“Does size matter?” when it comes to backtesting?It’s the kind of question that gets a few smirks, sure. But when it comes to backtesting trading strategies, it’s not a joke, it’s the difference between confidence and false hope.

Let’s get real for a minute: the size of your candles absolutely matters.

What you don’t see can hurt you

Most people start testing on bigger timeframes. It’s faster, easier on the eyes, and the results look clean. But clean doesn’t mean correct.

Larger candles blur the details. That one nice-looking 4-hour candle? Inside, price could’ve spiked, reversed, chopped around, or triggered your stop before closing where it did. You’d never know. And that’s the problem.

You might think your entry worked beautifully… but only because the data smoothed out everything that actually happened.

A backtest should feel like a real trade

Trading isn't just about the final price. It’s about what price does to get there. That messy movement inside the candle? That’s where most trades are made or broken.

If your strategy is even remotely reactive, waiting for structure, confirmation, retests, or anything time-sensitive, you need to see what price did between the open and close.

And the only way to see that? Use smaller candles.

Smaller data, clearer picture

1-minute candles might look overwhelming at first, but they give you something the higher timeframes just can’t: behavior.

Not just outcomes. Not just win/loss stats. But the actual shape of the move, the hesitation, the fakeouts, the precise moment when the trade made sense—or didn’t.

And once you start testing with that level of detail, your strategy either earns your trust… or shows its cracks.

So how small should you go?

There’s no one-size-fits-all here. But as a general rule: if your idea relies on precision, go small. Test it on 1-minute or 5-minute charts, even if you plan to execute on higher timeframes. You’ll quickly see if the entry makes sense, or if you’ve been relying on candle-close hindsight.

Yes, it takes longer. Yes, you’ll stare at noisy charts for hours. But your strategy will thank you.

Watch out for “too good to be true”

One last thing, if your backtest results look flawless on 1h or 4h candles, pause. That’s often a sign that you’re testing a story, not a strategy.

Zoom in. See what actually happens. You might be surprised at how different the same trade looks when you’re not glossing over the details.

TL;DR:

In backtesting, size absolutely matters. Smaller candles reveal real behavior. Bigger ones hide the truth. So if you care about how your strategy actually performs not just how it looks.

go smaller. Your backtesting will get sharper, and your confidence? Way more earned.

X-indicator

Trend Exhaustion SignalsTrend Exhaustion Signals: How to Know When a Trend is Losing Steam

Every trend eventually runs out of fuel. Knowing when momentum is fading can give you the edge to exit early, avoid late entries, or even prepare for a reversal. This article dives into key signs of trend exhaustion and how to trade around them.

🔵Understanding Trend Exhaustion

Trends can persist far longer than expected, but they don’t last forever. Trend exhaustion occurs when the driving force behind a trend—be it buying or selling pressure—starts to weaken. Recognizing this shift is crucial for:

Protecting profits

Avoiding bad entries

Spotting early reversal opportunities

🔵1. RSI and MACD Divergence

A classic signal of trend exhaustion is divergence between price and momentum indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence).

Bearish Divergence: Price makes a higher high, but the indicator makes a lower high.

Bullish Divergence: Price makes a lower low, but the indicator makes a higher low.

This suggests that although price continues in the trend's direction, momentum is lagging—a red flag for potential exhaustion.

🔵2. Volume Dry-Up

Volume is the fuel of trends. When volume starts to shrink during a strong move, it often signals that the crowd is losing interest or that institutions are offloading positions.

In an uptrend, a series of green candles with decreasing volume = caution.

In a downtrend, falling volume can signal seller fatigue.

🔵3. Long-Wick Candles at Extremes

Candlestick patterns offer visual clues of exhaustion. When you start seeing long upper wicks at the top of an uptrend (or long lower wicks at the bottom of a downtrend), it means price is being rejected from continuing further.

Common exhaustion patterns:

Shooting Star (bearish)

Inverted Hammer (bullish)

Doji at highs/lows

These patterns are more reliable when they form near resistance or support zones.

🔵4. Structure Break: CHoCH and BOS

Market structure tells a deeper story than indicators. Two key terms here:

CHoCH (Change of Character): The first sign of reversal—a higher low broken in an uptrend, or a lower high broken in a downtrend.

BOS (Break of Structure): The confirmation—a key swing point is broken, confirming a new trend.

Traders can watch for these breaks to anticipate when the current trend is ending and a reversal is forming.

🔵5. Parabolic Price Action & Overextension

When a trend becomes parabolic—with steep, accelerating price movement—it often signals the final stage of the trend. This is when retail traders usually enter, and smart money begins to exit.

Warning signs:

Sudden vertical moves

Price far above/below moving averages

Lack of consolidation or pullbacks

Parabolic moves are unsustainable. Look for reversion to the mean or a sharp correction.

🔵How to Trade Around Trend Exhaustion

Tighten Stops: If in a winning trend trade, consider locking in profits or trailing your stop.

Avoid Chasing Entries: Late entries into exhausted trends are high-risk, low-reward.

Prepare for Reversal Setups: Watch for confirmation (CHoCH, divergence, candle patterns) before entering counter-trend positions.

Use Multi-Timeframe Analysis: Exhaustion on the 1H chart may just be a pullback on the 4H. Always zoom out for context.

Trend exhaustion is a natural part of market behavior. Recognizing the signs—such as divergence, fading volume, long wicks, structure breaks, and parabolic moves—can help you time exits better and avoid late trades. Instead of reacting after the fact, you’ll be prepared in advance. Add these tools to your trading routine and stay one step ahead of the crowd.

RSI-Volume Momentum Signal Score: Trading the Momentum PressureThe indicator used in this chart is an updated version of the RSI-Volume Momentum Score.

The RSI-Volume Momentum Signal Score is a predictive technical indicator designed to identify bullish and bearish momentum shifts by combining volume-based momentum with the Relative Strength Index (RSI). It generates a Signal Score derived from:

• The divergence between short-term and long-term volume (Volume Oscillator), and

• RSI positioning relative to a user-defined threshold. The Signal Score is calculated as follows:

Signal Score = tanh((vo - voThreshold) / scalingFactor) * ((rsiThreshold - rsi) / scalingFactor)

The logic of this formula are as follows:

• If Volume Oscillator >= Volume Threshold and RSI <= RSI Threshold: Bullish Signal (+1 x Scaling Factor)

• If Volume Oscillator >= Volume Threshold and RSI >= (100 – RSI Threshold): Bearish Signal (-1 x Scaling Factor)

• Otherwise: Neutral (0)

The tanh function provides the normalization process. It ensures that the final signal score is bounded between -1 and 1, increases sensitivity to early changes in volume patterns based on RSI conditions, and prevent sudden jumps in signals ensuring smooth and continuous signal line.

This updated version Introduces colored columns (green and red bars) representing momentum pressure directly. These bars:

o Green bars represent bullish pressure when the signal score is +1.

o Red bars represent bearish pressure when the signal score is -1.

o The transition point from one color to another acts as a visual signal of momentum reversal.

LONG SIGNAL: A transition from green bar to red bar indicates that bullish pressure has reached a tipping point—price is likely to rise soon.

SHORT SIGNAL: A transition from red bar to green bar signals bearish pressure is peaking—potential price drop ahead.

These transitions become intuitive signals for bullish or bearish entries, depending on the context.

Why this strategy works so well (Ticker Pulse Meter + Fear EKG) Disclaimer: This is for educational purposes only. I am not a financial advisor, and this is not financial advice. Consult a professional before investing real money. I strongly encourage paper trading to test any strategy.

The Ticker Pulse + Fear EKG Strategy is a long-term, dip-buying investment approach that balances market momentum with emotional sentiment. It integrates two key components:

Ticker Pulse: Tracks momentum using dual-range metrics to pinpoint precise entry and exit points.

Fear EKG: Identifies spikes in market fear to highlight potential reversal opportunities.

Optimized for the daily timeframe, this strategy also performs well on weekly or monthly charts, making it ideal for dollar-cost averaging or trend-following with confidence. Visual cues—such as green and orange dots, heatmap backgrounds, and SMA/Bollinger Bands—provide clear signals and context. The strategy’s default settings are user-friendly, requiring minimal adjustments.

Green dots indicate high-confidence entry signals and do not repaint.

Orange dots (Fear EKG entries), paired with a red “fear” heatmap background, signal opportunities to accumulate shares during peak fear and market sell-offs.

Now on the the educational part that is most fascinating.

Load XLK on your chart and add a secondary line by plotting the following on a secondary axis:

INDEX:SKFI + INDEX:SKTH / 2

Now, you should see something like this:

Focus on the INDEX:SKFI + INDEX:SKTH / 2 line, noting its dips and spikes. Compare these movements to XLK’s price action and the corresponding dot signals:

Green and Orange Dots: Opportunities to scale into long positions.

Red Dots: Opportunities to start scaling out of positions.

This concept applies not only to XLK but also to major stocks within a sector, such as AAPL, a significant component of XLK. Chart AAPL against INDEX:SKFI + INDEX:SKTH / 2 to observe how stock and sector indices influence each other.

Now, you should see something like this:

Long-Term Investing Considerations

By default, the strategy suggests exiting 50% of open positions at each red dot. However, as long-term investors, there’s no need to follow this rule strictly. Instead, consider holding positions until they are profitable, especially when dollar-cost averaging for future retirement.

In prolonged bear markets, such as 2022, stocks like META experienced significant declines. Selling 50% of positions on early red dots may have locked in losses. For disciplined long-term investors, holding all open positions through market recoveries can lead to profitable outcomes.

The Importance of Context

Successful trading hinges on context. For example, using a long-term Linear Regression Channel (LRC) and buying green or orange dots below the channel’s point-of-control (red line) significantly improves the likelihood of success. Compare this to buying dots above the point-of-control, where outcomes are less favorable.

Why This Strategy Works

The Ticker Pulse + Fear EKG Strategy excels at identifying market dips and tops by combining momentum and sentiment analysis. I hope this explanation clarifies its value and empowers you to explore its potential through paper trading.

Anyway, I thought I would make a post to help explain why the strategy is so good at identifying the dips and the tops. Hope you found this write up as educational.

The strategy:

The Companion Indicator:

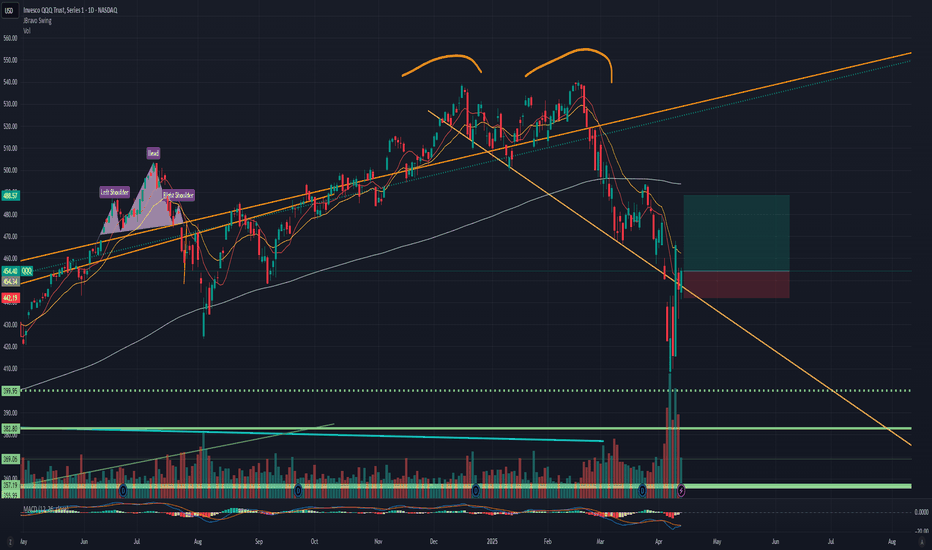

THE DEATH CROSSDeath Cross Triggered During Consolidation: What It Could Mean

The 50 SMA (blue) just crossed below the 200 SMA (red), signaling a Death Cross—a traditionally bearish indicator. But here’s the catch: this didn’t happen during a steep downtrend. It happened during consolidation.

That changes the narrative.

When a Death Cross forms during a period of sideways chop instead of a clear downtrend, it often reflects lagging momentum, not accelerating weakness. It can trap shorts expecting a breakdown, especially if price is coiling above strong support or forming a basing pattern.

💡 Key things I’m watching:

Does price respect the consolidation range low?

Are we forming a bullish divergence on RSI or MACD?

How does volume behave around the cross?

This may not be a "short and hold" moment—this might be a shakeout before trend resolution. Stay sharp. Don't trade the cross, trade the context.

Technical Analysis on BitcoinHey guys

Bitcoin has recently broken out of a long-term descending channel, which has caught the attention of many traders. Typically, once the price stabilizes outside of such a channel with confirmed candlestick closes, buyers enter the market in anticipation of a bullish move. However, it's important to be cautious.

There is still a possibility that the price may retrace to a highlighted liquidity zone below, where it can gather enough momentum and liquidity for a stronger upward movement.

Therefore, traders should be aware of potential false breakouts and wait for solid confirmations before fully committing to long positions.

Elliott Wave Analysis of DLF: A Technical PerspectiveHello friends, let's analyze the DLF chart on a daily time frame. Currently, we're observing a corrective phase, where the stock has completed a flat correction pattern (A-B-C) with a 3-3-5 structure. Following this correction, we've seen a significant drop, accompanied by a strong double divergence in the RSI indicator. Where Fibonacci Retracement of last long Rally on Weekly is near 50% - 55% which is less than 61.8% should consider as a Healthy Retracement

As the price is currently moving upwards, completing wave counts, a breakout above the downward trend line would increase our conviction in the analysis.

This analysis is for educational purposes only and not a tip or advisory. If the price breaks out and stays above the trend line while maintaining the low of 601, we can expect further upside momentum. However, 601 would remain a crucial invalidation level, and a breakdown below it would require us to reassess our wave counts.

Key points:

1. DLF chart analysis on daily time frame

2. Flat correction pattern (A-B-C) with 3-3-5 structure

3. Healthy Retracement

4. Strong double divergence in RSI indicator

5. Breakout above trend line increases conviction (Which is pending yet)

6. 601 as invalidation level

Please note that this is a Educational technical analysis post and not a recommendation to buy or sell.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

What to consider when trading...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

This is my personal opinion, so it may differ from yours.

Please keep this in mind.

-

So, how should I proceed with day trading?

When trading day trading, the first thing to consider is the trading volume.

Coins (tokens) with low trading volume should be avoided because volatility can occur in an instant, making it difficult to respond quickly and likely to result in losses.

Therefore, if possible, it is recommended to choose coins (tokens) with high trading volume.

The next thing to consider is the price of the coin (token).

If the price of the coin (token) becomes too high or too low, even if you sell it for profit, you may incur a loss.

Therefore, when trading a coin (token) with a very high price, you should trade with a longer time frame.

In other words, the increase should be high.

When trading a coin (token) with a very low price, you need to be persistent.

This is because the amount you want to trade is large, so the rise or fall may be slow.

The next thing to consider is the size of your trading funds.

If your trading funds are too small, you may not be able to enjoy trading because you will earn too little profit compared to the stress of trading.

If you lose the fun of trading like this, you will have difficulty continuing to trade or you will likely leave the investment market, so you need to be careful.

If you set the trading fund size too high, you can suffer a big loss with one mistake, so you must set a stop loss point and keep it.

You can find out how much trading fund size is right for you by looking at your psychological state when you trade.

If you think you are trading too boldly, it is better to think that the trading fund size is small and increase it little by little.

If you feel extremely anxious when you trade and incur a loss, it is better to reduce the trading fund size little by little.

-

(BTCUSDT 30m chart)

Considering the above considerations (trading volume, price, trading fund size), you should continuously observe the selected coin (token) chart to check the movement at the support and resistance points.

To do this, you need to check whether there is support at the support and resistance points drawn on the 1M, 1W, and 1D charts when you meet the HA-Low and HA-High indicators, which can be the basis for starting a transaction, or when you have a trading strategy.

Usually, when the Trend Cloud indicator shows an upward trend while receiving support near the HA-Low indicator and rising, there is a high possibility of rising.

Therefore, you should consider whether to buy when the HA-Low indicator shows support.

And, when the HA-High indicator touches and falls, there is a high possibility of falling when the Trend Cloud indicator shows a downward trend.

Therefore, the area near the HA-High indicator corresponds to the first selling section.

In this way, you can conduct transactions within the sideways section trading within the HA-Low ~ HA-High section.

Then, when there is a movement that falls below the HA-Low indicator or rises above the HA-High indicator, you can conduct a transaction according to the trend.

Therefore, split trading is essential.

The basics of split trading are to sell half when you make a profit and set the stop loss at the principal price for the remaining half.

-

This is something everyone knows, but it is not easy to follow.

Also, there are times when it is difficult to decide what to use as the standard for trading.

In such cases, as I mentioned, I recommend that you choose a coin (token) considering the trading volume, price, and trading fund size and continuously check the movement of the chart.

Even if you are not familiar with chart analysis, if you continuously look at the chart, there is a possibility that you will see movement.

However, you need prior knowledge on how to set the stop loss point.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Understanding Our Approach: High-Probability Reversals Understanding Our Approach: High-Probability Reversals with Price & Time Analysis

Hello Fellow Traders!

We often get asked about the core principles behind our analysis here on TradingView. Today, we want to share a key part of our methodology: how we combine Price Analysis and Time Analysis to pinpoint potentially high-probability reversal signals in the market.

Our goal isn't just about finding any setup, but finding setups where the odds seem stacked more favorably for a potential trend change. We do this by looking for confluence – where different factors align.

1. Price Analysis: Finding Where the Market Might Turn

What it is: This is about identifying significant price levels on the chart. Think of these as important zones, not just single lines.

How we use it:

Support & Resistance: We look for historical areas where price has repeatedly bounced off (support) or struggled to break through (resistance). The stronger and more tested the level, the more significant it becomes.

Price Action Clues: We watch how price behaves when it reaches these key levels. Are there strong rejection candles (like pin bars or engulfing patterns)? Is momentum slowing down? These clues tell us if buyers or sellers are stepping in or losing control.

2. Time Analysis: Finding When the Market Might Turn

What it is: This adds the dimension of time to our price analysis. Markets often move in cycles or react around specific time points.

How we use it:

Timing Cycles: We look for potential cycles or rhythmic patterns in price swings. Sometimes, trends tend to exhaust themselves after a certain duration.

Time Convergence: We pay close attention when price approaches a key Price Level (from step

1) around a potentially significant Time point (e.g., end of a known cycle, specific session timing, alignment with time-based indicators if used).

The Synergy: Combining Price & Time for High-Probability Signals

The real power in our approach comes when Price and Time align.

Imagine price reaching a major historical resistance level (Price Analysis).

Now, imagine this happens exactly when a known time cycle is expected to complete (Time Analysis).

This convergence signals a potentially higher probability reversal point than if only one factor was present. It tells us that where the market is and when it got there are both significant.

How You Can Apply This Concept:

Identify Key Levels: Mark major support and resistance zones on your charts.

Observe Time: Become aware of market timing – session opens/closes, news events, or potential cyclical patterns you observe.

Look for Confluence: Wait for price to test a strong level around a potentially significant time point.

Seek Confirmation: Always look for confirmation signals (like candlestick patterns or divergence) at these points of confluence before considering any action.

Important Note: Trading involves significant risk. This methodology aims to identify higher probability setups, but no method guarantees success. Always use proper risk management and conduct your own analysis before making any trading decisions. This is shared for educational purposes.

We hope this gives you a clearer insight into our analysis process! Follow us here on TradingView to see how we apply these concepts in our regular updates. Feel free to ask questions in the comments – we're all here to learn together.

Want to Level Up?

Join Shunya Trade’s Mentoring Program to master these strategies and sharpen your technical analysis skills.

Trade safely!

-----------------------------------------------------------------------------------------------

Here few Historical chart study's

-----------------------------------------------------------------------------------------------

PriceAnalysis, TimeAnalysis, PriceAction, TechnicalAnalysis, SupportResistance, CandlestickPatterns, ChartPatterns, MarketStructure, TimeCycles, MarketTiming, TradingSignals, ReversalTrading, TradingStrategy, MarketAnalysis, TradingView, Forex, Stocks, Crypto, Trading, Investing, DayTrading, SwingTrading, MarketCycles, FibonacciTime, Gann, TradingLevels, PricePatterns

Do You Know the Difference Between an Indicator and a Strategy?A lot of traders jump into Pine Script or apply a script on TradingView without understanding one key difference:

Indicators and Strategies are not the same — especially when it comes to real-time performance and backtesting.

---

What’s the Key Difference?

Indicators

Indicators are visual tools designed to help you analyze price action in real time . They do not track trade performance or simulate trades automatically.

You can use them to:

- Generate signals

- Stack confluences

- Set custom alerts

- Overlay custom visuals on charts

Best for: Chart analysis, signal confirmation, and manual or semi-automated alerts.

---

Strategies

Strategies are built for backtesting . They simulate how your trade logic would have performed historically, using `strategy.entry`, `strategy.exit`, and related functions.

They automatically calculate:

- Hypothetical P&L

- Win/loss ratio

- Drawdowns

Best for: Validating trade logic, optimizing entries and exits, performance tracking.

---

But Here’s the Catch

Many traders assume that once a strategy backtest looks good, it will behave exactly the same in live trading. This assumption can lead to poor decision-making.

❌ Why Forward Testing Isn't Perfect

When you set alerts based on a strategy, you're asking a backtest engine to behave like a live trading engine — and that’s not what it was designed for.

TradingView strategies:

- Only execute on candle close

- Do not simulate intrabar price action

- Do not account for slippage

- Do not reflect real-time market volatility

So:

- Your strategy alert may fire late compared to actual price movement

- Your SL/TP may be hit within a candle, but the strategy won’t know until close

- You may see better backtest results than what happens live

---

Takeaway

If you're using strategies with alerts, it’s critical to understand these constraints:

TradingView’s strategy engine is optimized for historical testing, not for real-time execution. It provides insight into the validity of your logic — but it’s not a replacement for a live execution engine.

Best Practice Recommendations:

- Always forward-test on a demo or paper account first

- Monitor how alerts perform in real-time

- Be ready to adjust parameters based on your asset and timeframe

If you need better responsiveness or real-time adaptability, consider using indicators to generate your alerts. Indicators react to price in real time and are often more suitable for live market conditions.

---

Final Note

Some strategies are built with these limitations in mind. They can still be useful in real-time trading as long as you're aware of how they work.

Transparency is key. Backtesting is a guide, not a guarantee.

Trade smart, stay informed.

Feel free to reach out if you have questions or insights to share!

Best Technical Indicator to Identify Order Block & Imbalance

Your ability to correctly identify Order Blocks on a price chart is essential for profitable trading Smart Money Concept.

In this article, I will show you a great technical indicator that will help you to spot Order Blocks on any financial market.

First, in brief, let me give you my definition of Order Block.

The problem is that in SMC trading there is no one single definition of that and many traders interpret it differently.

To me, an Order Block is a specific zone on a chart from where a strong price movement initiates and where a significant imbalance between supply and demand occurs .

This imbalance should strictly originate from a liquidity zone.

That definition implies that in order to identify an Order Block zone, one should learn to properly identify the imbalance and liquidity zones.

And again, there is no precise definition of an imbalance on a price chart. To me, a bullish imbalance is a formation of a bullish engulfing candle - the one that engulfs a range of previous bearish candle with its body.

Above is the example of a valid Order Block on GBPUSD.

A bearish imbalance is a formation of a bearish engulfing candle - the one that engulfs a range of a previous bullish candle with its body.

Above, you can see the example of an Order Block on USDCAD, based on a bearish imbalance.

There is one technical indicator that will help you to recognize such Order Blocks. It is called " All Candlestick Patterns" on TradingView.

Open settings of the indicator and make it show ONLY Engulfing Candles and choose "No Detection" in "Detect Trends Based on".

After that, hide the indicator and first, Identify the liquidity zones on a chart and wait for a test of one of these zones.

Here is a test of a liquidity zone on NZDUSD on an hourly time frame.

After that, turn on the indicator, and wait for its signal.

You can see that after some time, the price formed a bullish imbalance with a bullish engulfing candle. The indicator highlight that candle.

The Order Block zone will be based on the lowest low of 2 candles and the high of a bearish candle preceding the imbalance.

One more example. We see a test of a significant liquidity zone on EURAUD on a 4H time frame.

We turn on the indicator and look for a signal.

A bearish imbalance is formed and the indicator immediately notifies us.

An Order Block Zone in that case will be the area based on the highest high of 2 candles and the low of a bullish candle preceding the imbalance .

Of course, there will be the rare cases when the indicator will miss the imbalances. But while you are learning to recognize Order Blocks, this indicator will definitely help you a lot!

Thank you for reading!

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

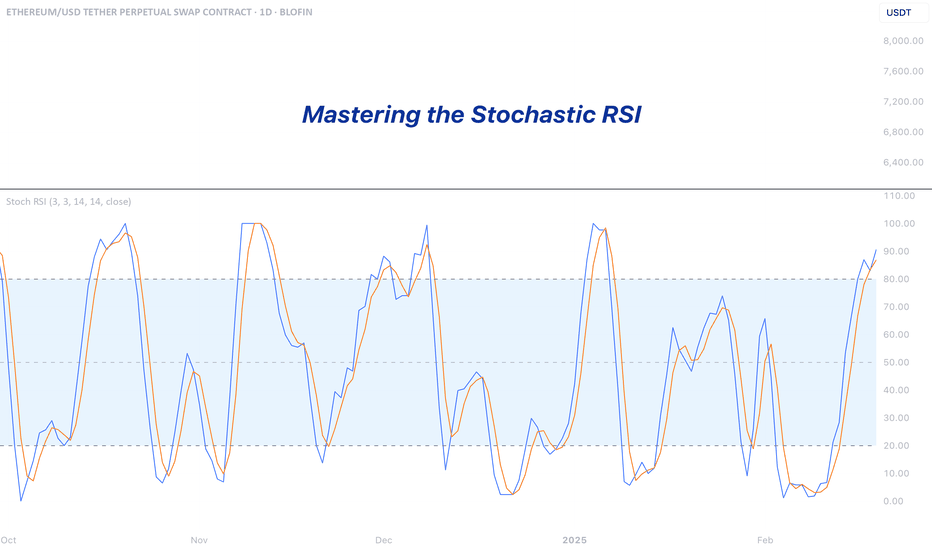

Mastering the Stochastic RSI - Guide to Spotting Momentum ShiftsIntroduction

In the world of technical analysis, momentum indicators are essential tools for understanding market sentiment and potential price movements. One such tool is the Stochastic RSI (Stoch RSI), a unique and highly sensitive variation of the traditional Relative Strength Index (RSI). While the standard RSI focuses on price, the Stoch RSI takes it a step further by measuring the momentum of the RSI itself. This makes it a faster-reacting and more dynamic indicator that many traders use to anticipate trend shifts and spot overbought or oversold conditions earlier.

What is the Stochastic RSI?

The Stochastic RSI (Stoch RSI) is a momentum oscillator that operates similarly to the RSI but with a twist — instead of measuring the price of an asset, it measures the movement of the RSI. Because of this, the Stoch RSI is typically more sensitive and quicker to respond to changes in market momentum.

It consists of two lines:

* The blue line: The primary line that reacts quickly and shows when the RSI is gaining or losing momentum.

* The orange line: A moving average of the blue line, which acts as a smoother version to help filter out noise and highlight potential turning points.

How to Read the Stoch RSI

The Stoch RSI moves between 0 and 100, and traders often focus on the 20 and 80 levels as key thresholds:

Above 80 (Overbought): Indicates that the RSI has been running hot compared to recent values. This suggests strong upward momentum that could be due for a slowdown or minor correction. However, it doesn’t necessarily mean the price will drop immediately, just that conditions are extended.

Below 20 (Oversold): Suggests the RSI has been suppressed, signaling weakening bearish momentum and a possible reversal upward. Again, this isn’t a guaranteed bounce but rather a situation where a shift may be more likely.

How to Trade with the Stoch RSI

While entering overbought or oversold zones can offer insight, trading solely based on those levels is risky. Instead, look for crossovers between the blue and orange lines:

Bearish signal: When the Stoch RSI is above 80 and the blue line crosses below the orange line, it can indicate that bullish momentum is fading — a potential short entry.

Bullish signal: When the Stoch RSI is below 20 and the blue line crosses above the orange line, it may suggest that bearish momentum is weakening — a potential long entry.

These crossover points provide more reliable signals than the levels alone, especially when confirmed by price action or other indicators.

What Timeframes to Use

The Stoch RSI can be applied to any timeframe, but its effectiveness varies. On lower timeframes (like 1-minute or 5-minute charts), it generates many signals, including plenty of false or weak ones. For stronger and more reliable signals, it’s best used on higher timeframes such as the 4-hour, daily, weekly, or monthly charts. Generally, the higher the timeframe, the more significant the signal becomes.

Conclusion

The Stochastic RSI is a powerful indicator that combines the strengths of the RSI and Stochastic Oscillator to deliver sharper, more responsive momentum signals. While it’s tempting to act on overbought or oversold readings alone, true effectiveness comes from understanding the behavior of the two lines and using it in conjunction with other analysis tools. Whether you're a short-term trader or a long-term investor, mastering the Stoch RSI can add depth to your strategy and help you make more informed decisions.

Breakout trading

(Title)

Breakout trading starts with finding support and resistance points

-------------------------------

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I will take the time to talk about breakout trading.

This is my opinion, so the content may be lacking.

The reason I did not explain what other people say with examples is because trading is a psychological battle.

Most of the content in books or on the Internet is explained with patterns.

However, it is not easy to find patterns when checking the movement of a real-time chart.

Therefore, I think it is more important to understand why such movements occur than to explain them with patterns.

Therefore, I think it is better to create a trading strategy by finding support and resistance points and checking whether or not they are supported by the support and resistance points rather than memorizing patterns.

Breakout trading refers to starting a transaction after checking whether there is support at a point or section when the price rises above a certain point or section, and there is a possibility of a larger rise.

If you do a breakout trade incorrectly, you may end up buying at a high point, which could result in a large loss, so it is recommended to always keep a stop loss point when trading.

In order to reduce the stop loss, you need to make an effort to lower the average purchase price by selling in installments when the price rises after purchasing and buying in installments when the price falls again.

Therefore, the stop loss point is when it is beyond the range you can handle.

-

Let's take the BTCUSDT 1D chart as an example.

It has fallen after renewing the ATH.

Looking at the current price position, it feels like it will fall further.

However, if the price rises to around the HA-Low indicator on the 1D chart, that is, around 89294.25, you will feel like it will turn into an uptrend.

Even if you think that you won't feel that way now, you will feel that way after it rises.

Therefore, the most important thing in breakout trading is to find important support and resistance points.

To find support and resistance points, you need to basically understand candles.

Any book or video about candles will do.

I recommend that you don't try to memorize the content in it, but read or watch it repeatedly several times.

In my case, after watching the video about candles about 3 times, my understanding of the chart became easier.

The reason for finding support and resistance points is to select a trading point.

What you need to find support and resistance is a horizontal line.

It is not easy to start trading with chart tools that are not horizontal lines but diagonal lines or curves.

The reason is that when you try to start a trade, you are more likely to miss the timing because your psychological state is added.

-

You can see that the uptrend started when it broke through the 73072.41 point.

Therefore, you can see that it is possible that the uptrend will start when it breaks through the 106133.74 point this time as well.

However, in this case, since it is rising while renewing the ATH, it is a point where it is thought to be difficult to actually start trading.

In other words, it is likely that you will be reluctant to trade because it is thought to be a high point.

Therefore, as I mentioned earlier, the actual breakout trade will be conducted when it breaks through the 89294.25 point.

Then, even if it rises to around the 106133.74 point, you will be more likely to respond stably without feeling much psychological anxiety.

-

However, there is one problem.

That is, the StochRSI indicator is currently in the overbought zone.

Therefore, when it rises near the 89294.25 point and confirms support, the StochRSI indicator should show a downward trend from the overbought zone.

Otherwise, the 89294.25 point is likely to act as a resistance point.

Even if the market is messy and difficult to predict, you should not be too busy finding support and resistance points.

After all, you need to have a standard for creating a trading strategy to start trading.

It is better to create a trading strategy and respond at the support and resistance points you have selected if possible.

Even if you suffer a loss, if you continue to trade, you will be able to better organize the support and resistance points.

For reference, the indicators that can create a trading strategy on my chart are the HA-Low and HA-High indicators.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

How Momentum Divergence Reveals Hidden Market Strength and WeaknMost traders watch price action closely: candlesticks, moving averages, trendlines. But there’s a deeper, less obvious layer of information that often signals shifts in direction before price confirms it: momentum.

📌 Quick overview – what you'll learn:

What momentum divergence is (clearly explained)

How it helps predict potential trend shifts

Practical ways to spot and trade divergences

📈 Price vs Momentum: They're Not the Same!

Momentum doesn't simply track price direction. Instead, it measures the strength behind price movements.

Rising prices, falling momentum often signals upcoming bearish reversals.

Falling prices, rising momentum often hints at bullish reversals building beneath the surface.

These subtle divergences are powerful because they reveal hidden market shifts before everyone else notices them.

⚠️ How to Spot Momentum Divergence (Simple Steps):

Step-by-step:

- Find clear price swings:

Clearly defined highs/lows on your chart.

- Check momentum indicators (RSI, MACD, CCI, etc.):

Does the indicator agree or disagree with the price action?

- Spot divergence:

Bullish divergence: Price makes lower lows, indicator shows higher lows.

Bearish divergence: Price makes higher highs, indicator shows lower highs.

- Confirmation:

Always wait for price confirmation like a reversal candle or break of a trendline.

🔥 Why Momentum Divergence Works:

Divergence highlights hidden accumulation or distribution by smart money.

Helps you anticipate reversals before price confirms.

Filters out weak moves and helps you avoid fake breakouts.

📊 Real Example (XAUUSD – April 2025):

Recently in Gold:

Price was dropping steadily, reaching new lows.

Meanwhile, RSI showed clear higher lows – classic bullish divergence.

Result: Price exploded significantly shortly after momentum divergence appeared clearly.

🧠 Trading Tips to Remember:

Divergence signals are stronger near key support/resistance zones.

Use momentum divergence with your existing strategy for confirmation, not isolation.

Always define your risk clearly (set stops above/below recent highs/lows).

🚩 Common Pitfalls to Avoid:

Trading divergence without confirmation: always wait for the market to show its hand.

Ignoring the bigger picture: check higher timeframes for stronger signals.

Overtrading: not every divergence leads to a reversal; quality beats quantity.

🚀 Your Action Plan for Next Week:

Pick one momentum indicator and identify at least 3 divergences on your favorite assets.

Monitor how they play out.

Note down what works best in your trading journal.

💬 Question for you:

What’s your go-to momentum indicator when spotting divergence? RSI, MACD, CCI, or something else? Drop a comment below!

Happy trading!

TrendGo Team

Instructional for my brother. IThis is a bad swing trade, it is under the 180 day moving average. You wouldn't enter this using a swing trading system alone, its more advanced to identify. But you can see the yellow line I drew, that is strong resistance. That means the price don't want to go below that line.

I put what a trade would look like on it. You see how in this trade there is much more green than red? That is a good risk to reward ration.

Now here is CBOE. See how the green and red of this projected trade are nearly equal? Yeah, that is a bad risk to reward ration. At a 1:1 (that is for each dollar you can gain, you are risking) you are at a coin toss odds. Which is better than gambling but isn't trading.

You pretty much have the gist of Bravo simple trading, these are more advanced things. IF you are trading, you want to know where you will set your stop loss and where you will set your take profit BEFORE you buy anything. And then set those with the trade. That way you know beforehand what a worse case scenario looks like. If you do this, you will very likely succeed in the long run.

RSI 101: Revealing the Special Characteristics of RSIWhy does RSI have support and resistance levels at 40 and 60?

Why does divergence happen between RSI and price?

What is RSI momentum?

All the characteristics of RSI (that I know) will be explained here.

Formula and Meaning

If you are using TradingView, you probably already know what RSI is and what "overbought" and "oversold" mean. So, I won’t repeat it here. Instead, I’ll dive deeper into the true nature of RSI, giving you a different perspective.

You can skip the mathematical formula of RSI, it’s already discussed everywhere online. Just remember this ratio table:

Here’s how I explain the table:

At RSI = 50, the average gain equals the average loss (I'll call this the buy/sell ratio). This is a balanced point. Buyers and sellers are equally strong.

At RSI ~ 60 (66.66), the buy/sell ratio = 2/1. Buyers are twice as strong as sellers.

At RSI ~ 40 (33.33), the buy/sell ratio = 1/2. Sellers are twice as strong as buyers.

At RSI = 80, the buy/sell ratio = 4/1. Buyers are four times stronger.

At RSI = 20, the buy/sell ratio = 1/4. Sellers are four times stronger.

The formula shows that when RSI reaches 80 or 20, the buyer or seller is extremely strong — about four times stronger — confirming a clear trend.

At these levels, some Trading strategies suggest placing a Sell or Buy based on the overbought/oversold idea.

But for me, that’s not the best way. The right approach is: when a trend is clearly formed, we should follow it.

I'll explain why right below.

Look at this chart showing RSI changes with the buy/sell ratio:

When RSI > 50:

When RSI < 50:

You can see that the higher RSI goes, the slower it climbs, but the high buy/sell ratio makes price move up faster.

Similarly, when RSI goes lower, it drops slower but price drops faster.

That’s why at overbought (RSI=80) or oversold (RSI=20) areas, you need to be careful. Even a small RSI moving can lead to big price changes, easily hitting your stop loss.

On the other hand, if you follow the trend and wait for RSI to pull back, you will trade safer and more profitably.

RSI Key Levels

Here are some special RSI levels I personally find useful when observing FX:XAUUSD :

(These levels are relative. They might vary with different timeframes or trading pairs. Check historical data to find the right ones for you. On bigger timeframes like M15 or above, the accuracy is better.)

RSI = 20

When RSI hits 20, sellers dominate. This confirms a trend reversal to bearish.

RSI = 80

When RSI hits 80, buyers dominate. This confirms a trend reversal to bullish.

RSI = 40

This is a sensitive level. Sellers start gaining the upper hand (sell/buy = 2/1).

If buyers lose 40, they lose their advantage.

So RSI >= 40 is "buyer territory". In an uptrend, RSI usually stays above 40.

RSI = 40 acts as support in an uptrend.

RSI = 60

Same idea. RSI <= 60 is "seller territory".

RSI = 60 acts as resistance in a downtrend.

40 and 60 are considered the key levels of RSI.

Now you guys know why RSI has support/resistance around 40/60!

RSI Range

As you know, RSI moves between 0 and 100.

Since RSI >= 40 is buyer territory, we can see the relationship between price and RSI:

When RSI stays above 40, price tends to move in an uptrend:

When RSI stays below 60, price tends to move in a downtrend:

When RSI stays between 40 and 60, buyers and sellers are balanced, and price moves sideways in a box:

When RSI is moving, It creates a RSI Range.

Whenever the trend switches between the three states — uptrend, sideways, and downtrend — a Range Shift is formed.

At first, RSI moves in 40-60 range, price moves sideways. A strong price move pushes RSI to 80. Later, RSI stays above 50, helping price grow strongly. When momentum fades, RSI returns to 40-60 and price moves sideways again.

Note:

RSI reflects Dow Theory by showing the stages of accumulation, growth, and distribution.

And as you see, when RSI touches key levels, the trend often pulls it back.

RSI Momentum

Price momentum means how fast price changes.RSI momentum represents the change in the strength between buying and selling forces.

When RSI > 50:

If price falls, RSI shows high momentum — RSI drops fast but price drops slowly.

If price rises, RSI shows low momentum — RSI rises slowly but price rises fast.

For example, at first RSI is above 50.

Price drops from (a) to (b) by 44 units, RSI drops from (Ra) to (Rb) by 25 units.

Later, RSI drops from (Rb) to (Rc) (also 25 units) but price drops from (b) to (c) by 73 units.

When RSI < 50:

If price falls, RSI has low momentum — RSI drops slowly but price falls fast.

If price rises, RSI has high momentum — RSI rises fast but price rises slowly.

RSI and Price Divergence

Divergence happens when price and RSI move in opposite directions:

Price goes up but RSI goes down, or vice versa.

Why does divergence happen?

In a strong downtrend, price forms a bottom at point (1), and RSI drops to level (r1).

When a price pullback happens, price pushes up to a peak at point (2), and RSI also bounces back to level (r2).

Because the downtrend is strong, after completing the pullback (1-2), price continues to make a lower bottom at point (3).

At this point, remember the behavior of RSI momentum when RSI is below 50:

It takes a large price drop (from 2 to 3) to cause a small RSI drop (from r2 to r3).

Meanwhile, even a small price increase (from 1 to 2) causes a large RSI rise (from r1 to r2).

Since the distance (1-2) is smaller than (2-3), but the RSI move (r1-r2) is bigger than (r2-r3), divergence is created.

Divergence shows that the current trend is very strong, not a complete signal of a trend reversal.

(I might share with you how to spot a complete RSI reversal signal in future posts.)

As shown in the example above, after forming bottom (5) and creating a bullish divergence between (3-5) and (r3-r5), price still kept dropping sharply while RSI kept rising.

In these areas, if you keep trying to catch a reversal just based on divergence, you will likely need to DCA or cut your losses many times.

That’s why the most important thing in trading is always to follow the trend.

RSI Exhaustion

RSI Exhaustion happens when RSI keeps getting rejected by a resistance or support zone and can’t break through.

After a strong downtrend, RSI recovers but stalls around the 5x zone.

It tries many times but fails, showing buying power is weakening.

Then the downtrend continues:

Exhaustion near high or low RSI levels creates stronger divergences than exhaustion in the middle range:

Double or triple tops/bottoms on RSI (M or W shapes) basically indicate RSI exhaustion.

RSI Can Identify Trend Strength

In an uptrend:

If RSI pulls back to a higher level before going up again, the trend is stronger.

The pullback should not fall too deep (below 40).

Example:

First rally: RSI drops to 60 before rising again → strong rally (273 units).

Second rally: RSI drops to 50 before rising again → weaker rally (94 units).

Same idea for a downtrend:

If RSI pullbacks to 50 then drops again, the downtrend is stronger than if it pullbacks to 60.

RSI Support and Resistance

Besides 40-60 acting as support/resistance, RSI also reacts to old tops and bottoms it created.

Why does this happen?

RSI is calculated from closing prices.

On a higher timeframe, the candle close price is a high/low or support/resistance price on lower timeframes.

When RSI moves in a trend on a higher timeframe, it maintains a buy/sell ratio, forcing lower timeframe RSI to oscillate within a range.

Example:

On H4, RSI stays above 40 → uptrend.

It makes H1 RSI move between 30-80.

Sharp RSI tops/bottoms react even stronger because they show strong buying/selling forces.

Summary

When looking at the price chart, we can see that price can rise or fall freely without any defined boundaries.

However, RSI operates differently: it always moves within a fixed range from 0 to 100.

During its movement, RSI forms specific patterns that reflect the behavior of price.

Because RSI has a clear boundary, identifying its characteristics and rules becomes easier compared to analyzing pure price action.

By studying RSI patterns, we can make better assumptions and predict future price trends with higher accuracy.

I have shared with you the core characteristics of RSI, summarized as follows:

Besides overbought (80) and oversold (20), RSI respects 40 and 60.

40 is support level in an uptrend. 60 is resistance level in a downtrend.

In an uptrend, RSI stays above 40.

In a downtrend, RSI stays below 60.

An RSI Range-Shift leads to a trend change.

RSI Divergence shows strong trends.

Double or triple tops/bottoms show RSI exhaustion → potential reversals.

The higher the RSI level, the slower it moves, but the faster the price rises.

The lower the RSI level, the slower it moves, but the faster the price falls.

A strong uptrend can be identified when RSI moves within a higher range or shows continuous bearish divergences.

A strong downtrend can be identified when RSI moves within a lower range or shows continuous bullish divergences.

RSI reacts to its old tops and bottoms.

Sharper RSI peaks show stronger selling.

Sharper RSI bottoms show stronger buying.

In the next parts, I’ll show you how to apply these RSI's Characteristics to trend analysis, multi-timeframe analysis, and trading strategies, that you might have never seen before.

I trade purely with RSI. Follow me for deep dives into RSI-based technical analysis and discussions!

Learning The Excess Phase Peak Pattern : How To Identify/Use ItThis new tutorial video is for all the new followers I have on TradingView who don't understand the Excess Phase Peak pattern (EPP) yet.

I received a question from a new follower yesterday about the EPP patterns. He/She could not understand what they were or how to use/identify them.

This video should help you understand what the EPP patterns are, how to identify them, how to trade with them, and how to identify/use proper expectations with them.

I hope this video is informative and clear. Remember, price only does two things...

FLAG or TREND - NOTHING ELSE

And the EPP pattern is the CORE STRUCTURE of price that happens on all charts, all intervals, and all the time.

The second pattern, the Cradle pattern, is part of the EPP pattern, but it acts as another price construct related to how to identify opportunities in price action.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trading A Divergence Trade (Breakdown) with Pivots and LiquidityTrading divergences was always a problem for me in the past. I did the same thing you did and got it wrong every time. I was trading divergences when i saw them instead of realizing a divergence is a flip of support and resistance levels. I just needed to know where they are.

In this video:

Internal vs External Pivot divergence confirmation:

You can have two types of pivots on your chart. One for long term and one for short term.

Using them to confirm short and long term price action is intuitive as youll be able to see the market squeezing on the short term while knowing where your long term price structure exists.

Price action to Divergence Confirmation:

A divergence on a short term pivot is an indication of short term loss of trend or reversal.

If the short term has no divergence but the long term does, you are about to end up with some pretty large price moves.

Youll be confirming the divergence by looking for highs, lows, and closes moving the wrong way from current price action.

This video will give you a method you can use to draw out your support zone / resistance zone / divergence zone and use them to your advantage.

The "Divergence Zone" that you draw out is the very reason why so many people fail at divergences.

Bare in mind that when you have a divergence, support and resistance are on the WRONG sides as their normally are so you'll learn here how to find those zones as well.

Then in the end of the video ill show you how to use lower timeframes to confirm the new move of the market.

Thanks, everyone. For coming through to the CoffeeShop.

12 Tips Every New Forex Trader Should Know!New to Forex? These 12 tips will save you months of frustration.

Forex trading can be overwhelming in the beginning, but it doesn’t have to be. Whether you're just starting out or still finding your feet, these tips are designed to help you avoid common mistakes and fast-track your learning curve.

✅ Save this post

✅ Follow for more Forex insights

✅ Drop a comment with your biggest struggle as a beginner, I might turn it into the next tip!

Let’s grow together. 📈💪

Trump's Tariff Wars : Why It Is Critical To Address Global TradeThis video, a continuation of the Trump's Tariff Wars video I created last week, tries to show you why it is critically important that we, as a nation, address the gross imbalances related to US trade to global markets that are resulting in a $1.5-$1.8 TRILLION deficit every fiscal year.

There has been almost NOTHING done about this since Trump's last term as President.

Our politicians are happy to spend - spend - spend - but none of them are worries about the long-term fiscal health of the US. (Well, some of them are worried about it - but the others seem to be completely ignorant of the risks related to the US).

Trump is raising this issue very early into his second term as president to protect ALL AMERICANS. He is trying to bring the issue into the news to highlight the imbalances related to US trade throughout the world.

When some other nation is taking $300B a year from the us with an unfair tariff rate - guess what, we need to make that known to the American consumer because we are the ones that continue to pay that nation the EXTRA every year.

Do you want to keep paying these other nations a grossly inefficient amount for cheap trinkets, or do you want our politicians and leaders to take steps to balance the trade deficits more efficiently so we don't pass on incredible debt levels to our children and grandchildren?

So many people simply don't understand what is at risk.

Short-term - the pain may seem excessive, but it may only last 30, 60, 90 days.

Long-term - if we don't address this issue and resolve it by negotiating better trade rates, this issue will destroy the strength of the US economy, US Dollar, and your children's future.

Simply put, we can't keep going into debt without a plan to attempt to grow our GDP.

The solution to this imbalance is to grow our economy and to raise taxes on the uber-wealthy.

We have to grow our revenues and rebalance our global trade in an effort to support the growth of the US economy.

And, our politicians (till now) have been more than happy to ignore this issue and hide it from the American people. They simply didn't care to discuss it or deal with it.

Trump brought this to the table because it is important.

I hope you now see HOW important it really is.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

OptionsMastery: This is the "h" DayTrading Pattern.This is the "h" pattern. A highly successful daytrading pattern!

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!