

Possibly, this is a momentum move according to Elliott Wave theory, which we can call the third of the third of the third.

Now that we have this low of wave IV at ₹1135, it should not go below this level according to Elliott Wave theory. If it does, our current wave count will be invalidated. That's why we have an invalidation level within Elliott Wave, which according to this chart is at ₹1135. This low should not be breached. If it is breached for any reason, we'll have to re-analyze our entire count, and the counts could be different.

However, if this low holds, then the minimum target for wave V, based on the projection of wave theory, would be at least 100% to 123% of the fall from top III to bottom IV, which could take it to around ₹2000 to ₹2100. Shown in chart image below

Possible Elliott Wave Counts on Daily Time Frame Along with Invalidation level & Target levels.

Dow Theory Suggests now Up Trend

After forming the top of wave III, we can see that the price has moved downwards in a pattern of lower highs and lower lows. However, after completing the bottom of wave IV, the price has started forming a pattern of higher highs and higher lows, indicating that an uptrend has begun.

This is a clear signal that supports our wave counts moving upwards, i.e., towards an impulse move, based on Dow theory. The successful completion of wave IV and the initiation of the higher highs and higher lows pattern suggest a strong bullish trend, and we can expect the price to continue moving upwards. Shown in chart image below

Breakout with good intensity of Volumes

In this chart, we've observed a rounding bottom type chart pattern, and today, we've seen a breakout above the upper resistance trend line. Today's candle volume is also significantly higher than the average. Shown in chart images below

Chart Pattern: Rounding Bottom

Resistance Trendline Breakout with Good Intensity of Volumes

Supporting Indicators & Moving Averages

Also we can see that the current price has closed above the 50-day EMA and 100-day EMA. Additionally, indicators like RSI is above 60 and showing momentum, MACD is positive and above the zero line, and the histogram is also showing a breakout. Shown in chart images below

Breakout above 50DEMA & 100DEMA

RSI Breakout above 60+ on Daily Time Frame

Bullish side Breakout in Histogram on Daily Time Frame

MACD running Positive & above zero line on Daily Time Frame

Bollinger Band on Weekly

If we look at the weekly time frame, the current week's candle is above the middle Bollinger Band, indicating that the price is above the 20-period simple moving average on the weekly time frame. which is very good sign. Shown in chart image below

Price Trading above 20 SMA on Weekly Time Frame (Mid.Bollinger Band)

Significant Observation in Price Action & Volumes

Before the breakout, the rounding bottom chart pattern that was forming at the bottom can be interpreted as accumulation, as a red bearish candle with high volume appeared, marking the highest volume. Notably, no candle has closed below the low of that candle since then.

Although a gap-down candle occurred, it opened and closed bullish, indicating no selling pressure below that level. The absence of bearish follow-up and the subsequent breakout today are significant observations, combining price action and volume. This is a positive sign suggesting the price may move upwards. Shown in chart image below

This is how chart analysis is done for investment purposes. We've seen many signs in our favor, and yet we still use a stop loss to prevent significant losses in case the stock or market moves unexpectedly. This is what stop loss is all about - minimizing potential losses.

We've also discussed the target projection based on Wave theory, 123.6% level, which we explained through an image. So, friends, I hope you've understood the entire conclusion and learned how to analyze charts using different methods, one of which we shared with you today.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Chaarts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

X-indicator

Do You Have a Trading Edge?A Practical Guide to Figuring Out if What You’re Doing Is Actually Working

There comes a point in every trader’s journey when you stop asking “what indicator should I use” and start asking something much more important.

Is what I’m doing actually working?

It’s an honest question. When the P&L has been chopping sideways or dipping red for weeks, it’s easy to feel stuck. Maybe you’ve been grinding for months, jumping from one setup to another, but still not seeing consistent progress. Before you give up or double down, it’s worth stepping back and looking at the one thing that matters most.

Do you have an edge?

What Is a Trading Edge, Really?

A trading edge isn’t about being right all the time. It isn’t some secret indicator or a feeling in your gut. It’s a cold, hard number.

Your edge is the amount of money you can expect to make or lose on average every time you place a trade. If the number is positive, you’re on the right side of probability. If it’s negative, then no amount of motivation or mindset work will stop the account from bleeding over time.

Thankfully, there’s a simple formula that tells you exactly where you stand.

The Formula: No Hype, Just Maths

Edge per trade = (Average Win × Win Rate) − (Average Loss × Loss Rate)

Or more simply:

Edge = W × R – L × (1−R)

Where:

• W is your average winning trade in pounds

• L is your average losing trade (as a positive number)

• R is your win rate, written as a decimal (so 55% becomes 0.55)

This is your trading edge. It’s not a concept. It’s a number. And it either works or it doesn’t.

Let’s Put It Into Practice

Say you win 45% of the time. Your average winning trade makes £180. Your average losing trade costs £120. Plug the numbers in.

Edge = £180 × 0.45 minus £120 × 0.55

Edge = £81 minus £66

Edge = £15

That £15 is your expected value per trade. So if you take 100 trades following that same pattern, you’d expect to make £1,500 before costs. That’s the kind of maths you want working in your favour. It’s not glamorous. It’s not loud. But it’s sustainable.

What if the Edge Is Negative?

This is where a lot of traders lose heart. But it’s actually good news. If the formula tells you the edge isn’t there, you can stop guessing. It means you’ve identified the problem.

A negative edge just tells you that, on balance, either:

• you’re winning too infrequently

• your losses are too large

• your winners aren’t big enough

And every one of those can be adjusted. This isn’t about tearing down your whole system. Often, a small shift in one variable is all it takes to turn a negative edge into a positive one.

Three Ways to Nudge the Numbers in Your Favour

1. Improve the win rate slightly

Look for trades with more confluence. Stick to clearer trends. Avoid taking marginal setups during unpredictable conditions. You don’t need a huge jump, even going from 40% to 47% can have a big impact.

2. Increase the size of your winners

Let trades run a little longer when the conditions are right. Take partials if it helps your mindset, but keep a portion on to capture the extended move. Most traders cut profits too early and let losers drift too far.

3. Tighten up the losses

Use hard stops. Respect them. Review your biggest losing trades and ask yourself if they really had to be that big. Often they didn’t. The goal is to keep losses small and repeatable, not devastating and unpredictable.

A Note on Sample Size

Five or ten trades won’t give you a reliable read on your edge. You need a bigger pool. Ideally 50 to 100 trades minimum. Patterns emerge over time, not in the heat of one session.

A strong edge can go through losing streaks. A poor strategy can get lucky for a while. But when you track your numbers over enough trades, the truth becomes very clear.

You’re Probably Closer Than You Think

If you’ve never done this calculation before, don’t feel behind. Most retail traders never actually work out their edge. They focus on indicators, entry techniques, or mindset work without ever stopping to ask if the numbers stack up.

But once you do the maths, things start to change. You stop judging yourself by your last trade and start thinking in averages. You stop chasing every setup and start focusing on quality. You stop worrying about being right, and start focusing on being consistent.

That’s what separates hobbyists from professionals. The numbers are the difference.

Summary:

If your edge is negative, you now know where to look. If it’s positive, even just slightly, you’ve got something worth building on. Either way, the path forward is clearer.

Trading is hard, no question. But it’s not magic. It’s probability, risk control and discipline applied consistently. And it all starts with understanding the maths behind what you’re doing.

So next time you’re questioning whether your system is any good, don’t ask how it feels. Run the numbers.

Do you have a trading edge?

If yes, protect it. If not, now you know what to fix.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85.24% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

USDJPY FXAN & Heikin Ashi exampleIn this video, I’ll be sharing my analysis of USDJPY, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Velocity Market Conditions Explained.There are 6 primary upside Market Conditions. Currently the stock market is in a Velocity Market Condition where price and runs are controlled by retail investors, retail swing traders, retail day traders and the huge group of Small Funds Managers using VWAP ORDERS to buy shares of stock with an automated systematic buy order trigger when the volume in that stock starts to rise. The more volume in a stock the faster the VWAP order will trigger.

You task is to study Dark Pool hidden and quiet accumulation bottoming formations to be ready for the Velocity Market Condition that always follows.

Price is a primary indicator.

Volume is a primary Indicator.

These are the most important indicators in your trading charting software tools.

The next most important indicator is Large lot versus Small lot indicators which are NOT based on volume but more complex formulations.

HFTs use algorithms, AI, social media discussions etc.

To ride the Velocity wave upward, you must enter the stock before the run upward.

Learning to read charts as easily takes practice and experience.

The benefit is the ability to forecast with a very high degree of accuracy what that stock will due in terms of rising profits, over the next few days or longer.

Candlesticks have many new candle patterns that have just developed in the past couple of years. The stock market is evolving at a fast pace and the internal market structure that you can't see is only visible in the candlesticks, large lot vs small lot indicators, and other semi professional to professional level tools for analyzing stocks.

The stock market is changing and becoming far more tiered with more off exchange transactions. Learn to read charts so that you can trade with higher confidence and higher revenues.

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

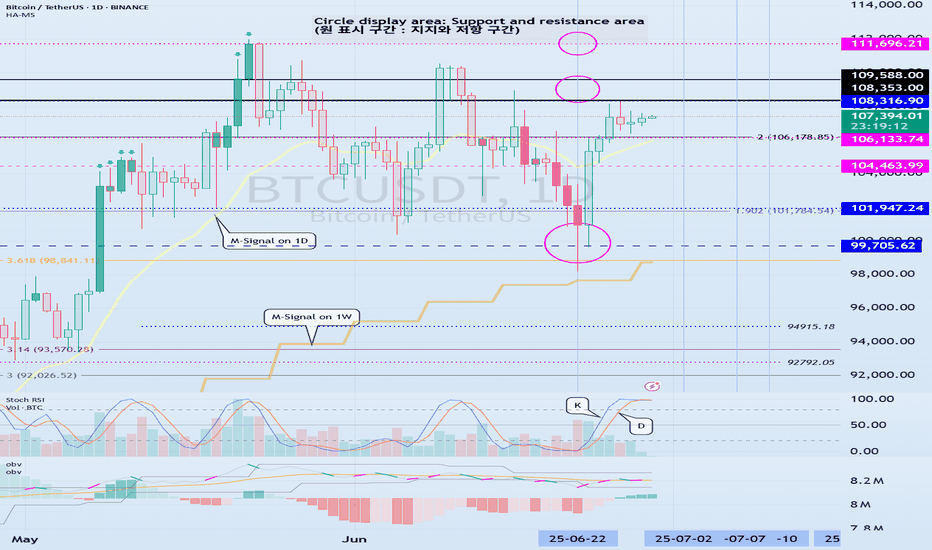

We use the StochRSI indicator to draw a trend line.

We draw a trend line by connecting the peaks of the StochRSI indicator, i.e. the K line, when they are created in the overbought area or when they are created in the overbought area.

That is, when the K line of the StochRSI indicator forms a peak in the overbought area, the trend line is drawn by connecting the Open values of the falling candles.

If the candle corresponding to the peak of the StochRSI indicator is a rising candle, move to the right and use the Open value of the first falling candle.

When drawing the first trend line, draw it from the latest candle.

Since the third trend line indicates a new trend, do not draw anything after the third trend line.

The currently drawn trend line corresponds to the high-point trend line.

-

Therefore, you should also draw the low-point trend line.

The low-point trend line is drawn by connecting the K line of the StochRSI indicator when the top is formed in the oversold zone.

The low-point trend line uses the low value of the candle when the K line of the StochRSI indicator forms the top in the oversold zone.

That is, it doesn't matter whether the candle is a bearish candle or a bullish candle.

The drawing method is the same as when drawing the high-point trend line, drawing from the latest candle.

The top of the best K line of the StochRSI indicator was not formed within the oversold zone.

(The top is indicated by the section marked with a circle.)

Since the trend line was not formed, the principle is not to draw it.

If you want to draw it and see it, it is better to display it differently from the existing trend line so that it is intuitively different from the existing trend line.

-

The chart below is a chart that displays the trend line drawn separately above as a whole.

It is also good to distinguish which trend line it is by changing the color of the high-point trend line and the low-point trend line.

The chart below is a chart that distinguishes the high-point trend line in blue (#5b9cf6) and the low-point trend line in light green (#00ff00).

The low-point trend line is a line drawn when the trend has changed, so it does not have much meaning, but it still provides good information for calculating the volatility period.

-

To calculate the volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

However, since I am currently explaining how to draw a trend line, it is only drawn on the 1M chart.

-

I use the indicators used in my chart to indicate support and resistance points.

That is, I use the DOM(60), DOM(-60), HA-Low, HA-High, and OBV indicators to indicate support and resistance points.

Since the DOM(-60) and HA-Low indicators are not displayed on the 1M chart, I have shown the 1W chart as an example.

The indicators displayed up to the current candle correspond to the main support and resistance points.

Although it is not displayed up to the current candle, the point where the horizontal line is long is drawn as the sub-support and resistance point.

It is recommended to mark them separately to distinguish the main support and resistance point and the sub-support and resistance point.

The trend line drawn in this way and the support and resistance points are correlated on the 1D chart and the volatility period is calculated.

(For example, it was drawn on the 1M chart.)

The sections marked as circles are the points that serve as the basis for calculating the volatility period.

That is,

- The point where multiple trend lines intersect

- The point where the trend line and the support and resistance points intersect

Select the point that satisfies the above cases at the same time to display the volatility period.

When the point of calculating the volatility period is ambiguous, move to the left and select the first candle.

This is because it is meaningless to display it after the volatility period has passed.

If possible, the more points that are satisfied at the same time, the stronger the volatility period.

If the K-line peak of the StochRSI indicator is formed outside the overbought or oversold zone, it is better to exclude it when calculating the volatility period.

-

The chart below is a chart drawn on a 1D chart by summarizing the above contents.

The reason why there are so many lines is because of this reason.

For those who are not familiar with my charts, I have been simplifying the charts as much as possible these days.

However, when explaining, I have shown all the indicators to help you understand the explanation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

A Step-by-step Guide to One of the Chart Analysis MethodHello Friends,

Welcome to RK_Chaarts,

Today we're going to learn step-by-step guide to one of the chart analysis Method by analyzing a chart of " Varun Beverages Ltd. (VBL) " to identify a trend change opportunity.(Educational Post).

Let's get started!

Applying Elliott Wave Theory

First, we can see that the bottom formed in March 2025 is likely a Wave ((4)) in Black as a bottom, marked as such on the chart. From there, Wave 5 should move upwards. Looking at the daily timeframe, we can see that price gone up in five sub-divisions of Wave (1) in Blue of Wave ((5)) in Black have completed, marked as Red 1-2-3-4-5, that means blue intermediate Wave (1) has ended, and Wave (2) has begun, which is unfolded in corrective nature marked as WXY in Red of Wave (2) in Blue.

According to the wave principle, Wave (2) should not retrace more than 100% of Wave (1), which started from the 419.65 bottom. Therefore, 419.65 becomes our invalidation level. If the price moves below this level, it would invalidate our Wave (2) principle.

Assuming our wave counts are correct, the upward movement is in the five sub-divisions, and the downward movement is in the three sub-divisions. Definitely, the conviction is increasing that we have correctly identified Waves (1) and (2). Shown in chart image below

Tweezers at Bottom

Now, we can see that Wave 2 has retraced more than 70% and has formed a Tweezer candlestick pattern at the bottom. A bearish candle was followed by a bullish candle, both with a Tweezer-like shape, with the second candle being green. This could indicate a potential reversal. Moreover, the latest candle has also taken out the high of the previous two candles, showing follow-through. The price has also shown follow-through on the upside after that. So, this can be considered as the first sign that Wave 2 might be ending, marked by a significant Tweezer pattern at the bottom with a follow-through candle. Shown in chart image below

Significant Breakout Pending Yet

Secondly, from the top where Wave 1 ended, we've been considering the decline from around 560.50 as a resistance. We drew a resistance trend line, and if the price breaks out above it, we can say that the resistance trend line has been broken, indicating a breakout above the last fall's trend line, Which is not Broken yet. Shown in chart image below

Dow Theory

The Dow Theory states that when the price moves up, it forms a Higher High, Higher Low pattern, and when it moves down, it forms a Lower High, Lower Low pattern. Somehow, the Dow Theory also needs to change, as the last swing was forming a Lower High, Lower Low pattern. The last swing high was at 479, which we marked with a green arrow. If the price crosses above it, we can say that the price is now forming a Higher High pattern. This indicates that the Dow Theory is changing from a falling trend to a rising trend. Shown in chart image below

Stop Loss

Once the Dow Theory also changes, we can use the last swing low at 446.15 as our stop loss. However, this stop loss will only be valid after the Dow Theory changes; otherwise, the invalidation level will remain at 419. Shown in chart image below

Projected Target of Wave (3)

So, friends, we've applied the Elliott Wave principle, and there's been a significant retracement, all within the valid range, without violating any rules or triggering invalidation. There's limited room left on the downside, and then we have the Tweezer candlestick pattern, which is a significant sign. We're expecting a reversal from there, and the price has followed up with an upward move.

What's left now is the breakout above the resistance trend line and a change in the Dow Theory. Once these two conditions are confirmed, all parameters will match, and we can add a position to our portfolio using the last swing low as our stop loss, instead of the invalidation level.

This is how chart analysis is done for investment purposes. We've seen many signs in our favor, and yet we still use a stop loss to prevent significant losses in case the stock or market moves unexpectedly. This is what stop loss is all about - minimizing potential losses.

We've also discussed the target projection based on Wave theory, 161.8% level, which we explained through an image. So, friends, I hope you've understood the entire conclusion and learned how to analyze charts using different methods, one of which we shared with you today.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Instructions on how to potentially use the SIG[TP/SL (1H-4H-1D)]It's a HF algorithm for the 1H,4H,1D Time-Frames. Which means whenever the instrument reaches the open price, the algo might give a lot of signals and sometimes it might give plenty of reverse signals. In order to use the specific algo in the best possible way, here's a helpful guide on how to potentially use it:

1)Wait for the instrument to reach the open price.

2) ALWAYS, Follow the signals, e.g: We are at the open price. If it indicates buy signal, then open a long position. If for example 5 seconds later (again at the open price) it indicates a sell signal, then reverse the long position into a short position, and keep doing it until it gives a signal, that will be followed by a good sized candle.

3) The safest way is to close the trade when the price reaches the potential TP1.

4) Happy Trading!

*The text above is not an investment advice, and it does not guarantee any profit.

US–Iran Conflict Triggers a Potential Nasdaq Bearish Setup🟣 Geopolitical Flashpoint Meets Technical Confluence

The U.S. weekend airstrike on Iranian nuclear facilities has reignited geopolitical instability across the Middle East. While broader markets often absorb news cycles quickly, high-beta assets like Nasdaq futures (NQ) tend to react more dramatically—especially when uncertainty meets existing technical vulnerability.

Monday’s session opened with a notable gap to the downside, reflecting immediate risk-off sentiment among futures traders. While the initial drop is being retraced intraday, historical patterns suggest that such gap-fills can often serve as ideal shorting zones—particularly when other bearish signals confirm the narrative. The backdrop is clear: this is no ordinary Monday open.

🟣 Bearish Divergence on CCI Builds the Case

From a technical standpoint, the setup gains weight through a clear bearish divergence on the Commodity Channel Index (CCI) using a 20-period setting. While prices recently pushed higher, momentum failed to follow—an early indication that buyers may be running out of steam. This divergence appears just as price approaches the origin of Friday’s gap, a level that frequently acts as a resistance magnet in such contexts. This confluence of weakening momentum and overhead supply aligns perfectly with the geopolitical catalyst, offering traders a compelling argument for a potential reversal in the short term.

🟣 Gap Origin: The Line in the Sand

The origin of the gap sits at 21844.75, a price level now acting as potential resistance. As the market attempts to climb back toward this zone, the likelihood of encountering institutional selling pressure increases. Gap origins often represent unfinished business—zones where prior bullish control was suddenly interrupted. In this case, the added layer of global tension only strengthens the conviction that sellers may look to reassert dominance here. If price action stalls or rejects at this zone, it could become the pivot point for a swift move lower, especially with bearish momentum already flashing caution signals.

🟣 Trade Plan and Reward-to-Risk Breakdown

A potential short trade could be structured using 21844.75 as the entry point—precisely at the gap origin. A conservative stop placement would rest just above the most recent swing high at 22222.00, offering protection against a temporary squeeze. The downside target aligns with a prior UFO support area near 20288.75, where demand previously showed presence. This sets up a risk of 377.25 points versus a potential reward of 1556.00 points, resulting in a reward-to-risk ratio of 4.12:1. For traders seeking asymmetrical opportunity, this ratio stands out as a strong incentive to engage with discipline.

🟣 Futures Specs: Know What You’re Trading

Traders should be aware of contract specifics before engaging. The E-mini Nasdaq-100 Futures (NQ) represent $20 per point, with a minimum tick of 0.25 worth $5.00. Typical margin requirements hover around $31,000, depending on the broker.

For smaller accounts, the Micro Nasdaq-100 Futures (MNQ) offer 1/10th the exposure. Each point is worth $2, with a $0.50 tick value and much lower margins near $3,100.

🟣 Discipline First: Why Risk Management Matters

Volatility driven by geopolitical events can deliver fast gains—but just as easily, fast losses. That’s why stop-loss orders are non-negotiable. Without one, traders expose themselves to unlimited downside, especially in leveraged instruments like futures. Equally critical is the precision of entry and exit levels. Acting too early or too late—even by a few points—can compromise an otherwise solid trade. Always size positions according to your account, and never let emotion override logic. Risk management isn’t a side-note—it’s the foundation that separates professionals from those who simply speculate.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Your Trading System Isn't the Problem. Your Discipline Is.📘 Your Trading System Isn't the Problem. Your Discipline Is.

Hard truth:

Your endless search for a new system is a smokescreen.

The best system in the world can't save you from poor discipline.

Here's why discipline matters more than your strategy:

You quit your system after a few losses, never allowing it to prove its value.

You deviate from your rules when emotions run high—wrecking consistency.

You're focused on shiny objects instead of sharpening the knife you already have.

🎯 The solution?

Commit to discipline. Track your adherence rigorously. Measure your success by consistency, not immediate outcomes.

TrendGo’s power isn’t just in clear signals—it's in enabling disciplined action.

🔍 Stop blaming your tools. Own your discipline.

Best Free Volatility Indicator on TradingView for Gold Forex

This free technical indicator will help you easily measure the market volatility on Forex, Gold or any other market.

It will show you when the market is quiet , when it's active and when it's dangerous .

We will go through the settings of this indicator, and you will learn how to set it up on TradingView.

Historical Volatility Indicator

This technical indicator is called Historical Volatility.

It is absolutely free and available on TradingView, MetaTrader 4/5 and other popular trading terminals.

TradingView Setup

Let me show you how to find it on TradingView and add it to your price chart.

Open a technical price chart on TradingView and open the "Indicators" menu (you will find it at the top of the screen).

Search "Historical Volatility" and click on it.

It will automatically appear on your chart.

"Length" parameter will define how many candles the indicator will take for measuring the average volatility. (I recommend keeping the default number, but if you need longer/shorter-term volatility, you can play with that)

Timeframe drop-down list defines what time frame the indicator takes for measuring the volatility. (I recommend choosing a daily timeframe)

And keep the checkboxes unchanged .

How to Use the Indicator

Now, let me show you how to use it properly.

Wider the indicator and analyse its movement at least for the last 4 months.

Find the volatility range - its low levels will be based on the lower boundary of the range, high levels will be based on its upper boundary.

This is an example of such a range on USDCAD pair.

When the volatility stays within the range, it is your safe time to trade.

When volatility approaches its lows, it may indicate that the market might be slow .

Highs of the range imply that the market is very active

In-between will mean a healthy market.

The Extremes

The violation of a volatility range to the downside is the signal that the market is very slow . This would be the recommended period to not trade because of high chance of occurrence of fakeouts.

An upward breakout of a voliatlity range is the signal of the extreme volatility . It will signify that the market is unstable , and it will be better to let it calm down before placing any trade.

Volatility Analysis

That is how a complete volatility analysis should look.

At the moment, volatility reached extreme levels on CADJPY pair.

The best strategy will be to wait till it returns within the range.

Remember This

With the current geopolitical uncertainty and trade wars, market volatility reaches the extreme levels.

Such a volatility is very dangerous , especially for newbie traders.

Historical volatility technical indicator will help you to easily spot the best period for trading and the moment when it is better to stay away.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

About the chart that shows a sideways movement...

Hello, traders.

If you "follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

When you study charts, you will realize how difficult it is to move sideways.

Therefore, depending on how long the sideways movement was before the big wave, the size of the wave is also predicted.

However, in the charts showing sideways movement, the price range and wave size are often known after the wave appears.

This shows that the location of the sideways movement and the size of the sideways wave are important.

-

Looking at the chart above, we can say that it is showing a sideways movement.

However, since the price is located at the lowest price range, it is better to exclude this chart.

The reason is that if it is showing a sideways movement at the lowest price range, it is likely that the trading volume has decreased significantly due to being excluded from the market.

This is because it is likely to take a long time to turn into an upward trend in this state.

-

Looking at the chart above, the price is showing a sideways movement while maintaining a certain interval after rising.

The sideways movement is about 31%, so it may be ambiguous to say that it is actually sideways.

However, if the price moves sideways while maintaining a certain interval after rising, it means that someone is trying to maintain the price.

Therefore, when it shows a movement that breaks through the sideways section, it should be considered that there is a possibility that a large wave will occur.

The wave can be either upward or downward.

Therefore, it is necessary to be careful not to jump into a purchase with the idea that it will definitely rise in the future just because it moves sideways.

A box section is set at both ends of the sideways section.

Therefore, it is recommended to proceed with a purchase in installments when it shows support after entering this box section.

In other words, it is important to check the support in the 1.5-1.9669 section or the 25641-2.6013 section.

You can see that the HA-Low indicator and the HA-High indicator are converging.

Therefore, if this convergence is broken, it is expected that a trend will be formed.

-

Like this, you should measure the price position of the sideways movement and the width of the sideways movement well and think in advance about whether to proceed with the transaction when it deviates from that range.

Otherwise, if you start trading after the wave has already started, you may end up giving up the transaction because you cannot overcome the wave.

Since it is not known when the movement will start once the sideways movement starts, individual investors easily get tired.

Therefore, when the coin (token) you want to trade shows a sideways movement, it is recommended to increase the number of coins (tokens) corresponding to the profit while conducting short-term trading (day trading).

If you do this, you will naturally be able to see how the sideways waves change, and you will be able to hold out until a big wave starts.

I think there are quite a few people who are not familiar with day trading and say they will buy at once when the wave starts.

If you can hold out well against the wave, you will get good results, but there is a possibility that the trade will fail 7-8 times out of 10, so if possible, it is good to get used to the feeling by day trading coins (tokens) that show this sideways pattern.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Most Traders React to Markets. The Best Anticipate Them.Most Traders React to Markets. The Best Anticipate Them.

Hard truth:

You're always one step behind because you trade reactively.

You can’t win a race if you're always responding to moves already made.

Here's how reactive trading burns your edge:

- You chase breakouts after they've happened, entering at the peak.

- You panic-sell into downturns because you didn't anticipate.

- You miss major moves because you're looking backward, not forward.

🎯 The fix?

Develop anticipatory trading habits. Identify scenarios in advance, set clear triggers, and act decisively when probabilities align - not after the market confirms.

TrendGo provides structure for anticipation - not reaction.

🔍 Stop responding, start anticipating. Your account will thank you.

Intraday Gold Trading System with Neural Networks: Step-by-Step________________________________________

🏆 Intraday Gold Trading System with Neural Networks: Step-by-Step Practical Guide

________________________________________

📌 Step 1: Overview and Goal

The goal is to build a neural network system to predict intraday short-term gold price movements—typically forecasting the next 15 to 30 minutes.

________________________________________

📈 Step 2: Choosing Indicators (TradingView Equivalents)

Key indicators for intraday gold trading:

• 📊 Moving Averages (EMA, SMA)

• 📏 Relative Strength Index (RSI)

• 🌀 Moving Average Convergence Divergence (MACD)

• 📉 Bollinger Bands

• 📦 Volume Weighted Average Price (VWAP)

• ⚡ Average True Range (ATR)

________________________________________

🗃 Step 3: Data Acquisition (Vectors and Matrices)

Use Python's yfinance to fetch intraday gold data:

import yfinance as yf

import pandas as pd

data = yf.download('GC=F', period='30d', interval='15m')

________________________________________

🔧 Step 4: Technical Indicator Calculation

Use Python’s pandas_ta library to generate all required indicators:

import pandas_ta as ta

data = ta.ema(data , length=20)

data = ta.ema(data , length=50)

data = ta.rsi(data , length=14)

macd = ta.macd(data )

data = macd

data = macd

bbands = ta.bbands(data , length=20)

data = bbands

data = bbands

data = bbands

data = ta.atr(data , data , data , length=14)

data.dropna(inplace=True)

________________________________________

🧹 Step 5: Data Preprocessing and Matrix Creation

Standardize your features and shape data for neural networks:

from sklearn.preprocessing import StandardScaler

import numpy as np

features =

scaler = StandardScaler()

data_scaled = scaler.fit_transform(data )

def create_matrix(data_scaled, window_size=10):

X, y = ,

for i in range(len(data_scaled) - window_size - 1):

X.append(data_scaled )

y.append(data .iloc )

return np.array(X), np.array(y)

X, y = create_matrix(data_scaled, window_size=10)

________________________________________

🤖 Step 6: Neural Network Construction with TensorFlow

Use LSTM neural networks for sequential, time-series prediction:

import tensorflow as tf

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import LSTM, Dense, Dropout

model = Sequential( , X.shape )),

Dropout(0.2),

LSTM(32, activation='relu'),

Dense(1)

])

model.compile(optimizer='adam', loss='mse')

________________________________________

🎯 Step 7: Training the Neural Network

history = model.fit(X, y, epochs=50, batch_size=32, validation_split=0.2)

________________________________________

📊 Step 8: Evaluating Model Performance

Visualize actual vs. predicted prices:

import matplotlib.pyplot as plt

predictions = model.predict(X)

plt.plot(y, label='Actual Price')

plt.plot(predictions, label='Predicted Price')

plt.xlabel('Time Steps')

plt.ylabel('Gold Price')

plt.legend()

plt.show()

________________________________________

🚦 Step 9: Developing a Trading Strategy

Translate predictions into trading signals:

def trade_logic(predicted, current, threshold=0.3):

diff = predicted - current

if diff > threshold:

return "Buy"

elif diff < -threshold:

return "Sell"

else:

return "Hold"

latest_data = X .reshape(1, X.shape , X.shape )

predicted_price = model.predict(latest_data)

current_price = data .iloc

decision = trade_logic(predicted_price, current_price)

print("Trading Decision:", decision)

________________________________________

⚙️ Step 10: Real-Time Deployment

Automate the model for live trading via broker APIs (pseudocode):

while market_open:

live_data = fetch_live_gold_data()

live_data_processed = preprocess(live_data)

prediction = model.predict(live_data_processed)

decision = trade_logic(prediction, live_data )

execute_order(decision)

________________________________________

📅 Step 11: Backtesting

Use frameworks like Backtrader or Zipline to validate your strategy:

import backtrader as bt

class NNStrategy(bt.Strategy):

def next(self):

if self.data.predicted > self.data.close + threshold:

self.buy()

elif self.data.predicted < self.data.close - threshold:

self.sell()

cerebro = bt.Cerebro()

cerebro.addstrategy(NNStrategy)

# Add data feeds and run cerebro

cerebro.run()

________________________________________

🔍 Practical Use-Cases

• ⚡ Momentum Trading: EMA crossovers, validated by neural network.

• 🔄 Mean Reversion: Trade at Bollinger Band extremes, validated with neural network predictions.

• 🌩️ Volatility-based: Use ATR plus neural net for optimal entry/exit timing.

________________________________________

🛠 Additional Recommendations

• Frameworks: TensorFlow/Keras, PyTorch, scikit-learn

• Real-time monitoring and risk management are crucial—use volatility indicators!

________________________________________

📚 Final Thoughts

This practical guide arms you to build, deploy, and manage a neural network-based intraday gold trading system—from data acquisition through backtesting—ensuring you have the tools for robust, data-driven, and risk-managed trading strategies.

________________________________________

Great analysing from smart analysis This Wyckoff Accumulation scenario on Gold was like a blueprint—every stage played out almost exactly as anticipated. From the Selling Climax (SC) to the Spring and Test, it was as if the market followed the textbook. Watching this unfold live last night was both thrilling and affirming. Truly, it was a masterclass in market behavior.

Analysis : mohsen mozafari nejad 😎

Minimize Big Losses by Managing your EmotionsHow many times have your emotions taken control in the middle of a trade? Fear, greed, or stress can be a trader’s worst enemy.

This analysis teaches you how to manage your emotions to avoid big losses and look at the crypto market with a more professional eye.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on PEPE :

PEPE is testing a strong daily trendline alongside key Fibonacci support, signaling a potential upside of at least 30%, targeting 0.000016 . Keep an eye on this confluence for a solid entry point.

Now , let's dive into the educational section,

💡 Market Psychology and Emotional Management

Crypto markets are highly volatile, which triggers strong emotions in traders. Fear of missing out (FOMO) and greed are two of the biggest enemies of any trader. Without emotional control, it’s easy to fall into bad trades.

The first step in managing emotions is recognizing your behavioral patterns. Once you know when fear or greed kicks in, you can adjust your trading plan accordingly.

Second, stick to a clear trading plan. Whether the market is crashing or pumping hard, stay loyal to your strategy and make decisions based on logic and analysis—not feelings.

🛠 TradingView Tools and Indicators to Manage Emotions

First off, TradingView tools aren’t just for technical analysis—they can help you control emotions and impulses in your trades. One of the best indicators is the Relative Strength Index (RSI), which clearly shows whether the market is overbought (extreme greed) or oversold (extreme fear).

Using RSI, you can spot moments when the market is too emotional—either overly optimistic or fearful—and avoid impulsive decisions. For example, when RSI rises above 70, the market may be too greedy, signaling you to hold back from jumping in hastily.

Besides RSI, indicators like MACD and Bollinger Bands help you better visualize trends and volatility, allowing you to avoid emotional entry or exit points.

The key is to combine these indicators with awareness of market psychology, making them powerful tools to manage your feelings while trading crypto.

📊 Practical Use of Indicators to Avoid Big Losses

Imagine you entered a Bitcoin long position. By watching RSI and MACD, you can pinpoint better entry and exit points.

If RSI is above 70 and MACD shows a reversal signal, a price correction is likely. In such cases, trade cautiously or consider exiting to avoid significant losses.

Additionally, setting stop-loss orders based on support/resistance levels identified by Bollinger Bands is another key risk management strategy. This keeps your losses controlled and within acceptable limits, even if the price moves suddenly.

⚡️ The Psychology of Loss and Greed — Two Big Trader Traps

After losing, it’s natural to want to recover quickly, but that’s where greed often leads to risky, poorly thought-out trades. To break this harmful cycle:

Focus on the size of your losses, not just your profits

Take a break from trading after a loss to calm your emotions

Use TradingView tools for thorough analysis and never let feelings drive your decisions

🔍 Final Advice

Managing emotions is the backbone of successful trading in highly volatile crypto markets. Smart use of technical indicators like RSI, MACD, and Bollinger Bands, combined with self-awareness and strict adherence to your trading plan, can drastically reduce big losses and maximize gains. Always remember to view the market through a logical lens, not an emotional one.

✨ Need a little love!

We put so much love and time into bringing you useful content & your support truly keeps us going. don’t be shy—drop a comment below. We’d love to hear from you! 💛

Big thanks,

Mad Whale 🐋

📜Please remember to do your own research before making any investment decisions. Also, don’t forget to check the disclaimer at the bottom of each post for more details.

Mastering Liquidity Dynamics: Understand the Dynamic True ValueDear Reader,

Thank you for reading—your time is valuable.

Use the chart's zoom-in/out (-/+) function for better visibility. This chart captures a large sample for your evaluation.

Below is the manual detailing the Smart Farmer System —a Dynamic True Value framework derived from real-time data to anticipate market intent and liquidity behavior .

If this resonates with you, drop a comment below— constructive insights are always welcome .

The Dynamic True Value - a Smart Farmer System: Terminology and Mechanics

: For now, I have firmed up POC - Price of Control, VAP - Value Average Pricing, SULB - Sell Upper Limit Bound, BLLB - Buy Lower Limit Bound.

Mechanic:

POC - Where fair value price dynamic is read.

VAP - Trading above indicates bullish sentiment of the cycle, and the opposite for bearish sentiment.

A crossed over of:

Grey POC above Green VAP - Signaling distribution, accumulation, consolidation, build-ups, correction, retracement .

Green VAP above Grey POC - Bullish strength and momentum consistency .

Pink VAP above Black POC - Bearish strength and momentum consistency .

Flip of Pink VAP to Green VAP - Sentiment flips from bear to bull, and the same goes for green flip to pink showing bull to bear.

Validation of entry signals requires:

Signal's candle must close past the opposite side of POC – flip sentiment .

The confirmation candle (is the closed next candle immediately after entry signal candle) must continue closed past the POC – maintain sentiment .

The progress candle (is the next candle closed right after the Confirmation Candle) shows traction, momentum build-up, and volume consistency .

Hint of invalidation:

Signal's candle is considered void if the next candle prints a new entry signal in the opposite direction. This often signals accumulation, sideways movement, build-up, uncertainty, or swings in range .

The immediate next candle closed past POC to the opposite side.

What to understand about Liquidity Trap, SULB, and BLLB:

Liquidity traps

Often occur at the recent/previous flatlines of Dynamic True Value (POC, VAP, SULB, BLLB) .

It is worth paying attention to the market’s intent and institutional positioning.

Signs of exhaustion, absorption, inducement, offloading, and accumulation are visible in the M1 (one-minute) TF, with significant confluence near the previous/recent flatlines of Dynamic True Value in the higher/macro-TFs.

An Anchored VWAP tool can be helpful for filtering noise in the market. This tool can be found in the drawing tab in the TradingView platform.

SULB

Details the dynamic of upper resistance where Bears remain in control below the dynamic level.

Below this limit bound (LB) , bears show strength – bear sentiment .

A converging price toward this LB indicates bulls are present.

Moving past this LB (a candle closed above) and successfully RETESTING newly formed support indicates a confirmed directional shift . Followed by printing a new BLLB in the next following candles with price continuing to rise above this failed SULB.

A rejection below LB (a rejection/exhausted candle closed below LB) and successful RETEST reaffirms the resistance holds , indicating downside continuation .

BLLB

Details the dynamic of lower support where Bulls remain in control above the dynamic level.

Above this LB, bulls show strength – bull sentiment .

A converging price toward this LB signifies bears are present.

Moving past this LB (a candle closed below) and successfully RETESTING newly formed resistance indicates a confirmed directional shift . Followed by printing a new SULB in the next following candles with price continuing to push lower below this failed BLLB.

A rejection above LB (a rejection/exhausted candle closed above LB) and successful RETEST reaffirms the support holds , indicating upward continuation .

Important Notes:

Select preferred Entry’s Signal TF (ex. M3 TF, M5 TF for scalping strategy, M15 for intraday/daily strategy, 4H TF for day-to-weekly strategy, etc.).

Always refer to the selected Entry’s TF for trading progress. Anticipate TP and SL by watching the range in this TF.

Non-entry TFs are not for entry purposes. These multi-TFs are used for measuring strength, momentum, liquidity, positioning, structure – The market intends . The Non-entry TF is used to anticipate institutional executions and liquidity pools.

These criteria MUST BE MET. A failed criterion suggests vague execution. Be patient and wait for clear validations.

Institutions excel in creating illusions.

SFS is designed to stand ready, calm, and execute with Clarity.

SFS cuts through noise, distraction, and stays independent of NEWS, GEOPOLITIC, RUMORS, and herd mentality because all these are designed to mislead retail traders into institutional traps.

When we see such ambiguity against the criteria, we know not to fall into the TRAP and become the liquidity FUEL.

Stay sharp, only respond when signals are firmed. SFS is designed to counter Smart Money capitalism. It is about time to level the playing field.

Differences Between Trading Stock Market and Coin Market

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

Please read with a light heart.

-

Trading stock market and coin market seem similar, but they are very different.

In stock market, you have to buy and sell 1 share at a time, but in coin market, you can buy and sell in decimals.

This difference makes a big difference in buying and selling.

In the stock market, you should buy when the price is rising from a low price if possible.

The reason is that since you buy in units of 1 week, you have to invest more money when you sell and then buy to buy 1 week.

I think the same goes for the coin market, but since you can buy in decimal units, you have the advantage of being able to buy at a higher price than when you buy in the stock market.

For example, if you sell and then buy again at the same price, the number of coins (tokens) will decrease, but there will be no cases where you can't buy at all.

Therefore, the coin market is an investment market where you can trade at virtually any price range.

-

In terms of profit realization, the stock market can only be traded in a way that earns cash profits.

The reason is that, as I mentioned earlier, since you have to trade in units of 1 week, there are restrictions on trading.

However, in the coin market, in addition to the method of earning cash profits, you can also increase the number of coins (tokens) corresponding to the profits.

The biggest advantage of increasing the number of coins (tokens) corresponding to profit is that you can get a large profit in the long term, and the burden of the average purchase price when conducting a transaction is reduced.

When the price rises by purchase price, if you sell the purchase amount (+ including the transaction fee), the coins (tokens) corresponding to profit will remain.

Since these coins (tokens) have an average purchase price of 0, they always correspond to profit even if there is volatility.

In addition, even if the price falls and you buy again, the average purchase price is set low, so it plays a good role in finding the right time to buy and starting a transaction.

Of course, when the number of coins (tokens) corresponding to profit is small, it does not have a big effect on the average purchase price, but as the number increases, you will realize its true value.

You can also get some cash when you increase the number of coins (tokens) corresponding to profit.

When selling, if you add up the purchase price + transaction fee X 2~3, you can also get some cash profit.

If you get cash profit, the number of coins (tokens) remaining will decrease, so you can adjust it well according to the situation.

When the profit is large, increase the cash profit slightly, and when you think the profit is small, decrease the cash profit.

-

Therefore, when you first move from the stock market to the coin market and start trading, you will experience that the trading is not going well for some reason.

In the stock market, there are some restrictions on the rise and fall, but in the coin market, there are no restrictions, so it is not easy to respond.

However, as I mentioned earlier, the biggest problem is the difference in the transaction unit.

When trading in the stock market, you need to check various announcements and issues in addition to the chart and determine how this information affects the stock or theme you want to trade.

This is because trading is not conducted 24 hours a day, 365 days a year like the coin market.

This is because if an announcement or issue occurs during a non-trading period, the stock market may rise or fall significantly when trading begins.

-

When using my chart on a stock chart, the basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if you want to buy more, you can buy more when the M-Signal of the 1D chart > M-Signal of the 1W chart, and it shows support near the M-Signal indicator of the 1W chart.

In the stock chart, it is recommended to trade when the M-Signal indicators of the 1D, 1W, and 1M charts are aligned.

The reason is that, as I mentioned earlier, trading must be done in 1-week units, so the timing of the purchase is important.

In the coin chart, you can actually trade when it shows support at the support and resistance points.

However, since trading is possible 24 hours a day, 365 days a year, even if it shows support at the support and resistance points, psychological anxiety due to volatility increases, so it is recommended to proceed with trading according to the basic trading strategy.

The creation of the HA-Low indicator means that it has risen from the low range, and the creation of the HA-High indicator means that it has fallen from the high range.

Therefore, if it shows support near the HA-Low indicator, it is likely to rise, and if it shows resistance near the HA-High indicator, it is likely to fall.

However, on the contrary, if it is supported and rises at the HA-High indicator, it is likely to show a stepwise rise, and if it is resisted and falls at the HA-Low indicator, it is likely to show a stepwise fall.

In order to confirm this movement, you need to invest a lot of time and check the situation in real time.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Guide: How to Read the Smart Farmer SystemDear Reader , Thank you for tuning in to my first video publication.

This video explains the 3-step signal validation process—helping you quickly and precisely anticipate market intent and liquidity dynamics before taking action.

We do not react to noise; we respond with structured execution because we understand the market’s true game.

Listen to the market— this guide is here to sharpen your journey.

Correction Notice (16:58 timestamp): A slight clarification on the statement regarding signal validation :

SELL signals: The trading price must close BELOW the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

BUY signals: The trading price must close ABOVE the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

Multiple signals indicate liquidity games are actively unfolding, including accumulation, control, distribution, and offloading.

Quick Lesson: Slow & Fast Flows (Study it & Benefit in Trading)It is always important to look not only at levels (supports/resistances), but how exactly price moves within them.

On the left side , we see a slow flow—a controlled and gradual decline. Sellers are patient, offloading positions over time into visible liquidity levels. Each dip is met with small bids, creating a staircase-like drop. This kind of move doesn’t trigger panic immediately, but it’s dangerous because it builds up pressure. Eventually, when buyers dry up, a larger breakdown happens.

On contrary, the right side shows a fast flow. Here, a large sell order slams into a thin order book, causing an immediate price spike down. There's little resistance, and multiple levels are skipped. This creates an inefficient move, often forming a sharp wick. These fast drops are typically caused by fear, liquidation, or aggressive exit orders. But what’s interesting is the recovery: because the move was so aggressive and liquidity was so thin, price can snap back up quickly. These are often V-shaped reversals with low resistance on the way back.

Try to look for such setups on the chart and learn how the price behaves . Studying such cases will help you identifying upcoming sell-offs/pumps and earn on them.

Uncontrolled Greed: Save Your Portfolio by these strategies Think fear is the only emotion causing big losses? Think again — this time, it’s all about greed .

🤯 That feeling when you don’t close a profitable position because you think it still has room .

📉 Let’s dive into the chart and see how even pro traders fall into the greed trap .

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Bitcoin:

Bitcoin is currently testing a major monthly trendline alongside a key daily support zone, both aligning with Fibonacci retracement levels.📐 This confluence suggests a potential upside move of at least 9%, with a primary target projected near the $116,000 mark .📈 Market participants should watch this level closely as it may serve as a pivot for mid-term price action.

Now , let's dive into the educational section,

🧠 The Psychology of Greed in Trading

Greed speaks quietly but hits hard. It whispers: “Just a bit more. Let it run.”

But that’s the same voice that turns green into deep red. Markets don’t care about your dreams.

When a small win turns into a big loss — that’s greed in action.

No one knows the top. Trying to predict it out of emotion is how portfolios get wrecked.

Greed often spikes after multiple winning trades — when overconfidence kicks in.

That’s when you need data, not dopamine.

📊 TradingView Tools That Help Tame Greed

TradingView isn’t just a charting platform — if used right, it can be your emotional assistant too.

Start with RSI . When it crosses above 70, it signals overbought zones — prime time for greedy entries.

Volume Profile shows you where the smart money moves. If you see high volume at price peaks, it’s often too late to jump in.

Set up Alerts to get notified when your indicators hit key levels — avoid reacting in real-time chaos.

Use Replay Mode to rewatch old setups and identify where greed affected your past decisions.

Customize Chart Layouts per market type. Having a focused view helps you act based on logic, not emotion.

🛡 Strategies to Defeat Greed

Pre-define your take-profit and stop-loss before you enter. Non-negotiable.

Create a Psych Checklist: “Am I trading based on a missed move? Or a solid signal?”

After every trade, reflect on what drove your decisions — fear, logic, or greed?

Take a trading break after a streak of wins. That’s when greed loves to sneak in.

Withdraw a portion of your profits to reinforce the habit of securing gains.

Practice on demo during volatile days to build emotional discipline.

Never try to win back all losses in one trade — that’s greed’s playground.

If you're sizing up every position just because "the market is hot", pause.

Focus on surviving, not conquering. Long-term traders are calm, not greedy.

✅ Wrap-Up

In crypto's wild swings, greed destroys faster than any technical mistake.

Enter with a plan. Exit with purpose. Greed-based trades usually end with regret.

Emotional control equals long-term survival. Trade smart — not just hungry

📜 Please remember to do your own research before making any investment decisions. Also, don’t forget to check the disclaimer at the bottom of each post for more details.

✨ Need a little love!

We put so much love and time into bringing you useful content & your support truly keeps us going. don’t be shy—drop a comment below. We’d love to hear from you! 💛

Big thanks ,

Mad Whale 🐋

Reading The Room: Market Sentiment TechnicalsThe Market Sentiment Technicals indicator, created by LuxAlgo , is a powerful tool that blends multiple technical analysis methods into a single, easy-to-read sentiment gauge. It’s designed to help traders quickly assess whether the market is bullish, bearish, or neutral by synthesizing data from trend, momentum, volatility, and price action indicators.

🧠 How We Use It at Xuantify

At @Xuantify , we integrate this indicator into our multi-layered strategy stack. It acts as a market context filter , helping us determine whether to engage in trend-following, mean-reversion, or stay on the sidelines. We use it across multiple timeframes to validate trade setups and avoid false signals during choppy conditions. This example uses MEXC:SOLUSDT.P , symbols like BINANCE:BTCUSDT or BINANCE:ETHUSDT are fine to use as well.

⭐ Key Features

Sentiment Panel: Displays normalized sentiment scores from various indicators.

Market Sentiment Meter: A synthesized score showing overall market bias. (Below image)

Oscillator View: Visualizes trend strength, momentum, and potential reversals.

Divergence Detection: Highlights when price action and sentiment diverge.

Market Sentiment Meter: A synthesized score showing overall market bias.

💡 Benefits Compared to Other Indicators

All-in-One : Combines multiple indicators into one cohesive tool.

Noise Reduction : Filters out conflicting signals by averaging sentiment.

Visual Clarity : Histogram and oscillator formats make interpretation intuitive.

Adaptability : Works across assets and timeframes.

⚙️ Settings That Matter

Smoothing Length: Adjusts how reactive the sentiment is to price changes.

Indicator Weighting: Customize which indicators influence the sentiment more.

Oscillator Sensitivity: Fine-tune for scalping vs. swing trading.

📊 Enhancing Signal Accuracy

We pair this indicator with:

Volume Profile: To confirm sentiment with institutional activity.

VWAP: For intraday mean-reversion setups.

Breakout Tools: To validate momentum during sentiment spikes.

🧩 Best Combinations with This Indicator

LuxAlgo Premium Signals: For entry/exit confirmation.

Relative Volume (RVOL): To gauge conviction behind sentiment shifts.

ADX/DMI: To confirm trend strength when sentiment is extreme.

⚠️ What to Watch Out For

Lag in Consolidation: Sentiment may flatten during sideways markets.

Overfitting Settings: Avoid tweaking too much—stick to tested configurations.

False Divergences: Always confirm with price structure or volume.

🚀 Final Thoughts

The Market Sentiment Technicals indicator is a game-changer for traders who want a 360° view of market psychology . At Xuantify, it’s become a cornerstone of our decision-making process—especially in volatile conditions where clarity is key.

🔔 Follow us for more educational insights and strategy breakdowns!

We break down tools like this weekly—follow @Xuantify to stay ahead of the curve.