Wedge Pattern — A Key to Trend Movements📐 Wedge Pattern — A Key to Trend Movements 📈

🔍 Introduction

The Wedge is a chart pattern that represents a phase of directional consolidation following a trending move. It can act as a continuation 🔄 or a reversal 🔃 signal, depending on the context. The structure consists of two converging trendlines, both sloping in the same direction.

🧩 Pattern Description

Unlike the Flag pattern 🚩, the Wedge has no flagpole and doesn’t depend on the direction of the previous move. The direction of the wedge body determines its type:

A falling wedge ⬇️ is bullish 🟢 (buy signal)

A rising wedge ⬆️ is bearish 🔴 (sell signal)

The breakout is the key point to watch. The two trendlines slope in the same direction but at different angles, causing them to converge. This reflects a loss of momentum ⚠️ and typically indicates that buyers or sellers are preparing to take control.

This pattern can act as:

A continuation signal 🧭 — appearing at the end of a correction

A reversal signal 🔄 — forming at the end of a strong trend

📉 Volume is usually low during the wedge and rises on breakout. A low-volume breakout increases the risk of a false breakout ❗. Often, price retests the breakout level 🔁, giving traders a second chance to enter.

🎯 Entry & Stop-Loss Strategy

📥 Entry: On breakout confirmation

🛑 Stop-loss: Below the pattern’s low (bullish) or above its high (bearish), or under/above the most recent local swing point

🎯 Target: Project the height of the widest part of the wedge from the breakout point. Alternatively, use key price levels 📊 or a trailing stop 🔂 to lock in profits.

💡 My Pro Tips for Trading the Wedge

✅ Pattern Criteria

Two converging trendlines ➡️➕➡️

Clearly defined structure ✏️

Prior trending move before the wedge 🚀

Low volume within the wedge 📉, high volume on breakout 📈

Retest of breakout level = confirmation 🔁

🔥 Factors That Strengthen the Signal

Breakout on strong volume 📊💥

Appears after an extended trend 🧭📉📈

More touches = stronger pattern ✍️

Breakout occurs close to the apex 🎯

⚠️ Factors That Weaken the Signal

Low volume on breakout 😐

Poorly defined trendlines 🫥

Few touches on lines

Early breakout (too far from apex) ⏱️

No prior trend / appears in a range-bound market 📏

✅ Examples of My Successful Wedge Trades

📸

❌Examples of Failed Wedge Overview

💥

💬 Do you use the wedge pattern in your trading?

It’s a powerful pattern, especially when confirmed by volume and market structure. Share your favorite wedge setups or ask questions below 👇👇

X-indicator

How Do Traders Use the Pivot Points Indicator? How Do Traders Use the Pivot Points Indicator?

Pivot points are a popular technical analysis tool for spotting areas where the price is expected to react, i.e. pause or reverse. Calculated using the previous day’s high, low, and close, they’re projected onto the current session to highlight potential support and resistance levels, especially useful for intraday traders.

Alongside stock charts, pivot point levels can be used in a wide variety of markets, including forex, commodities, and cryptocurrencies*. As a versatile indicator, pivot points also come in many different types. This article breaks down the definition of pivot points, the variations traders use, and how they can fit into a broader trading strategy.

A Deeper Look at Pivot Points

A common question in technical analysis is, “What is a pivot point?” Pivot points trading, or pivot point theory, is a popular technical analysis concept used in a range of financial asset classes, including stocks, currencies, cryptocurrencies*, and commodities. The indicator assists traders in gauging overall market trends and determining possible support and resistance barriers.

How to Read Pivot Points

The pivot point indicator is static—it’s an average of the high, low, and close prices from the previous trading day. It includes three levels: pivot point (P), support (S), and resistance (R). If the price is above the pivot point, it is supposed to target resistance barriers. Conversely, if it’s below the pivot, it could move to support levels. Thus, support and resistance levels serve as targets or stop-loss zones. They remain constant throughout the period, enabling traders to plan ahead.

In the EURUSD daily chart below, the price is trading above R2; therefore, market sentiment is assumed to be bullish. R3 indicates the next possible price target. Should a shift below P occur, bearishness arises, and S1 becomes the upcoming support level.

Pivots are widely used with trend indicators such as moving averages and Fibonacci tools. In the chart below, Fibonacci retracements could be used to identify intermediate levels of support and resistance within widely placed pivots.

How to Calculate Pivot Points?

There are four key types of pivots, including standard, Woodie’s, Camarilla, and Fibonacci. While there’s no need to use a pivot points calculator—they’re calculated automatically when implemented on a price chart—it is worth looking at their formulas to understand how they differ from each other.

Note the labels for the following formulas:

P = pivot point

H = high price

L = low price

C = close price

Standard Pivot Points

Traders commonly use standard pivot points. Traditional pivots (P) identify potential levels of support (S) and resistance (R) by averaging the previous trading period's high, low, and close prices.

P = (H + L + C) / 3

S1 = (2 * P) - H

S2 = P - (H - L)

R1 = (2 * P) - L

R2 = P + (H -L)

Although they are popular among traders, they can produce false signals and lead to incorrect trades in ranging markets and during periods of high volatility.

Woodie’s Pivot Points

Woodie's pivots are similar to standard pivots but include a slight modification to the calculation. In Woodie's method, the close price is assigned more weight.

P = (H + L + 2 * C) / 4

R1 = (2 * P) - L

R2 = P + H - L

S1 = (2 * P) - H

S2 = P - H + L

However, their extra sensitivity can make them less reliable during choppy markets or when the price lacks a clear direction.

Camarilla Pivot Points

Camarilla pivots use a set formula to generate eight levels: four support and four resistance. They are based on the previous day’s close and range and multiplied by a certain multiplier. The inner levels (R3 and S3) often act as reversal zones, while R4 and S4 are watched for breakouts. Still, in trending markets, the reversals can fail frequently.

R4 = C + (H - L) x 1.5

R3 = C + (H - L) x 1.25

R2 = C + (H - L) x 1.1666

R1 = C + (H - L) x 1.0833

P = (High + Low + Close) / 3

S1 = C - (H - L) x 1.0833

S2 = C - (H - L) x 1.1666

S3 = C - (H - L) x 1.25

S4 = C - (H - L) x 1.5

Fibonacci Pivot Points

Fibonacci pivot points are based on the Fibonacci sequence, a popular mathematical concept in technical analysis.

They are calculated in the same way as the standard indicator. However, the levels of support and resistance are determined by including the Fibonacci sequence with a close monitoring of the 38.2% and 61.8% retracement levels as the primary price points.

P = (High + Low + Close) / 3

S1 = P - (0.382 * (H - L))

S2 = P - (0.618 * (H - L))

R1 = P + (0.382 * (H - L))

R2 = P + (0.618 * (H - L))

Despite their popularity, Fibonacci pivots can become less reliable when the price reacts to other fundamental drivers.

Trading with the Pivot Points

Although every trader develops their own trading approach, there are common rules of pivot point trading that are expected to improve their effectiveness.

Day Trading

Day trading with pivot points is usually implemented for hourly and shorter intraday timeframes. As pivot levels are updated daily and calculated on the previous day's high, low, and close prices, this allows traders to react promptly to market changes and adjust their strategies. Some traders prefer Camarilla pivots as their calculation takes into account the volatility of the previous trading period to produce pivot levels closer to the current price.

Medium-Term Trading

When looking at a medium-term analysis, weekly pivot levels are added to four-hour and daily charts. These are calculated using the previous week's high, low, and close prices, which remain unchanged until the start of the next week.

Long-Term Trading

For longer-term analysis, traders use monthly pivots on weekly charts. These levels, gathered from the previous month's data, offer a broader picture of market trends and price movements over time.

Pivot Point Trading Strategies

The pivot points indicator is typically used in two ways – breakout and reversal trading.

Breakout Trading Strategy

The breakout approach seeks to take advantage of market momentum by entering trades when prices break above or below significant levels of support and resistance.

- Bullish Breakout. When levels P and R1 are broken, and the price closes above either, it’s more likely a rise will occur.

- Bearish Breakout. When levels P and S1 are broken, and the price closes below either, it’s more likely the price fall will occur.

Strong momentum and high volume are two critical factors needed for a solid price movement in both cases.

Trading Conditions

If a breakout is confirmed, traders enter a trade in the breakout direction. A take-profit target might be placed at the next pivot level. A stop-loss level can be placed beyond the previous level or calculated according to a risk/reward ratio. Traders continuously monitor their trades and adjust their stop-loss levels to lock in potential returns if prices move in their favour.

Reversal Trading Strategy

The reversal strategy seeks to take advantage of a slowdown in market momentum by entering trades when prices stall at significant levels of support or resistance.

- Bullish Reversal. When levels S1 and S2 are not broken and the price stalls above either, a reversal is more likely to occur.

- Bearish Reversal. When levels R1 and R2 are not broken and the price stalls below either, a reversal is expected to happen.

Note: Reversals are always confirmed by another indicator or a chart pattern.

Trading Conditions

If a reversal is confirmed, traders consider entering a trade in its direction. The next level may be a take-profit target, which might be trailed to the next level if the market conditions signal a continuation of a price move. A stop-loss level is typically placed below a swing low or above a swing high, depending on the trade direction.

Pivot Points and Other Indicators

While pivots show where the price may reverse, there’s nothing to say a market won’t trade through these areas. Therefore, traders typically pair them with other technical indicators and patterns.

Candlestick and Chart Patterns

Traders often combine levels with specific reversal candlestick formations, like three black crows/three white soldiers or engulfing patterns, to confirm a change in market movements. For example, a bullish engulfing candle forming at S1 could reinforce the idea of a reversal at that level.

Moving Averages

When a pivot aligns with a major moving average, e.g. the 50-period or 200-period EMA, it strengthens the area. As moving averages act as dynamic support and resistance levels, an overlap can signal a strong area where a reversal might occur.

RSI and Stochastic Oscillator

Momentum indicators like RSI or Stochastic help judge whether the price is likely to bounce or break through a pivot. If it hits support and RSI is oversold, that adds conviction. But if momentum is still strong in one direction, it might get ignored.

Considerations

Even with strong confluence, these combinations can fail. Markets don’t always respect technical alignment, especially around data releases or sharp movements in sentiment. For instance, in stocks, pivot points may be ignored if an earnings release strongly beats analyst estimates. Instead, they are believed to work when treated as one piece of a broader technical framework.

Limitations

Pivot points are widely used, but like any tool, they have flaws. They’re based purely on past price data, so they don’t account for news, sentiment shifts, or broader market context.

- False signals in ranging markets: The price often oscillates around pivot zones in markets without a clear direction, meaning setups might not follow through.

- Less reliable during strong trends: In trending conditions, the price can blow past several levels without reacting.

- No built-in volatility filter: The points don’t adapt to changing volatility, so levels might be too close or too far apart to be useful.

- Lag in real-time shifts: Since pivots are pre-calculated, they don’t adjust mid-session as new data emerges.

Final Thoughts

Pivot points are widely used in stock trading as well as in commodity, cryptocurrency*, and currency markets. While they can be useful tools, their limitations cannot be overlooked. It is essential to conduct a comprehensive analysis and confirm the indicator signals with fundamental and technical analysis tools.

FAQ

What Is a Pivot Point in Trading?

The pivot point meaning refers to a technical analysis tool used to identify potential support and resistance levels. It’s calculated using the previous day’s high, low, and close prices, and helps traders find areas where the price may react during the current session.

What Is the Best Indicator for Pivot Points?

There isn’t one best indicator, but traders often pair pivot points with moving averages, RSI, or candlestick patterns to confirm a potential reversal. The most effective setup usually depends on the strategy and market conditions.

What Are the Pivot Points’ R1, R2, and R3?

R1, R2, and R3 are resistance levels above the central point. They represent increasingly stronger potential resistance zones where the price may stall or reverse.

Which Is Better, Fibonacci or Camarilla?

Fibonacci offers wider levels based on retracement ratios, useful in trending markets. Camarilla focuses on tighter reversal zones, which are mostly used for intraday strategies. Each suits different trading styles; neither is objectively better.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Thea **Cup and Handle** pattern✨ **Imagine the market serving profits in a teacup!**

Thea **Cup and Handle** pattern isn’t just a technical term—it’s the market whispering, *“Get ready for liftoff!”* Let’s break it down in an engaging way:

### ☕ The Cup

- Picture a graceful drop in price that curves back up, forming a U-shape.

- It’s like the market takes a sip, then refills—symbolizing recovery and building strength.

### 🛠️ The Handle

- After the cup fills, the price dips slightly again, forming a small slope downward.

- This is the “handle”—a moment of consolidation, often with lower trading volume.

- It’s the calm before the bullish storm.

### 💡 Bullish Signal

- When the price **breaks above the handle’s resistance**, it’s like the market pulls the trigger.

- This signals a potential buying opportunity as the trend resumes upward.

### 📆 Duration

- The cup can take weeks or even months to form, while the handle is shorter and more subtle.

- Patience pays off, as the breakout often leads to explosive momentum.

---

🏆 *Want proof?* Check the comments—one of our past trades using this exact pattern scored a massive win of **100,000 pips**! 🚀

Technical analysis isn’t just charts and numbers—it’s decoding the market’s rhythm.

Option Chain AnalysisTable of Contents

Introduction to Option Chain

What Is an Option Chain?

Key Components of an Option Chain

Call vs. Put Options in the Chain

How to Read an Option Chain

Open Interest (OI) Analysis

Implied Volatility (IV) Analysis

Strike Price Selection

Support and Resistance Levels from Option Chain

Option Chain for Intraday & Swing Trading

1. Introduction to Option Chain

In the world of options trading, success is not just about buying calls or puts randomly—it’s about understanding market data. One of the most important tools for analyzing this data is the Option Chain. Whether you're a beginner or an advanced trader, mastering option chain analysis can help you identify market sentiment, key levels, and trading opportunities.

2. What Is an Option Chain?

An Option Chain, also known as an Options Matrix, is a tabular representation of all available option contracts (both Call and Put) for a particular underlying asset—like Nifty, Bank Nifty, Reliance, TCS, etc.—for a specific expiry date.

It shows:

Strike prices

Premiums (Prices)

Open interest (OI)

Volume

Implied volatility (IV)

Bid/ask prices

Think of it like a menu card for options, showing all the possible trades you can take, and key stats about each.

3. Key Components of an Option Chain

✅ Strike Price:

The price at which you can buy (Call) or sell (Put) the underlying asset.

✅ Premium (LTP):

The last traded price (LTP) of the option.

✅ Open Interest (OI):

The number of open contracts for a strike price. Indicates trader interest.

✅ Change in OI:

The change in open positions compared to the previous day.

✅ Volume:

The number of contracts traded in the current session.

✅ Implied Volatility (IV):

Market's expected volatility of the underlying asset.

4. Call vs. Put Options in the Chain

In every option chain, you’ll see two sections:

Call Options (Left side) Put Options (Right side)

Bullish expectation Bearish expectation

Buy if expecting upside Buy if expecting downside

Sell if expecting sideways/down Sell if expecting sideways/up

Usually, the middle column contains strike prices, with Call data on the left and Put data on the right.

5. How to Read an Option Chain

Let’s take an example:

Assume Nifty is trading at 22,200. You look at the Nifty option chain.

You’ll see multiple rows of strike prices (e.g., 22,000, 22,100, 22,200…) and for each, data like LTP, OI, IV.

Look for:

ATM (At-the-money): Closest strike to the current price (22,200).

ITM (In-the-money): For calls, strikes < spot; for puts, strikes > spot.

OTM (Out-of-the-money): For calls, strikes > spot; for puts, strikes < spot.

Example:

22,200 is ATM.

22,100 Call is ITM.

22,300 Call is OTM.

6. Open Interest (OI) Analysis

OI is one of the most powerful indicators in option chain analysis. It shows where traders are placing their bets.

✔️ What to Look For:

High OI = Strong interest at that strike.

Increase in OI = New positions being added.

Decrease in OI = Positions being closed.

✔️ Interpretations:

High OI in Call → Resistance level.

High OI in Put → Support level.

Let’s say:

22,500 Call has 30 lakh OI → Strong resistance.

22,000 Put has 35 lakh OI → Strong support.

This gives you the trading range of Nifty: 22,000 to 22,500.

7. Implied Volatility (IV) Analysis

IV represents the market's future expectations of volatility. Higher IV means higher premiums.

✔️ Why IV Matters:

When IV is high, options are expensive.

When IV is low, options are cheaper.

✔️ Practical Use:

Sell options when IV is very high (premium is inflated).

Buy options when IV is low (premium is cheap).

8. Strike Price Selection

Choosing the right strike is key for successful trading.

✔️ For Buying Options:

Buy slightly ITM for better delta and time value.

ATM works for short-term, fast movements.

✔️ For Selling Options:

Sell OTM options with high OI and low IV.

✔️ Tip:

Always check the OI and IV before choosing a strike. Avoid illiquid strikes (with low OI or volume).

9. Support and Resistance Levels from Option Chain

You can spot support and resistance based on OI data.

✔️ Support:

Strike where Put OI is highest.

E.g., 22,000 Put with highest OI = Support zone.

✔️ Resistance:

Strike where Call OI is highest.

E.g., 22,500 Call with highest OI = Resistance zone.

This helps you create a trading range.

10. Option Chain for Intraday & Swing Trading

✅ Intraday Trading:

Watch change in OI during live market.

Spike in Call OI → Possible resistance forming.

Spike in Put OI → Possible support forming.

✅ Swing Trading:

Analyze overall OI trend.

Look at monthly expiry data.

Identify positional buildup or unwinding.

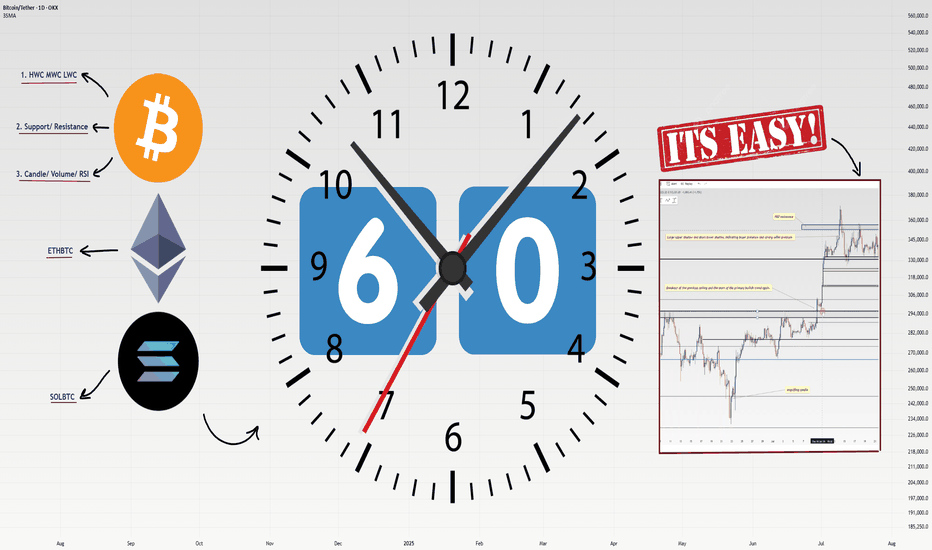

How I Analyze Any Coin in 60 Seconds: 4-Step Masterclass!Heyy traders, it’s Skeptic from Skeptic Lab! 🩵 I’m breaking down my lightning-fast method to analyze any coin in just 60 seconds . This 4-step process is how I spot long/short triggers like a pro. Buckle up, let’s dive in:

✔️ Step 1: Identify HWC/MWC/LWC (10 seconds)

Nature’s got a cool vibe—bet a lot of you hit the outdoors on weekends. When I see an apple tree from afar, it’s majestic, but up close, I spot branches and worm-eaten fruit. From a distance, I miss the details; up close, I lose the tree’s grandeur. Markets work the same. You need different timeframes to grasp the market structure. With practice in Dow Theory, trends, and tools, spotting HWC (Higher Wave Cycle), MWC (Mid Wave Cycle), and LWC (Lower Wave Cycle) becomes second nature. For me, this takes 10 seconds.

Want a full HWC/MWC/LWC guide? Check my free article I wrote a while back—it’s a hands-on tutorial ( link Cycle Mastery ).

📊 Step 2: Draw Support/Resistance Lines (20–30 seconds)

I start with higher timeframes: Monthly, then Weekly, then Daily. Once I’ve drawn lines up to Daily, I don’t always redraw for lower timeframes—often, I just adjust them.

Pro tip : Give more weight to the right side of the (recent data) since it’s fresher and more valuable. I change line colors for 4-hour lines, so I know they’re less critical than Daily. I don’t draw lines below 4-hour, but if you’re a scalper, tweak this to your strategy. This step takes me 20–30 seconds, the longest part.

📉 Step 3: Analyze Candles, Volume, Oscillators, and Indicators (10–15 seconds)

Here, I check everything I can: candles, volume, oscillators, and indicators . The goal? Stack confirmations for my triggers. Think RSI hitting overbought, volume spikes, larger candle sizes, or momentum surges—you get the vibe. This step’s length depends on your tool mastery. For me, it’s quick because I know what to look for.

🔔 Step 4: Check Coin Dominance (5–10 seconds)

This is the most critical yet simplest step. We need to track where liquidity’s flowing . For example, if SOL/BTC is bearish, I skip buying Solana—liquidity’s exiting. BTC.D (Bitcoin Dominance) is also key. The relationships dominance creates are complex and don’t fit in one analysis, but if you want a full dominance tutorial, drop it in the comments!

🔼 Key Takeaway: Using these 4 steps—HWC/MWC/LWC, support/resistance, candles/indicators, and dominance—I analyze any coin in 60 seconds. Your speed depends on experience and knowledge. If you’re new, this might take 60 minutes per coin, but don’t sweat it— practice makes you lightning-fast . Thanks for vibing with this educational idea! <3 I’ll catch you in the next one—good luck, fam!

💬 Let’s Talk!

Want a dominance tutorial or more tips? Hit the comments, and let’s crush it together! 😊 If this guide lit your fire, smash that boost—it fuels my mission! ✌️

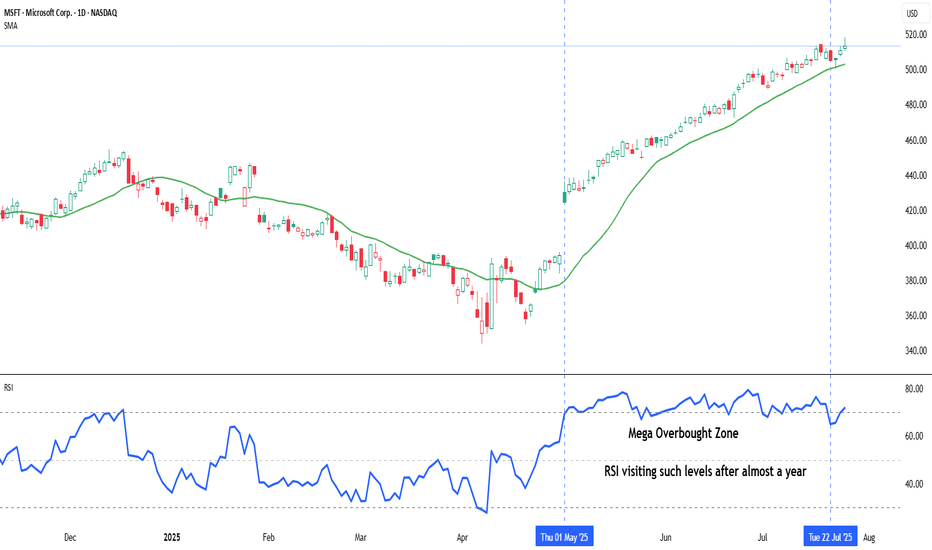

Indicator Decoded: RSI Mega Zones: Signals from the EdgeMost traders are familiar with the textbook RSI levels—70 indicating overbought and 30 indicating oversold. But markets, especially in strong momentum phases, do not always obey these boundaries. That is where the concept of Mega Overbought and Mega Oversold zones becomes vital. These are not fixed thresholds, but adaptive zones often beyond 80 and below 20, where the RSI reflects extreme strength or weakness. Rather than acting as reversal points, these levels often signal trend continuation.

A reading above 80 is typically seen during powerful uptrends or post-breakout rallies. It indicates not just buying, but unhesitating, aggressive demand, especially after key resistance zones have been cleared. Such RSI levels have often not been seen in several months—if not more than a year—making their appearance especially significant. Rather than a signal of exhaustion, this may be the start of a major trend, suggesting that the broader structure of the stock or index has shifted decisively. Traders who misinterpret this as a reversal signal often find themselves fighting momentum. Instead, price tends to grind higher, sometimes pausing briefly before further gains. This is why the chapter suggests using Mega Overbought zones as confirmation of bullish control, not a trigger for counter-trades.

The inverse applies to the Mega Oversold zone—RSI falling below 20. This is usually not a buy-the-dip moment, especially if the broader trend and chart structure are bearish. Such readings typically accompany panic-driven breakdowns, where sellers dominate without any counterforce. These extreme values are often rare and may not have appeared for months or even over a year, marking a moment where the market’s character may be undergoing a structural change. As with Mega Overbought, context is critical. If RSI hits such depths after prolonged distribution or a topping pattern, it does not indicate value—it confirms that the tide has turned, and a strong downtrend may be setting in.

Both Mega zones are best used in conjunction with structure—trendlines, volume shifts, anchored VWAP zones, or price patterns. The RSI alone is not enough. But when it aligns with other technical signals, a Mega Overbought or Oversold status becomes a momentum amplifier, not a contrarian prompt. In fact, your RSI chapter rightly warns that entering against such zones can be fatal unless clear divergences, climax patterns, or volume exhaustion are also present. Think of these extremes not as ceilings or floors, but as accelerators when backed by structure.

A word of caution: These signals are rare and often widely spaced. The real challenge lies in managing risk–reward, as strong momentum and shallow pullbacks can make it difficult to find entries with favourable R:R ratios.

Chart: Microsoft Corp. (MSFT) – Daily Chart with 20-DMA and RSI (as on July 25, 2025)

Microsoft continues its strong upward trajectory, with price action staying well above the rising 20-day simple moving average. The recent surge in RSI into the mega overbought zone marks a significant shift in momentum, as the indicator revisits such elevated levels after nearly a year—an occurrence that often coincides with extended bullish phases.

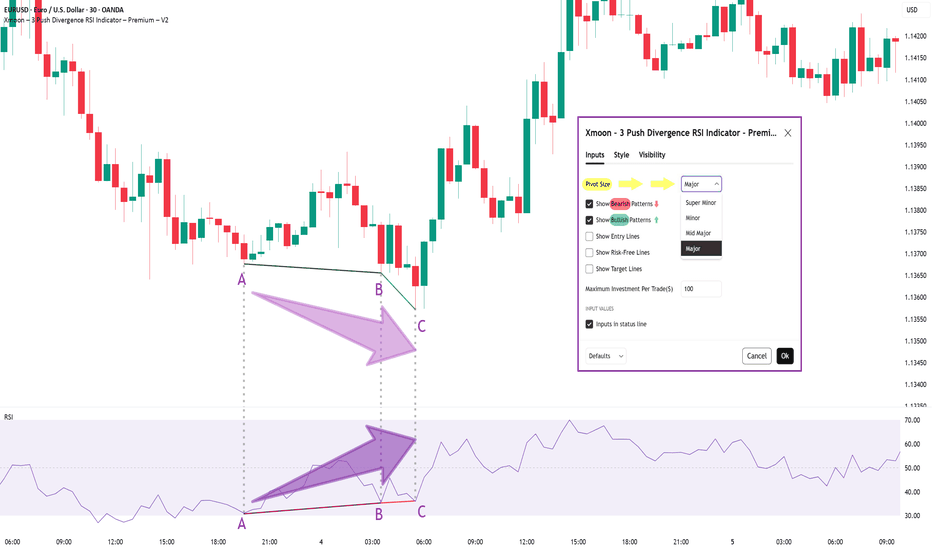

Xmoon Indicator Tutorial – Part 1 – Strategy🔻🔻🔻+ Persian version below🔻🔻🔻

📘 Xmoon Indicator Tutorial – Part 1

🎯 3Push Divergence RSI Strategy

🔥 The core of the Xmoon indicator

is built upon one of the most powerful strategies in technical analysis:

The advanced 3Push Divergence RSI pattern

🔁 A pattern that typically appears at key market turning points.

📉 When the price moves in the same direction three consecutive times on pivot points (e.g., making lower lows or higher highs), but the RSI shows the opposite behavior, it indicates a clear divergence !

💡 This divergence can act as a strong signal for a potential trend reversal.

🎯 The Xmoon Indicator is designed to detect this critical moment.

⚙️ Xmoon Indicator Settings Panel

The Xmoon settings panel offers the following options:

🔸 Pattern Type Selection: In the first and second lines, you can specify which type of pattern should be displayed: only bullish patterns or only bearish ones. You can also check both options.

🔸 Pivot Type Selection: From the dropdown menu, you can choose one of four pivot types:

“Super Minor”, “Minor”, “Mid-Major”, and “Major”, ordered from smallest to largest.

📌 Educational Note: The greater the distance (in candle count) between two lows or two highs, the larger the pivot is considered.

A Major Pivot is the largest among them.

✅ Larger Pivot = Higher Accuracy

❗ But naturally = Fewer Signals

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

🔻🔻🔻بخش فارسی – Persian Section 🔻🔻🔻

📘 آموزش اندیکاتور ایکسمون - قسمت اول

🎯 استراتژی سهپوش واگرایی (3Push Divergence RSI)

🔥 هسته اصلی ایکسمون

بر پایه یکی از قویترین استراتژیهای تحلیل تکنیکال طراحی شده است

الگوی پیشرفته سهپوش واگرایی

🔁 الگویی که معمولاً در نقاط چرخش مهم بازار ظاهر میشود

📉 وقتی قیمت سه بار پشت سر هم روی نقاط پیوت ، در یک جهت حرکت میکند (مثلاً کفهای پایینتر یا سقفهای بالاتر میسازد) ، اما آر-اِس-آی خلاف آن را نشان میدهد، یعنی یک واگرایی آشکار رخ داده است

💡این واگرایی میتواند سیگنالی قوی برای برگشت روند باشد

🎯 اندیکاتور ایکسمون این لحظه را شناسایی میکند

⚙️ پنجره تنظیمات اندیکاتور ایکسمون

در بخش تنظیمات اندیکاتور ایکسمون، امکاناتی در اختیار شما قرار دارند

🔸 انتخاب نوع الگو: در خط اول و دوم میتوانید مشخص کنید چه نوع الگویی نمایش داده شود

فقط الگوهای صعودی یا فقط نزولی. همچنین می توانید تیک هر دو گزینه را بزنید

🔸 انتخاب نوع پیوتها: از پنجره کشویی بالا، می توانید یکی از ۴ نوع پیوت را انتخاب کنید

پیوت ها به ترتیب از کوچک به بزرگ عبارتند از: سوپر مینور ، مینور ، میدماژور و ماژور

📌 نکته آموزشی: هرچه فاصله بین دو کف یا دو سقف بیشتر باشد (یعنی تعداد کندلهای بین آنها زیادتر باشد)، آن پیوت، بزرگتر محسوب میشود

پیوت ماژور از بقیه بزرگ تر است

✅ پیوت بزرگتر = دقت بالاتر

❗ اما طبیعتاً = تعداد سیگنال کمتر

📣 اگر سوالی دارید یا نیاز به راهنمایی دارید، خوشحال میشویم از ما بپرسید

با کمال میل در خدمتتان هستیم

5 Lessons from My First 100 TradesAfter executing and reviewing over 100 real trades in crypto, forex, and gold — I found patterns. Bad patterns. Repeating mistakes. And lessons I wish someone had told me earlier.

So I broke them down into 5 key insights that changed how I trade — and might just save you thousands.

📘 Here’s what’s inside:

1️⃣ Smart Profit-Taking:

How I turned 10 R/R into 32 R/R using a dynamic exit plan.

📘Further resource:

Cycle Mastery (HWC/MWC/LWC)

---

Multi-Timeframe Mastery

2️⃣ The Sleep Edge:

70% of my losing trades happened after bad sleep. Here’s why that matters more than emotions.

3️⃣ No More Blind Stop Orders:

Why I stopped using buy/sell stops without real candle confirmation — and what I do instead.

📘 Further reading:

Breakout Trading Mastery

---

Indecision Candle Strategy

4️⃣ Multi-Layered Setups Win:

How structure, S/R, patterns, and timing stack into high-probability entries.

5️⃣ News Trading? Just Don’t.

The data behind why most of my SLs were hit near news time — and how I avoid the trap.

💡 These aren’t theories. These are real lessons from real trades.

If this video helped you or sparked an “aha” moment, give it a boost, commenting your takeaway, and sharing it with a fellow trader.

lets grow together :)

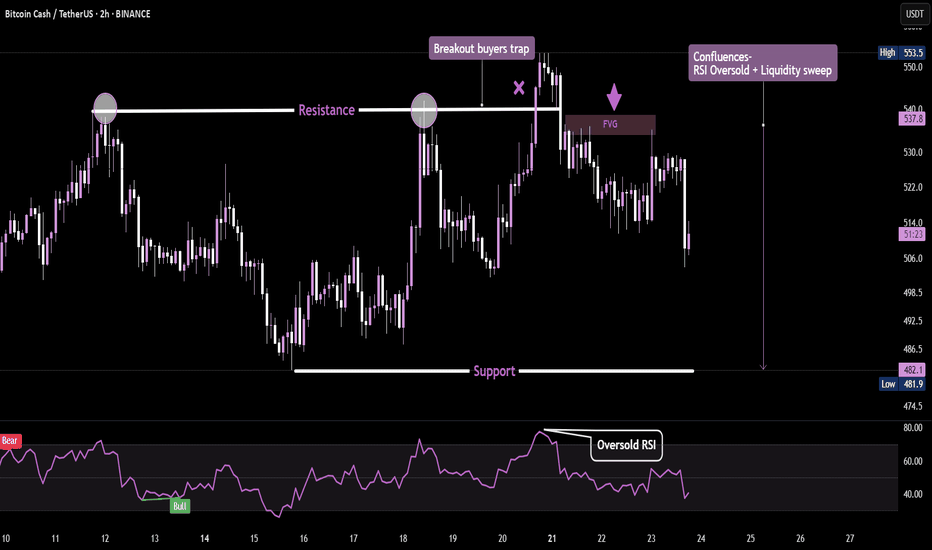

Liquidity Sweep + FVG + RSIThis BCH/USDT 2H chart illustrates a textbook example of a liquidity sweep and reversal, backed by RSI confluence. Price repeatedly tested a horizontal resistance level, eventually triggering a breakout trap — enticing late buyers just before reversing.

The false breakout swept buy-side liquidity, trapping retail longs above resistance. Immediately after, price dropped back below the key level and formed a Fair Value Gap (FVG) — a common area where smart money re-enters positions. This signaled distribution rather than continuation.

Adding to the bearish confluence, RSI showed overbought conditions during the sweep, reinforcing that momentum was exhausted. Once liquidity was taken and RSI began dropping, a strong bearish move followed.

📉This setup combines multiple Smart Money Concepts:

🔁Liquidity engineering

🔁Breakout trap

🔁Fair Value Gap re-entry

🔁RSI confirmation

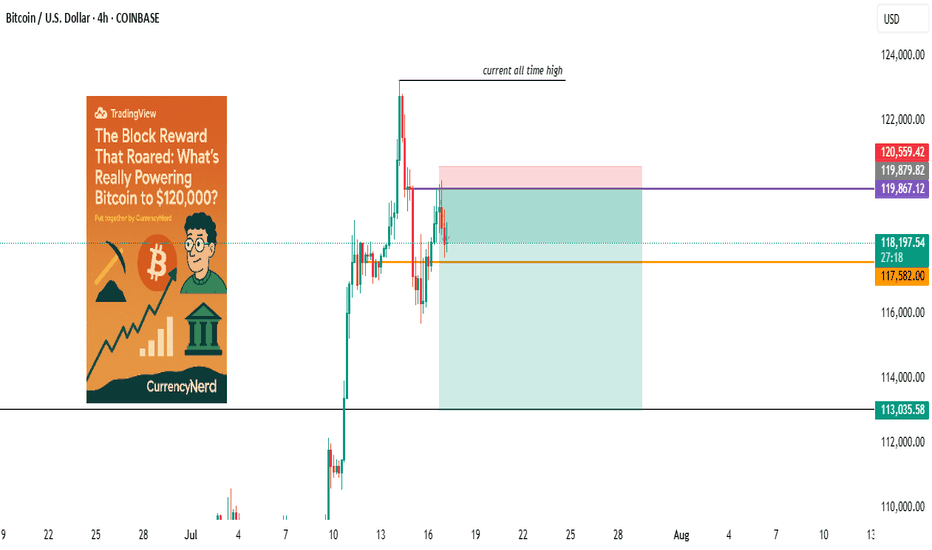

Bitcoin: Forecasting the Cycle ATHBitcoin has set a new all-time high this July, continuing the upward cycle tied to the spring 2024 halving. The decline in bitcoin dominance since early July has sparked a minor altcoin season. On this topic, I invite you to revisit my latest crypto analyses in the Swissquote market analysis archive. You can also subscribe to our account to receive alerts every time I publish a new crypto market analysis for Swissquote.

By clicking on the image below, you can read my latest perspective on Ether’s outperformance, which I now expect to last until the end of the cycle.

In this new article, I’ll address an important subject: the final top price for Bitcoin in this 2025 cycle. I’ll publish a separate article soon regarding timing. Today, I present three tools to combine in order to define a target zone for Bitcoin’s final cycle high by year-end.

1) Elliott Wave Technical Analysis on a Logarithmic Scale

Bitcoin is currently building wave 5 of the bullish cycle that started in autumn 2022 around $15,000. To calculate theoretical targets for wave 5, we use Fibonacci extensions, particularly projections from wave 3 and from the bottom of wave 1 to the top of wave 3. This gives a target range between $145,000 and $170,000.

2) Pi Cycle Top Prediction Tool

The Pi Cycle Top is based on the interaction of two moving averages: the 111-day MA and the 350-day MA multiplied by 2. Historically, a bullish crossover of the 111 MA above the 2×350 MA preceded the market peaks of 2013, 2017, and 2021 by a few days. This tool captures late-stage bull market speculation but can give false signals when used alone, hence the need for multiple approaches. The current 2×350-day MA stands at $175,000.

3) Terminal Price Tool

Developed by analyst Willy Woo, Terminal Price is an on-chain model based on Bitcoin’s fundamental network data. It combines the Price-to-Thermocap Ratio (market value vs cumulative mining cost) with a logarithmic metric to estimate a theoretical ceiling. Unlike the Pi Cycle Top, it does not rely on price action but on network economic activity, making it complementary. Terminal Price currently trends around $200,000.

Used together, these three approaches can help identify likely cycle top zones. The Pi Cycle Top signals excess momentum through price dynamics, while Terminal Price provides a more fundamental upper bound. Their convergence with Elliott wave analysis and Fibonacci extensions increases the probability that the final cycle top will occur by late 2025 in a range between $145,000 and $200,000.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

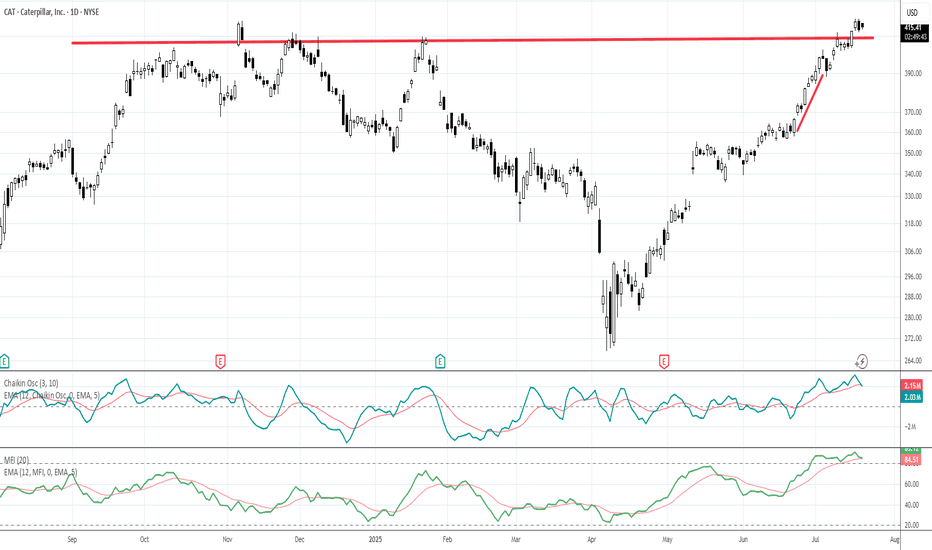

Angle of Ascent: what it means, how to use it.Angle of Ascent is a visual pattern that forms on a chart when stocks are running with momentum or velocity. Drawing a line along an up trending price action helps you see the Angle of ascent. Also Chaikins Osc and EMA MFI indicators are extremely helpful in warning a day ahead of time that the Angle of Ascent is too steep to sustain.

This is an exit signal for profit taking at or near the highest high of a swing style run.

Angle of Ascent is also used on Weekly Charts to determine how far a stock can run before resistance from previous highs will stall that stock and cause a minor to intermediate correction.

Recognizing when an angle of ascent has become too steep to sustain and using these indicators will help you hold a swing run but also help you exit before a retracement or correction starts.

The professional side of the market uses penny spreads, millisecond routing to the ques of the market, and can easily front run retail traders orders.

Reminder: retail brokers are required to light your order before sending to the PFOF Payment for Order Flow Market Maker of their choice.

The Digital Stock Market moves at a much faster pace with subtle nuances such as Angle of Ascent. As you become an advanced level trader to a semi-professional trader, or potentially a full time professional trader, these details matter more than when you are just learning stock trading.

Trade Wisely

Martha Stokes CMT

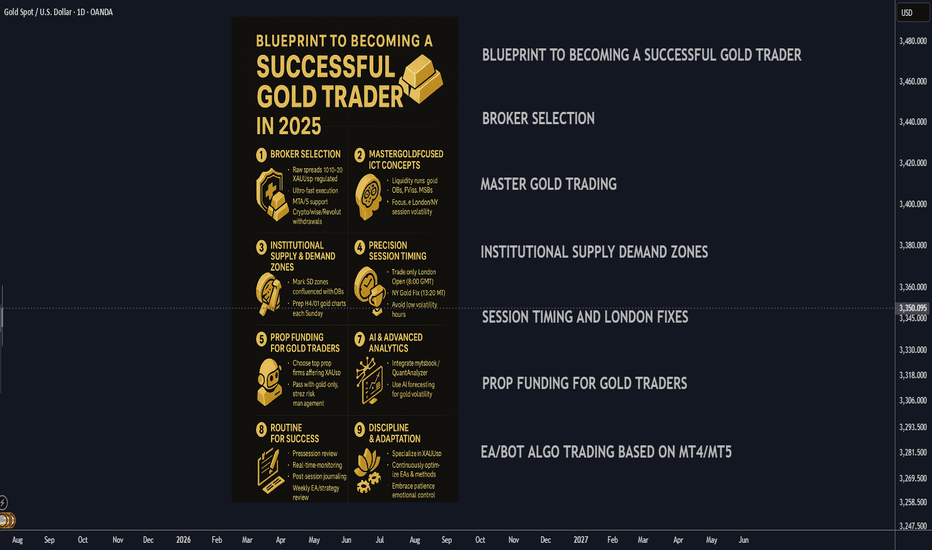

Blueprint to Becoming a Successful Gold Trader in 2025🚀 Blueprint to Becoming a Successful Gold Trader in 2025

A strategic, step-by-step plan to master gold trading by combining institutional concepts, cutting-edge automation, and the best prop funding opportunities for XAUUSD.

________________________________________

🏦 Broker Selection (Gold-Specific)

• 🔍 Choose Brokers Offering Raw Spread XAUUSD Accounts:

Seek brokers with raw/zero spread gold trading or tight gold spreads (0.10-0.30 average) with deep liquidity.

• ⚡ Prioritize Ultra-Fast Execution for Metals:

Confirm broker servers are in NY4/LD4 and latency is optimized for gold volatility spikes.

• 🛡️ Verify Regulation & Execution:

ASIC, FCA, FSCA preferred; check for proof of XAUUSD execution quality (Myfxbook/FXBlue verified).

• 📊 MetaTrader 4/5 Gold Support:

Ensure MT4/5 platform offers tick-chart precision for gold and supports custom EAs/indicators.

• 💳 Flexible Withdrawals/Payouts:

Crypto, Wise, and Revolut compatibility for fast, secure funding.

________________________________________

🎯 Gold Trading Strategy (ICT + Supply/Demand Zones)

• 🧠 Master Gold-Adapted ICT Concepts:

o Liquidity runs and stops at London/NY session highs/lows

o XAUUSD-specific Order Blocks (OBs), FVGs, and Market Structure Breaks (MSB)

• 📍 Map Institutional Supply-Demand Zones:

Gold reacts violently to these—align SD zones with ICT Order Blocks for best confluence.

• 📐 Precision Entries:

Only enter after liquidity sweeps at key XAUUSD levels (H4/D1), avoiding choppy retail entries.

• 📈 Time & Price for XAUUSD:

Focus exclusively on London Open (8:00 GMT) and NY Open/Gold Fixing (13:20 GMT)—peak volatility windows.

• 📆 Weekly Preparation:

Annotate D1/H4 gold charts every Sunday with clear OBs, liquidity points, and SD zones for the week.

________________________________________

💰 Prop Funding for Gold Trading

• 🥇 Select Firms Offering XAUUSD with Tight Rules:

Choose FTMO, The Funded Trader, MyFundedFX, or similar with high leverage and XAUUSD trading enabled.

• 📑 Pass Evaluation with Gold-Only Strategy:

Use high-probability, low-frequency XAUUSD trades—1-3 setups per week, strict risk parameters.

• 🎯 Risk Management:

Max 1% risk/trade, stop trading after 2 consecutive losses—protect account and pass evaluations.

• 📊 Analytics Monitoring:

Use prop dashboards (FTMO Metrics, FundedNext stats) to review XAUUSD trade stats and adjust.

• 📚 Diversify Funded Accounts:

Split funded capital among multiple firms to hedge against firm-specific risk and maximize payouts.

________________________________________

⚙️ Automating Gold Trading (MT4/5 EAs & Bots)

• 🛠️ Hire MQL4/5 Developers for XAUUSD EAs:

Code bots focused on gold-specific ICT (OBs, FVGs, London/NY volatility).

• 🤖 Develop EAs for Gold:

o OB/FVG/Market Structure detection on XAUUSD

o Supply/Demand zone algo entries

o Gold breakout EAs for session openings

• 📌 Trade Management Automation:

o Entry, stop loss, partial TP, BE, trailing for gold’s high volatility

o Dynamic lot-sizing by daily ATR

• 📡 VPS Hosting Near Broker’s Gold Server:

Use NY4/LD4 VPS for lowest latency (ForexVPS, Beeks).

• 📈 Quarterly Forward-Testing:

Optimize EAs in demo before live trading, retest on every major gold volatility shift (FOMC, CPI).

________________________________________

📲 Leveraging Bots & AI in 2025

• 📊 Integrate with MT4/5 Analytics Tools:

Use myfxbook, QuantAnalyzer for detailed gold trade breakdowns.

• 🔮 AI-Based Gold Forecasting:

Layer in machine learning models (e.g., TensorTrade, TradingView AI) to anticipate session volatility and direction.

• 🔔 Real-Time Alert Bots:

Set up Telegram/Discord bots for instant notification of ICT-based XAUUSD signals.

• 🧑💻 Manual Oversight:

Always review high-impact news (NFP, CPI, FOMC) and override automation when macro risk spikes.

• 🔄 Continuous Bot Updates:

Retrain your EAs monthly on latest XAUUSD price action to maintain edge.

________________________________________

🗓️ Daily Gold Trader Routine

• 🌅 Pre-Session (30 mins):

Review annotated gold charts, key session highs/lows, OB/FVG/SD levels, and upcoming news.

• 💻 During Session:

Monitor bot execution, validate setups manually, manage risk during NY/London overlap.

• 📝 Post-Session (15 mins):

Journal gold trades, note reasoning for entry/exit, emotional state, and lessons learned.

• 📆 Weekly Review:

Assess overall gold trading stats and EA performance, adjust strategy as needed.

• 📚 Continuous Learning:

Stay updated on ICT, gold market fundamentals, and new trading tech.

________________________________________

📌 Final Success Advice for 2025

• 🔍 Specialize in XAUUSD/Gold—Don’t Diversify Randomly:

Depth > Breadth—become a true gold trading expert.

• 🚩 Keep Adapting Your Gold Trading EAs:

Markets change—so must your bots and playbooks.

• 🧘 Stay Patient, Disciplined, and Selective:

Gold rewards precision and patience, not overtrading.

• 💡 Embrace AI & Automation:

Leverage every tool: AI, analytics, and custom EAs for a real 2025 trading edge.

Volume Gaps and Liquidity Zones: Finding Where Price Wants to GoDifficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is best suited for traders familiar with volume profile, liquidity concepts, and price structure. It blends practical trading setups with deeper insights into how price seeks inefficiency and liquidity.

🔵 INTRODUCTION

Ever wonder why price suddenly accelerates toward a level — like it's being magnetized? It’s not magic. It’s liquidity . Markets move toward areas where orders are easiest to fill, and they often avoid areas with little interest.

In this article, you’ll learn how to identify volume gaps and liquidity zones using volume profiles and price action. These tools help you anticipate where price wants to go next — before it gets there.

🔵 WHAT ARE VOLUME GAPS?

A volume gap is a price region with unusually low traded volume . When price enters these areas, it often moves quickly — there’s less resistance.

Think of a volume gap as a thin patch of ice on a frozen lake. Once the market steps on it, it slides across rapidly.

Volume gaps usually show up on:

Volume Profile

Fixed Range Volume tools

Session or custom volume zones

They’re often created during impulsive moves or news events — when price skips levels without building interest.

🔵 WHAT ARE LIQUIDITY ZONES?

Liquidity zones are price areas where a large number of orders are likely to be sitting — stop losses, limit entries, or liquidation levels.

These zones often form around:

Swing highs and lows

Order blocks or fair value gaps

Consolidation breakouts

Psychological round numbers

When price approaches these areas, volume often spikes as those orders get filled — causing sharp rejections or breakouts.

🔵 WHY THIS MATTERS TO TRADERS

Markets are driven by liquidity.

Price doesn’t just move randomly — it hunts liquidity, clears inefficiencies, and fills orders.

Your edge: By combining volume gaps (low resistance) with liquidity zones (target areas), you can forecast where price wants to go .

Volume gap = acceleration path

Liquidity zone = destination / reversal point

🔵 HOW TO TRADE THIS CONCEPT

1️⃣ Identify Volume Gaps

Use a visible range volume profile or session volume. Look for tall bars (high interest) and valleys (low interest).

2️⃣ Mark Liquidity Zones

Use swing highs/lows, OBs, or EQH/EQL (equal highs/lows). These are magnet areas for price.

3️⃣ Watch for Reactions

When price enters a gap, expect speed.

When it nears a liquidity zone, watch for:

Volume spike

Wick rejections

S/R flip or OB retest

🔵 EXAMPLE SCENARIO

A strong bearish move creates a volume gap between 103 000 – 96 000

Below 96 000 sits bullish order blocks — clear liquidity

Price enters the gap and slides fast toward 96 000

A wick forms as buyers step in, volume spikes — the reversal begins

That’s price filling inefficiency and tapping liquidity .

🔵 TIPS FOR ADVANCED TRADERS

Use higher timeframes (4H/1D) to define major gaps

Look for overlapping gaps across sessions (Asia → London → NY)

Align your trades with trend: gap-fills against trend are riskier

Add OB or VWAP as confirmation near liquidity zones

🔵 CONCLUSION

Understanding volume gaps and liquidity zones is like reading the market’s intention map . Instead of reacting, you start predicting. Instead of chasing, you’re waiting for price to come to your zone — with a plan.

Price always seeks balance and liquidity . Your job is to spot where those forces are hiding.

Have you ever traded a volume gap into liquidity? Share your setup below

From Liquidation to Withdrawal, It’s the MapDo you remember your first heavy loss? That exact moment when you realized trading isn’t just about patterns and candles?

This analysis is for you if you’re looking for a path to escape that liquidation pit and actually make your first real withdrawal.

No hype, no signals just a practical roadmap built on experience and mistakes.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Cardano:

BINANCE:ADAUSDT is testing a crucial daily support near the 0.38 Fibonacci retracement level, setting up for a potential 16% upside toward the key psychological and monthly resistance at $1. If this level holds, ADA could confirm bullish momentum and target higher levels soon. 📊🚀

Now , let's dive into the educational section,

🧭 It All Starts With the Tools

Before anything else, you need a compass and in trading, that compass is made of tools you can actually use on TradingView.

Here are some tools that serious traders never ignore, especially when analyzing crowd behavior and institutional traps:

Volume Profile (Fixed Range)

Shows you where money is actually concentrated, not just where price is. High-volume nodes often become breakout or breakdown zones in days ahead.

Liquidity Zones – Custom Indicators

Search for "liquidity" or "order block" in the Indicators section. There are tons of free community scripts that help you spot stop-loss clusters the exact places where the market loves to hunt.

Relative Volume (RVOL)

Tells you how strong the current market move is compared to its average volume. Is this a real breakout, or just noise? RVOL helps answer that.

Session Volume & Time-Based Boxes

Use drawing tools to box London, New York, or Asia sessions. This lets you track where real money enters. Time matters volume without time is meaningless.

Got the tools? Great. But now what? Let’s walk the path...

🚪 The Entry Point: First Liquidation

Almost every trader starts here: a signal, a rushed entry, a tight stop... then liquidation or a brutal margin call.

But that exact moment? It’s not your failure. It’s the beginning of your real journey.

Ask yourself:

Why did I take that trade?

What tool was available but ignored?

Was my position size reasonable or emotional?

Analyze this moment deeper than you analyze Bitcoin’s chart.

🔁 Repeat or Reroute?

This is the loop most traders never escape.

They stay stuck between losses because they don’t reflect, don’t learn, and don’t adjust.

What you should do instead:

Start a trade journal raw and honest.

Use TradingView as your lab, not just a chart. Practice, backtest, fail, and fix.

🧠 Turning Point: Where Your Mind Starts Trading

Once you stop chasing profit and start chasing clarity, things shift.

You begin spotting real triggers, real volume, and real market intent.

Here’s where tools become meaningful:

Use OBV to confirm volume alignment

Let RSI tell you about weakness before reversal

Follow EMA50/EMA200 to map trend structure

Not because someone told you to but because now you know why and when to use them.

🤑 The First Real Withdrawal Isn’t From Your Wallet

The first "withdrawal" isn’t a bank transfer.

It’s when you can walk away from the market without FOMO, without guilt, and without overtrading.

You now:

Accept risk, every single trade

Respect the market, not fear it

Have patience not because you're lazy, but because you understand timing

That’s the real payout.

📌 Final Thoughts

The path to becoming a trader starts with loss, grows with tools, and ends with discipline.

TradingView isn’t just for charts it’s your practice field.

Before chasing the next win, start by understanding your last mistake.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

wall Street has set camp on Satoshi's backyard...Bitcoin didn’t just wake up and choose violence. It chose velocity.

As BTC blasts through the six-figure ceiling and fiddles $120k with laser precision, everyone’s pointing to “the halving” like it’s some magical switch. But let's be real, Bitcoin bull runs don’t run on fairy dust and hope. They run on liquidity, macro dislocations, structural demand shifts, and a pinch of regulatory chaos.

Here’s the nerdy breakdown of what’s really driving the Bitcoin Rocketship (and why this one’s different):

1. The Halving Effect (Not Just the Halving)

Yes, the April 2024 halving slashed miner rewards from 6.25 to 3.125 BTC. But this time, the reflexivity is louder. Miners now have to sell less, and buyers (especially ETFs) have to beg for more.

Miners = Reduced Sell Pressure.

ETFs = Constant Buy Pressure.

That’s a one-way order book squeeze. Simple math, but powerful dynamics.

2. ETF Flows: The "Spot" That Launched a Thousand Rallies

When the SEC finally gave the green light to Bitcoin spot ETFs, TradFi didn’t walk in—they stormed in.

Think BlackRock, Fidelity, and friends becoming daily buyers. It's not retail FOMO anymore, it's Wall Street with billions in dry powder doing dollar-cost averaging with institutional consistency.

🧠 Nerd Note: The top 5 U.S. spot ETFs alone are now hoarding more BTC than MicroStrategy.

3. Dollar Liquidity is Leaking Again

Despite Fed jawboning, real rates are still under pressure and global liquidity is quietly creeping back. Look at the TGA drawdowns, reverse repo usage, and China’s stealth QE.

Bitcoin, being the apex predator of liquidity, smells it from a mile away.

“In a world flooded with fiat, Bitcoin doesn’t float. It flies.”

4. Sovereigns Are Quietly Watching

El Salvador lit the match. Now, Argentina, Turkey, and even Gulf countries are tiptoeing toward a Bitcoin pivot, hedging USD exposure without broadcasting it to CNN.

Central banks don’t need to love BTC to stack it. They just need to fear the dollar system enough.

5. Scarcity Narrative Goes 3D

With 99% of BTC supply already mined and over 70% HODLed for over 6 months, every new buyer is bidding for a smaller slice of the pie. ETFs and institutions are trying to drink from a faucet that only drips.

This is not a market with elastic supply. This is financial physics with a scarcity twist.

6. Market Microstructure is Fragile AF

Order books are thin. Real liquidity is fragmented. And the sell-side has PTSD from getting blown out at $70k.

This creates a “skateboard-on-a-freeway” scenario, when a few billion in inflows hit, prices don’t just rise. They gap.

Nerdy Bonus: The Memecoin Effect (No, Really)

The memecoin mania on Solana, Base, and Ethereum has been injecting dopamine into degens—and their profits are increasingly flowing into the OG digital gold.

It’s the 2021 cycle all over again, just with more liquidity bridges and fewer inhibitions.

Nerdy Insight: The Bull Run Has Layers

What’s driving BTC to $120,000 isn’t a single headline. It’s a stacked convergence of macro, structure, psychology, and coded scarcity.

Bitcoin isn’t “going up” just because of hope or halving hype. It’s going up because it’s the cleanest asset in a dirty system, and now both retail and institutions agree.

Still shorting? That’s not “fading the crowd.” That’s fighting thermodynamics.

Stay nerdy, stay sharp.

put together by : @currencynerd as Pako Phutietsile

WHY DO YOU KEEP ASKING ABOUT PRICE SO MUCH?WHY DO YOU KEEP ASKING ABOUT PRICE SO MUCH?

The problem lies in the wrong frame of reference when you first enter the market. Faulty input leads to flawed thinking, resulting in poor actions and bad outcomes.

I constantly receive questions like:

“Can I buy at this price yet?”

“Should I wait for a lower price?”

“Is this the bottom?”

“BTC is at 108k, is it still good to LONG?”

“It’s at 123k now, will it go to 180k?”

All of these revolve around PRICE, but in reality, price isn't what you should focus on. What's important is understanding market movements and trends.

Many of you DCA blindly at resistance, support, or based on on-chain data, thinking the price will reverse or bounce… but it doesn’t. So why?

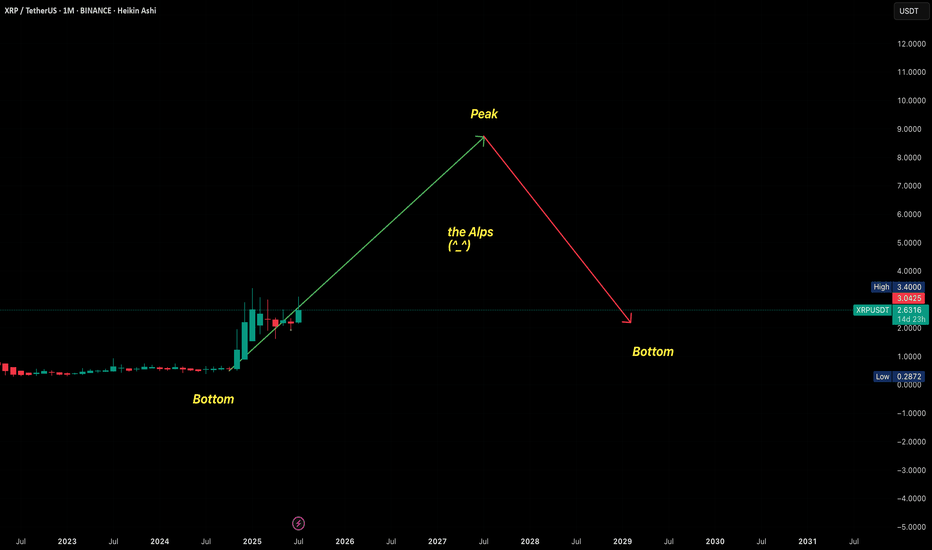

---------------------------------------------------------------------------------------------

Let me give you an analogy:

Imagine you're hiking the Alps.

You start early in the morning. When you're tired, you rest. When the scenery is beautiful, you stop and enjoy it. When you're thirsty or hungry, you take a break. Eventually, you reach the top (PEAK).

Did you ever ask your friend along the way:

"How many meters have we climbed?"

"How many meters left to the top?"

Of course not.

You just know you're ascending, and when you reach the peak, you’ll know.

Uptrend is like climbing up, downtrend is climbing down.

You don’t need to know your exact altitude — you just need to know whether you’re going up or down, and when you’re at the top, you’ll feel it.

---------------------------------------------------------------------------------------------

The market is the same.

When it goes up, you know it’s going up.

When it goes down, you know it’s going down.

When it’s the peak, you’ll know.

When it’s the bottom, you’ll feel it.

There's no need to obsess over:

“Is this the top?”

“Is this the bottom?”

Why?

Because when you're fixated on the real-time price, without understanding market movement, you’re being led by price — not leading your trades.

---------------------------------------------------------------------------------------------

In summary:

Stop letting price control your mind.

Focus on trends and market movement, and you’ll know where you are.

When climbing, you know you’re climbing. When peaking, you’ll know it’s time to pause. Simple as that.

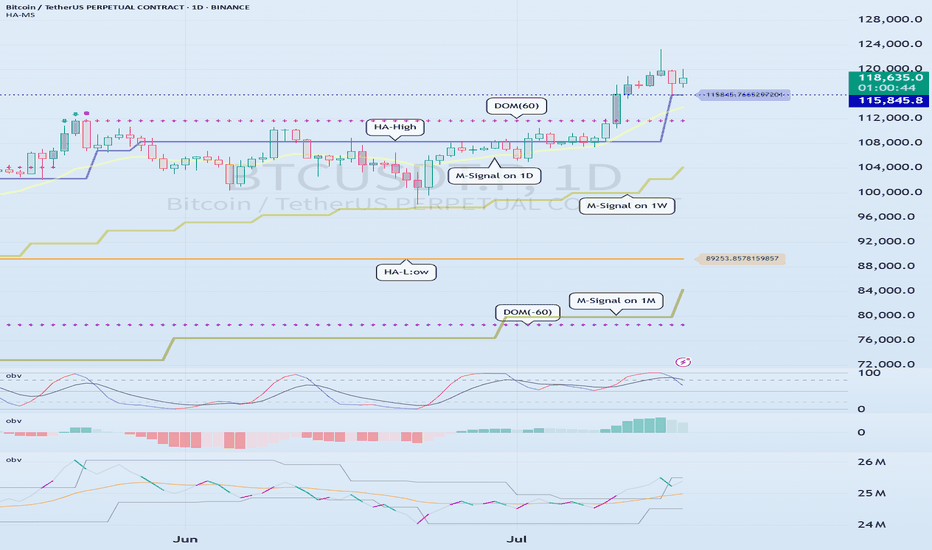

Need a trading strategy to avoid FOMO

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

1D chart is the standard chart for all time frame charts.

In other words, if you trade according to the trend of the 1D chart, you can make profits while minimizing losses.

This can also be seen from the fact that most indicators are created based on the 1D chart.

In that sense, the M-Signal indicators of the 1M, 1W, and 1D charts are suitable indicators for confirming trends.

If the price is maintained above the M-Signal indicator of the 1M chart, it is highly likely that the upward trend will continue in the medium to long term, so it is recommended to take note of this advantage especially when trading spot.

The M-Signal indicator on the 1W, 1D chart shows the medium-term and short-term trends.

The M-Signal indicator uses the MACD indicator formula, but it can be seen as a price moving average.

You can trade with just the price moving average, but it is difficult to select support and resistance points, and it is not very useful in actual trading because it cannot cope with volatility.

However, it is a useful indicator when analyzing charts or checking general trends.

Therefore, what we can know with the M-Signal indicator (price moving average) is the interrelationship between the M-Signal indicators.

You can predict the trend by checking how far apart and close the M-Signal indicators are, and then checking the direction.

-

If you have confirmed the trend with the M-Signal indicator, you need support and resistance points for actual trading.

Support and resistance points should be drawn on the 1M, 1W, and 1D charts.

The order of the roles of support and resistance points is 1M > 1W > 1D charts.

However, the strength of the role of support and resistance points can be seen depending on how long the horizontal line is.

Usually, in order to perform the role of support and resistance points, at least 3 candles or more form a horizontal line.

Therefore, caution is required when trading when the number of candles is less than 3.

The indicators created considering this point are the HA-Low and HA-High indicators.

The HA-Low and HA-High indicators are indicators created for trading on the Heikin-Ashi chart and indicate when the Heikin-Ashi candle turns upward or downward.

Therefore, the creation of the HA-Low indicator means that there is a high possibility of an upward turn.

In other words, if it is supported by the HA-Low indicator, it is a time to buy.

However, if it falls from the HA-Low indicator, there is a possibility of a stepwise decline, so you should also consider a countermeasure for this.

The fact that the HA-High indicator was created means that there is a high possibility of a downward turn.

In other words, if there is resistance from the HA-High indicator, it is a time to sell.

However, if it rises from the HA-High indicator, there is a possibility of a stepwise upward turn, so you should also consider a countermeasure for this.

This is where a dilemma arises.

What I mean is that the fact that the HA-High indicator was created means that there is a high possibility of a downward turn, so you know that there is a high possibility of a downward turn, but if it receives support and rises, you think that you can make a large profit through a stepwise upward turn, so you fall into a dilemma.

This is caused by greed that arises from falling into FOMO due to price volatility.

The actual purchase time should have been when it showed support near the HA-Low indicator, but when it showed a downward turn, it ended up suffering a large loss due to the psychology of wanting to buy, which became the trigger for leaving the investment.

Therefore, if you failed to buy at the purchase time, you should also know how to wait until the purchase time comes.

-

It seems that you can trade depending on whether the HA-Low and HA-High indicators are supported, but the task of checking whether it is supported is quite difficult and tiring.

Therefore, to complement the shortcomings of the HA-Low and HA-High indicators, the DOM(60) and DOM(-60) indicators were added.

The DOM(-60) indicator indicates the end of the low point.

Therefore, if it shows support in the DOM(-60) ~ HA-Low section, it is the purchase time.

If it falls below the DOM(-60) indicator, it means that a stepwise downtrend is likely to begin.

The DOM(60) indicator indicates the end of the high point.

Therefore, if it is supported and rises in the HA-High ~ DOM(60) section, it means that a stepwise uptrend is likely to begin.

If it is resisted and falls in the HA-High ~ DOM(60) section, it is likely that a downtrend will begin.

With this, the basic trading strategy is complete.

This is the basic trading strategy of buying when it rises in the DOM(-60) ~ HA-Low section and selling when it falls in the HA-High ~ DOM(60) section.

For this, the trading method must adopt a split trading method.

Although not necessarily, if it falls in the DOM(-60) ~ HA-Low section, it will show a sharp decline, and if it rises in the HA-High ~ DOM(60) section, it will show a sharp rise.

Due to this volatility, psychological turmoil causes people to start trading based on the price, which increases their distrust in the investment market and eventually leads them to leave the investment market.

-

When looking at the movement of the 1D chart, it can be seen that it is not possible to proceed with trading at the moment because it is already showing a stepwise upward trend.

However, since there is a SHORT position in futures trading, trading is possible at any time.

In any case, it is difficult to select a time to buy because the 1D chart shows a stepwise upward trend.

However, looking at the time frame chart below the 1D chart can help you select a time to buy.

The basic trading strategy is always the same.

Buy when it rises in the DOM(-60) ~ HA-Low section and sell when it falls in the HA-High ~ DOM(60) section.

Currently, since the 1D chart is continuing a stepwise upward trend, the main position is to eventually proceed with a long position.

Therefore, if possible, you should focus on finding the right time to buy.

However, if it falls below the HA-High indicator of the 1D chart, the possibility of a downtrend increases, so at that time, you should focus on finding the right time to sell.

In other words, since the HA-High indicator of the current 1D chart is generated at the 115845.8 point, you should think of different response methods depending on whether the price is above or below the 115845.8 point.

Therefore, when trading futures, increase the investment ratio when trading with the main position (a position that matches the trend of the 1D chart), and decrease the investment ratio when trading with the secondary position (a position that is different from the trend of the 1D chart) and respond quickly and quickly.

When trading in the spot market, you have no choice but to trade in the direction of the 1D chart trend, so you should buy and then sell in installments whenever it shows signs of turning downward to secure profits.

In other words, buy near the HA-Low indicator on the 30m chart, and if the price rises and the HA-High indicator is created, sell in installments near that area.

-

You should determine your trading strategy, trading method, and profit realization method by considering these interrelationships, and then trade mechanically accordingly.

If you trade only with fragmentary movements, you will likely end up suffering losses.

This is because you do not cut your losses.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

The only key levels you need - DITCH THE INDICATORS- Previous day high/Low

- Weekly high/low

- Session high/low

- Closing Price

In this specific example on OANDA:AUDUSD we have a day 3 Tuesday breakout fail reversal setup on the backside of a previous weeks expansion.

Fridays closing price was plotted going into Monday day 2 on the backside of a new week. Once the initial high low was set on day 2 below the previous weeks high and closing price we than look for short opportunities going into day 3 Tuesday.

In this case day 2 Ny session high acted as the reversal point staying below Friday closing price below the high of the previous week. The Asia/London session printed a beautiful high/low range reversing at near the midpoint of the previous days range (50% retrace.)

A great opportunity for a projected range expansion presented with confluence at a previous days low giving a solid set and forget trade with little to no stress or heat. This parabolic opportunity took place in the NY session below Fridays closing price to a previous weeks LOD level.

- Mondays High (Stop)

- NY session High, Fridays Close (Entry)

- Wed Low, Range expansion (Target)

KEY NOTES:

It is very important to keep your trading simple. As a newer trader I filled my chart with as many indicators as possible trying to find a "signal" because I lacked the patience for the market to give me a setup over multiple days. Now as a more experienced trader I sit back on higher time frames (1H/15M) TO WAIT FOR THE DAILY LEVELS TO PRINT. Avoiding trading inside a range on a low time frame. Lower time frames are only to decrease risk and increase position accuracy already derived from higher time frames. It is key to understand when higher time frame traders are triggered into a market and to understand there are only two main plays from key levels. Keep it simple, find the scalable setups, AND PUT THE SIZE ON WITH CONFIDENCE.

Earnings HFT gapsThe gaps that form during earnings season on or the next day after the CEO reports the revenues and income for that past quarter are always HFT driven. The concern over the past 2 previous quarters was the fact that the High Frequency Trading Firms were incorporating Artificial Intelligence into their Algos to make automated trading decisions on the millisecond scale. These small lot orders fill the ques milliseconds ahead of the market open in the US and any huge quantity of ORDERS (not lot size) causes the computers of the public exchanges and market to gap up or gap down, often a huge gap.

This can be problematic for those of you who use Pre Earnings Runs to enter a stock in anticipation of a positive to excellent earnings report for this upcoming quarter.

The HFT algos had several major flaws in the programming that did the opposite: The AI triggered sell orders rather than buy order causing the stock price to gap down hugely on good earnings news.

Be mindful that normal gaps due to a corporate event are far more reliable and consistent.

When you trade during earnings season, be aware that there is still added risk of an AI making a mistake and causing the stock to gap and run down on good news.

It is important to calculate the risk factors until it is evident by the end of this earnings season that the errors within the AI programming have been corrected and that the AI will gap appropriately to the actual facts rather than misinterpreted information.

Full Breakdown of My Trading Strategy Dow Futures DaytradingI will be detailing my strategy to both help others and to help myself fine tune my strategy.

My strategy is one of market maker cycles. The end goal: to trade off of the Daily chart by drilling down to the 15 minutes for entries. Everything revolves around the Daily chart. The only indicator I use is ATR, other than that, pure price action. I use opening prices a lot in my trading.

Starting with the MONTHLY chart:

Every month has the following-

An opening price

A first trading day

A last trading day

These are things that ALL traders see and can't misinterpret.

I will use June as the basis for my examples.

I try to figure out what kind of monthly candle is likely to form. Bullish, Bearish or Doji. I use ATR to try to figure out the likely size also. For Dow Futures, a typical Monthly candle is around 3000 ticks +/-

Going to the Daily chart, I mark the beginning of the month and the end of the month.

The meat of the strategy, and the one quite frankly is the most difficult and the most discretionary, is reading price action on the Daily chart to determine what the next daily candle is likely to do and where it opens at. No strategy is 100% accurate and I do take losses from being wrong. With proper risk management ( I will detail my personal risk management later ) you can still make tons of money being 50% right.

Not everyday is meant to be traded and quite frankly, most days are pure trash. Over 55% of all Daily candles are small, resting Doji days. You are looking for the expansion daily candles.

Starting with the first trading of June:

1. May 29th, Large Doji day and and formed a mother bar

2. May 30th, another doji day and still inside the previous bar

3. June 2nd, opened up in middle of inside bar, Bias for day is Long. Buy near the bottom of the inside bar and a break of Yesterday's Low.

This is an actual trade I took. Once I saw the Doji candle on the 15 minute break below yesterday's low I entered in Long. I will go over stops and targets later. For now, I am explaining how I find my bias and locations.

The next day: start the process over again. Look at the Daily and the context of the bars. Look for swing points, Daily highs and lows. Key Daily bars as signals. I usually like to do this 5 minutes after Asia opens just to see where price opens at. I then mark the daily open with a cyan blue line. If I am Long bias then I want to buy under the open at key levels. I use SP as swing point, a daily high or low that has not been broken yet.

Tuesday, I would have a Long bias again. Because we opened still inside of the mother bar and I see highs not broken, I want to trade in that direction. What is a key level on this Tuesday? I see the monthly open right underneath. The big question I would ask myself on this Tuesday is where in that move can I get in on a pullback for the Long trade?

The market gives you an entry here.

I did not take that trade, I WILL show you the trade I did take on this day. After NY opened, I saw the spike into the monthly open and a doji right ON the open. I slammed Long. Especially, the three swing points to be used as the direction.

Now on to trade management. Stops, Targets. I have the same bracket for every trade, so the only variable is my entry. Once I enter, I set my ATM strategy.

I use the 15 minute ATR to determine my stop loss. This part is also up to the individual trader and is discretionary. I will show you MY strategy.

Take a zoomed-out view of the 15-minute chart with the 14 period ATR, mark the clusters of the peak ATR readings from NY sessions. In this case it is between 70-90. I tend to go towards the upper limit, this case 90. I then use 1.25-1.5 times of this reading based on my account and position sizing. In June AND in July, I am using 120 tick stops.

My targets are all strictly 2.5 risk to reward of what my stop is plus or minus a few ticks for commissions. Since I am using 120 tick stops, my targets are therefore, 300-310 ticks. Going back to my Tuesday trade, the trade management would be a set 2.5R all or nothing. Enter the trade and walk away. Go read a book or play PS5. Go to gym. It will either hit stop, target or close out at 4pm NY close.

2 Winning trades wipes away 5 losers. I have losers all the time with a 50% win rate. I can expect 8 losing trades in a row at any given time. Something I have experienced multiple times.

Now on to my money management strategy. The holy grail of this entire system. Quite frankly, how you enter and your strategy at the end of the day doesn't amount to much. How you manage your money is where professionalism is achieved.

Take your starting account balance, divide it in fours. I will use a 10,000 account as simple math.

10,000

2500 Level 1 14.5R

2500 Level 2 11.5R

2500 Level 3 9.5R

2500 Level 4 8.5R

I risk 1.75% per trade and each level will stay fixed until the next level is reached. In this example, Level 1 will be using $175 risk per trade and a 2.5 risk to reward, $440 reward. You will keep risking $175 per trade until you hit your $2500 profit goal to advance to Level 2. In this case this will take you 14.5R

Now you are on Level 2, you find your new account balance is now $12,500. Find 1.75% of this = $220. Keep using $220 risk until you hit another $2500 in profits. This will take you 11.5R.

Keep repeating these steps until you have hit all 4 profit levels and your account has doubled. Your new account balance is now $20,000. You will start this process over again. To double your account you will need a total of 44-45R. At a conservative approach of 5-7% monthly gain, you can expect to double your account in 8 months +/- depending on how good you can get.

The number one major key to ALL OF THIS IS

One trade per Daily candle. You lose on that day, move on and come again tomorrow

All profit targets need to be hit or close out at 4pm depending on price

Trading Style, Timeframe Compatibility & Reasonable RiskTrading Style & Timeframe Compatibility

When selecting a timeframe for your trading strategy, it's essential to understand how that timeframe interacts with your chosen approach. Not every timeframe works well with every style — and the reason is rooted in time itself.

Each strategy — scalping , day trading , intra-week trading , or swing trading — is defined by how long you intend to hold a position:

-Scalping involves entering and exiting within minutes.

-Day trading means you're flat by the end of the day.

-Intra-week trading covers trades held for several days, but typically wrapped within one or two weeks.