Dollar Off to Weak Start After Worst Year Since 2017. Now What?The US dollar rang in 2026 without much enthusiasm. No fireworks. No flex. Just a quiet shuffle out of the gate that felt eerily familiar to anyone who shoved cash in FX markets last year.

After logging its worst annual performance since 2017, the greenback has started the new year on the back foot

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

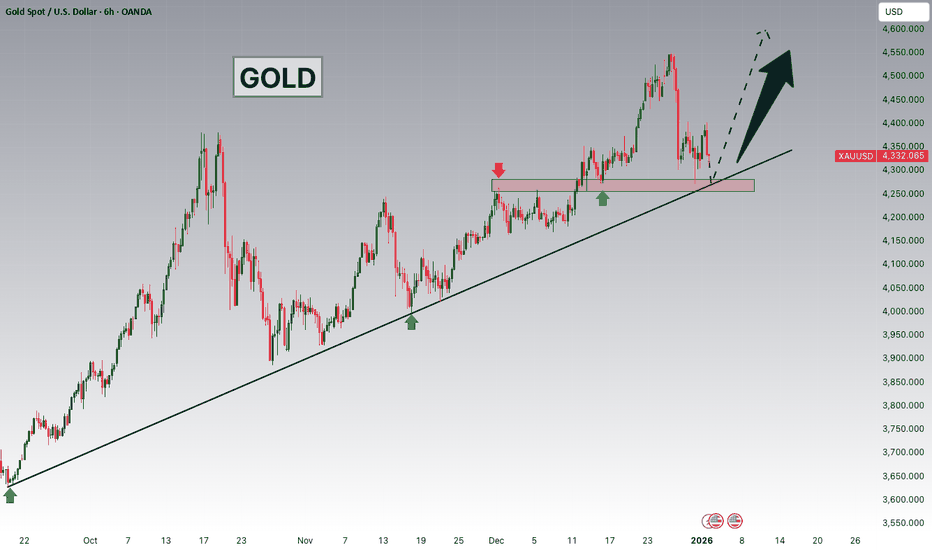

Gold - Control vs Patience… Who Wins Next?Gold hasn’t done anything crazy lately, and that’s exactly the point.

Zooming out, the structure is still bullish. Every dip so far has been met with buyers, and the market keeps printing higher highs and higher lows.

Right now, price is sitting inside what I like to call a decision zone. This is

SUI is on the verge of another rally (4H)From the point where we marked the green arrow on the chart, a bullish phase has started on SUI. This area acted as a key reaction zone where buyers stepped in decisively, shifting market sentiment from corrective to bullish.

Based on the current price structure, it appears that we are developing a

XAUUSD (H4) – Monday SetupGeopolitical shock risk, gold may spike | Trade liquidity and reaction zones only

Quick summary

News around Trump’s claim that Maduro has been detained, plus Venezuela’s response (they don’t know his and his wife’s whereabouts and are demanding proof of life), raises geopolitical uncertainty sharpl

ETHBTC W Pattern Makes the Case for a Macro Bull MarketIt seems pretty clear to me that ETHBTC is in a multi year W pattern. The higher low on the W, with hidden bullish divergence helps confirm the pattern, as does the recent price action.

From April to May of 2025 price consolidated in a low and then surged to a local high in August when it the oran

BTC/Gold A Simple Signal That Has Worked Only 4 Times in HistoryThe BTC/XAU (monthly) chart has produced only four clear local bottom signals throughout its entire history.

This is a deliberately simple, noise-free setup. No indicators overload, no short-term speculation—just relative strength between Bitcoin and gold.

Each of these historical bottom zones mar

Gold Bullish Outlook | Dollar Weakness & Geopolitical Risks!Hey Traders,

In the coming week, we are closely monitoring XAUUSD (Gold) for a potential buying opportunity around the 4,280 zone. Gold remains in a strong bullish trend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and 4,280 support & resistance

2025 Ends With a Breakout?Year Ends With a Breakout, yes!🚀📈

Bitcoin just delivered what the market was waiting for — a clean breakout back into the channel 🎯

This is how we close the year… with intent.

Key Technicals:

• Major support holding at 88,273 – 88,535

• ATA 200 support confirmed

• Price reclaimed the channel

Gold Costs 175 Hours Of Work To BuyI like to price everything I buy in hours of work.

That’s the only price that actually matters.

Money can be replaced. Time can’t. When I look at a purchase in terms of how much of my life it costs, it becomes instantly clear whether it’s worth it.

My kids hate me for it because their view is that

JPM — Bullish Channel at Decision PointTechnical Overview

• Price is moving inside a well-defined ascending channel

• Currently testing the upper channel resistance

• Trend remains bullish as long as price holds above the channel midline & SMA

Bullish Scenario

• Confirmation: Strong daily close above the channel top (~330)

• Tar

See all editors' picks ideas

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

Breakouts & Pullbacks [Trendoscope®]🎲 Breakouts & Pullbacks - All-Time High Breakout Analyzer

Probability-Based Post-Breakout Behavior Statistics | Real-Time Pullback & Runup Tracker

A professional-grade Pine Script v6 indicator designed specifically for analyzing the historical and real-time behavior of price after strong All-Ti

See all indicators and strategies

Community trends

Amazon - A quite boring new all time high!🎈Amazon ( NASDAQ:AMZN ) is simply heading for new highs:

🔎Analysis summary:

For the past couple of months, Amazon has overall just been consolidating. But in the meantime, we witnessed a major bullish break and retest and an expected rally of +50%. Following this quite slow behavior, Amazon w

MU: Time for HEAVY PutsIf you caught the ride up in MU, congrats! I've been following this stock since 2020 and it's about time it catches up with the rest of the semis.

The fibs show 325 range is the final top for a wave 5 dating back to Dec 2022 lows. With tech earnings kicking off Jan 26, I am expecting MU to reach 21

AAPL: The 30% Rule — Why Apple’s Next True Low Likely at 200 USD🍎 AAPL WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Apple Inc. is entering the late phase of a multi-year corrective cycle

📉 Primary thesis: A ~30% correction is still unfolding, consistent with prior Apple macro drawdowns

🏛️ Macro backdrop: Dow Jones Industrial Average extended near psychological 50,000

MICRON scripted blue-print. More than -50% sell-off expected.Micron Technology (MU) is on an amazing long-term rally since the April 2025 Low, currently on the 6th straight green month (1M candle) and 8th in the last 9 months. Its historic price action however shows that this remarkable uptrend may be coming to an end as the price is approaching the top of it

$ETSY has >11% FreeCashFlow Yield! Sometimes great returns are just staring us in the face and those returns seem risky since the price of an asset has been falling for a while we never know when the bottom is in.

So, when we get a technical "trending up" signal like we are seeing in the monthly chart AND we have a great "free cash

$META — Short SetupNASDAQ:META — Short Setup

Opened a short in $META. We saw strong selling right out of the open, likely influenced by headlines around China reviewing the Manus acquisition under AI-security scrutiny.

Technically, the chart is forming what looks like a bear flag with downside magnets below. Yes, y

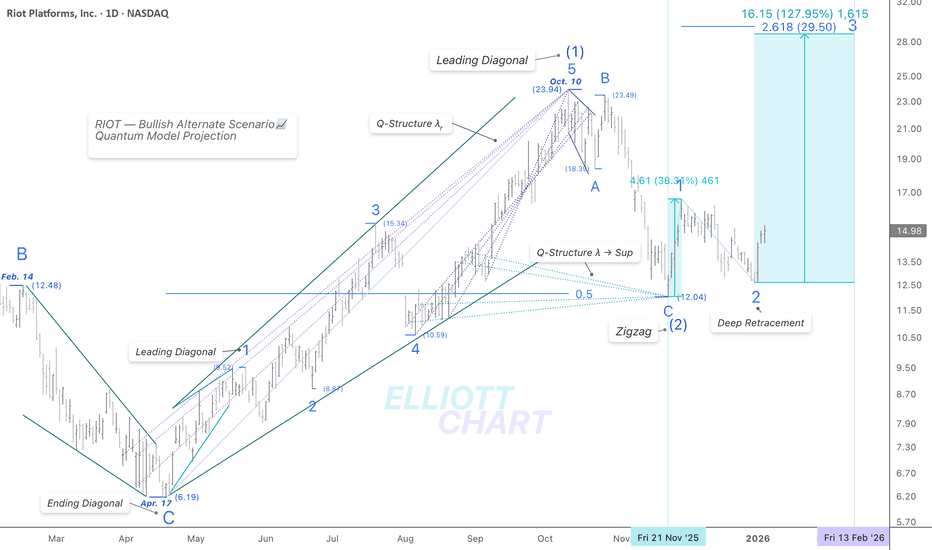

RIOT | DailyNASDAQ:RIOT — Bullish Alternate Scenario📈

Technical Update

As depicted on the chart, RIOT has continued to advance following a deep correction in Minor Wave 2, occurring within the projected extension of Intermediate Wave (3).

If this structure remains intact, the potential extension of Minor

A Devastating Double BottomThose who follow me know I love looking ahead to spot opportunities that are coming.

The AI revolution will create many losers and a few winners.

Some winning companies were obvious from the start, like Palantir in software and the entire chain of hardware manufacturers and infrastructure providers

See all stocks ideas

Today

CALMCal-Maine Foods, Inc.

Actual

2.13

USD

Estimate

1.95

USD

Today

MSMMSC Industrial Direct Company, Inc.

Actual

0.99

USD

Estimate

0.95

USD

Today

APOGApogee Enterprises, Inc.

Actual

1.02

USD

Estimate

1.02

USD

Today

RELLRichardson Electronics, Ltd.

Actual

−0.01

USD

Estimate

−0.01

USD

Today

HURCHurco Companies, Inc.

Actual

—

Estimate

—

Today

PKEPark Aerospace Corp.

Actual

—

Estimate

—

Today

ANIXAnixa Biosciences, Inc.

Actual

—

Estimate

−0.09

USD

Today

LFCRLifecore Biomedical, Inc.

Actual

—

Estimate

−0.14

USD

See more events

Community trends

Bitcoin - Soon pump to 98k! But sell here, because...Bitcoin is temporarily bullish, and from a technical point of view, we can expect 98,439 USD in the short term. There are many reasons behind this movement, the first is that Bitcoin is forming a bigger bearish flag that is well visible on the daily chart. This is not the ultimate bottom on Bitcoin

Bitcoin - Range High Pressure, Expansion or Rejection AheadHappy New Year everyone 🎉

I hope you all had a great start to the year. I have been offline for a while due to holidays and some personal stuff, but I am back and ready to start posting trade ideas again. Let’s kick things off with a fresh look at Bitcoin based on the chart I shared.

Market Overvi

TON/USDT | TON Coin Rallying Over 20%, Bullish Momentum ContinueCRYPTOCAP:TON has surged from $1.65 to $1.95, delivering over 20% return since our last analysis. Price has held above the key $1.58 level and is now pushing aggressively higher, confirming short-term bullish momentum.

If strength continues, next bullish targets to watch are $2.07, $2.22, $2.38, an

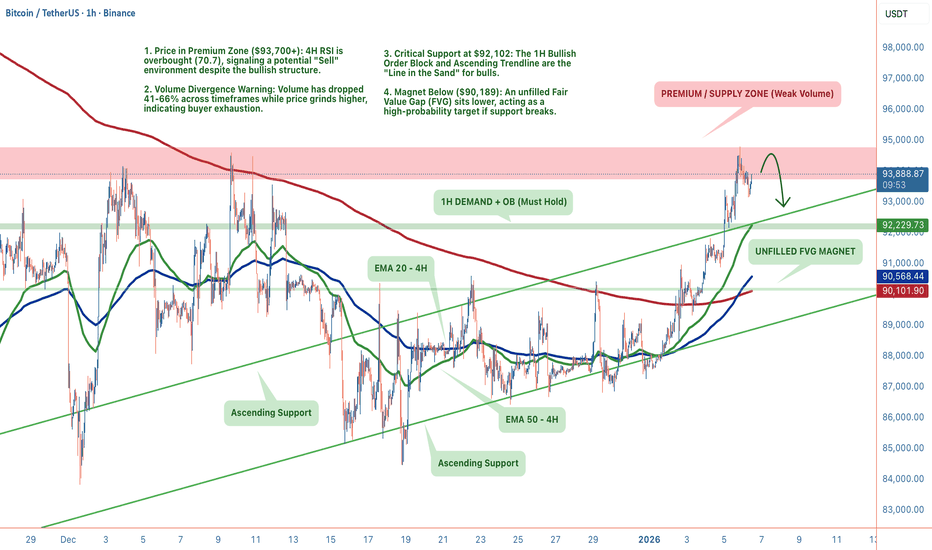

BTC: The Premium Zone Trap (4H vs 1H)Bitcoin is at a decisive junction. We are trading in the Premium Zone ($93,700+) with a clear conflict between timeframes. The 4H screams exhaustion (RSI 70.7 + Low Volume), while the 1H structure remains stubbornly bullish, holding above the $92,102 demand zone. The structure is intact, but t

BTCUSDT Holding Higher Lows, $94,700 Resistance in FocusHello traders! Here’s my technical outlook on BTCUSDT (3H) based on the current chart structure. BTCUSDT initially experienced a strong sell-off, marked by aggressive bearish momentum as price dropped from higher levels. After this decline, the market found a base and started to grow, transitioning

Bitcoin (D1) - Breaks The Channel - Liquidity Grab Complete ?📝 Description 🔍 Setup (Market Structure) BINANCE:BTCUSDT

Bitcoin was trading inside a well-defined descending channel on the Daily timeframe.

Price has now broken above the channel resistance, showing early signs of trend reversal.

Key confluences:

Multiple support reactions inside the demand

BTCUSDT: Pullback Toward Demand ZoneHi!

Bitcoin is showing short-term weakness after failing to hold above the recent high. Price is currently trading below the local resistance area, suggesting a corrective pullback rather than continuation.

The highlighted demand zone around 90.4K–90.9K is a key area to watch. This level previousl

BTCUSDT Price Update – Clean & Clear ExplanationBitcoin Overall, the market structure remains bullish, but price is currently facing strong resistance, causing a short-term pullback.

Bitcoin is moving inside a rising channel, which indicates an overall uptrend higher highs and higher lows confirm bullish momentum recently, price made a strong im

Chainlink (LINK): This Might Be The Start of The Pump | Bullish LINK has been cycling in clean waves for a long time — push up, pullback, push up again — and that rhythm is still visible on the chart. After the big doomsday dump, price found a base near the lows and now we’re seeing buyers step in again, which fits the start of another upside wave if it holds.

January 2026 Alt Analysis RequestFamily, January 2026 marks the opening of a new trading year and a critical reset point for the broader market. With Bitcoin setting the tone and liquidity gradually repositioning, this phase is decisive for identifying which altcoins are preparing for expansion and which will continue to lag.

Thi

See all crypto ideas

GOLD - Consolidation before resistance at 4470. Bullish trendFX:XAUUSD resumes growth and tests 4470, an important resistance level, amid a weakening dollar caused by expectations of further easing of Fed policy and continuing geopolitical uncertainty.

Expectations of a Fed rate cut intensified after the release of weak ISM Manufacturing PMI data.

Geop

XAUUSD Long: Demand Holds at 4,400 - Push Toward 4,500 in FocusHello traders! Here’s a clear technical breakdown of XAUUSD (2H) based on the current chart structure. XAUUSD previously moved within a steady bullish structure, respecting a rising trend line that supported price during multiple pullbacks. After a strong impulsive rally, Gold transitioned into a co

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Yesterday we took something on the short but due to it being late session and the end of day report we suggested we would wait for the price to either reject or break above. We did mention we were a bit too high to long and a retracement was needed into that

XAU/USD | Bullish momentum continues (READ THE CAPTION)As you can see in the Hourly chart of Gold, the market opened at 4356 yesterday and then it went on a Bullish Move, reaching as high as 4475. That means in a matter of a single day, Gold moved more than 1000 pips!

Currently it is being traded at 4455, I can see it going going to the high of the FVG

#SILVER: Swing Buying Up To Yearly End Target Of $100XAGUSD(SILVER) ANALYSIS🎇

🔺After a big rally, silver took a dip, dropping about $70 from its high of $82. But don’t worry, it’s bounced back from $70 and is now trading at $80, with a chance to hit $85 by the end of January. The market is a bit wild right now, mostly because of recent political stuf

XAUUSD 30M – Bullish Trend Continuation SetupPrice is in a strong bullish structure, respecting the ascending trendline and holding above the key support zone near 4,395–4,410.

A healthy pullback into 4,450–4,460 can offer continuation entries, with first target at 4,495–4,500.

A confirmed breakout above 4,500 opens the path toward the main ta

30% Silver correction to support - January 2026The Silver bugs are chattering more than usual. For months they say nothing, until that one moment they like grasshoppers on a summer's evening, all sing with cheer as if looking for a new mate.

Exactly, and somewhat ironically, they refuse to take profits as price action reaches new all time highs

Lingrid | GOLD Retracement Ends - Bullish Trend ContinuesOANDA:XAUUSD is forming a controlled retracement after printing a higher high, with price now reacting positively above the rising trendline and key demand zone. The pullback appears corrective and structure remains constructive while higher lows continue to form. Momentum has cooled, but buyers ar

XAUUSD Rising Support Holds - Next Target 4,500 ResistanceHello traders! Here’s a clear technical breakdown of XAUUSD (4H) based on the current chart structure. After a prolonged consolidation phase, Gold was trading inside a well-defined range, indicating balance between buyers and sellers. This range acted as an accumulation zone before price initiated a

Gold 30Min Engaged ( Bearish Volume Reversal entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 4471 Area

See all futures ideas

EURUSD: Fake Breakdown from Support Signals Potential ReversalHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD previously traded inside a clearly defined range, where price moved sideways and showed equilibrium between buyers and sellers. From this range, price attempted a bullish breakout, but the move resulted in a

EURCAD: Smart Money Trap LoadingMacro / COT

The latest COT data paints an interesting picture:

EUR – Non-Commercials remain heavily net-long, and long exposure continues to increase. This indicates that a large portion of speculative capital is already positioned to the upside.

CAD – Commercials are accumulating long exposure, whi

USDCAD: Short-Term Bounce Play Inside a High-Risk StructureUSDCAD: Short-Term Bounce Play Inside a High-Risk Structure

USDCAD is currently trading inside a short-term consolidation after a strong impulsive move.

Price is holding above a minor support zone, suggesting a possible bullish reaction toward nearby resistance levels.

This setup is strictly sh

EURUSD Weekly CLS Model 1Hi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

USD/JPY - Triangle Breakout (07.01.2026)📝 Description🔍 Setup (Price Action) FX:USDJPY

USD/JPY is forming a well-defined triangle pattern on the M30 timeframe.

Price is compressing between lower highs and higher lows, signaling a volatility squeeze.

The market is approaching the apex, where a strong directional move is likely.

📌 Trade

Technical Rebound at Key EMA, Medium-Term Uptrend Remains IntactHello everyone,

EUR/USD has just completed a fairly deep but well-controlled correction. The prior sell-off pulled price back toward the medium-term EMA zone around 1.1680–1.1700, and the subsequent rebound suggests selling pressure is no longer expanding, while buyers have started to step in to d

EURUSD Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.16600 zone, EURUSD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.16600 support and resistance

EURUSD Breakdown Confirmed, 1.1640 Support in FocusHello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. EURUSD initially traded within a well-defined ascending channel, showing a strong bullish structure with higher highs and higher lows after the market started to grow from the lower levels. This bullish p

EUR/USD CHART QUICK ANALYSIS IN LONDON SESSION I 01/071. Market Structure & Trend

Main Trend: The market is currently in a consolidation (sideways) phase following a previous sharp decline. Price is compressing inside a Symmetrical Triangle pattern, defined by the two converging trendlines.

Current Price Action: The price is trading around 1.16838, si

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.